You’re here because you trade, you invest, and you want to keep more of what you make without giving HMRC an inch you don’t legally owe. Good. This is the straight-talking, Jordan-Belfort-energy guide to reporting UK crypto taxes the right way-fast, accurate, and bulletproof. No fluff. No waffle. Just what works.

⚡ The 60-Second Takeaway: What HMRC Actually Wants From You

- Sold, swapped or spent crypto? You’ve likely triggered Capital Gains Tax (CGT).

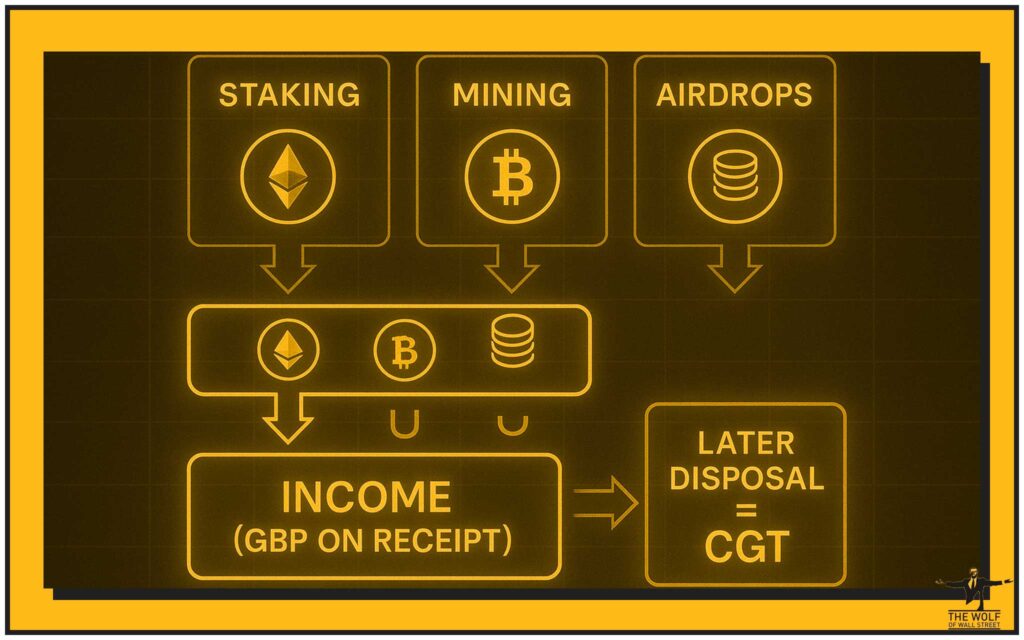

- Earned crypto (staking, mining, employment, some airdrops)? That’s Income Tax territory on receipt-later disposals can still be CGT.

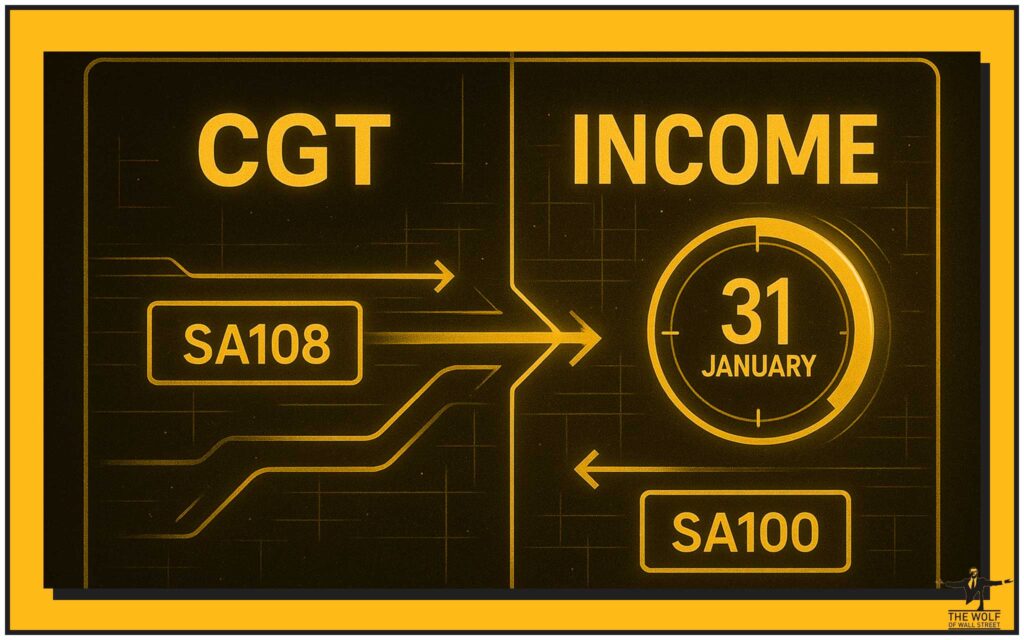

- Forms: CGT goes on SA108, income goes on SA100.

