Alright, listen up! This isn’t your grandad’s financial market anymore. We’re in the wild, untamed frontier of crypto, and if you think you can just blindly throw your cash at it and make a fortune, you’re dead wrong. This ain’t about luck; it’s about strategy, information, and knowing the damn rules of the game before the whistle even blows. We’re talking about stablecoins, the supposed bedrock of this digital economy, and the two legislative proposals – the STABLE Act and the GENIUS Act – that are about to decide their fate, and by extension, your potential for massive, undeniable profit!

This isn’t some academic debate, folks. This is about power, control, and ultimately, the flow of capital. The government, bless their hearts, finally realized they can’t ignore this phenomenon. So now they’re trying to put their stamp on it, and how they do it will either unleash a tidal wave of opportunity or create a regulatory quagmire that traps the unprepared. You’re here because you’re not unprepared. You’re here because you’re a wolf, not a sheep, and wolves dominate!

Stablecoins: The New Oil? Or Just Fool’s Gold?

Look, stablecoins are supposed to be the sensible older brother in the crazy crypto family. Pegged to fiat currencies like the good ol’ US dollar, they promise stability, a safe harbour in a storm. But don’t let that fool you. Just because they’re ‘stable’ doesn’t mean they’re immune to the long arm of the law. These bills, the STABLE Act and the GENIUS Act, are here to regulate the issuance and operation of these digital assets. They want to set the rules, protect the consumers (they always say that, don’t they?), and maintain financial stability. But for us, the real players, it’s about understanding how these rules impact the flow of money, where the bottlenecks will be, and most importantly, where the explosive opportunities lie. This is your chance to get in early, to position yourself like a shark circling its prey.

The Common Ground: Where the Big Shots (Reluctantly) Agree

Even when politicians are trying to one-up each other, there are always some fundamental truths they can’t escape. Both of these acts, despite their differences, agree on a few core principles that are absolutely essential for the long-term viability of stablecoins. This is the foundation, the non-negotiables that will shape the market.

🚪 Issuance Pathways: More Doors, More Dollars!

First off, both bills acknowledge that stablecoins are here to stay, and they’ve got to allow somebody to issue them. We’re talking federally approved banks, non-banks, and even state-qualified entities. What does that mean for you, the savvy investor? It means diversification in who’s bringing these assets to market. More issuers, more competition, potentially better terms, and more liquidity. It’s like opening up new pipelines for capital to flow, and where capital flows, profit follows. You want to see the new players enter the game? This is how it starts.

🏦 Reserve Requirements: Backing Up the Brinks Truck

This is paramount. Both the STABLE Act and the GENIUS Act are screaming “1:1 reserve backing!” We’re talking about every stablecoin in circulation being backed by high-quality liquid assets. Think US dollars, short-term Treasurys – real, tangible assets, not thin air. Why? Because the last thing anyone wants is another catastrophic de-pegging event.

This isn’t just about consumer protection; it’s about market integrity. When you know a stablecoin is truly backed, you can trade with more confidence, take bigger positions, and sleep sounder at night. For those of you who want to understand the nuts and bolts of managing your capital and mitigating risk, it pays to understand things like money flow index (MFI) or even how to effectively take profits in crypto. Knowing your reserves are solid gives you the green light to go for the jugular.

🔍 Transparency: No More Shady Deals!

Monthly reserve disclosures, audited by independent accounting firms. Let’s be clear: this isn’t for fun. This is to pull back the curtain, to expose any hanky-panky. Transparency builds trust, and trust brings in the big money. For us, it means less speculation and more verifiable data. You’ll know exactly what’s backing your stablecoins, giving you a crystal-clear view of the landscape. No more flying blind, no more relying on whispers and rumors. This is about verifiable facts that empower your trading decisions.

🚨 AML Compliance: Play By The Rules, Or Pay The Price!

Anti-Money Laundering (AML) regulations and the Bank Secrecy Act – these are not negotiable. Both bills hammer home the need for strict compliance. The government wants to track the money, plain and simple. For legitimate businesses and traders, this is just the cost of doing business. For anyone thinking of using stablecoins for illicit activities, consider this your flashing red light. The noose is tightening, and you don’t want to be caught in it. This is about cleaning up the market, making it safer for the big players to enter, and that, my friends, means more liquidity for us.

