When Changpeng “CZ” Zhao — the legendary founder of Binance — bowed out after a jaw-dropping $4.3 billion settlement with U.S. regulators, the entire crypto world gasped. The question wasn’t just what’s next for Binance — it was who’s crazy enough to step into those shoes?

Enter Richard Teng — the man with 30 years of financial regulatory grit, the sharp instincts of a market veteran, and the guts to steer the world’s largest crypto exchange straight through the storm.

This isn’t a soft handover. This is a fight for Binance’s survival — and Teng’s move could define the future of global crypto.

Let’s break down exactly who Richard Teng is, what he’s bringing to the table, the mountains he must climb, and why his leadership could be the single most important story in crypto today.

🧑💼 Richard Teng’s Background

Educational Foundation

This guy didn’t just wake up and land in the driver’s seat of Binance. Teng’s path was built on hard academic chops:

- Bachelor’s in Accountancy – Nanyang Technological University, Singapore.

- Master’s in Applied Finance – University of Western Australia.

- Executive program – The Wharton School, University of Pennsylvania.

That’s not just credentials. That’s a foundation in both numbers and strategic finance.

Professional Origins

Before crypto even existed, Teng was cutting his teeth at the Monetary Authority of Singapore (MAS). Over 13 years, he was part of the team sculpting one of Asia’s most respected regulatory frameworks.

Bottom line? This guy knows how regulators think — because he was one of them.

🚀 Regulator to Innovator: Teng’s Career Progression

Singapore Exchange (SGX)

After MAS, Teng shifted gears to the Singapore Exchange (SGX) as Chief Regulatory Officer. There, he became the architect of market safeguards that protected investors while fuelling market growth.

He learned how to balance safety with innovation — a theme that follows him into Binance today.

ADGM & Crypto Regulation

Then came his defining chapter: CEO of the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority.

At ADGM, Teng was instrumental in creating one of the world’s first crypto regulatory frameworks. He wasn’t just regulating finance anymore — he was laying the tracks for crypto adoption at scale.

And guess what? ADGM became so successful it bagged the title of Financial Centre of the Year (MENA) multiple times. Teng didn’t just talk regulation — he built the damn playbook.

🔑 The Binance Chapter

Entry into Binance

By 2021, Binance needed a regulatory heavyweight. Teng was brought in as CEO of Binance Singapore, instantly giving the exchange more credibility with watchdogs.

His remit expanded quickly to MENA regional leadership, proving he wasn’t just a regulator — he was a global strategist.

Global CEO Appointment

Fast forward to 2023. With CZ stepping down amid a U.S. crackdown, Teng was chosen as the man to lead Binance worldwide.

Now he’s in charge of the biggest crypto exchange on Earth, serving over 150 million users across the globe.

👉 Want the backstory on CZ’s rise and fall? Check out Changpeng Zhao’s Binance Vision Controversy.

📉➡️📈 Acknowledging the Past, Owning the Future

Richard Teng doesn’t sugar-coat it. He admits Binance stumbled early on. Compliance wasn’t their strong suit. They were the wild west of crypto — and regulators came knocking hard.

But under Teng? The message is crystal clear:

“The era of playing catch-up is over. Binance will now set the compliance standard.”

And here’s why that matters — because compliance = survival.

👉 Related read: Crypto AML Compliance Guide.

🥊 The Primary Challenges Teng Faces

Let’s not kid ourselves — this job is a warzone. Teng has five massive battles ahead:

- Regulatory hurdles across the U.S., Europe, and Asia.

- Balancing innovation vs. compliance without killing Binance’s growth edge.

- Keeping Binance at the top of the leaderboard while Coinbase, Bybit, and DeFi giants circle like sharks.

- Expanding into new, highly regulated markets where governments won’t tolerate games.

- Staying ahead of cybersecurity threats in a market plagued by billion-dollar hacks.

👉 See how compliance rules are evolving: Crypto Travel Rule Strategy.

🔐 Security Above All

Binance has been grilled, audited, and investigated. But here’s the kicker: no funds were ever found to be misappropriated.

Teng is doubling down on that reputation:

- Multi-layered cybersecurity protections.

- Regular third-party audits.

- Clearer proof-of-reserves mechanisms.

His rally cry is simple: “Your funds are SAFU.”

👉 Dive deeper into secure storage: Multisignature Wallet Security Guide.

🇪🇺 Europe: The MiCA Opportunity

One man’s regulation is another man’s growth strategy. Teng sees the EU’s Markets in Crypto-Assets Regulation (MiCA) as a golden ticket.

While others complain about strict rules, Teng sees clarity — and clarity means expansion. Binance plans a comeback in Europe with full compliance under MiCA.

👉 Explore more: Cryptocurrency Regulations in Latin America.

🌍 Global Expansion Strategy

Binance’s dominance can’t just be about Europe. Teng is plotting expansion across:

- Asia: where retail adoption is exploding.

- Africa: where crypto solves real-world banking gaps.

- North America: the toughest regulatory battlefield, but too big to ignore.

This isn’t expansion for hype — it’s strategic survival.

⚖️ Innovation vs. Regulation: Teng’s Balancing Act

Teng’s biggest gamble? Balancing the razor’s edge between innovation and compliance.

He’s doubling down on:

- Layer-1 and Layer-2 ecosystems to boost scalability.

