🏁 Introduction: Shake Up or Shut Down? The SEC’s Bitwise ETF Move Unpacked

Picture this: the market’s buzzing, analysts are glued to their screens, and then—bang! The SEC approves Bitwise’s historic move to become the first multi-asset crypto ETF in the US. But just as the confetti starts to fall, they slam on the brakes with a surprise “pause.” Instant confusion. Headlines everywhere. Retail and institutional traders scrambling for answers.

This isn’t just another regulatory blip—it’s a seismic event. If you’re in crypto, your next move matters more than ever. In this article, we’re stripping away the fluff and exposing what’s really happening behind the curtain—and what YOU can do to profit, no matter how the cards fall.

🚦 What Just Happened? The SEC’s Rollercoaster Approval Explained

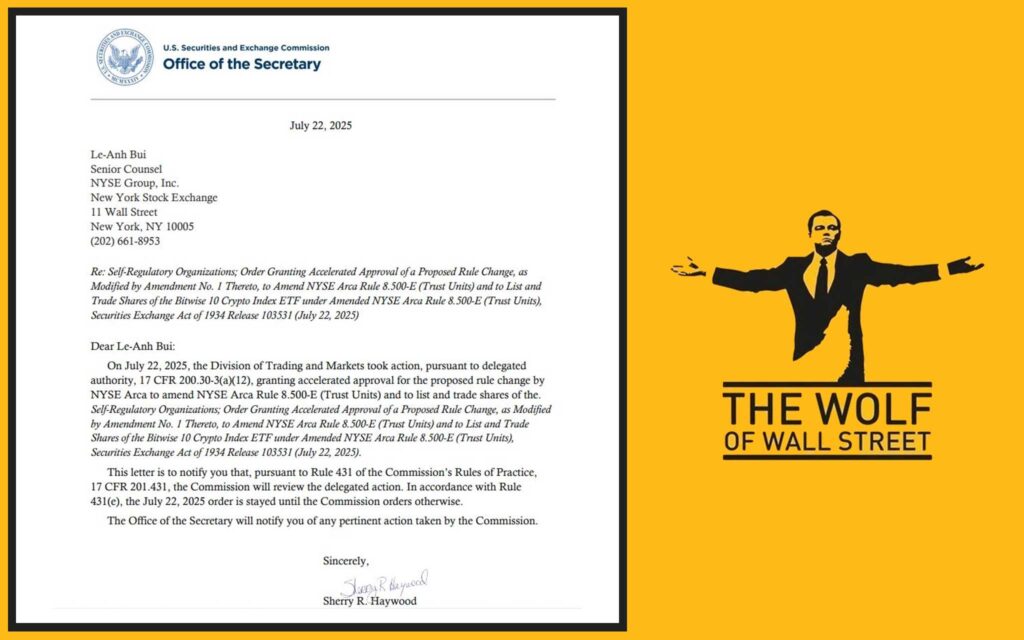

Let’s keep this direct: On July 22, 2025, the SEC’s Division of Trading and Markets granted “accelerated approval” for Bitwise to convert its 10 Crypto Index Fund (BITW) into a spot ETF. Wall Street cheered—this was set to be the first of its kind, a diversified, multi-coin ETF in the States. Crypto mainstream at last!

But within hours? The SEC issued a stay. All progress froze. No launch, no ticker symbol, no ETF party. Just a cold, bureaucratic “pause until further Commission orders.”

For traders, this was the definition of whiplash.

🧩 Meet the Bitwise 10 Crypto Index Fund

Here’s what you must know: BITW isn’t just any fund. It’s a juggernaut launched in 2017, tracking the top 10 cryptocurrencies by market cap—think Bitcoin, Ethereum, Solana, XRP, Cardano, and more. As of this writing, it manages a heavyweight \$1.4 billion in assets, trading on the OTCQX Best Market, with about 90% of its exposure in Bitcoin.

But here’s the twist: Bitwise wants ETF status. That means everyday investors could buy in with the click of a button, no sketchy wallets or risky exchanges. That’s the power move.