🛡️ Consumer Protection: Your Money, First in Line!

In the devastating event of an issuer collapse – because let’s face it, things go south sometimes – both acts prioritize your claims. Consumers get paid before other creditors. This is a huge win for stablecoin holders, offering a layer of protection that wasn’t always there in the early days. It’s about minimizing your downside, so you can maximize your upside. When you know your assets are protected, you’re free to focus on what you do best: making aggressive, intelligent trades. This is about safeguarding your potential.

The Battleground: Where the Real Fight Begins!

Now, here’s where the rubber meets the road. While these bills share some common ground, their differences are massive, and they represent completely different philosophies on how to handle the future of digital finance. This isn’t just legislative jargon; these distinctions will dictate the very structure of the stablecoin market, impacting innovation, competition, and ultimately, your profit margins. Get this wrong, and you’ll be left in the dust!

📈 Algorithmic Stablecoins: Ban ‘Em or Brace For Impact?

This is a hot-button issue, a real make-or-break point. The STABLE Act wants a two-year ban on algorithmic stablecoins. Think of the Terra/Luna disaster – that’s the nightmare scenario they’re trying to avoid. They’re saying, “Too risky, too volatile, put it on ice!” The GENIUS Act, on the other hand, is more open-minded, allowing them under certain, strict conditions. This is the classic innovation vs. safety debate. If you’re a fan of high-risk, high-reward plays, the GENIUS Act offers a glimmer of hope. But be warned: the market has seen what happens when these things go sideways. Understanding these nuances is key to adapting your portfolio; you need to be dynamic, like mastering various crypto trading strategies or employing powerful indicators like Bollinger Bands to spot shifts.

🏛️ Regulatory Oversight: Federal Hammer or Flexible Handshake?

The GENIUS Act rolls out a dual regulatory approach: smaller issuers, those under $10 billion in market value, can register at the state level. The big boys, the multi-billion-dollar whales, gotta go federal. The STABLE Act? Full-on federal oversight, no matter how big or small. This is about power, plain and simple. The STABLE Act wants a centralized, iron-fisted control, which might crush smaller innovators under a mountain of compliance costs. The GENIUS Act offers a bit more breathing room, but some argue it opens the door to regulatory arbitrage. This distinction is crucial for new market entrants and for the competitive landscape. Are we building a centralized financial leviathan or a decentralized innovation hub? This decision impacts everyone.

💰 Interest Payments: No Yield, No Deal?

Here’s another big one for those looking to squeeze every drop of value out of their assets. The STABLE Act explicitly prohibits paying interest to stablecoin holders. They want to draw a clear line in the sand: stablecoins are for payments, not for generating returns like a savings account. The GENIUS Act, crucially, is silent on this. That silence, my friends, is an opportunity! If interest-bearing stablecoins become a reality, it opens up entirely new avenues for passive income and yield farming. This is about whether your stablecoins are just a parking spot for cash or an active, wealth-generating asset. Every percentage point matters in this game. If you’re into optimizing your returns, you’ve probably already looked into how to earn crypto without selling.

✅ Legal Clarity: Is it a Security? A Commodity? Or Just… Money?

This is the legal minefield. The GENIUS Act delivers a massive blow for clarity: it explicitly states that payment stablecoins are not securities, commodities, or investment companies under federal law. This is a game-changer for legal certainty, slashing the regulatory ambiguity that has plagued the crypto space. Imagine the peace of mind for big institutions and corporations! The STABLE Act? Not so clear. This lack of clarity can be a massive deterrent for institutional money. The GENIUS Act, if passed, would be like shining a spotlight on the legal pathway, making it easier for massive amounts of capital to flow into the stablecoin market. This is the kind of clear guidance that unlocks serious, serious money. For those deep in the world of decentralized finance, understanding these distinctions is as vital as mastering DeFi strategies.