- DeFi integrations that don’t spook regulators.

- NFTs and gaming expansions for mass-market engagement.

- Institutional-grade tools for serious investors.

👉 Explore: Layer 1 & Layer 2 Solutions.

🎯 Leadership Style: The Teng Difference

Unlike CZ’s charismatic rebel energy, Teng’s style is measured but decisive. He’s collaborative with regulators but firm on execution.

He’s not here to win headlines — he’s here to build Binance’s second act.

🏆 Awards & Recognitions

- Multiple Financial Centre of the Year (MENA) awards during ADGM tenure.

- International credibility as a fintech thought leader.

- Frequent keynote speaker at global finance and crypto events.

🔮 The Bigger Picture: Binance’s Future Under Teng

What Teng is doing is bigger than Binance. He’s proving crypto can mature, survive regulation, and thrive globally.

His bet: compliance-driven innovation isn’t a buzzword — it’s the only way forward.

💰 What This Means for Crypto Investors

Here’s why you should care:

- Binance under Teng = safer trading environment.

- Institutional money feels safer when compliance is strong.

- Long-term adoption of Bitcoin, Ethereum, and DeFi is accelerated.

👉 Learn strategies: Master Crypto Dominance Trading.

🐺 The Wolf’s Take: Teng’s Move is Bold but Necessary

Let me cut the noise: Richard Teng is not here to pump Binance stock or play meme games. He’s playing the long game.

This is survival. This is credibility. This is the moment where Binance either becomes the Goldman Sachs of crypto — or fades into history.

And Teng? He’s betting everything that compliance + innovation = victory.

🔑 Conclusion: Teng’s Vision for the Future

Richard Teng is not just a CEO — he’s the lifeline of Binance. With 30 years of regulatory muscle, a proven record of building frameworks, and a vision to blend compliance with innovation, he’s turning the page on the CZ era.

The takeaway? Binance’s fate isn’t about hype anymore. It’s about building a credible, compliant, global crypto empire.

Adapt. Comply. Innovate. Or die. That’s the Teng doctrine.

❓ FAQs

1. Why did Richard Teng replace CZ as CEO of Binance?

CZ stepped down after a $4.3B U.S. regulatory settlement, and Teng was chosen for his regulatory expertise.

2. What are Teng’s biggest challenges leading Binance?

Global regulations, cybersecurity threats, and balancing innovation with compliance.

3. How will Binance use MiCA regulation in Europe?

By leveraging the EU’s regulatory clarity to re-enter and expand responsibly.

4. Is Binance safe for traders under Teng’s leadership?

Yes — Binance emphasises SAFU funds, stronger cybersecurity, and transparent audits.

5. What makes Richard Teng different from other crypto CEOs?

His background as a regulator gives him unmatched credibility with global watchdogs.

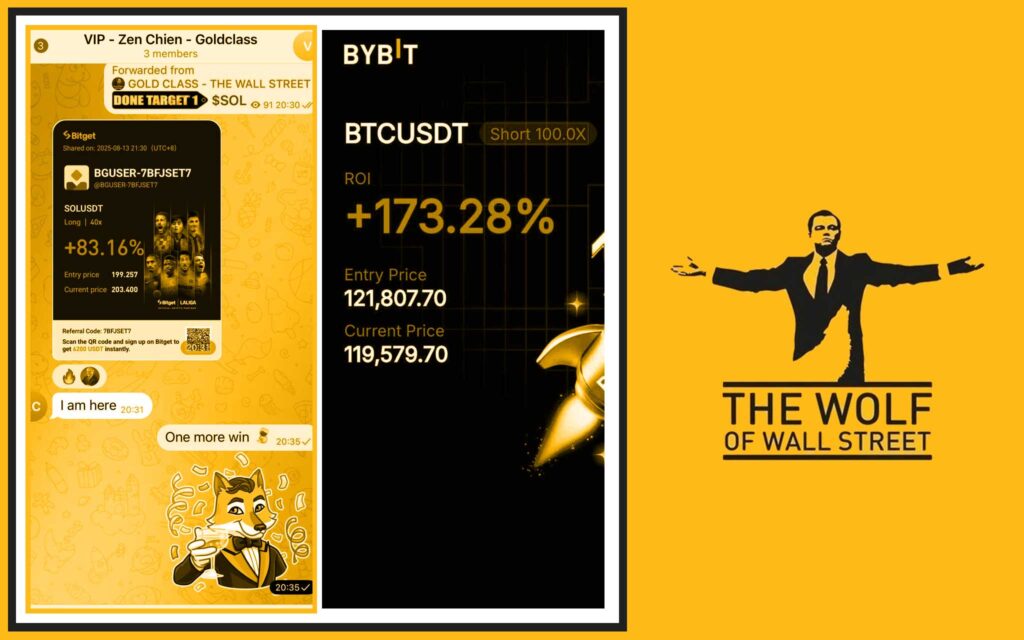

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

Here’s what you gain:

- Exclusive VIP Signals: Proprietary signals to maximise profits.

- Expert Market Analysis: In-depth insights from seasoned traders.

- Private Community: 100,000+ traders sharing strategies and support.

- Essential Tools: Volume calculators and pro-level trading aids.

- 24/7 Support: Dedicated help whenever you need it.

👉 Empower your trading journey: