🚀 Introduction

When Wall Street power collides with blockchain innovation, fortunes are made. That’s exactly what we’re witnessing right now. StablecoinX and TLGY just dropped a $530 million PIPE bomb, pushing their total commitment to a staggering $890 million. And it’s all aimed at Ethena’s ENA tokens — the crown jewels of tomorrow’s digital money ecosystem.

This isn’t just another crypto funding round. It’s a market-defining, liquidity-shaping, ecosystem-rewriting move. Let’s break it down, Belfort-style: direct, sharp, and all about the money.

💰 The Mega Deal That Shook the Market

PIPE financing — Private Investment in Public Equity. Translation? It’s Wall Street’s way of betting big without wasting time. StablecoinX and TLGY raised $530 million in a fresh PIPE, bringing the total capital injection to $890 million.

Why it matters:

- PIPE shares priced at $10 each — signalling institutional confidence.

- Cash isn’t just sitting idle; it’s being used to scoop ENA tokens at scale.

- Part of it goes into locked, discounted ENA purchases from the Ethena Foundation. That’s smart money buying cheap, locking future upside.

This isn’t retail speculation. This is institutional firepower aiming to reshape DeFi liquidity.

🦾 StablecoinX Inc.: The Powerhouse Merger

StablecoinX and TLGY have joined forces under the new StablecoinX Inc. banner. And they’re not playing small-ball. The combined entity will hold over 3 billion ENA tokens.

Think about that for a second: billions of tokens under one strategic treasury. That’s not just a bag; that’s a war chest capable of dictating liquidity, governance, and influence across the Ethena ecosystem.

🔑 The Treasure Chest: ENA Token Accumulation

Here’s the playbook:

- Multi-year ENA accumulation strategy — not a quick pump and dump.

- Buyback programmes to stabilise value and fuel long-term confidence.

- Locked, discounted ENA buys directly from the foundation.

This is a professional, structured accumulation plan. They’re not chasing yield — they’re building a fortress of ENA liquidity.

👉 For traders looking to master accumulation strategies, check our trading insights and deep-dive into emerging ecosystems.

📈 Who’s Behind the Billions? The Investor Lineup

The roster is impressive:

- New sharks: YZi Labs, Brevan Howard, Susquehanna Crypto, IMC Trading.

- Returning whales: Dragonfly, ParaFi, Maven11, Kingsway, Mirana, Haun Ventures.

These aren’t your average crypto bros. These are Wall Street titans and crypto veterans who don’t back losers. Their involvement is the ultimate stamp of legitimacy.

🌍 The Ethena Stablecoin Empire

At the heart of it all: Ethena’s stablecoins.

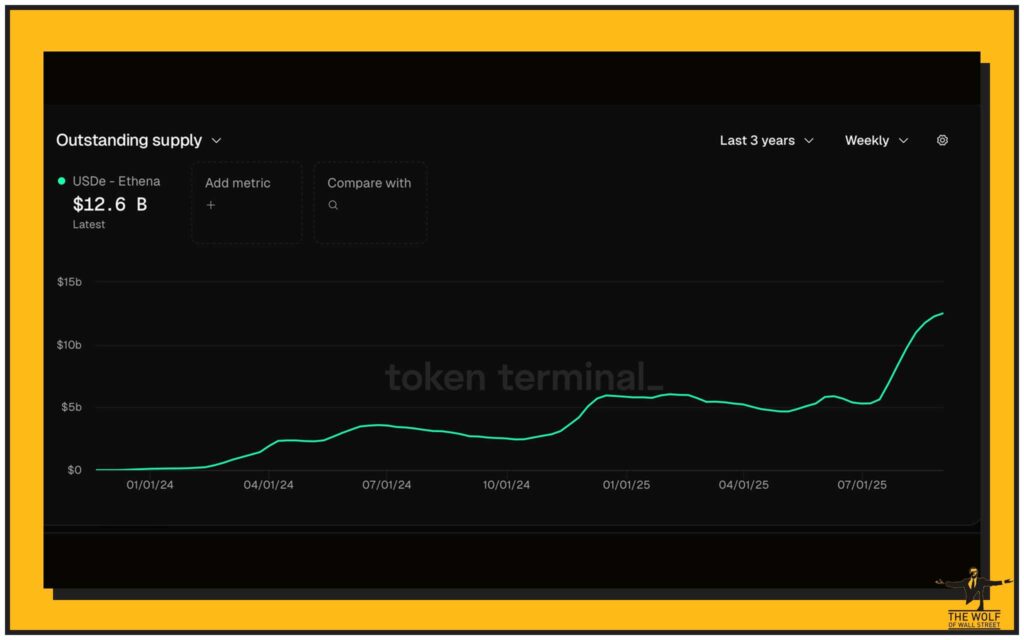

- USDe: exploded to $12.6 billion supply by September 2025. That’s record-breaking — faster than Tether (USDT) and Circle (USDC) in their early glory days.