The Ripple Effect: Winners, Losers, and Your Path to Riches!

These bills aren’t just dry legal texts; they’re blueprints for the future of finance. Their passage, or failure, will send shockwaves through the market, creating both challenges and unparalleled opportunities.

🐋 Market Structure: Giants or a Level Playing Field?

The STABLE Act’s stringent requirements, particularly the high compliance costs, might just hand the stablecoin market on a silver platter to established giants like Circle and PayPal. Smaller, innovative players could get squeezed out, limiting competition and potentially innovation. It’s a consolidation play, benefiting the existing titans. The GENIUS Act, with its more flexible, dual-licensing model, could foster a vibrant ecosystem, allowing new entrants to challenge the status quo. This directly impacts where you, as a trader, will find liquidity, innovation, and ultimately, profit. Do you want to play in a market dominated by a few, or one bustling with hungry entrepreneurs?

🚀 Innovation: Caged Beast or Unleashed Power?

This is about the very soul of crypto. The STABLE Act, with its outright ban on algorithmic stablecoins and its no-interest rule, could stifle the kind of groundbreaking innovation that defines this industry. It’s like putting a chokehold on progress. The GENIUS Act, by contrast, seeks to balance oversight with flexibility, potentially unleashing a torrent of new stablecoin designs and use cases. For those of you who thrive on the cutting edge, who seek out the next big thing, the GENIUS Act offers a far more fertile ground. This decision shapes whether the US remains a leader in crypto innovation or falls behind. Want to be part of the future? Then you better be paying attention to which way this winds blow. You should also be clued into how new advancements like AI agents in trading are shaping the landscape.

🌎 Global Context: America’s Place on the World Stage

Don’t be naive. The world isn’t waiting for the US Congress to figure things out. The EU’s MiCA regulation already provides a unified compliance framework for all crypto-assets across Europe. While the US dithers, its regulatory landscape remains fragmented. This fragmented approach could put American crypto companies at a significant disadvantage on the global stage, limiting their ability to scale and compete. Understanding this global dynamic is key to predicting market shifts and identifying where the smart money is moving. If the US falls behind, other jurisdictions will gladly pick up the slack.

The Critics’ Chorus: Is This the Best We Can Do?

No bill is perfect, and these two are no exception. There are legitimate concerns, and understanding them is crucial for a complete picture.

