Alright, listen up. The discussion around self-custody vs centralized crypto cards isn’t some boring tech talk for geeks in their mother’s basement; it’s the most important conversation you can have about your money, your freedom, and your future.

🚀 Introduction: Stop Letting Other People Control Your Money

You think you’re in the game because you’ve got a flashy new crypto debit card? You think you’re a player? Let me tell you something. While you’re tapping to buy your coffee, feeling like a Wall Street hotshot, you’re missing the point entirely. Most of you are playing with house money, and the house can change the rules—or kick you out—whenever it feels like it.

The Illusion of Choice in Crypto Spending

They present you with a choice that isn’t a choice at all. They give you a piece of plastic and tell you it’s the key to spending your digital assets. What they don’t tell you is that in most cases, you’re holding nothing more than a permission slip. An IOU. You’ve handed your assets over to a third party, a custodian, and you’re simply asking them nicely to let you spend what was already yours. That’s not power. That’s a leash. The real choice, the one that matters, is between true, absolute ownership and the convenience of being a guest in someone else’s financial house.

Why This Isn’t Just a Tech Debate – It’s About Your Freedom

Forget the jargon for a second and focus. This is about one fundamental question: who holds the keys to your kingdom? Is it you, and you alone? Or is it some faceless corporation in an office building a thousand miles away? Every time you choose how to store and spend your crypto, you are making a declaration. You’re either declaring your financial sovereignty or you’re admitting you need a handler. This isn’t just a showdown between two types of technology. This is you versus the system.

🔑 What the Hell is a Seed Phrase and Why Should You Care?

Pay attention, because this is the part where 99% of aspiring players get wiped out. If you don’t understand what a seed phrase is, you have no business being in crypto. Period.

Your Financial DNA: The Seed Phrase Explained

A seed phrase, or recovery phrase, is a list of 12 to 24 simple words generated by your crypto wallet. But here’s what it really is: it’s the master key to your entire financial life. It’s your DNA. It’s the blueprint from which your private keys—the things that actually control your funds—are born. With that phrase, you can recreate your wallet and access your assets from anywhere in the world, on any compatible device, even if your phone gets smashed or your laptop gets stolen. It gives you absolute, unquestionable power.

The Cold, Hard Truth of Losing It

Now, listen very carefully. That absolute power comes with absolute responsibility. If you lose that seed phrase—if you misplace it, if it burns in a fire, if your dog eats it—your money is gone. Poof. It has vanished into the digital abyss, forever. There is no one to call. There is no “forgot my password” button. There is no helpdesk. There are no second chances. You are the master, but you are also the sole guardian. This isn’t a game. This is the price of admission for total control, and if you can’t handle it, get out of the way.

🦁 The Path of the Alpha: Unleashing Self-Custody Crypto Cards

For those of you with the spine to take control, welcome to the path of the alpha. This is where the real players operate.

What is a Self-Custody Card, Really?

A self-custody card is a direct pipeline from your non-custodial wallet—the one you control with your seed phrase—to the real world. When you swipe or tap, the transaction is executed on-chain, directly from your wallet. There is no middleman holding your funds hostage. There’s no one you need to ask for permission. It is your money, moving at your command. It’s the purest expression of what crypto was meant to be: decentralised, permissionless, and sovereign.

The Pros: Why Winners Choose Self-Custody

Winners choose this path for three simple reasons. It’s about power, privacy, and principle.

- Absolute Control: It’s your crypto. They are your private keys, which are derived from that all-powerful list of words. If you don’t grasp the fundamental difference, read our guide on Private Key vs Seed Phrase right now. No bank, government, or regulator can freeze your funds or deny your transaction. You are the final authority.

- Unyielding Privacy: You think the bank isn’t watching where you spend your money? You think these centralised exchanges aren’t logging every single purchase? With self-custody, your transactions are on-chain, giving you a level of privacy that the establishment hates. You’re a ghost in their machine.

- Permissionless Power: You want to spend your money? You spend it. You don’t need to ask for an increase in your spending limit or explain a large purchase to a compliance department. It’s your wealth. Your rules.

The Cons: The Razor’s Edge of Responsibility

This path isn’t for the faint of heart. It demands discipline and knowledge.

- Total Responsibility: I’m going to say it again because it needs to be drilled into your head. You lose your seed phrase, you lose everything. You are the only line of defence. For those playing in the big leagues, using advanced setups like a Multisignature Wallet isn’t optional; it’s essential for protecting serious wealth.

