Semler Scientific isn’t just dipping a toe into crypto – they’re cannonballing into the deep end. This U.S. healthcare tech company has launched a no-holds-barred strategy to skyrocket their Bitcoin holdings from around 4,000 BTC to a mind-bending 105,000 BTC by the end of 2027. That’s a 28x leap – not in your wildest dreams, but in their real-world roadmap.

Let’s break it down, high-velocity Wall Street style – what this move means, why it’s turning heads, and what smart traders can learn from the chaos.

🚀 Why This Isn’t Just Another Crypto Hype Move

First off, this isn’t a tweet-fueled gamble or a pump-and-dump scheme. Semler is serious – they’re structuring their corporate treasury around Bitcoin. You’ve got a company rooted in medical diagnostics now playing the long game with a digital gold play. Why? Because they’re betting that the world’s scarcest asset is the safest long-term store of value.

They’re not replacing stethoscopes with private keys, but they’re damn sure hedging the future with blockchain.

🔥 The Roadmap to Crypto Domination – Three Explosive Phases

They’re not YOLOing 105,000 BTC overnight. This is a calculated, laser-eyed plan:

- Phase 1 (2025): Hit 10,000 BTC – the warm-up lap.

- Phase 2 (2026): Scale up to 42,000 BTC – that’s where momentum kicks in.

- Phase 3 (2027): Full throttle to 105,000 BTC.

This isn’t dollar-cost averaging – it’s strategic accumulation with Wall Street discipline and Bitcoin maximalist ambition.

🔗 Check out more crypto trading insights for strategies that echo this kind of precision.

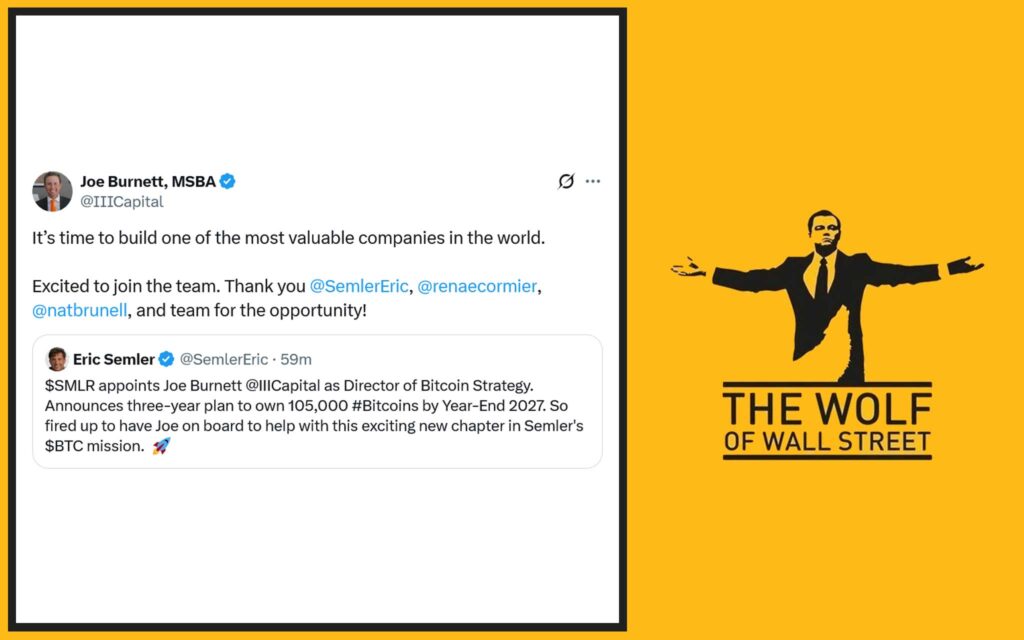

🧠 Joe Burnett – The Brain Behind the Bitcoin War Chest

You don’t make a power move like this without bringing in a shark. Enter Joe Burnett – a heavyweight Bitcoin strategist with a history of cutting through market noise. Now Semler’s Director of Bitcoin Strategy, Burnett brings clarity, conviction, and credibility.

He’s not here for games. He’s here to execute, and that should scare the competition.

💰 Funding the Dream – Equity, Debt, and Pure Cash Flow

So how do you finance the acquisition of 105,000 BTC without torching the business?

Simple: use equity, debt, and operational cash flow. That’s right – they’re playing the capital stack like a concert pianist. It’s risky, yes. But they’re not overleveraging. They’re smartly distributing risk while maximizing upside.

This is MicroStrategy 2.0 – but with a healthcare twist.

