🛎️ Introduction: The Wolf’s Wake-Up Call to Crypto

Listen up! If you’re still sitting on the sidelines wondering where the next big wave in finance is, I’ve got news for you: Robinhood just doubled its crypto revenue in a single quarter—and if you’re not paying attention, you’re leaving money on the table. This isn’t just another quarterly update. This is the dawn of a new era where retail and institutional money collide, and Robinhood is betting big on asset tokenization.

What’s that mean for you? Everything. If you want a seat at the new Wall Street, now’s the time to claim it.

Let’s break down why Robinhood’s Q2 2025 isn’t just an earnings beat—it’s a blueprint for the next financial revolution.

💸 The Big Numbers: Robinhood’s Crypto Revenue Blasts Off

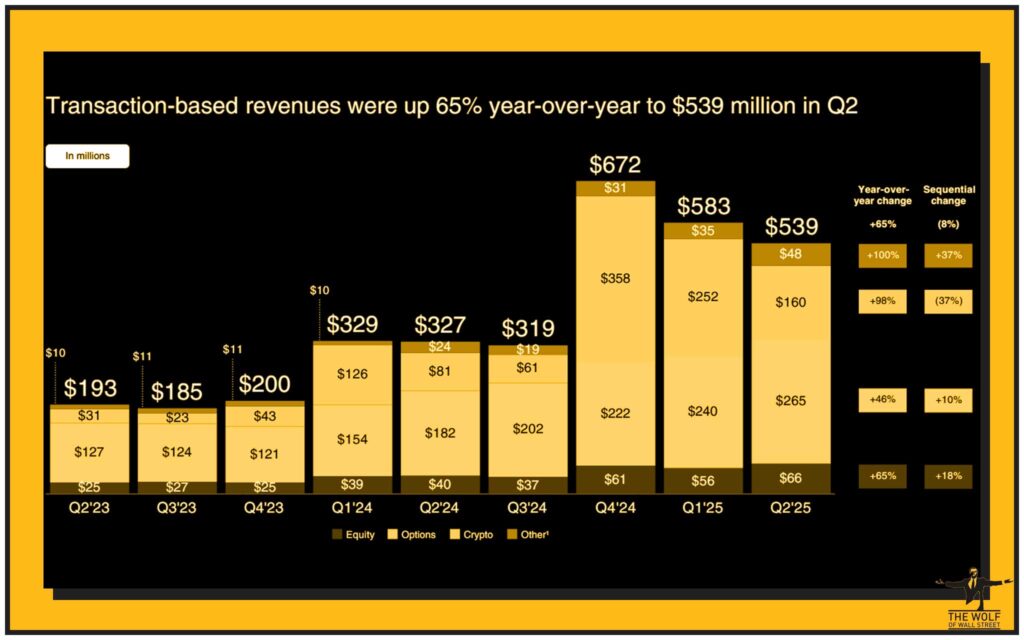

Here’s what matters: Robinhood’s Q2 2025 crypto revenue hit $160 million—a 98% year-on-year jump. Let’s not sugarcoat this. That’s nearly doubling up while the rest of the market is still figuring out what hit them.

How did they do it? Simple. The company saw a 32% surge in crypto trading volume, clocking in at a mind-bending $28 billion.

Here’s how the hard numbers stack up:

| Q2 2024 | Q2 2025 | YoY Change | |

|---|---|---|---|

| Crypto Revenue | ~$81M | $160M | +98% |

| Total Revenue | $682M | $989M | +45% |

| Net Income | ~$163M–$188M | $336M–$386M | +100%–105% |

| Trading Volume | ~$21B | $28B | +32% |

| Funded Accounts | ~24M | 26.5M | +10% |

Let’s keep it straight—these numbers don’t lie. They tell the story of a company that’s pivoted hard into the future, with crypto as its engine.

🏦 Total Net Revenue: Robinhood Prints Money

Take a look at the big picture: Total net revenue surged 45% year-on-year to $989 million. That’s not just growth, that’s domination. Net income more than doubled, landing somewhere between $336–386 million.

What’s fuelling this monster run? You guessed it—crypto. Not just as a speculative asset, but as the core revenue driver.

Want to see what’s happening behind the scenes in the industry? Check out the news section for sector trends, and dive deep into cryptocurrencies for market-shaking moves.

📈 The Engine Room: Crypto Trading Volumes Surge

Volume is the heartbeat of any trading platform, and Robinhood’s pulse is racing. Crypto trading volumes soared by 32%, reaching $28 billion for the quarter. But here’s where it gets wild: This wasn’t just retail FOMO—Robinhood has started onboarding serious institutional players, thanks to the Bitstamp acquisition. Retail traders, whales, and even hedge funds are now mixing in the same pool.