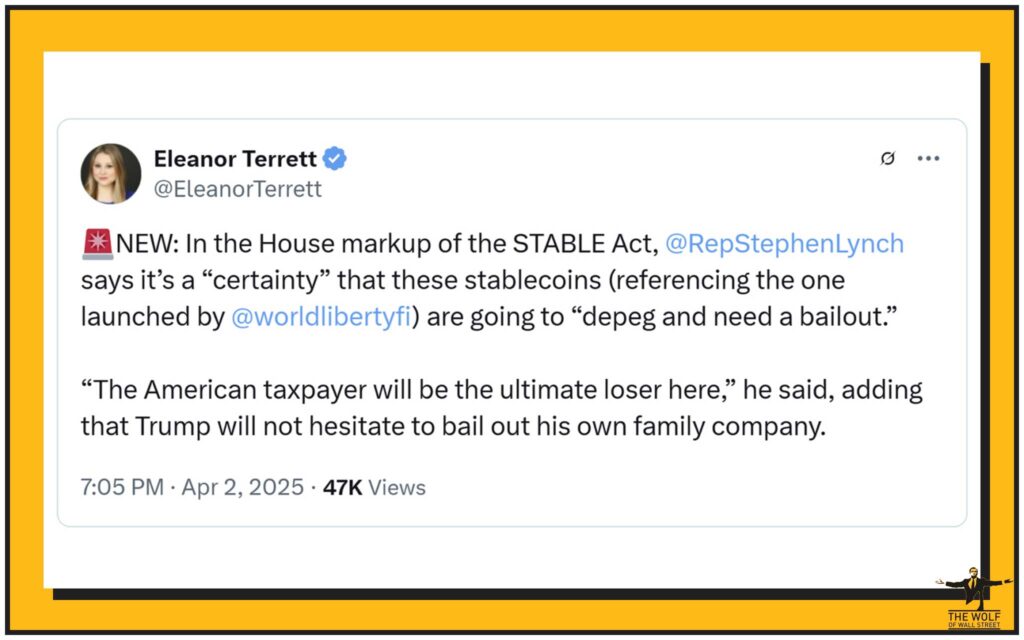

💥 STABLE Act Under Fire: The Gaps That Could Sink You

Critics are sounding the alarm on the STABLE Act for a few reasons. First, no FDIC insurance. That’s right, your stablecoins won’t have the same government backing as your traditional bank deposits. This is a significant risk that every holder needs to understand. Second, concerns about federal preemption of state roles – effectively steamrolling state-level oversight. And that ban on interest-bearing stablecoins? Many see it as a massive blow to user adoption and an unnecessary restriction that pushes innovation offshore.

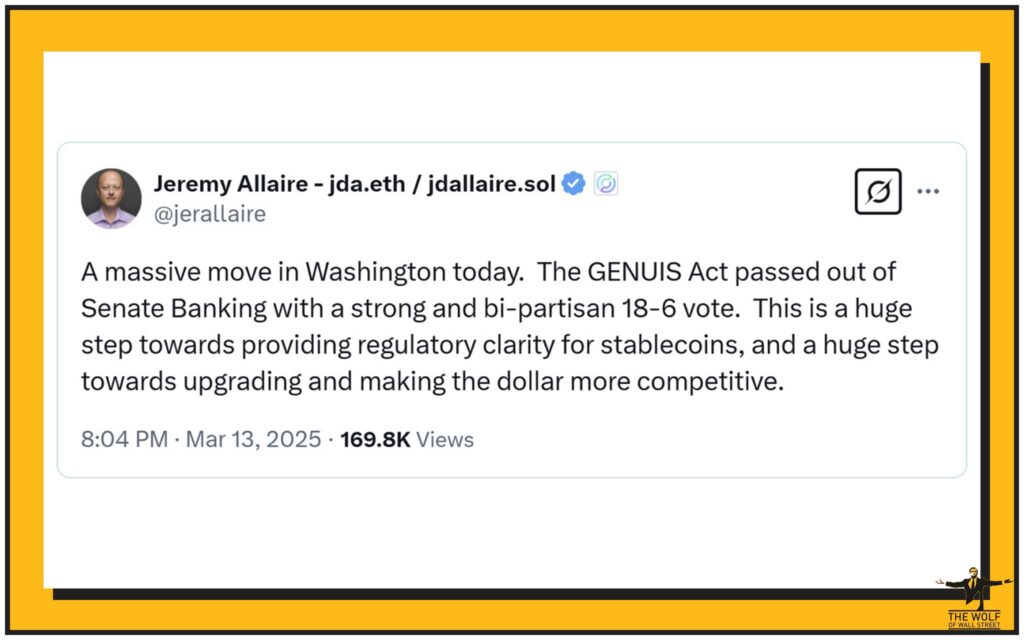

🚧 GENIUS Act’s Hurdles: Roadblocks on the Path to Progress

The GENIUS Act isn’t without its detractors either. Some argue its dual approach, while seemingly flexible, could still burden smaller issuers with complex, overlapping compliance requirements. Its narrow domestic focus is also a concern in a globally interconnected market. But perhaps the biggest threat? Partisan setbacks in Congress. This isn’t just about good policy; it’s about political gridlock, and that’s an unpredictable force that could derail the entire thing. You need to be aware of these political currents, because they can be as volatile as the market itself.

Your Playbook for Profit: Navigating the Legislative Maze

So, with all this legislative wrestling, what does it mean for you? It means you need to be sharper, more informed, and more agile than ever before. This isn’t the time for complacency; it’s the time for decisive action.

🦎 Adapting Your Strategy: Be a Chameleon, Not a Dinosaur!

If the STABLE Act becomes law, prepare for a more centralized stablecoin market. This means potentially fewer choices, but perhaps more perceived stability from established financial giants. Your focus might shift to the compliant players. If the GENIUS Act gets the green light, get ready for a more dynamic, competitive market with new innovations popping up left and right. Your strategy needs to be flexible enough to thrive in either scenario. Are you skilled in trendline charting? Do you know when to sell your crypto to maximize gains? Adaptability is your greatest asset in this new paradigm.

🐺 Identifying Opportunities: Where the Wolves Hunt!

Look for companies that are proactively addressing compliance, building robust frameworks, and positioning themselves for regulatory clarity. These are the ones that will dominate the next phase of stablecoin growth. If the GENIUS Act opens the door for innovation, keep your eyes peeled for cutting-edge stablecoin projects that prioritize security and transparency. This is about spotting the next big wave before it hits, about getting in before the masses drive up the price. Don’t be a follower; be a leader. You want to research crypto opportunities like a pro.

🤝 The Power of Community and Information: Don’t Go It Alone!

In a market this complex, this volatile, going it alone is a fool’s errand. You need a network, a community of fellow wolves, all sharing insights, spotting trends, and supporting each other. You need access to exclusive, proprietary information and expert analysis that the average retail investor can only dream of.

This is exactly what the The Wolf Of Wall Street crypto trading community offers. It’s not just a platform; it’s your unfair advantage in the market.

- Exclusive VIP Signals: Forget guesswork. Get access to proprietary signals designed specifically to maximize your trading profits. This is actionable intelligence, direct to your screen.

- Expert Market Analysis: Our seasoned crypto traders dissect the market, the legislative landscape, and the emerging trends. You get in-depth analysis that cuts through the noise, allowing you to make surgical, informed decisions.

- Private Community: Join a powerhouse network of over 100,000 like-minded individuals. Share insights, get real-time support, and collaborate with people who are just as hungry for success as you are. This is a brotherhood of profit.

- Essential Trading Tools: We arm you with the best. Volume calculators, advanced analytics, and more – all the resources you need to make precise, informed decisions. You wouldn’t go to war without your weapons, would you?

- 24/7 Support: The crypto market never sleeps, and neither do we. Our dedicated support team is available around the clock, ready to assist you with any challenge, answer any question. We’ve got your back, every step of the way.

The Future of Stablecoins: What’s on the Horizon?

The legislative journey for both the STABLE Act and the GENIUS Act is far from over. These bills will be debated, amended, and influenced by the ever-shifting winds of political will. But one thing is absolutely clear: the days of unregulated, Wild West stablecoins are coming to an end.

🕰️ The Long Road Ahead: Patience and Vigilance

Don’t expect immediate resolutions. The legislative process is notoriously slow, often frustrating, but its impact is undeniable. Remain vigilant, keep a close eye on congressional developments, and understand that delays can create both new risks and unexpected opportunities. This is a marathon, not a sprint.

⚔️ The Power of Adaptation: Your Ultimate Weapon!

In this rapidly evolving financial landscape, your ability to adapt, to pivot, to absorb new information and integrate it into your strategy will be your greatest asset. Whether it’s mastering MACD indicator momentum signals or understanding crypto hedge funds’ market shifts, continuous learning is non-negotiable. The rules of the game are changing, but the core principles of shrewd trading and calculated risk-taking remain eternal.

📜 Conclusion: Seize the Fing Day!

The STABLE Act and the GENIUS Act are not just dry legislative proposals; they are the battle lines drawn for the future of stablecoins in the United States. They both aim for stability and consumer protection, but their differing approaches will fundamentally shape the market’s structure, dictate the pace of innovation, and ultimately, determine who thrives and who gets left behind.

For those of us who are ready to seize the moment, who understand that chaos breeds opportunity, the future is blindingly bright. Don’t just skim the headlines; dig deep, understand the underlying forces at play, and position yourself strategically. Equip yourself with the knowledge, the cutting-edge tools, and the unwavering support of a community like The Wolf Of Wall Street. This isn’t just about understanding stablecoins; it’s about unlocking your unlimited potential to profit in the cryptocurrency market. The time to act, my friends, is NOW! Stop dreaming about success and start making it a reality!

The The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.