🔥 Introduction: Solana’s Relentless Rise in RWA Tokenization

Forget what you thought you knew about crypto. In 2025, Solana RWA tokenization isn’t just making headlines—it’s rewriting the rules of the game. We’re not here to dabble; we’re here to dominate. This isn’t about slow, steady growth.

This is about a 140.6% rocket surge—Solana muscling into the real-world asset (RWA) space and shaking the foundations of Wall Street’s last fortress. You want numbers? I’ll give you numbers. You want a roadmap to action? Stick with me. By the end, you’ll know exactly why Solana is the real disruptor and how to ride this wave to real profit. Ready? Let’s hunt.

💸 What is RWA Tokenization and Why Does It Matter?

Let’s cut the jargon. RWA tokenization is about taking real assets—think stocks, treasuries, funds—and putting them on the blockchain. Why? Because it unlocks liquidity, kills middlemen, and lets anyone, anywhere, trade like a pro. No more closed doors or slow banks. In 2025, tokenization is the unlock code for global finance. Billions in real estate, government debt, and blue-chip stocks—traditionally locked away—are now available for digital trading 24/7. This is not just technical innovation. It’s a money revolution.

🏆 Solana: The Disruptor Gunning for Ethereum’s Crown

Ethereum’s been the king for years, but Solana is that hungry wolf at the door—fast, efficient, and relentless. While the old guard talks, Solana acts. In just twelve months, Solana’s slice of the RWA pie has exploded, and the big boys—Ethereum, ZKsync Era, Aptos—are glancing over their shoulders. Why? Because Solana’s giving institutions and regular investors what they really want: speed, scale, and profit potential.

📈 By the Numbers: Solana’s RWA Growth Story

Let’s talk growth—the only metric that matters. In 2025, Solana’s tokenized assets soared 140.6% year-to-date, smashing through the $418 million mark. Compare that to the overall RWA tokenization market’s 62.4% rise. That’s not just outpacing; that’s outclassing. Solana’s growth rate is more than double the sector average, and the gap with Ethereum, ZKsync, and Aptos is closing faster than anyone predicted. Bottom line: Solana isn’t here to play catch-up. It’s here to lead.

⚔️ Market Share Shootout: Solana vs. the Titans

Let’s size up the field. Right now, Solana owns 3.9% of the global RWA tokenization market, placing it right behind Ethereum (58.4%), ZKsync Era (17.2%), and Aptos (4%). But while Ethereum’s crown looks shiny, Solana’s growth speed is the real story. Institutional flows, new project launches, and developer migration are all moving in Solana’s direction. Who’s still leading? Sure, Ethereum dominates, but Solana’s momentum is undeniable—and that spells opportunity for the hungry.

Want more on the shifting RWA landscape? Check our news section for the latest developments.

🛠️ Why Solana? Technical Edge and Unique Selling Points

This is where Solana leaves the rest eating dust. Up to 65,000 transactions per second. Average fees? Less than a penny. That means no more worrying about gas wars or slow settlement. For big money and everyday traders, that’s an open invitation to move size without friction. Solana’s developer ecosystem is thriving—new protocols, integrations, and institutional interest hit record highs in 2025. When speed, scale, and cost all line up, the market takes notice.

🔗 Inside the Ecosystem: Solana’s RWA Power Protocols

You want names? Here’s who’s making the magic happen:

- Ondo’s U.S. Dollar Yield Fund: The institutional favourite. Ondo’s protocol puts yield-generating US dollar assets on Solana, letting everyone—from retail to the big dogs—tap into real-world profits.

- ONe Institutional Fund: Where the whales move. ONe’s fund has lured major capital, adding $277 million in tokenized assets to Solana’s network in just months.

These aren’t vaporware projects—they’re the backbone of Solana’s new RWA empire.

Want to see what’s hot in decentralised finance? Head over to our DeFi category.