- USDtb: the fiat-backed sibling, now aligning with regulatory pathways.

Together, these tokens are positioning Ethena as the third-largest stablecoin issuer in the world. And with StablecoinX’s treasury backing, that rank could rise.

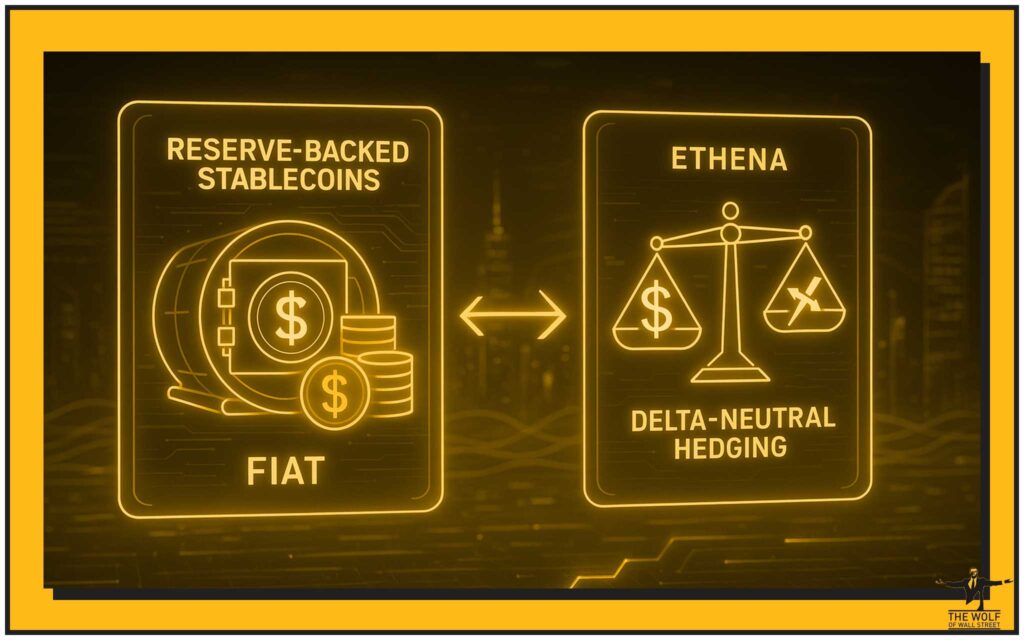

🔒 The Secret Sauce: Delta-Neutral Hedging

Forget old-school reserves. Ethena runs on a delta-neutral hedging model. Here’s the simplified version:

- Traditional stablecoins = dollars in a bank.

- Ethena = hedged positions neutralising volatility while capturing yield.

It’s like running an insurance desk that prints dollars without needing billions in fiat custody. It’s smarter, leaner, and built for the crypto-native economy.

💸 The Revenue Machine: Ethena’s Earnings Power

Let’s talk money. Ethena has generated:

- $500 million+ cumulative revenue.

- $13 million+ weekly earnings as demand keeps soaring.

This isn’t a proof-of-concept. This is a cash flow monster, proving that stablecoin innovation equals serious profits.

🌊 The Market Impact: Liquidity & Growth

StablecoinX’s $890M commitment means deeper liquidity pools, stronger spreads, and more efficient trading conditions. In short:

- Traders get tighter markets.

- DeFi projects get stability and scalability.

- Ethena cements itself as a liquidity powerhouse.

👉 Explore more on DeFi evolution and top cryptocurrencies shaping markets right now.

📜 The Governance Playbook

This isn’t cowboy crypto. StablecoinX is bringing in:

- A strategic advisory board.

- Governance best practices.

- Alignment of long-term incentives.

Think of it as DeFi growing up — institutional polish meets crypto innovation.

⚖️ Regulation on the Horizon

Regulators are finally entering the stablecoin arena. Ethena’s USDtb is moving toward compliance with the US GENIUS Act.

Why it matters:

- Provides a regulatory framework for fiat-backed tokens.

- Opens the door for mainstream adoption.

- Reduces risks of sudden crackdowns.

Regulation isn’t a roadblock. It’s the bridge to trillions in institutional capital.

🥊 Ethena vs. The Giants: Tether & Circle

The question on everyone’s mind: can Ethena dethrone Tether or Circle?

- USDe supply growth: fastest on record.

- USDT/USDC still dominant but stagnant in growth.

- Ethena’s edge: delta-neutral innovation + institutional backing.

This isn’t a David vs. Goliath story. This is Goliath building a bigger club.

⚠️ Risks and Challenges Ahead

No play is risk-free. Ethena’s challenges include:

- Delta-neutral hedging model exposed to extreme volatility scenarios.