Let’s be clear: It’s not just about more trades. It’s about bigger money, higher stakes, and a platform that’s finally able to handle both sides of the street.

🔄 From Meme Stocks to Market Makers: Robinhood’s Evolution

Remember when Robinhood was the “meme stock” casino? Those days are over. This isn’t a kid’s app anymore. The platform has outgrown its meme-stock roots, evolving into a legitimate, diversified financial powerhouse.

The playbook? Expand aggressively, court both retail and institutional, and put real money behind next-gen technology.

This is how you graduate from being the joke of Wall Street to being the one writing the punchlines.

🎲 Tokenization: Robinhood’s All-In Bet

Let’s talk about what really moves markets—asset tokenization.

CEO Vlad Tenev is betting the house that the future isn’t just about trading tokens, it’s about tokenising everything: private equity, real estate, venture capital, even pre-IPO shares.

Here’s the translation: It means giving you access to investments that used to be locked away for the ultra-rich. With tokenization, the velvet rope drops. Anyone, anywhere can buy a piece of what used to be “insider only.”

This is Wall Street for everyone—or what I call “All Street.”

🔗 The Robinhood Chain: Layer 2 Unleashed

Alright, here’s where we get a little technical—but not boring. Robinhood launched its own Layer 2 blockchain, the Robinhood Chain.

What’s the point? It makes trading tokenized stocks faster, cheaper, and borderless—starting with 30 European countries, and soon targeting the US as regulations allow.

How does it work?

- Layer 2 Blockchain: Think of it as a superhighway built on top of the main crypto roads—fast lanes for tokenized trades.

- Asset Tokenization: They’re creating digital versions of real-world assets. You want a slice of SpaceX, OpenAI, or a chunk of prime London real estate? Now you can buy, sell, and trade in seconds.

For those who want to go deep into the tech weeds, check out layer-1-and-layer-2-solutions for the nuts and bolts.

💼 Bitstamp Acquisition: Buying Credibility and Scale

When Robinhood dropped $200 million on Bitstamp, it wasn’t just a headline move—it was a play for global domination.

Here’s what they got:

- Institutional Trust: Bitstamp brings a reputation that unlocks serious institutional capital.

- Licenses Galore: Cross-border licenses open doors in Europe and beyond.

- Deeper Product Suite: Bitstamp’s staking, advanced order types, and tokenization capabilities are now Robinhood’s to wield.

That’s how you buy instant credibility and take your tokenization roadmap global.

🌍 WonderFi and the DeFi Push: Expansion Without Limits

If you thought Robinhood was going to stop with Bitstamp, think again. They’re teeing up a deal to acquire Canada’s WonderFi—a move that cranks their DeFi ambitions to the next level.

Here’s what it means:

- DeFi Integration: Seamless access to decentralised finance products.

- Cross-Border Reach: Expanding into Canada and further afield.

- Platform Synergy: More ways for users to earn, borrow, and trade.

Want to see how DeFi fits into this picture? Take a look at our defi insights for more.

🏰 User and Asset Growth: Building a Fortress

Robinhood isn’t just adding users—it’s building an empire. Funded customer accounts climbed 10% to 26.5 million.

Total platform assets? Nearly doubled, sitting at a staggering $279 billion. Premium subscriptions (Robinhood Gold) hit 3.5 million, while cash sweep balances ballooned 56% to $32.7 billion.

They’re not just growing; they’re fortifying. This is the kind of base you need if you’re planning to reshape global finance.

⚠️ Challenges: Not All That Glitters is Gold

Let’s not pretend everything is perfect. Monthly active users came in below the wildest expectations—12.8 million versus the 14.25 million some analysts wanted. And Robinhood’s push into tokenization has already drawn regulatory fire, especially in Europe (Lithuanian legal inquiries, anyone?).

Even with strong earnings, the share price barely budged—proving the market wants to see execution, not just vision.

This is high-stakes poker, and the regulatory chips are still on the table.

⚔️ Tokenization Tech: The Competitive Battlefield

Robinhood’s not the only wolf in the yard.

- Ethereum dominates tokenization, with $7B in real-world assets (RWAs) locked.

- ZKsync Era holds a cool 19% ($2.4B) of that pie.

- eToro and other platforms are muscling in, but Robinhood’s edge is user base, assets, and execution speed.

Want the inside scoop on how tokenization is shaking up the entire crypto ecosystem? Dive deeper.

🗡️ Risk and Regulation: The Knife’s Edge

Here’s the truth—tokenization is a legal minefield.

- Ongoing regulatory scrutiny in the US and Europe.

- Lithuania’s legal challenge over Robinhood’s tokenized equity moves.

- Even OpenAI distanced itself from tokens representing its shares.

The risks are real. But so is the upside.