- The Tech Hurdle: You have to know what you’re doing. You need to understand concepts like gas fees for processing transactions. You are your own bank, which means you have to be your own bank manager, security guard, and vault technician.

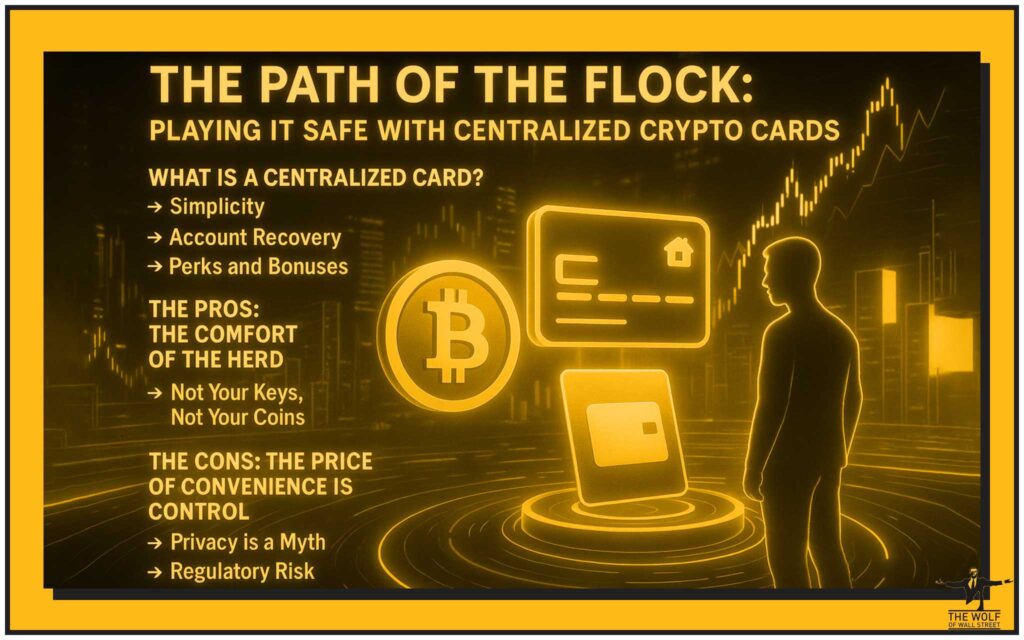

🐑 The Path of the Flock: Playing it Safe with Centralized Crypto Cards

Now, let’s talk about the other path. The path the flock takes. This is where most people live, because it’s easy, it’s comfortable, and it requires zero thought.

What is a Centralized Card?

This is the card you get from a major crypto exchange. You top it up by moving crypto from your trading account to your card wallet. When you spend, the exchange handles everything on the backend, converting your crypto to fiat currency to pay the merchant. It’s seamless. It’s simple. But here’s the catch: the crypto you moved to that card wallet isn’t really yours anymore. It’s sitting in the exchange’s giant pot, and they’ve just given you a credit line against it.

The Pros: The Comfort of the Herd

Look, there are reasons people choose this. I get it.

- Simplicity: It works exactly like your regular debit card. If you can order a pizza, you can use a centralised crypto card.

- Account Recovery: You forgot your password? No problem. You can click a link, answer a security question, and a customer support agent will help you get back in. They hold your hand.

- Perks and Bonuses: They throw rewards at you—cashback, rebates—to keep you happy and spending inside their ecosystem. It’s a gilded cage.

The Cons: The Price of Convenience is Control

This is the part they don’t want you to think about. The convenience you enjoy comes at a terrible price: control.

- Not Your Keys, Not Your Coins: This is the golden rule of crypto. If you don’t control the private keys, you do not own the crypto. The exchange does. And if they get hacked, go bankrupt, or their founder decides to take a permanent vacation, your money is gone with them.

- Privacy is a Myth: Every single transaction is tracked, logged, and analysed. You have to complete Know-Your-Customer (KYC) verification, handing over your identity. They know more about your spending habits than your own mother.

- Regulatory Risk: You think the exchange is on your side? Think again. If a government agency decides they want to freeze your assets, the exchange will comply in a heartbeat. Your funds can be locked with a single email, and there’s not a damn thing you can do about it.

🥊 The Showdown: Head-to-Head Feature Battle

Let’s break it down, head-to-head. No fluff.

Security: Fortress vs. Glass House

- Self-Custody: You build your own fortress. Its strength depends entirely on your discipline and knowledge. It can be impenetrable, or you can leave the front door wide open.