- Regulatory risks if governments change the rules overnight.

- Execution risk managing billions in treasury capital.

Smart investors weigh risks, but they also chase asymmetric upside. That’s the game.

🔥 Why This Deal Is a Game-Changer for Traders

Here’s why you should care:

- Retail traders: deeper liquidity = better entries and exits.

- Institutions: scalable yield in a compliant wrapper.

- ENA holders: direct exposure to a high-demand treasury-backed token.

StablecoinX just made ENA must-watch territory for anyone serious about crypto profits.

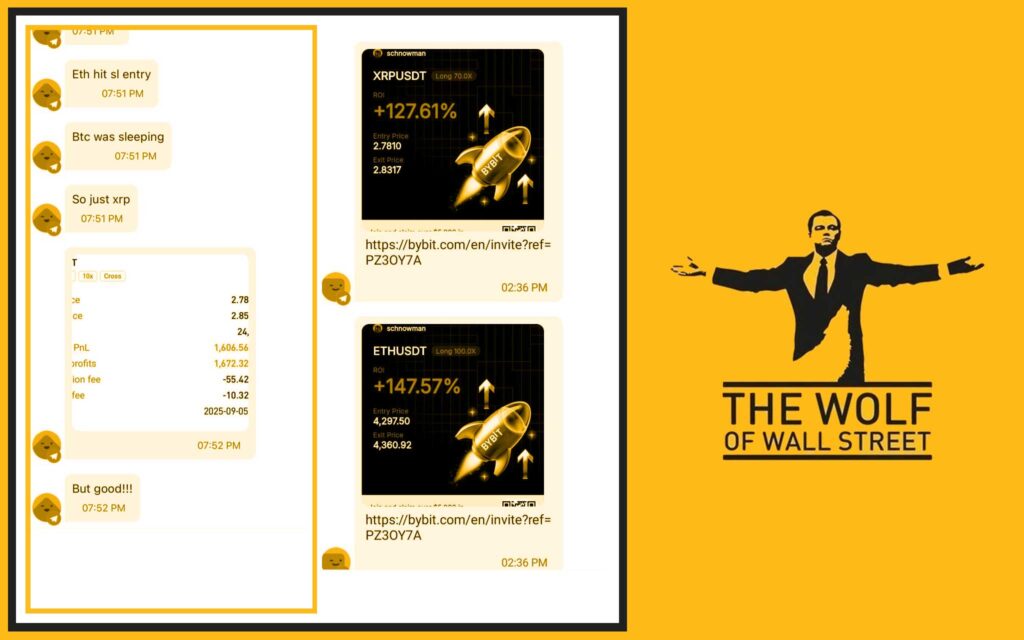

🧠 The Wolf Of Wall Street Trading Edge

Want to ride this wave? You need more than news — you need an edge. That’s where The Wolf Of Wall Street crypto trading community steps in:

- Exclusive VIP Signals: Get insider-level alerts to catch moves early.

- Expert Market Analysis: Learn from seasoned pros dissecting every angle.

- Private Community: Over 100,000 traders sharing insights daily.

- 24/7 Support & Tools: Volume calculators, resources, and non-stop assistance.

Empower your crypto journey today:

- Visit The Wolf Of Wall Street Service for the full package.

- Join our active Telegram community for real-time updates.

If you’re not plugged into The Wolf Of Wall Street, you’re trading blind.

🔮 Conclusion: The Future Is Written in ENA

StablecoinX’s $890 million move isn’t just funding. It’s a strategic shot across the bow of the stablecoin world. With billions in ENA locked, a booming treasury, and regulation-friendly pathways, Ethena is playing for the crown.

For traders, this is more than a headline. It’s a signal: liquidity is deepening, opportunities are multiplying, and the smart money is already positioning.

The question is simple — will you ride the wave or watch from the sidelines?

❓ FAQs

1. What is ENA and why is it important for Ethena?

ENA is Ethena’s ecosystem token, powering governance, liquidity, and treasury-backed stability across its stablecoin products.

2. How does Ethena’s delta-neutral model differ from Tether and USDC?

Unlike reserve-backed models (cash in banks), Ethena hedges crypto exposure to create synthetic dollars — flexible, yield-generating, and scalable.

3. What risks do investors face with this treasury strategy?

Volatility risks, regulatory uncertainty, and execution challenges. But the upside is equally massive.

4. How will the GENIUS Act shape stablecoin regulation?

It provides a clear legal pathway for fiat-backed tokens like USDtb, giving institutions confidence to adopt stablecoins at scale.

5. How can retail traders profit from these developments?

By watching ENA closely, trading on liquidity shifts, and joining communities like The Wolf Of Wall Street for real-time signals.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.