For the savvy trader, risk is opportunity in disguise. Just make sure you know where the landmines are.

If you’re new to these risks, start with our newbie guide.

🙋♂️ What This Means for Retail Investors

This isn’t just corporate strategy—it’s your shot at access.

- Diversification: Tokenized assets open the floodgates to private equity, VC, and real estate.

- Liquidity: Trade what used to be illiquid, 24/7.

- Accessibility: Invest in blue-chip opportunities that were once reserved for Wall Street insiders.

This is your wake-up call. The future isn’t Wall Street, it’s “All Street.”

Explore more in our trading insights.

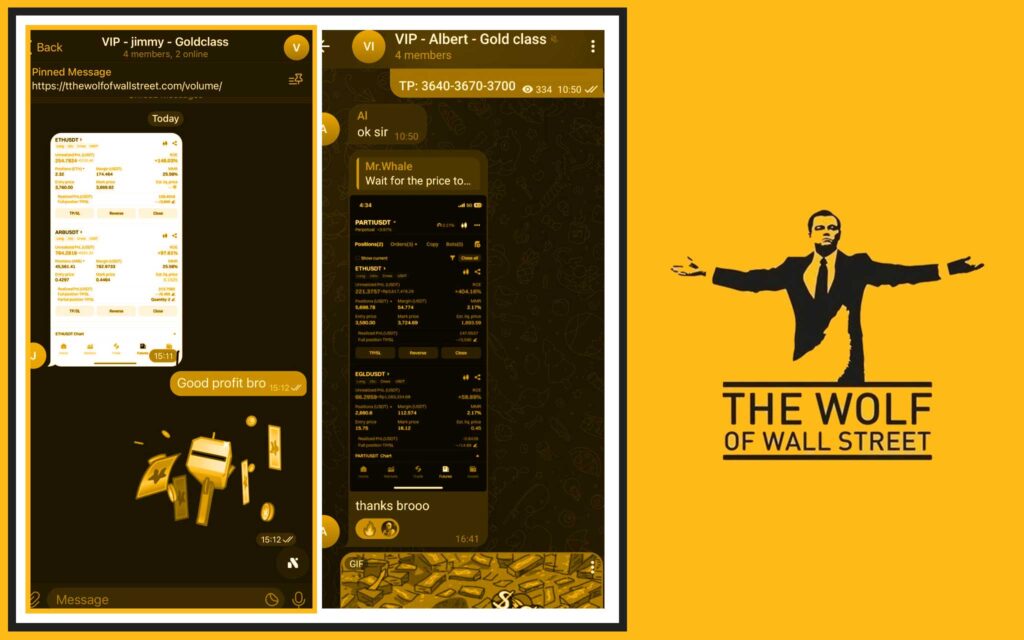

🦈 The Wolf Of Wall Street Crypto Trading Community: The Ultimate Crypto Edge

Want to play at the level Robinhood is betting on? Don’t go it alone—get the The Wolf Of Wall Street edge:

- Exclusive VIP Signals: Get the kind of proprietary trade signals that can help you maximise profits, even in wild markets.

- Expert Market Analysis: Leverage in-depth insights from seasoned pros—real knowledge, not hype.

- 100,000+ Member Private Community: Trade smarter with the crowd that actually knows what’s up.

- Essential Trading Tools: Make informed moves with calculators and resources built for serious traders.

- 24/7 Support: Never get left hanging, even when the market never sleeps.

Empower your crypto journey:

Unlock your potential in the crypto market with The Wolf Of Wall Street—don’t let the next big trade slip by.

🏁 Conclusion: The Wolf’s Verdict—Adapt or Get Left Behind

Let’s land this plane.

Robinhood’s pivot into crypto and asset tokenization is more than a corporate transformation—it’s a generational opportunity.

Will there be volatility, risk, and regulatory battles? Absolutely. But fortune favours the bold.

If you want to ride this wave, get informed, get strategic, and get moving. Don’t just watch—profit.

❓ FAQs: Real Answers for Real Traders

Q: What is asset tokenization and why does it matter?

A: It’s converting real-world assets (like stocks, real estate, or private equity) into tradable blockchain tokens, giving retail investors access to markets once reserved for the ultra-wealthy.

Q: How do I benefit from Robinhood’s new crypto and tokenization features?

A: By trading a wider range of assets, diversifying your portfolio, and accessing new markets via a user-friendly platform.

Q: What are the risks for retail investors?

A: Regulatory changes, market volatility, and the unknowns of new tech. Always do your homework.

Q: How does the The Wolf Of Wall Street community help me profit in volatile markets?

A: By giving you access to VIP signals, expert analysis, and a massive support network so you can make smarter moves.

Q: Where can I find more trading insights?

A: Check out trading insights, hot topics, and our trending section.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.