💼 Tokenized Stocks, Treasuries & Funds: Real-World Impact

This is where tokenisation gets real. We’re talking tokenized stocks, US treasuries, and institutional-grade funds—all issued by regulated entities like Backed Finance and available on major exchanges. Solana’s tokenized stock market tripled in value in just two weeks, smashing through $48.5 million—now representing over 11% of the total tokenized stock market cap. The message? Institutions are moving, and they’re picking Solana as their blockchain of choice.

💰 Solana’s Revenue Engine: Where the Money Flows

How does Solana stack up in real revenue? In the past 30 days, Solana raked in $3.9 million from RWA activities, compared to Ethereum’s $15.9 million. Sure, Ethereum leads in absolute terms—but Solana’s revenue trajectory is a rocket. Cross-chain volume from Ondo alone hit $2.7 million in just 24 hours, with real transaction fees flowing back to Solana. The takeaway: This is a blockchain that’s already monetising its RWA edge, and the cash flow is only accelerating.

Ready for smarter trading? Dive into our trading insights for actionable strategies.

🤼 The Competitive Arena: Ethereum, Aptos, ZKsync Era

Numbers don’t lie. In the last 30 days:

- Aptos: 52.7% RWA growth

- Solana: 14.6% RWA growth

- Ethereum: Just 3.6% RWA growth

Ethereum’s still king in market share, but when it comes to growth rates, Solana and Aptos are the new apex predators. ZKsync Era is showing muscle, too. The big lesson? The future is fluid, and old empires are built to be toppled.

🚦 What’s Driving the RWA Boom in 2025?

Let’s call it what it is—a perfect storm. Institutional demand is off the charts. Regulators are finally greenlighting tokenization, and adoption by governments and exchanges is snowballing. The global RWA tokenization market just bulldozed past $25 billion in Q2 2025—up 245x since 2020. This is no hype cycle. It’s a foundational shift, and Solana’s at the epicentre.

🧪 Speed, Scale & Security: Solana’s Secret Sauce

Solana’s not just fast. It’s built for scale and security—65,000 transactions per second, average fees under $0.01, and a rock-solid developer toolkit. This combo isn’t just for show; it enables everything from token issuance to real-time settlement at institutional scale. The result? Developers flock to Solana, institutional capital pours in, and end-users finally get a blockchain that works.

Learn more about how Solana stacks up against the competition in our Layer 1 and Layer 2 Solutions section.

📊 Why This Matters: Real Implications for Investors & Users

Here’s where the rubber meets the road. For investors, Solana’s RWA ecosystem means:

- Greater access: Fractional shares, instant settlement, global liquidity.

- Higher yields: Protocols like Ondo and ONe deliver stable, above-market returns.

- Portfolio diversification: Exposure to real assets in a crypto-native package.

Case in point: Early users of Solana’s RWA protocols are reporting faster transaction times, lower costs, and real asset-backed returns compared to Ethereum-based solutions.

⚠️ Risks and Challenges: What Could Slow Solana Down?

It’s not all blue skies. Key risks include:

- Regulatory uncertainty: Governments can flip the script fast.

- Technical hiccups: Outages and bugs have dogged Solana before.

- Market volatility: Price swings can spook both retail and institutional players.

But the wolf knows—risk is just opportunity in disguise.

🏁 Action Steps: How to Get Involved with Solana RWAs

Ready to make your move? Here’s your playbook:

- Research protocols: Ondo, ONe, and other RWA leaders on Solana.

- Set up a wallet: Get your SOL, connect to a reputable decentralised exchange.

- Join the conversation: Community-driven insights are worth their weight in gold.

If you’re just starting, check our Newbie section for simple, step-by-step guides.

