🔥 Introduction: The Wolf’s Take on Bitcoin Mining in 2025

Listen up. The crypto market doesn’t wait for anyone. Bitcoin mining has become a battlefield where only the most efficient, ruthless, and forward-thinking players survive. In August 2025, two giants—Riot Platforms and CleanSpark—didn’t just survive; they crushed expectations, pumping out more Bitcoin while mining difficulty hit record highs.

That’s not luck—it’s strategy, efficiency, and guts. And if you’re trading crypto today, you’d better learn from these moves—or risk getting eaten alive.

📈 The Mining Miracle: Riot & CleanSpark Defy Gravity

Let’s talk production. While weaker miners were drowning in the rising tide of mining difficulty, Riot and CleanSpark ramped up like predators on the hunt:

- Riot mined 477 BTC, a 48% year-over-year increase.

- CleanSpark mined 657 BTC, up 37.5% year-over-year.

That’s growth in the middle of chaos. Translation? These firms aren’t just surviving—they’re thriving.

💰 Financial Flex: Selling BTC but Growing Treasuries

Now, here’s the kicker. Both companies sold big chunks of Bitcoin in August, pocketing tens of millions—yet their treasuries still ballooned.

- Riot sold 450 BTC for $51.8M, but holdings shot to 19,309 BTC (+92.7% YoY).

- CleanSpark sold 533.5 BTC for $60.7M, yet their treasury climbed to 12,827 BTC (+69.7% YoY).

That’s what I call smart money. They’re liquidating enough to fuel expansion while stacking enough Bitcoin to keep a war chest. Traders, take notes: liquidity + long-term positioning is how you dominate.

👉 For deeper insights, check our Trading Insights section and the latest Cryptocurrencies news.

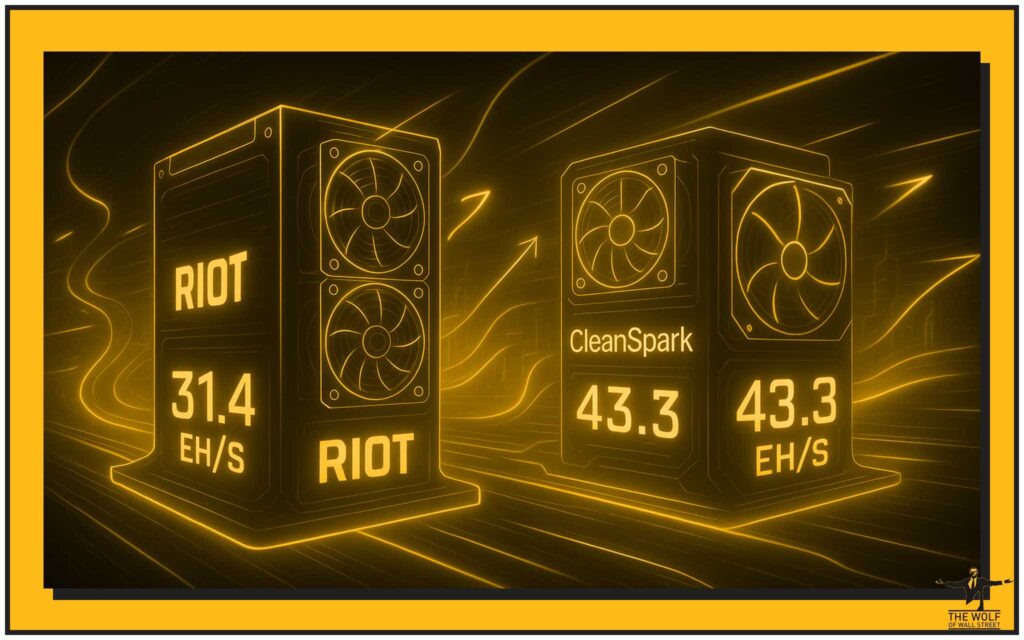

🚀 Hash Rate Arms Race: Powering Up for War

Hash rate is the miner’s horsepower. Riot and CleanSpark just strapped rockets to their rigs:

- Riot’s hash rate: 31.4 EH/s (+116.6% YoY).