- Tax year: 6 April–5 April. Online filing & payment deadline: 31 January following the tax year.

- Rules you can’t ignore: same-day rule, 30-day rule, and Section 104 pooling for your cost basis.

- Enforcement is rising: from 1 January 2026, UK crypto platforms must report user data to HMRC-assume transparency and file clean.

📚 HMRC Crypto Tax 101 (No Jargon, Just Money)

Disposals that trigger CGT. HMRC treats four actions as disposals: selling crypto for GBP, swapping one token for another, spending crypto on goods/services, and gifting to anyone other than your spouse/civil partner. If your total gains exceed the annual CGT allowance for the tax year, you must report and pay CGT.

When crypto becomes income. If you receive tokens-because you staked, mined, got paid by an employer, or you received an airdrop connected to work or services-that receipt is typically taxable as income at its GBP fair value on the day you receive it. If you later dispose of those same tokens, that second step is a CGT calculation using the value on receipt as your cost basis.

VAT & IHT in a minute. VAT generally attaches to the goods/services you buy, not to the crypto itself. For inheritance tax (IHT), your tokens are just another asset in your estate-same principles as shares or cash-so get proper advice if you’re dealing with large estates, domicile questions or trusts.

🧮 Capital Gains Tax on Crypto – Calculate Like a Pro

Let’s cut to the chase. Your CGT isn’t guesswork; it’s a mechanical process. Do it by the book and you’ll pay exactly what’s due-nothing more.

The three matching rules (order matters):

- Same-day rule. Disposals are matched to acquisitions of the same token on the same day.

- 30-day rule. Next, disposals are matched with acquisitions within 30 days after the disposal (the “bed & breakfasting” blocker).

- Section 104 pool. Anything left matches with your pooled holding, where all older acquisitions are averaged into a single cost per token.

What goes into your calculation:

- Proceeds in GBP when you sold or swapped.

- Allowable costs: purchase prices, exchange/wallet fees, and some professional fees.

- Pooled cost after applying the matching rules.

- Gain or loss per disposal, then net gains for the year.

- Annual exemption (if any for the tax year), applied to reduce net gains.

- CGT rate based on your income band for that year.

Worked example (simple, illustrative):

- You acquire 2 ETH at £1,200 and 2 ETH at £1,600. Fees total £80. You later sell 3 ETH for £6,000 with £30 fees.

- Pool cost: (2×1,200 + 2×1,600 + 80 fees) = £5,680 for 4 ETH ⇒ £1,420 per ETH.

- Proceeds after fees: £6,000 − £30 = £5,970.

- Cost of 3 ETH from pool: 3 × £1,420 = £4,260.

- Gain: £5,970 − £4,260 = £1,710 (before applying your annual allowance and rate).

Now repeat this for every disposal, respecting same-day and 30-day rules first.

Common curveballs (and fixes):

- Multiple exchanges & wallets: export all CSVs. Normalise timestamps to UTC/GMT.

- Fees paid in tokens: add them to allowable costs at GBP fair value.

- Part disposals: your pool updates after each transaction-track it meticulously.

- Token swaps: they’re disposals-even if you never touch fiat.

- Missing data: reconstruct from blockchain explorers and exchange statements; keep screenshots.

💷 Income Tax on Staking, Mining & Airdrops

Here’s the money line: if tokens land in your wallet as a reward, that receipt is usually income. You’ll value it in GBP on the day you get it and report it in SA100. When you later dispose of those tokens, you’ll do a CGT computation with that initial value as your cost.

Trading vs miscellaneous income. If your activity is organised, commercial, frequent and profit-seeking, HMRC may view it as trading-which can change how you report and whether National Insurance bites. If it’s not trading, it usually sits under miscellaneous or savings/investment income. The line isn’t about vibes; it’s about facts: scale, system, intention, sophistication.