📈 287% Gains and $177M in Unrealised Profits – The Power of Patience

They’ve already proven the model. As of June 2025, Semler’s Bitcoin play is up 287% with $177 million in paper profits. That’s not theory. That’s real-world validation that this game plan has legs.

While other companies are still talking ESG and dividends, Semler’s making moves.

🔗 Explore more big plays in Bitcoin news.

🏆 From Underdog to Bitcoin Titan: Top 15 Corporate BTC Holder

This move puts Semler in the elite club. Top 15 BTC corporate holders worldwide. And when they hit 105,000 BTC? That’s 0.5% of the global Bitcoin supply under one ticker symbol.

They’re no longer a healthcare company dabbling in crypto. They’re a crypto titan wearing a healthcare jacket.

🎯 Why This Strategy Could Crush (or Save) Their Stock

Here’s the kicker – their stock is down 41% year-to-date. Critics say they’re losing focus. But here’s the truth: this is precisely the time to buy in. Visionaries play the long game, and if they hit their BTC targets, the equity upside is monstrous.

Just like MicroStrategy, this could become the biggest reverse takeover of a stock narrative in Wall Street history.

🔗 See what’s trending in crypto right now.

⚖️ Risk vs Reward – What Could Go Sideways

Let’s keep it real. This isn’t risk-free:

- Volatility: Bitcoin can drop 30% in a week. Can they stomach it?

- Dilution: Raising capital via equity? That’s risky for current shareholders.

- Regulation: The U.S. isn’t exactly crypto-friendly in 2025. That could turn into a minefield.

This is high-stakes poker. But so was Amazon in 2002. Risk is the price of reward.

🌍 Global Context – Who Else is Going Big on Bitcoin?

Semler isn’t alone. MicroStrategy set the pace. Metaplanet from Japan just committed to a similar BTC accumulation plan.

This isn’t just a trend – it’s a tectonic shift. Bitcoin is becoming the corporate reserve asset of the future.

🔗 Explore the hottest narratives in global crypto right now.

🛡️ Can a Healthcare Company Really Handle This Heat?

Yes, they still develop health software. Yes, they’re expanding diagnostics. But here’s the truth: their crypto treasury strategy doesn’t cannibalise their core business – it amplifies it.

Imagine a healthcare company with a war chest worth billions in BTC. They can fund R\&D, acquisitions, and expansion without raising a penny in traditional financing.

That’s financial freedom – and that’s the real power play.

🧩 What It Means for Crypto as a Whole

This is institutional adoption on steroids. When companies outside of fintech adopt Bitcoin as a treasury standard, the market’s no longer speculative – it’s structural.

Every BTC bought by Semler is off the market. And with fixed supply, that drives scarcity, which drives price.

Their move is your macro bullish signal.

🗣️ Final Word from the Wolf: What You Can Learn from This Ballsy Move

This isn’t just about Semler. It’s a blueprint for anyone who’s got the guts to go big on conviction. Whether you’re a trader, founder, or investor – learn from the playbook:

- Have a vision.

- Build a plan.

- Bet big, but bet smart.

- Ignore the noise. Double down on the signal.

Want to play in this league? Then you need tools, not just tips.

🔗 If you’re new, start with our crypto beginner guide

🔗 Want to go deeper? Explore DeFi strategies and altcoin insights

❓ FAQs: Semler’s Bitcoin Gambit Decoded

Q1: What’s the risk to Semler’s shareholders?

The biggest risks are dilution and BTC volatility. But if BTC appreciates, long-term shareholder value could soar.

Q2: How does this compare to MicroStrategy?

It mirrors MicroStrategy’s BTC playbook but within the healthcare sector. It’s bold, disruptive, and potentially transformative.

Q3: Is Bitcoin still worth the gamble in 2025?

With institutional adoption growing and supply locked, BTC remains a compelling store of value – especially if you’re playing long-term.

🧨 Bonus: Fuel Your Portfolio Like a Pro

This kind of strategic conviction doesn’t happen in a vacuum. The The Wolf Of Wall Street trading community is where this mindset is forged. Here’s what you unlock:

- VIP Signals that front-run trends like Semler’s BTC bet

- Expert Analysis to break down market moves

- Private Community of 100K+ crypto warriors

- 24/7 Tools & Support to make every trade count

👉 Join The Wolf Of Wall Street now or tap into the fire live on Telegram

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals

- Expert Market Analysis

- Private Community

- Essential Trading Tools

- 24/7 Support

Visit: The Wolf Of Wall Street

Join: Telegram”