The SEC just waved the white flag and dropped its lawsuit against Binance and Changpeng Zhao. That’s right—one of the biggest legal battles in crypto history is officially over. If you’re in the market, you better pay attention. This is your signal. Because what just happened isn’t just a courtroom twist—it’s a full-blown paradigm shift for the crypto industry.

⚖️ The Binance Lawsuit – What Went Down

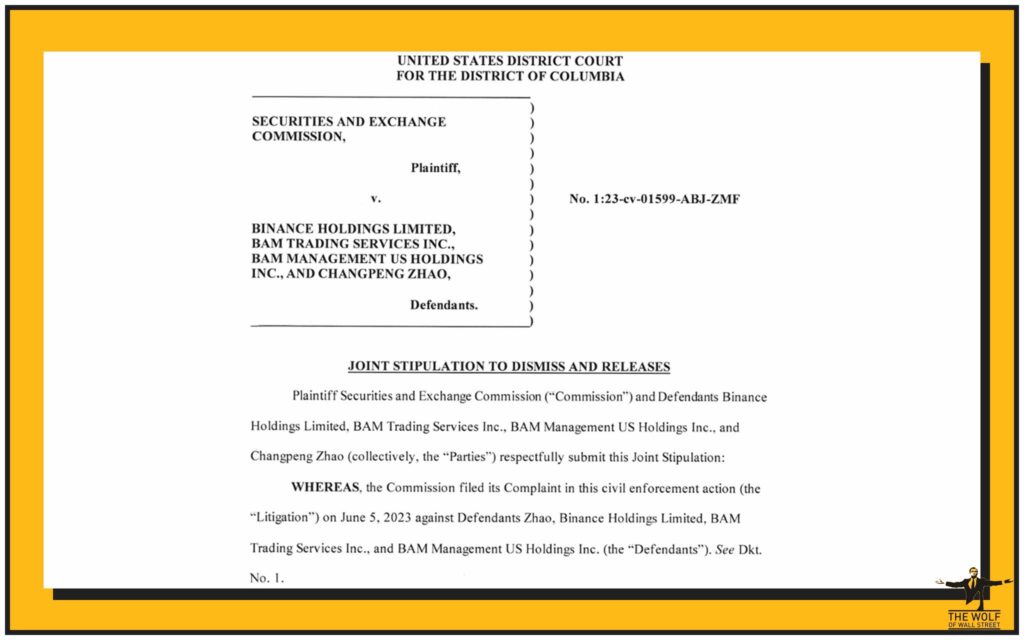

Let’s rewind the tape. June 2023—the SEC charges at Binance like a wrecking ball. The accusations? Operating without a licence, playing fast and loose with customer funds, and blowing smoke about compliance. The SEC claimed Binance was faking trading volume and misleading users. That’s serious heat.

But it didn’t stop there. The Department of Justice slammed Binance and CZ with a \$4.3 billion penalty. Zhao took the fall—stepped down as CEO, admitted wrongdoing, and served four months in prison. That was supposed to be the endgame. Spoiler alert: it wasn’t.

🧨 May 29, 2025 – Lawsuit Dismissed, Case Closed

Here’s where the plot twists.

On May 29, 2025, the SEC, Binance, and Zhao jointly filed to dismiss the case. Not just dropped—it was dismissed with prejudice, meaning the SEC can’t come back swinging with the same charges. It’s over. Done. Buried.

So why the sudden shift?

Enter the Crypto Task Force, internal shakeups, and a shift in leadership. The SEC said it made the move “in the exercise of discretion and as a policy matter.” Translation: they didn’t have the juice to win—and they knew it.

Trump’s administration played a massive role. His pro-crypto stance and appointment of Paul Atkins, a former crypto lobbyist, to chair the SEC flipped the game board. This wasn’t just a legal decision—it was a political manoeuvre.

🏛️ The New SEC Game Plan – From Attack Dog to Ally

Old SEC? Pure attack mode. Lawsuits left and right. Fear, uncertainty, chaos.

New SEC? Different animal. With Commissioner Hester Peirce leading the Crypto Task Force, the agency is shifting from crackdowns to collaboration. They’re finally asking the right questions instead of just firing legal missiles.

Atkins and Peirce are rewriting the rulebook, and for the first time, it looks like crypto’s getting a fair shot at real, structured regulation. Not the wild west. Not a police state. Something in between.

🚀 Want to stay ahead of this shift? Tap into real-time market moves with expert-led trading insights from the The Wolf Of Wall Street community.

Explore Trading Insights »

🚀 Why This Is a Turning Point for the Crypto Market

Binance called the dismissal a “huge win for crypto”—and they’re right. Not just for them, but for the entire industry.

Here’s why:

- Uncertainty is poison for markets. This clears the fog.

- Investors and developers alike now have the confidence to move forward.

- It sets a precedent that the SEC’s reign of terror may finally be winding down.

Look at the numbers: within hours of the announcement, trading volumes surged, and sentiment across Telegram and X (Twitter) turned bullish.

📊 Implications for Investors and Traders

You’re not just a bystander—you’re in this game. So what does this mean for you?

- More liquidity, less fear. When regulators pull back, traders jump in.

- Price action is no longer dictated by lawsuits. Fundamentals and sentiment are back in the driver’s seat.

- Regulatory clarity = better risk management.

💡 Pro tip from The Wolf Of Wall Street analysts: These moments are where wealth is made. News like this moves markets—but only the sharpest traders capitalise.

Want to stop guessing and start trading smart? The Wolf Of Wall Street VIP Signals decode moves like these into actionable entries.

Join The Wolf Of Wall Street VIP Now »

🔍 Comparing Binance to Other Crypto Lawsuits

Let’s not forget—Binance wasn’t alone. Coinbase, Kraken, Ripple—they all took hits from the SEC. But here’s the difference:

- Binance fought harder. They dealt with the DOJ, paid the price, then pushed back.

- Coinbase is still entangled. Kraken settled.

- Ripple won partial victories.

This Binance dismissal is the biggest victory yet, and it’s setting a powerful precedent. Global regulators? They’re watching closely. Some will follow suit. Others will double down. But the U.S.—the biggest domino—is falling in favour of crypto.

👀 Curious about other projects navigating this shift?

Explore DeFi Trends »

💼 What Happens Next for Binance and CZ

Binance walks away lighter—but not totally free. Binance.US still reports quarterly to the SEC, and third-party wallet audits are mandatory.

As for CZ? Four months in a cell, and he’s already planning his next move. Don’t be surprised if he comes back stronger—smarter—hungrier. Legends don’t quit.

🧠 What the SEC’s Shift Means for the Entire Industry

This isn’t just a legal story. This is a rebirth for the crypto landscape in America.

- “Regulation by enforcement” is dead.

- Policy-making and dialogue are the new rules of the game.

- Expect roundtables, clearer guidelines, and fewer courtroom surprises.

That opens the gates for:

- VCs to pour capital

- Startups to innovate without fear

- Exchanges to finally know what the hell is allowed

⚠️ Critics Aren’t Convinced – And They’ve Got a Point

Not everyone’s popping champagne. Some say the SEC’s backpedal could open doors for fraudsters. Others argue it’s a political stunt. They’re worried about consumer protection, especially for newcomers.

Valid? Sure. But here’s the truth: with structure comes accountability. The chaos came from unclear rules. The new model—done right—could be the fix.

🔧 Regulation vs. Innovation – Finding the Balance

This is where the rubber meets the road. Can America lead in crypto without choking the industry?

Other nations are already testing sandbox models. The UK, Singapore, UAE—they’re miles ahead. The U.S. needs to catch up—or get left behind.

That’s why this moment matters. It’s not just a Binance win. It’s a chance for America to lead.

🧭 How Traders Can Navigate the New Regulatory Landscape

In times of transformation, the winners are the ones who adapt fastest. Here’s how:

- Stay plugged into community intel – the The Wolf Of Wall Street Telegram is pulsing with updates.

- Use the tools that matter – volume calculators, signal alerts, sentiment monitors.

- Work smarter, not harder – don’t trade blind.

New to crypto?

👉 Check out our beginner-friendly content here »

💎 Why Now Is Prime Time to Double Down on Crypto

This isn’t just a news cycle. It’s a turning point. The fear phase is over. The future is up for grabs. And with regulators stepping back, the bulls are charging.

The Wolf Of Wall Street traders are already leveraging this moment:

- Timing entries on breakout news

- Using VIP signals to catch reversals

- Swapping strategies in a 100,000+ strong network

This is the moment that separates the watchers from the winners.

🔓 Unlock your trading potential with The Wolf Of Wall Street »

🎯 Final Verdict – Big Win or Just a Political Move?

It’s both.

Yes, it’s political. But it’s also progress. The SEC’s move might have been driven by strategy, but the effect is real, tangible market freedom.

Crypto just got its seat back at the table. And Binance—despite the drama—is still standing. That says something.

So here’s the real takeaway:

If you’re in crypto, get educated, get connected, and get ready.

Because the rules just changed, and the smart money is already moving.

❓ FAQs – Straight Talk

What does “dismissed with prejudice” mean?

It means the SEC can’t refile the same lawsuit. This case is closed—forever.

Is Binance fully off the hook?

Mostly, yes. Binance.US still has compliance obligations, but no more court battles over this case.

Should traders trust Binance again?

Market trust is rebuilding. The dismissal helps—but caution and due diligence are always key.

Will the SEC come after other platforms?

Less likely, under the new administration. The focus is shifting to policy, not punishment.

How does this impact The Wolf Of Wall Street members?

Massively. Less regulatory FUD = clearer trading signals, more confidence, and sharper strategies. The Wolf Of Wall Street traders are already capitalising.

🧠 The Wolf Of Wall Street Crypto Trading Community

The Wolf Of Wall Street is the go-to community for traders navigating today’s volatile crypto markets. When regulators zig, we zag—with tools and strategies that work:

- Exclusive VIP Signals to maximise your profit potential

- Expert Market Analysis for real-time trade opportunities

- 100K+ active members sharing knowledge, strategy, and support

- Powerful tools like volume calculators and real-time alerts

- 24/7 Support so you’re never trading alone

👉 Visit: https://tthewolfofwallstreet.com

👉 Join Telegram: https://t.me/tthewolfofwallstreet