Airdrops. If an airdrop is in return for services or there’s a reasonable expectation tied to your actions (like promotional tweets), HMRC tends to treat it as income on receipt. If the airdrop is truly random, unrelated to services, and you did nothing, treatment may differ-but expect to justify your position.

Staking specifics. For typical delegated or liquid staking, the reward’s GBP value on the day received is your taxable income. Keep a log that captures time, token, quantity, GBP value, and the transaction hash.

Mining. Solo or pool mining is normally taxable as income when you receive the coins. If HMRC considers your mining to be a trade, you may have deductible expenses and different reporting; if it’s not a trade, it still counts as taxable income.

🗂️ Filing: What to Put on SA100 & SA108 (Step-by-Step)

Register (if new). If you need to file a Self Assessment and you’re new to the dance, register by 5 October after the end of the tax year. You’ll get a UTR and access to file online via Government Gateway.

Deadlines that actually hurt if you miss them. Paper returns are due 31 October. Online filing and payment hit 31 January. Miss it and the £100 penalty is automatic, with daily penalties and interest stacking if you keep ignoring it. File early, see the bill, and set up Time to Pay if needed.

SA108 (Capital Gains). Enter your disposals, proceeds, allowable costs, and gains/losses. Attach or retain computations showing how you applied same-day, 30-day, and Section 104 pooling. If you’re claiming losses to carry forward, report them-don’t just keep them on your spreadsheet and expect HMRC to read minds.

SA100 (Income). Declare crypto income from staking, mining, employment or relevant airdrops. Use the appropriate sections (e.g., employment, self-employment, other income). Keep consistency: the tokens you received as income will carry that GBP value into your CGT pool for any later disposal.

Payments on account. If your bill is big enough and not collected via PAYE, you may face payments on account: two instalments on 31 January and 31 July towards next year’s bill. It’s not a fine-it’s a cash flow reality. If your income falls, you can apply to reduce them.

Practical tip: Open your return early. Enter the obvious wins (salary, interest, pensions). Then slot in CGT and crypto income with your computations ready. Don’t leave this to 11:59pm; HMRC’s site gets busy and errors love a deadline.

🧾 Records HMRC Expects You to Keep (Or Else)

If you can’t prove it, you don’t own it-at least not in a tax computation. HMRC expects clean, complete records. Build a paper trail that answers every question before it’s asked.

Keep these as standard:

- Date and time of every crypto transaction.

- Type of event (buy, sell, swap, spend, transfer, staking reward, mining payout, airdrop).

- Token, quantity, GBP value at the time, and fees.

- Wallet/exchange identifiers and transaction hashes.

- Your running Section 104 pool per token, with recalculations after each disposal.

- FX sources for GBP conversions and screenshots where helpful.

How long? Keep records for at least 5 years after the 31 January submission deadline. If you’ve got complex positions or overseas aspects, keep more. Storage is cheap; penalties aren’t.

🚨 What’s Changing in 2026 (Why It Matters Now)

From 1 January 2026, the UK implements the OECD’s Crypto-Asset Reporting Framework (CARF) and domestic rules requiring UK crypto service providers to collect and report standardised customer and transaction data to HMRC. Translation: the lights are on. If there are gaps in your historic filings, use HMRC’s disclosure facilities and clean it up before the data starts flowing.

Action list (now, not later):

- Reconcile all years where you traded or earned crypto.

- Log any unclaimed losses and make sure they’re on HMRC’s radar.

- Correct errors with a voluntary disclosure-penalties are usually kinder when you go first.

- Build a repeatable year-end workflow: export → classify → match rules → compute → file → archive.

🧭 Step-By-Step: From Wallet to Tax Return

- Export everything. Pull full histories from exchanges, wallets, and DeFi dashboards. Include fees and unique IDs.

- Convert to GBP the right way. Use reliable FX sources and timestamped rates. Consistency beats perfection.

- Classify each line. Buy, sell, swap, spend, transfer, reward, airdrop, income from work-tag them all.

- Apply the three rules. Same-day → 30-day → Section 104 pool. Update the pool after every disposal.

- Compute gains and losses. Aggregate per disposal, then net gains for the year. Apply your annual exemption for the tax year.

- Split income events. Route income to SA100; disposals to SA108.

- File and pay. Paper by 31 October; online and payment by 31 January.