🏛️ The Big Conversion Play: ETF Status and What’s at Stake

Let’s get real—converting BITW into a spot ETF is a game-changer. Why? ETFs are the institutional ticket. Pension funds, asset managers, and retail newbies all get access. Liquidity skyrockets. Fees drop. Legitimacy arrives.

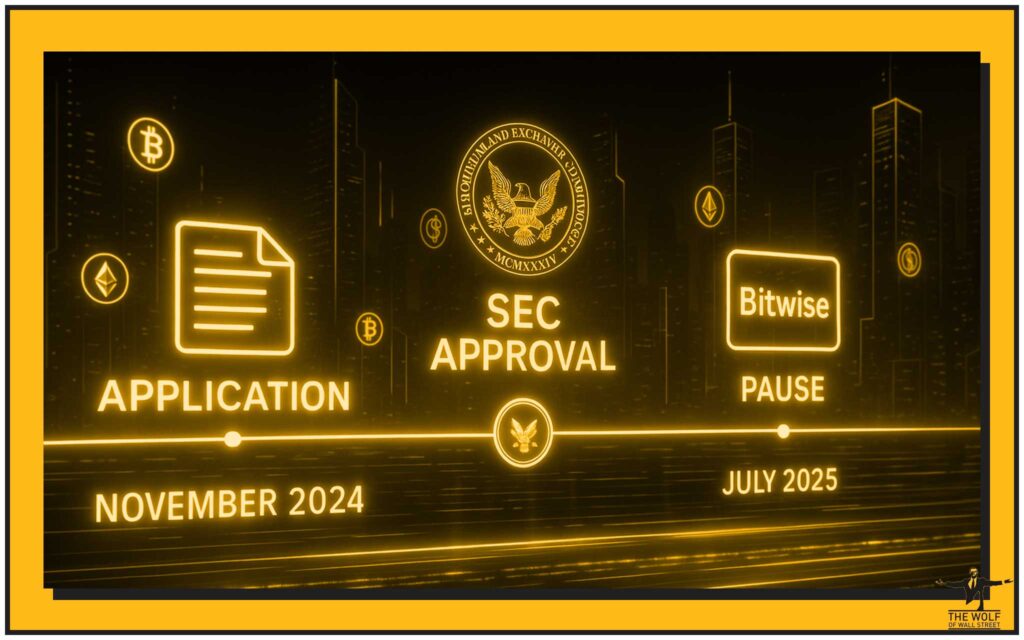

Bitwise has been gunning for this since November 2024, aiming to launch the US’s first multi-asset crypto ETF. If you want to know what “mainstream adoption” looks like, this is it.

⚡ Accelerated Approval—Then Full Stop: Timeline of Events

- November 2024: Bitwise submits its ETF conversion application.

- July 22, 2025: SEC approves the conversion—cue the market rally.

- Hours later: SEC reverses, issuing a “stay” letter. Trading on pause, future in limbo.

It’s déjà vu all over again. And the market? Left in a state of FOMO, frustration, and speculation.

For more on real-time market shifts, check out our news updates, trading insights, or get the edge with our full-service community.

🕵️♂️ Why the Pause? Inside the SEC’s Head

Here’s the kicker: The SEC isn’t saying much. No long statement, no press conference. But the smart money knows the script.

- Rumours say it’s about regulatory standards. Specifically, tokens like XRP and ADA are in the BITW mix, and neither has its own standalone ETF green light.

- Analysts believe the SEC is playing cautious—worried about “market manipulation, liquidity, and investor protection.” Translation? They’re not ready to unleash a multi-asset crypto ETF without bulletproof controls.

It’s the same old “protect the little guy” playbook, but this time with billions on the line.

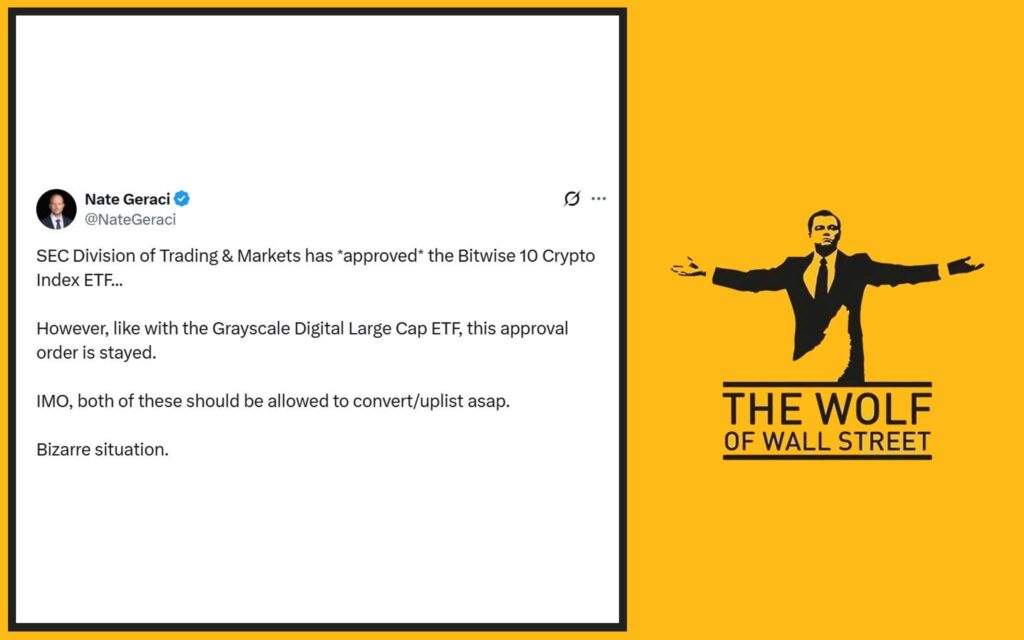

🏛️ Mirror Image: The Grayscale Precedent

Don’t think this is a one-off. It’s almost a carbon copy of what happened with Grayscale’s Digital Large Cap Fund—SEC said yes, then instantly pumped the brakes.

This is the SEC’s new MO: approve, pause, stall, review. It keeps the market guessing and protects their regulatory reputation while they figure out the rules in real time.

🔥 Market Reaction: Winners, Losers, and the Ripple Effect

The impact? Massive.

- Traders hoping to front-run the ETF launch got burned—at least for now.

- Institutional players? Paused their flows, but they’re not out. They’re watching every SEC move, ready to deploy billions the second the green light returns.

- Crypto Twitter and Telegram exploded with speculation, outrage, and wild theories.

For the smart traders in the The Wolf Of Wall Street crypto trading community, this is prime opportunity. Volatility = profit, if you know how to read the signals.

🔍 Deep Dive: What’s REALLY Holding Back U.S. Crypto ETFs?

Here’s the raw truth: The SEC’s got three big fears.

- Market Manipulation: Crypto’s still the Wild West. Thin liquidity, whale games, wash trading—they’re scared of headlines about retail getting fleeced.

- Liquidity Doubts: Can the underlying coins handle massive inflows and outflows from ETF buyers? If not, things break fast.

- Investor Protection: Regulators live in fear of the next FTX. They want bulletproof systems before letting Wall Street play.

It’s gridlock. And every new ETF application is stuck in the queue—Franklin Templeton, Fidelity, you name it.

🗺️ The Global Game: How Other Markets Are Eating the U.S.’s Lunch

If you want proof the US is dragging its feet, look abroad:

- Canada’s crypto ETFs? Already trading.

- Europe? Onboard. Multiple spot Bitcoin and Ethereum ETFs, even basket products.

- Asia’s big exchanges? Embracing innovation, not running scared.

Bottom line? The US is falling behind, and global capital is flowing to friendlier jurisdictions. Check the stats in our layer-1 and layer-2 coverage.

🏦 Institutional Investors: Dream Deferred or Disaster Avoided?

Here’s the million-dollar question: is this pause a fatal blow—or a setup for a monster rally?

- Institutions love ETFs. They need regulatory cover and deep liquidity.

- A US crypto index ETF opens the floodgates. Pension funds, hedge funds, and family offices pile in.

- But right now? Risk is being re-priced. Some see opportunity, others see a dead end—at least until the next SEC move.

🔄 The Road Ahead: What’s Next for Bitwise and the ETF Market?

Watch this space—2025 is an inflection point. Why?

- The US presidential election could reset the regulatory agenda.

- Every major asset manager is pushing ETF amendments, tweaks, and new filings.

- Industry insiders expect a political or regulatory catalyst could see a tidal wave of approvals.

Want to stay ahead? Bookmark our trending crypto news and hot stories for breaking updates.

🧠 Actionable Strategies: How Smart Traders Play Uncertainty

This isn’t the time to panic or freeze. Here’s how the pros at The Wolf Of Wall Street keep stacking wins:

- Follow real signals, not rumours. Ignore the noise—focus on verified, actionable trade setups.

- Diversify across coins and sectors. Don’t bet the farm on a single regulatory event.

- Leverage community wisdom. Don’t go it alone—tap into 100,000+ sharp minds in our private network.

And most importantly—never risk what you can’t afford to lose. Market shake-ups are where the big gains AND big mistakes happen.

🚀 The Wolf Of Wall Street Advantage: Outsmarting Market Madness

Want the Wolf’s playbook? Here’s the The Wolf Of Wall Street difference:

- Exclusive VIP Signals: Proprietary trades to maximise profit.

- Expert Market Analysis: Only the sharpest, most battle-tested traders break down the action for you.

- Private Community: Over 100,000 like-minded hustlers sharing insights, tips, and accountability.

- Essential Tools: Volume calculators, tracking dashboards—every edge you can get.

- 24/7 Support: When the market’s running hot, you need answers fast. We’ve got you, always.

Ready to trade smarter? Dive into our full service suite or connect with the Telegram community for round-the-clock updates.

📊 Quick Reference: ETF Approval Checklist & SEC Red Flags

ETF Approval Cheatsheet

- ETF application filed (19b-4 form)

- Accelerated approval announced

- SEC review, possible pause (“stay” order)

- Final decision after additional review/Commission order

SEC Red Flags

- Involvement of coins without standalone ETF status (e.g., XRP, ADA)

- Concerns about manipulation/liquidity

- Sudden reversals or policy shifts

Glossary

- ETF (Exchange-Traded Fund): Basket of assets, traded like a stock.

- Delegated Authority: Power given to a division of the SEC to make decisions quickly.

- 19b-4 Filing: The regulatory paperwork needed to change how securities trade.

❓FAQs: SEC, ETFs, and the New Crypto Landscape

What’s a crypto ETF, and why does it matter?

A crypto ETF lets anyone buy a slice of a diversified crypto basket—on a regulated exchange. It’s the bridge between old money and new tech.

Why does the SEC keep changing its mind?

Simple: they’re balancing risk, reputation, and regulatory control. Crypto is moving fast, regulators are moving slow.

What should traders do now?

Stay agile. Use verified signals, diversify, and stay plugged into real-time analysis from trusted communities like The Wolf Of Wall Street.

Conclusion: This Isn’t Over—Get Positioned or Get Left Behind

Here’s the bottom line, straight from the Wolf’s playbook: The SEC’s move isn’t a dead end. It’s a pause before the next big run. The traders who thrive are the ones who adapt, get educated, and act when others hesitate.

Whether the Bitwise ETF goes live next month or next year, the writing’s on the wall—crypto is going mainstream. Don’t wait for the headlines. Be the one making them.

Power up your strategy with real signals, top-tier tools, and a community that never sleeps. The smart money’s already here. Are you?

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”

Want the Wolf on your side? Stick with The Wolf Of Wall Street. See you at the top.