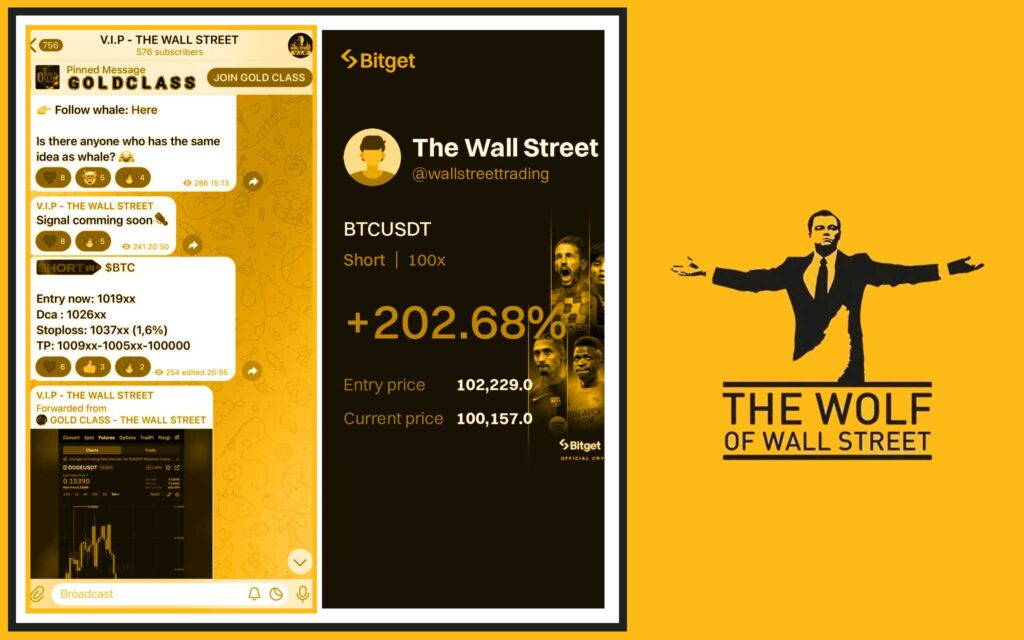

🦾 Power Up Your Crypto Game: Join the The Wolf Of Wall Street Community

You want an edge? This is where you get it:

- Exclusive VIP Signals: Tap into proprietary market signals—no more guessing.

- Expert Market Analysis: Seasoned traders break down the market so you don’t have to.

- Private Community: Over 100,000 members sharing insights, 24/7 support.

- Trading Tools: From volume calculators to strategy builders, you’re always prepared.

Empower your crypto journey—unlock your potential, trade smarter, and join the movement:

🏁 Conclusion: Solana’s Wolfish Ambition in the RWA Market

Solana isn’t just closing the gap—it’s rewriting the script. With a 140.6% surge in tokenized real-world assets in 2025, this blockchain is now a major player in the RWA tokenization game, snapping at Ethereum’s heels. The future? More assets, more users, more revenue. For investors, developers, and institutions alike, the message is clear: move fast, or get left behind. Solana’s hunting, and the feast has just begun.

❓ FAQs

What is RWA tokenization and how does Solana fit in?

RWA tokenization is the process of putting real-world assets—stocks, bonds, funds—on the blockchain for global, 24/7 trading. Solana offers speed, low fees, and a robust ecosystem, making it an ideal platform for RWA growth in 2025.

How does Solana compare with Ethereum in the RWA space?

Ethereum dominates in size but is losing ground to Solana’s speed and cost advantages. Solana’s technical architecture attracts both new projects and institutional money looking for scale and efficiency.

What are the main risks of RWA investing?

Regulatory changes, blockchain outages, and market volatility. Always do your own research and diversify accordingly.

How can retail investors participate in Solana’s RWA ecosystem?

Start by researching top protocols like Ondo and ONe, set up a Solana-compatible wallet, and join community channels for real-time updates.

Where can I get expert insights and trading signals for Solana RWAs?

Join the The Wolf Of Wall Street trading community and their Telegram for VIP signals, market analysis, and 24/7 support.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service page for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.

Ready to unleash your trading potential? The wolf never waits—act now, and lead the pack.