Forget the noise. Forget the ‘to the moon’ hype. If you want to make serious money in crypto, you don’t speculate; you research. The crypto market is a goldmine for the informed, and a graveyard for the lazy. Learning how to research and spot crypto opportunities is the only way to separate the real gems from the scams. This guide gives you the blueprint to find the value, manage the risk, and win big.

🕵️♂️ The Hunt Begins: Where to Start Your Research

The crypto market is a jungle of thousands of projects. Your first step is finding the ones worth a closer look, and then performing preliminary checks to filter out immediate red flags.

Discovering New Opportunities: Sources of initial leads.

Opportunities are everywhere, but you need to know where to look.

- Crypto forums and active social media groups (Reddit, Telegram, X, Discord): These are hotbeds of discussion. Look for engaged, knowledgeable communities, not just hype.

- Industry news outlets and reputable crypto publications: Stay updated on major announcements, technological breakthroughs, and regulatory shifts that impact projects.

- Decentralised Exchanges (DEXs) for early listings: New tokens often appear on DEXs before they hit major centralised exchanges. This offers early access, but also higher risk due to lower liquidity. Understanding the DeFi space is crucial here.

The White Paper: Your First Deep Dive.

Every legitimate crypto project has a white paper. This is its blueprint. You need to read it. It outlines the project’s vision, problem it solves, technology, tokenomics, roadmap, and team. Don’t just skim; understand the core idea. If there’s no white paper, or it’s vague, walk away.

The Team Behind the Tech: Credibility Check.

Who is behind the project? This is absolutely vital.

- Are the founders/developers doxxed (publicly identified)? Anonymous teams are a huge red flag unless there’s a strong, verifiable reason.

- What is their experience in blockchain, software, and business?

- Do they have a proven track record of delivering on previous projects?

A credible, transparent team is a cornerstone of a trustworthy project.

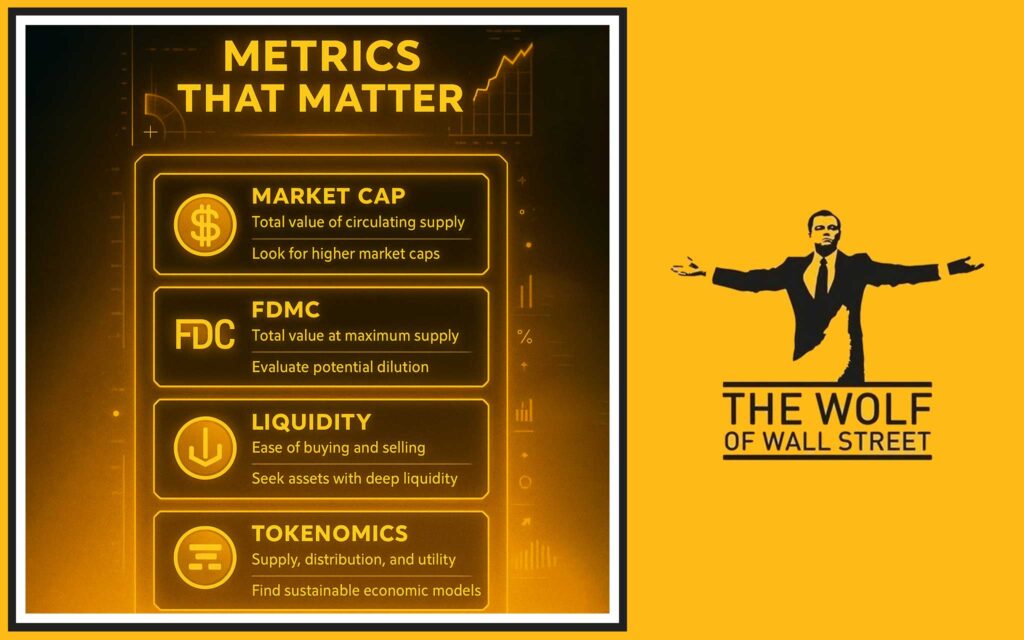

📊 Core Investment Factors: Metrics That Matter

Once you have a few promising leads, it’s time to dig into the numbers. These metrics give you a snapshot of a project’s market standing and economic structure.

Market Capitalization and Fully Diluted Market Cap (FDMC).

- Market Capitalisation (Market Cap) = Current Price * Circulating Supply. This tells you the total value of all tokens currently in circulation. It gives you a sense of the project’s size.

- Fully Diluted Market Cap (FDMC) = Current Price * Max Supply. This shows the market cap if all tokens that will ever exist were in circulation. A huge difference between Market Cap and FDMC can indicate significant future dilution, which can impact price.

Liquidity and Trading Volume.