- CleanSpark’s hash rate: 43.3 EH/s (+103.3% YoY).

When difficulty climbs, only the miners with brute-force hash power survive. Riot and CleanSpark didn’t just add horsepower—they doubled it. That’s aggression, that’s ambition, and that’s how you win.

🛠️ Efficiency is King: Riot’s 2.6¢ Power Play

You want a killer advantage? Check this: Riot runs electricity costs at just 2.6¢ per kWh. That’s not just cheap—that’s a weapon. Add in demand-response credits and clever energy strategies, and you’ve got a company mining at a cost competitors can’t touch.

Lesson for traders? Efficiency = survival. If your trading strategy bleeds fees and bad entries, you’re already losing.

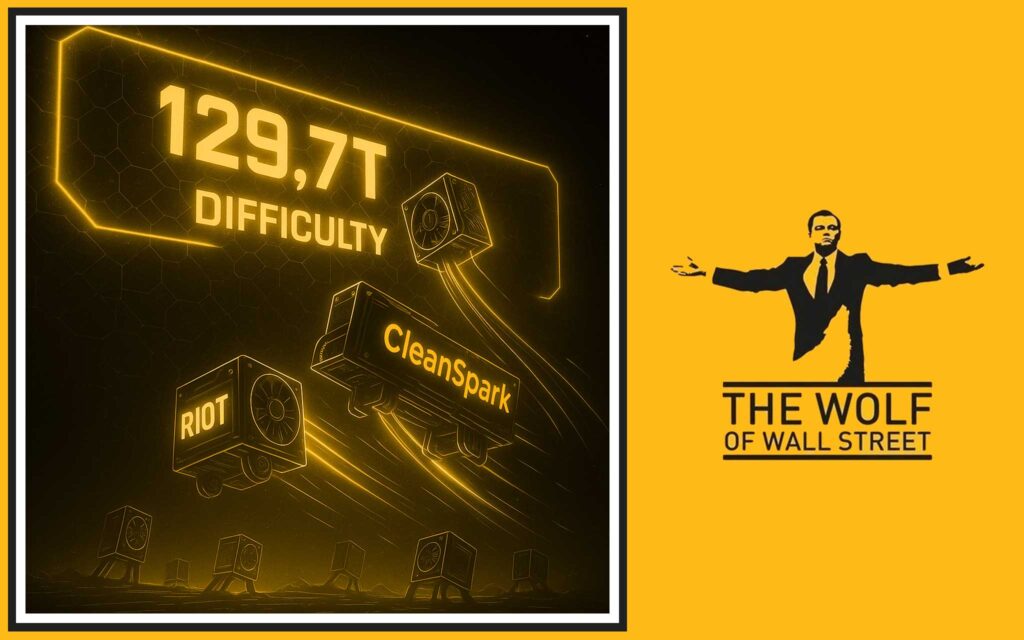

📊 Bitcoin Mining Difficulty: The 129.7T Monster

Here’s the ugly truth: Bitcoin mining difficulty surged 44.9% YoY to a mind-bending 129.7 trillion in August 2025. That’s a wall most miners smashed into head-first.

But Riot and CleanSpark didn’t crash—they accelerated. The takeaway? Challenges are opportunities for the prepared. Same applies to trading. The market doesn’t get easier, you just get smarter—or get wiped out.

🤖 Beyond Mining: The AI & HPC Pivot

Here’s where it gets interesting. Some miners—Hut 8, Hive, Iren—are hedging bets by jumping into AI and high-performance computing (HPC). They see the difficulty squeeze and pivot toward fresh revenue streams.

Smart move? Absolutely. But Riot and CleanSpark are laser-focused on BTC right now, and the numbers prove it’s working. Traders, the parallel is clear: diversify smartly, but never lose sight of your core edge.

🏦 The Bigger Trend: Miners Becoming Financially Self-Sufficient

The old miner game was simple: hodl every satoshi and pray for moonshots. That’s dead. Today’s giants are selling Bitcoin strategically to fund expansion, cover costs, and scale operations.

Riot and CleanSpark are the blueprint: don’t sit on your assets like a dead weight. Deploy them. Grow them. Make your portfolio work for you.

💡 Takeaway for Crypto Traders: What You Can Learn

Miners and traders are playing the same game—just with different tools. Here are three core lessons you should be applying now:

- Efficiency wins – Riot cut energy costs to the bone. Traders need to cut emotional decisions and fee-draining mistakes.

- Balance liquidity and growth – Sell some profits to reinvest, but stack long-term holdings.

- Embrace difficulty – Difficulty spikes are filters. Only the strong stay profitable.

👉 Want to sharpen your edge? Explore our Bitcoin insights or check out trending strategies in Hot.

🌍 Market Context: How Competitors Stack Up

Against the likes of Marathon Digital, Hut 8, Hive, and Iren, Riot and CleanSpark are pacing the pack. They’re not just competing—they’re setting the standard. While others pivot, these two are doubling down on mining dominance.

The signal? The big dogs are separating themselves from the herd.

⚡ The Trader’s Edge: Riding Mining Waves with The Wolf Of Wall Street

Here’s the crossover: Riot and CleanSpark dominate mining because they’ve got strategy, efficiency, and scale. You can dominate trading the same way—if you have the right community backing you.

That’s where The Wolf Of Wall Street crypto trading community steps in. Think of it as your personal mining rig for profits: VIP signals, expert analysis, 24/7 support, and a community of 100K+ traders moving as one.

🧠 Psychology of Winning in Volatile Markets

You know what separates winners from losers? Mindset. Riot and CleanSpark didn’t flinch when difficulty soared—they doubled down. Traders must do the same.

Discipline + aggression = wealth. Panic + hesitation = liquidation. Simple math.

🔐 Why Community Matters: Power in Numbers

Scale wins. Riot scaled hash rate. CleanSpark scaled operations. Traders? You scale community.

With The Wolf Of Wall Street’s private group of over 100,000 members, you’re not trading alone. You’re part of a machine that thrives on collective insight. Add 24/7 support, and suddenly you’ve got the trader’s equivalent of Riot’s cheap power advantage.

👉 Beginners, start with Newbie tips. Dive deeper into DeFi opportunities or learn how Ecosystems are shaping the next wave of crypto.

📉 Risk Management: Lessons from the Difficulty Surge

Mining difficulty up nearly 45%—yet Riot and CleanSpark still profit. That’s risk management in action. Traders must treat market volatility the same way:

- Expect difficulty.

- Prepare for turbulence.

- Use tools like The Wolf Of Wall Street calculators to keep risk controlled.

When the storm hits, amateurs panic. Professionals adapt.

🔮 The Future: Mining + Trading Evolution in 2026 and Beyond

Where are we headed?

- Mining firms will blend Bitcoin with AI, HPC, and data services.

- Bitcoin’s future price will hinge on miner efficiency and institutional liquidity.

- Traders will need stronger strategies, faster execution, and smarter insights.

The Wolf Of Wall Street positions you right in the middle of that shift—armed with tools and knowledge to exploit every wave.

✅ Conclusion: Adapt or Die – Lessons from Riot & CleanSpark

The lesson from Riot and CleanSpark is brutal but clear: adapt, scale, and execute—or get crushed. Mining difficulty soared, competitors scrambled, but these two built empires in chaos.

Traders, your playbook is the same. Efficiency. Liquidity. Discipline. Community. That’s how you win.

So here’s the bottom line: miners are evolving. Are you?

👉 Start levelling up today with The Wolf Of Wall Street crypto trading insights. Join the Telegram community and stop trading blind.

❓ FAQs

1. Why are Riot and CleanSpark growing despite higher mining difficulty?

Because they’ve scaled hash rates, slashed costs, and executed smarter than the competition.

2. How does hash rate growth affect Bitcoin price?

It strengthens network security and signals miner confidence, but also creates selling pressure as miners liquidate BTC.

3. Should traders mirror miner strategies in their trading approach?

Absolutely—manage risk, scale strategically, and reinvest profits to grow.

4. What role does The Wolf Of Wall Street play in helping traders manage volatility?

It provides VIP signals, expert analysis, calculators, and a massive support community so you never trade alone.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.