Want a deeper dive into trade strategy once you’re compliant? Sharpen your edge with indicator playbooks like RSI crypto trading strategies, MACD momentum signals and Bollinger Bands trading strategy.

🧱 Quick-Reference Tables (Snapshot)

CGT vs Income Tax (what triggers what):

- CGT: sell, swap, spend, gift to non-spouse. You calculate gains using matching rules and pools.

- Income: staking rewards, mining payouts, employment crypto, certain airdrops tied to services.

- Both can apply: income on receipt then CGT on later disposal.

Filing timeline (typical year):

- Tax year ends 5 April → Register by 5 October (if new).

- 31 October paper filing → 31 January online filing + payment.

- Possible payments on account in January and July.

Pooling rules cheat-sheet:

- Same-day matches first.

- 30-day matches next.

- Remaining quantity → Section 104 pool average cost.

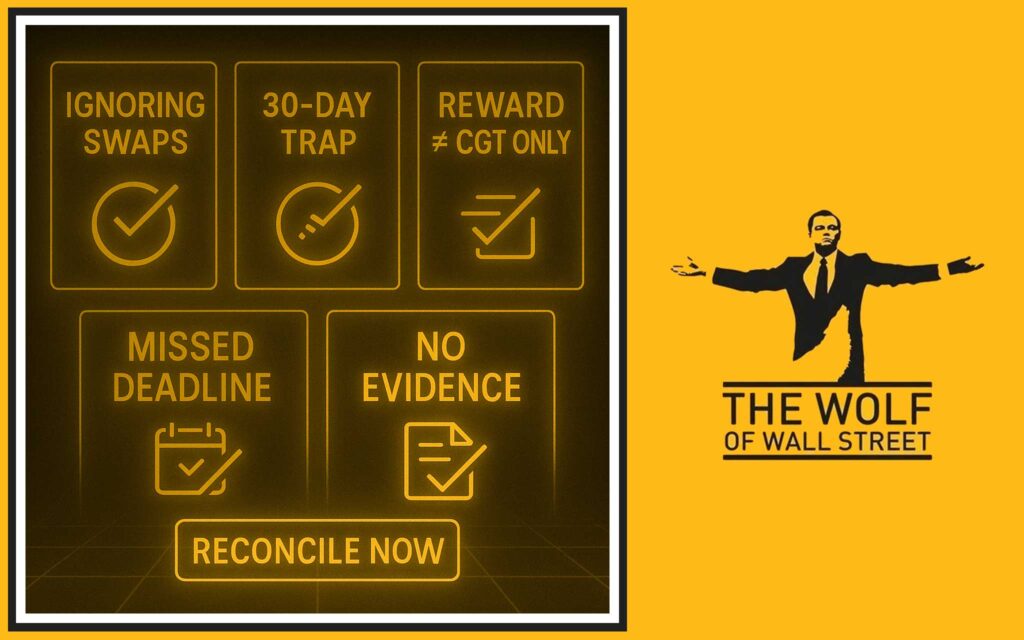

🧨 Five Costly Mistakes UK Crypto Investors Keep Making

- Treating swaps as non-events. Every token-for-token swap is a disposal.

- Ignoring the 30-day rule. Selling and rebuying the same token within 30 days changes your cost basis-plan it or pay for it.

- Forgetting that rewards are income. Staking/mining rewards get taxed when they hit your wallet.

- Missing the 31 January deadline. The first £100 late filing penalty arrives automatically, and interest doesn’t blink.

- No evidence. If you can’t show GBP values, fees, and pools, you’re leaving yourself open to adjustments you won’t like.

🧩 FAQs (Rapid-Fire, Plain English)

Do I owe tax if I just hold crypto?

No tax for just holding. Tax appears when you dispose (sell, swap, spend, or gift to non-spouse) or when you receive tokens as income.

Are gifts to my spouse taxable?

No CGT on transfers between spouses/civil partners. Your partner takes on your cost basis; when they later dispose, they’ll compute any gain from there.

How are airdrops taxed?

If they’re connected to services or work, they’re income on receipt; later disposals are CGT. If genuinely random with no strings attached, treatment may differ-document everything.

Which forms do I actually use?

SA108 for capital gains (disposals). SA100 for income (staking, mining, employment, some airdrops). Many people end up filing both.

What if I made losses?