- Liquidity: How easily can you buy or sell a token without causing a massive price swing? High liquidity means a healthy market. Low liquidity means your trades can move the price dramatically, making it hard to enter or exit.

- Trading Volume: How much of the token is being traded over a period (e.g., 24 hours)? High, consistent volume indicates genuine interest and activity. Fake volume (wash trading) is a major red flag.

Tokenomics: Supply, Distribution, and Utility.

This is the economic model of the token.

- Supply: What’s the total supply? How is it distributed (team, investors, public)? Are there vesting schedules (when tokens are released)?

- Utility: What is the token used for? Does it have real utility within the ecosystem (e.g., governance, staking, payment for services)? A token with no clear utility is just speculation.

Hashes, NVT, and On-Chain Activity (for relevant projects).

For Proof-of-Work (PoW) coins like Bitcoin, Hashrate indicates network security. For many projects, On-Chain Activity (number of transactions, active addresses) shows real usage. The NVT (Network Value to Transaction) Ratio compares market cap to transaction volume, offering a PE ratio equivalent for blockchain networks. These metrics give you a deeper look into the health and adoption of the underlying network, not just the token price.

Staking Participation (for PoS coins).

For Proof-of-Stake (PoS) coins, Staking Participation (percentage of total supply staked) indicates network security and community commitment. High participation is a good sign.

💻 Digging Deeper: Project Health and Development

Beyond the numbers, you need to assess the fundamental strength and progress of the project itself.

Development Activity: Code, Roadmap, Progress.

Is the development team actively working on the project? Check their public code repositories (like GitHub) for consistent updates. Does the project have a clear, realistic roadmap, and are they hitting their milestones? A stagnant development shows a dead project.

Partnerships and Integrations.

Are reputable companies or protocols partnering with the project? Real-world integrations mean the project is building utility and expanding its reach. Fake or vague partnerships are red flags.

Community Strength and Engagement.

Go beyond superficial social media follower counts. Is the community genuinely engaged, asking smart questions, and participating in governance? Or is it just a hype machine filled with bots and generic ‘moon boy’ comments? Organic growth is what you want.

Regulatory Compliance: The Non-Negotiable.

In today’s market, regulatory compliance is paramount. Projects must be aware of and adhere to relevant securities laws, anti-money laundering (AML) regulations, and consumer protection guidelines in the jurisdictions where they operate or target investors. A project with a questionable legal status is a massive risk. This is particularly relevant given evolving Policies worldwide.

Security Audits and Protocols.

Has the project’s code been audited by reputable third-party security firms? Smart contract audits are crucial to identify vulnerabilities that could lead to hacks and significant investor losses. A transparently audited project shows commitment to security. Look for multiple audits from different firms.

🚩 Avoiding the Pitfalls: Spotting Scams and Red Flags

The crypto market is rife with opportunities, but also with sophisticated scams. Knowing the red flags is your first line of defence.

Unrealistic Promises and Guaranteed Returns.

This is the biggest red flag. If a project promises guaranteed high returns (“100x gains in a week!”) or implies no risk, it’s a scam. Real investments carry risk. Period.

Lack of Transparency or Anonymous Teams.

While some privacy-focused projects have anonymous teams, for most, a lack of transparent information about the founders, developers, or their location is a major warning. If you can’t verify who they are, you can’t hold them accountable.

Low Liquidity and Wash Trading.

Be wary of tokens with extremely low liquidity but seemingly high volume (often a sign of wash trading – fake volume). If you can’t easily buy or sell a reasonable amount without huge price swings, you’re in a trap.

Pump-and-Dump Schemes.

These involve a coordinated effort to artificially inflate a token’s price (the ‘pump’) through misleading promotion, only for insiders to sell off their holdings at the peak (the ‘dump’), leaving retail investors with worthless tokens. Look for sudden, inexplicable price surges followed by massive crashes, often accompanied by heavy social media shilling.

The Hype Cycle: Riding vs. Avoiding.

Every major crypto trend or project goes through a hype cycle. Prices can surge on speculation, only to crash when fundamentals don’t match the promises. Your goal is to spot value before the hype, or avoid buying at the peak of irrational exuberance.

🛡️ Risk Management: Protecting Your Capital

Even after rigorous research, crypto investing carries risk. Disciplined risk management isn’t optional; it’s how you stay in the game.

Diversification Strategies: Don’t Put All Your Eggs in One Basket.

Never concentrate all your capital in one or two tokens. Diversify across different assets and sectors within crypto.

- Allocating across different crypto sectors: Spread your investments across DeFi protocols, Layer 1 blockchains, NFTs, GameFi tokens, and other categories to reduce risk exposure to a single segment.

- Balancing high-risk assets with stablecoins: Keep a portion of your portfolio in stablecoins or lower-volatility assets to act as a buffer during market downturns and to provide dry powder for opportunities.

Position Sizing and Capital Allocation.

Never invest more than a small percentage of your total trading capital into any single project, especially new or high-risk ones. Determine your risk tolerance and allocate capital accordingly.

Stop Losses and Profit Taking.

Use stop-loss orders to automatically limit potential losses if a trade moves against you. Have a plan for taking profits at predefined targets, whether it’s scaling out or selling a portion of your holdings. Discipline in taking profits is just as important as cutting losses.

Investing Only What You Can Afford to Lose: The golden rule.

This is non-negotiable. Only put capital into crypto that you are prepared to lose entirely. The market is highly volatile, and even well-researched projects can face unexpected challenges.

🛠️ Building Your Research Toolkit

Successful crypto research relies on using the right tools and staying informed.

Data Aggregators: CoinMarketCap, CoinGecko.

These platforms provide real-time market data, price charts, trading volumes, market caps, and links to white papers and project websites. They are your starting point for quantitative data.

On-Chain Analytics Platforms.

For deeper dives into blockchain activity, platforms like Glassnode or Santiment provide metrics like active addresses, transaction counts, exchange flows, and miner behaviour. These show genuine network usage.

Security Audit Resources.

Websites of reputable security audit firms (e.g., CertiK, ConsenSys Diligence) often publish the audit reports for projects they’ve reviewed. Always cross-reference audit reports.

News Outlets and Expert Commentary.

Stay updated with breaking news and analysis from respected sources. Be critical of ‘expert commentary’ – look for data-driven insights, not just opinions.

💡 Mini Case Studies: Learning from Real Outcomes

Understanding the process is one thing; seeing it in action is another.

Successful Research Leading to Strong Gains:

(Describe a generic positive example): “Consider a project that built a novel DeFi protocol with strong tokenomics and attracted early, organic community interest before its token listing. Thorough research would have revealed its active GitHub, experienced, doxxed team, and solid partnerships. Investing in this project early, based on these fundamentals, could have yielded significant returns as it gained adoption and listed on major exchanges, attracting more capital.” This highlights the pay-off of due diligence.

Missed Red Flags Leading to Losses:

(Describe a generic cautionary example): “Contrast that with a project promising absurd ‘APYs’ (Annual Percentage Yields) from a supposedly ‘revolutionary’ yield farming protocol. Research would have shown an anonymous team, no security audit, and a token distribution heavily skewed towards insiders. Investing in such a project, driven by FOMO and ignoring the obvious red flags, often resulted in massive losses as the liquidity was pulled, or the token’s value collapsed after an initial pump.” This stresses the cost of neglecting warnings.

✅ Your Research Checklist: A Step-by-Step Guide

To help you stay disciplined, here’s a checklist framework for evaluating any new crypto opportunity.

Initial Screening Checklist: Quick checks to filter.

- Is there a clear white paper?

- Is the team identified and verifiable?

- What is the project’s market cap and liquidity?

- Is it listed on reputable exchanges (or a credible DEX)?

- Any immediate red flags (guaranteed returns, anonymous team without strong justification)?

Deep Dive Checklist: For promising projects.

- Detailed review of tokenomics (supply schedule, vesting, utility).

- Thorough code review/security audit reports.

- Analysis of development activity (GitHub commits, roadmap progress).

- Assessment of community sentiment and activity across platforms.

- Review of major partnerships and investors.

- Regulatory risk assessment.

Ongoing Monitoring Checklist: Post-investment.

- Is the team delivering on roadmap milestones?

- Are there consistent news updates and announcements?

- Is the trading volume healthy and sustainable?

- Are there any new security concerns or regulatory changes?

- Is the community remaining engaged and growing organically?

Frequently Asked Questions (FAQs)

- What is the most important first step when researching a crypto project?

The most important first step is reading the project’s white paper to understand its core vision, technology, and economic model. - Why is an anonymous team a red flag in crypto?

An anonymous team lacks accountability and transparency, making it difficult for investors to verify their credentials or hold them responsible if issues arise. - What does ‘tokenomics’ refer to in crypto research?

Tokenomics refers to the economic model of a cryptocurrency, including its supply, distribution, vesting schedules, and how the token is used within its ecosystem. - How can I avoid pump-and-dump schemes?

Avoid projects with unrealistic promises, aggressive social media shilling, and tokens with low liquidity. Always research fundamentals and be wary of sudden, unexplained price surges. - Why is diversification important in crypto investing?

Diversification helps manage risk by spreading investments across different assets and sectors, reducing exposure to the potential failure or high volatility of any single token.

There you have it – How to Research and Spot Crypto Opportunities. This isn’t just about finding coins; it’s about building wealth by making smart, informed decisions.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team./n/nEmpower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street””