- Centralised: You live in a glass house built by someone else. It looks strong, but a well-aimed rock—a hacker, a regulator, a market crash—can shatter the whole thing, and you’re left exposed.

Privacy: Ghost vs. Open Book

- Self-Custody: You operate like a ghost. You move with a level of anonymity that gives you a strategic advantage in a world that wants to track your every move.

- Centralised: You are an open book. Your financial history is a commodity, bought and sold by data brokers and scrutinised by authorities.

Recovery: Lifeboat vs. Sinking Ship

- Self-Custody: Your seed phrase is your one and only lifeboat. Guard it with your life, and you can survive any storm. Lose it, and you go down with the ship.

- Centralised: You can file a support ticket when you’re in trouble. But that’s like having a lifeboat on the Titanic. It might save you, but if the entire ship—the exchange itself—goes under, you’re all going down together.

💰 It’s Time to Join the Winners’ Circle

Stop Guessing, Start Dominating

Let me be blunt. Navigating this market, choosing the right tools, and making the right moves is not for amateurs. The crypto market is a battlefield, a minefield designed to separate fools from their money. To win, you need more than just a gut feeling; you need an edge. You need a team of stone-cold killers who see the plays before they happen, who understand the risks and know how to turn them into profit.

The The Wolf Of Wall Street Crypto Trading Community Advantage

You think you can do this alone? Good luck. The real winners, the ones who build lasting wealth, move as a pack. That’s why we built the The Wolf Of Wall Street crypto trading community. This isn’t a chat room for hobbyists; it’s a war room for winners. Here’s what you get when you’re on the inside:

- Exclusive VIP Signals: Stop gambling on Twitter trends. We provide proprietary signals designed for one purpose: to maximise your trading profits.

- Expert Market Analysis: Get in-depth analysis from seasoned crypto traders who have serious skin in the game. We tell you what we’re doing, not what we think you should do.

- Private Community: You get access to our private network of over 100,000 like-minded individuals. You’ll be swimming with sharks, not getting eaten by them.

- Essential Trading Tools: We arm you with the resources you need, like volume calculators, to make informed, powerful decisions.

- 24/7 Support: The market never sleeps, and neither do we. Our dedicated support team is always on standby to assist you.

Stop trying to figure this out on your own. Empower your crypto journey and unlock your potential to profit.

- Visit our service for more details: https://tthewolfofwallstreet.com/service

- Join our active Telegram community for real-time intel: https://t.me/tthewolfofwallstreet

❓ Frequently Asked Questions (The Stuff Rookies Ask)

Q1: What happens if I lose my self-custody card?

The card itself is just a piece of plastic. It’s irrelevant. As long as you have your seed phrase, you can restore your wallet on a new device and keep going. The card is disposable; the seed phrase is everything.

Q2: Are centralised cards safer for beginners?

They are simpler, not safer. They protect you from your own mistakes (like losing a seed phrase) but expose you to bigger, more catastrophic risks (like an exchange collapsing). It’s a trade-off, and in my book, it’s a bad one. True safety comes from control, not convenience.

Q3: Can I use these cards to buy anything?

Mostly, yes. Anywhere Visa or Mastercard is accepted. But don’t be naive. Centralised providers might block transactions to certain merchants (gambling, etc.) if it goes against their terms of service. With self-custody, you are the only one who can block a transaction.

Q4: Which one has lower fees?

It varies wildly. Centralised cards often hide fees in the conversion spread. Self-custody cards require you to pay on-chain network fees (gas), which can be high or low depending on network congestion. You have to do the maths, but don’t let a few pennies in fees make you give up control of your entire fortune. Don’t be an idiot.

🏆 Conclusion: Make Your Choice – Leader or Follower?

The Verdict is In

So here we are. The choice is laid bare. On one side, you have the path of the alpha: absolute control, iron-clad privacy, and total responsibility. The path of self-custody. On the other, you have the path of the flock: convenience, hand-holding, and the surrender of your financial sovereignty. The path of centralisation. It’s not about which is better technology; it’s about who you are. To truly build wealth across all of The Wolf’s Guide to Asset Classes, you must first decide who is in charge of them.

Your Next Move

Don’t just stand there. Make a decision. Are you going to be the master of your own destiny, the captain of your own ship, with all the power and risk that entails? Or are you going to clip on the leash, take the easy route, and pray the person holding it has your best interests at heart? The choice is yours, but understand that the debate over self-custody vs centralized crypto cards is ultimately about deciding if you want to be the master of your own financial destiny.