🤑 Intro: Welcome to the Big Leagues

Listen up—because what you’re about to read isn’t just another crypto headline. This is the type of seismic move that sends tremors through the entire market. A legendary Satoshi-era Bitcoin investor just unloaded 80,000 BTC—that’s right, eighty thousand—for a staggering $9 billion through Galaxy Digital. If you don’t see the opportunity in this, you’re not looking hard enough.

This isn’t just a whale making a splash—this is generational wealth moving the chessboard, and the market barely blinked. You want to know what separates winners from the crowd? They see the playbook when the big money moves. Let’s break down why this matters—and how you can ride the next wave.

🚀 The Legend of Satoshi-Era Bitcoin

Let’s get something straight. “Satoshi-era Bitcoin” isn’t just an expression—it’s a badge of honour in the crypto world. These are coins mined when most people thought Bitcoin was a geeky science experiment, not the multi-trillion dollar juggernaut it is today. We’re talking about coins that haven’t moved for over a decade, sitting quietly in digital vaults, immune to every bubble, every crash, every FUD storm.

Owning Satoshi-era BTC means you were early. Like, first-in-line at the gold rush early. These coins come with a mystique, a story, and a level of respect reserved for OGs who saw what the world would become before anyone else believed. So, when one of these legends suddenly wakes up and moves tens of thousands of Bitcoin? Every serious trader, fund, and analyst on the planet sits up.