Claim them. Report in the year they occur or as soon as possible. Losses carry forward and can reduce future gains.

Do I need to tell HMRC about old unpaid tax?

Yes-use HMRC’s disclosure routes. Proactive beats reactive every day of the week.

🧰 Advanced Pooling & Matching: Mini Case Study

You buy 1,000 ABC at £1 each on 1 June, 1,000 ABC at £1.50 on 15 June, then sell 1,200 ABC on 20 June, and buy 500 ABC back on 25 June. Here’s the order of play:

- Same-day rule: none (no same-day buys to match with the 20 June sale).

- 30-day rule: the 500 ABC bought on 25 June match first with 500 of the 1,200 sold on 20 June-so those 500 units use the £1.50 cost (if that was the price on 25 June) plus fees.

- Section 104 pool: the remaining 700 sold on 20 June come out of your pool, where the average cost is built from the 1,000 at £1 and the 1,000 at £1.50. After the sale, update the pool for quantity and allowable cost.

This is where traders slip: they forget the 30-day pairing and misstate the gain. Build a habit: disposal → same-day → next 30 days → then pool. Make your spreadsheet reflect that logic.

🧠 CGT Rates, Allowances & Band Awareness

Your CGT rate on crypto (a chargeable asset) generally follows the 10%/20% structure depending on your taxable income band for the year-crypto isn’t residential property, so don’t use the 18%/28% figures that apply to that. Always mark your tables clearly with the tax year label and re-check the annual CGT allowance for that year on publication day. If your income straddles bands, expect marginal gains to be taxed at the higher rate.

Two pro moves:

- Harvest losses before year-end to offset gains-don’t trigger the 30-day replacement trap unless you plan for it.

- Spousal transfers can move assets into a lower band (no CGT on the transfer), potentially making the subsequent disposal more tax-efficient.

🛡️ Compliance Checklist (Print This)

- I can produce CSV exports and screenshots for every wallet and exchange I used.

- I have a master ledger with event tags (buy/sell/swap/spend/stake/mine/airdrop/employment).

- I applied same-day, 30-day, then Section 104 pooling-in that order-for every disposal.

- I reconciled totals so SA108 equals my computations and SA100 captures income receipts.

- I labelled my files clearly with subfolders for CSV, FX sources, computations and screenshots.

- I checked deadlines and payments on account and set calendar reminders.

- If I made mistakes in prior years, I have a plan to disclose and correct them before CARF reporting begins.

🧯 Common Pitfalls (and Fast Fixes)

- Buying back within 30 days unintentionally. Either space your trades or model the impact beforehand.

- Mixing up income and gains. Rewards on receipt are income; later disposals are CGT-two separate entries, two separate forms.

- No narrative. Keep a short note on unusual events (hard forks, protocol migrations, token swaps) so future-you can remember what past-you did.

🔗 Related Reading to Level Up

- Master order execution with market vs limit orders and more.

- Build context with Research crypto opportunities and When to sell crypto.

- Understand FIFO vs HIFO vs Specific ID for non-UK contexts and planning insights.

- New to this? Start with our Newbie guides.

🧾 Direct Links (Open in a new tab)

- HMRC: Check if you need to pay tax when you sell cryptoassets – disposal triggers and overview (GOV.UK).

- HMRC Cryptoassets Manual (Pooling & Matching) – Section 104 pool, same-day and 30-day rules (CRYPTO22200; CRYPTO22256).

- HMRC: Self Assessment deadlines – register, paper vs online, payment dates (GOV.UK).

- UK CARF rules from 1 January 2026 – reporting by UK crypto service providers (SI 2025/744; HMRC collection).

- HMRC Cryptoassets Manual: Staking & Airdrops – income on receipt guidance (Staking; Airdrops).

🏁 Get Compliant, Then Get Strategic

You’ve now got the rulebook. Stop bleeding profits to penalties and confusion. File clean. Pay exactly what you owe-nothing extra. Then stack the deck in your favour by levelling up your trading system.

If you want an unfair advantage after you’ve nailed compliance, plug into the The Wolf Of Wall Street crypto trading community–VIP signals, expert market analysis, a private network of 150,000+ investors, essential trading tools like volume calculators, and 24/7 support to keep you sharp when markets turn.

Explore the service here: Service and jump into real-time discussions on Newbie hub for curated fundamentals.

The Wolf Of Wall Street

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 150,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.