💰 Meet the Whale: 80,000 BTC on the Move

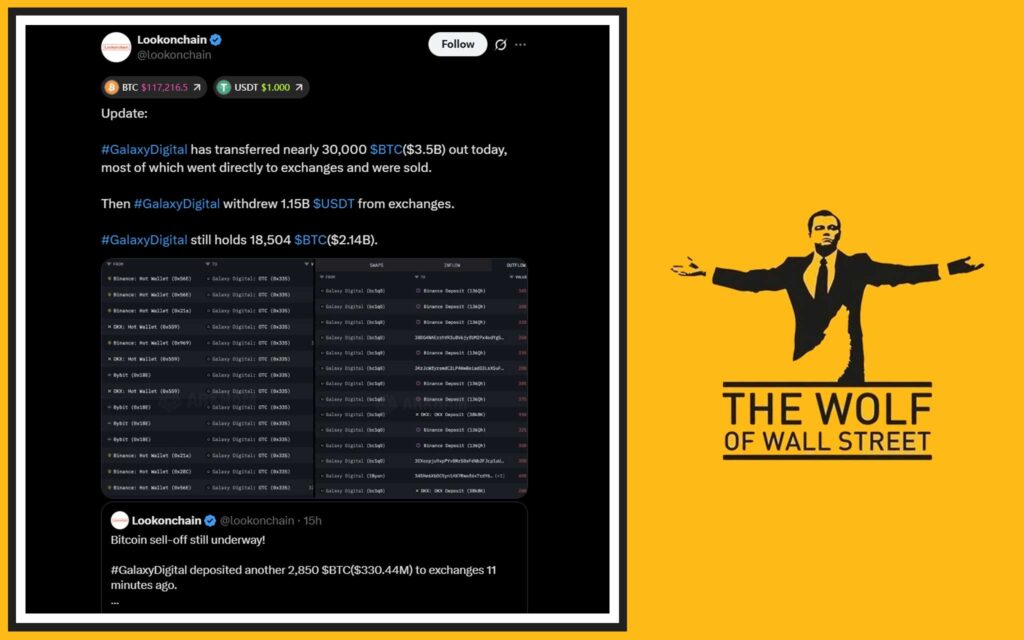

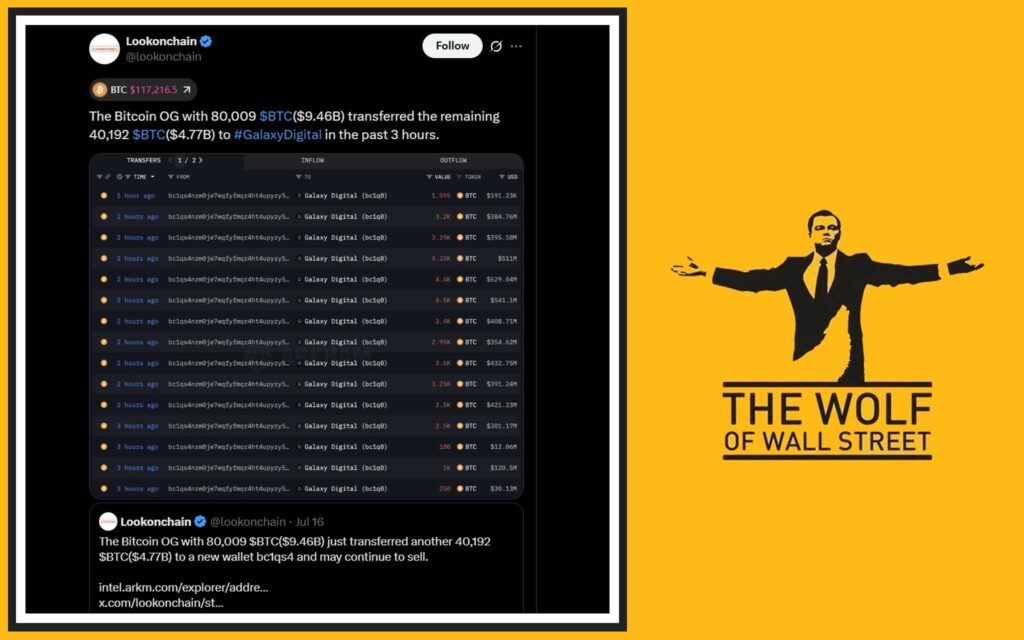

Who are these titans of early Bitcoin? Most operate in total silence—stealth mode. But blockchain doesn’t lie. The address in question had been dormant for years, accumulating digital dust while the price of Bitcoin rocketed from a few bucks to over $60,000. Suddenly, that wallet—holding enough BTC to move markets—sprang to life.

What’s 80,000 BTC worth? More than the GDP of some small countries. For context, this single transaction represents a significant chunk of daily trading volume on top exchanges. This wasn’t your typical market sell-off—this was a strategic, precision operation, likely planned months in advance.

🏦 Galaxy Digital: The Kingpin Facilitator

So why bring Galaxy Digital into the mix? Simple: if you want to move billions without breaking the market—or painting a target on your back—you need an institutional heavyweight. Galaxy Digital isn’t some fly-by-night operation. These guys have built their empire by handling mega-deals for whales, hedge funds, and the kinds of clients who don’t flinch at a $100M wire.

Galaxy’s role? Provide execution, discretion, and confidence. When a client wants to cash out a Satoshi-sized bag, they don’t just hit “market sell” on Binance. They call Galaxy, set up an over-the-counter (OTC) deal, and offload in a way that doesn’t crash the price or trigger panic selling. Galaxy’s reputation for institutional adoption is rock-solid. That’s why the biggest players trust them.

🔎 Anatomy of the $9 Billion Sale

Now, let’s dissect the move. Details are scarce, but here’s what’s known:

- Wallet Transfer: The dormant address shifted 80,000 BTC to a fresh wallet controlled by Galaxy.

- OTC Execution: Galaxy handled the sale discreetly—no wild price swings, no headlines until the deal was done.

- Real Estate Planning: Word from insiders is this was part of a major asset diversification, possibly for real estate.

Transparency? Limited. Blockchain sleuths can track the coins, but the precise execution price, timing, and final buyer? Still under wraps. What’s clear is this: the process was professional, strategic, and managed to avoid market chaos.

📉 Immediate Market Reaction – FUD or Opportunity?

Here’s where most people get it wrong. They expect an 80,000 BTC sale to nuke the price, trigger panic, and send headlines screaming. Reality? The market barely flinched. Sure, there was a brief dip, but it rebounded faster than you can say “diamond hands.”

Why? Because the smart money anticipated, the order books were deep, and the ecosystem is more resilient than ever. No flash crash, no death spiral—just a hiccup, then back to business. If you were glued to the latest crypto news or the trading insights desk, you saw it all unfold in real time.

🦾 Market Resilience: Why Bitcoin Didn’t Crash

This is where Bitcoin separates itself from every other asset on the planet. Back in the early days, a sale this size would have cratered the price. Now? The network absorbs it. Why?

- ETF Inflows: Institutions are buying dips at record pace.

- Corporate Adoption: Companies are stacking sats for balance sheets.

- Sophisticated Traders: OTC desks, bots, and quant funds soak up supply.

Compare this to 2017 or even 2020, and it’s night and day. The market has matured. This sale was a test of strength, and Bitcoin passed with flying colours.

🧠 What the Analysts Really Think

So what do the experts say? Let’s cut through the noise:

“The sale shows just how deep Bitcoin’s liquidity pool has become. For a move of this size to barely make a dent? That’s institutional-grade resilience.”

— Jason Williams, Bitcoin Analyst“We’re witnessing a new era. Whales can offload without tanking the market, thanks to sophisticated infrastructure and rising demand from ETFs.”

— Joe Consorti, Market Strategist

The consensus? This is bullish. It shows confidence, maturity, and the ability for big players to enter and exit without chaos.

🏗️ Motivations Behind the Move

Why sell now? For most whales, moves this size aren’t about fear—they’re about strategy.

- Diversification: Spreading risk into real estate, stocks, or other ventures.

- Legacy Planning: Transferring wealth to new generations.

- Market Timing: Taking profits as Bitcoin stabilises above historic highs.

Don’t fall for amateur FUD. This isn’t a “loss of faith”—it’s a textbook play by a pro who’s already won. They’re cashing out chips, not leaving the table.

📊 Sizing Up the Impact on Supply and Price

Let’s talk hard numbers:

- 80,000 BTC = ~0.4% of total supply.

- Daily exchange volume: Usually hovers around 300,000–500,000 BTC.

- Order book absorption: Multiple buyers, layered across desks and regions.

So while $9 billion sounds colossal, it’s a blip in the grand scheme. The supply shock is minimal when liquidity is this deep. It’s all about how and where it’s executed.

🌍 Ripple Effects Across the Crypto World

Big moves like this send shockwaves, not just through Bitcoin, but the entire digital asset ecosystem.

- ETF Demand: More institutions see these events as opportunities—not risks.

- Corporate Stacking: Companies increase exposure, using events like this as entry points.

- Altcoins Watch: Altcoins often rally as money rotates through the market.

If you’re tracking ecosystem news or monitoring hot trends, you’ll spot patterns that most retail traders miss. This is why data—and knowing where to find it—matters.

🔒 Transparency, Trust, and Market Maturity

Some critics will say, “But where are the details?” That’s the game. High-stakes OTC deals are never fully public for security, privacy, and market stability. Galaxy Digital shared what they could, and the rest? That’s for the sharpest eyes in the room.

But here’s the real trust signal: the market absorbed the move. No black swans. No exchanges imploding. This is what a mature asset class looks like. If you want pure transparency, track the blockchain yourself—no smoke, no mirrors.

🛠️ How to Trade Like a Wolf: Tools, Signals, and Communities

Think this level of play is out of reach? Think again.

Today, you’ve got access to pro-grade tools and insider-level signals that used to be reserved for institutional desks. One standout: the The Wolf Of Wall Street crypto trading community.

- VIP Signals: Get proprietary alerts designed to maximise profits.

- Expert Analysis: Leverage insights from battle-tested traders.

- Volume Calculators & Tools: Make data-driven decisions every trade.

- 100,000+ Members: Share strategies with a massive network.

- 24/7 Support: Never trade alone—real help, real time.

Bottom line: if you’re not leveraging these resources, you’re leaving money on the table.

👥 The Power of Private Crypto Networks

Serious traders understand: you’re only as strong as your network. That’s why private communities matter more than ever.

- Real-Time Updates: Stay ahead of news, pumps, and FUD.

- Shared Intelligence: Learn from wins—and losses—of others.

- Exclusive Access: Get in on deals and trends before they hit the mainstream.

Join the The Wolf Of Wall Street Telegram community for round-the-clock insights and discussions. If you want to move like a whale, start by swimming with them.

🏆 Lessons for Every Crypto Trader

What separates the winners from the bag-holders? Three things:

- Preparation: Know your exits before you enter.

- Information: Leverage signals, analysis, and tools like The Wolf Of Wall Street.

- Discipline: Don’t get shaken out by FUD or hype.

The Satoshi-era sale proves one thing: markets reward the prepared and punish the reckless. Learn the game, use the tools, and never stop levelling up.

⚡️ Action Steps: Profit from the Next Mega-Move

Ready to spot the next seismic shift? Here’s how:

- Track Whale Activity: Use on-chain tools and follow wallets.

- Subscribe to Pro Signals: Don’t trade blind—use proven alerts.

- Read, Learn, Repeat: Dive into trading insights, market analysis, and crypto news.

- Engage in Community: Share strategies, ask questions, collaborate in real-time.

Don’t wait for the next headline to act. The opportunity is now. If you’re not in the game, you’re already losing.

🏁 Conclusion: The Market Rolls On

Here’s the kicker: in crypto, resilience isn’t just a buzzword—it’s the core of survival. An 80,000 BTC sale would have wrecked the market years ago. Now? The network, the traders, the institutions—they eat it for breakfast.

Stay sharp. Stay connected. Stay in the money.

The next whale move is always around the corner. Will you be ready?

🙋 FAQs

1. How common are Satoshi-era Bitcoin sales?

Rare. These coins are legendary and usually stay put for years. When they move, everyone pays attention.

2. What risks do large Bitcoin liquidations pose?

If not handled via OTC or with institutional partners like Galaxy Digital, they can trigger flash crashes. But in mature markets, impact is limited.

3. Who can access VIP crypto signals?

Communities like The Wolf Of Wall Street offer signals to members—essential for serious traders.

4. How does Galaxy Digital handle mega-transactions?

Through discreet, strategic OTC deals that avoid slippage and minimise market disruption.

5. Where can new traders get a real edge?

Start with crypto newbie guides, join top communities, and use trusted trading tools for your journey.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.

Internal links naturally integrated throughout. For full market mastery, check out trading insights, Bitcoin market analysis, and stay ahead with the latest crypto news.