🔥 Introduction: The Billion-Dollar Power Play

Imagine walking into your office on Monday with nothing but an idea, and by Friday, you’ve launched your own stablecoin — backed by the same muscle that runs Wall Street. That’s exactly what Stripe just dropped on the world with Open Issuance.

This isn’t hype. It’s a billion-dollar pivot. And if you’re not paying attention, you’re already behind.

🚀 Stripe Open Issuance: Stablecoins in Days, Not Months

Stripe’s new tool, Open Issuance, allows businesses to mint, burn, and manage stablecoins with just a few lines of code. Translation? They’ve ripped away the complexity that kept most companies on the sidelines of crypto.

This isn’t just for tech startups. Traditional businesses can now leverage stablecoins for payments, loyalty rewards, and global transactions without becoming blockchain engineers.

💰 Backed by Giants: BlackRock, Fidelity, and Superstate

Trust is everything in money. And Stripe didn’t walk in empty-handed. Their treasury operations are backed by BlackRock, Fidelity Investments, and blockchain asset manager Superstate.

This isn’t some shaky altcoin experiment. It’s a Wall Street-backed, institutionally managed money infrastructure. That’s the difference between another crypto fad and a trillion-dollar opportunity.

📈 The $300B Market Heading for $2T by 2028

Right now, the US stablecoin market sits at $300 billion. By 2028, projections have it blasting to $2 trillion. That’s not speculation — it’s inevitable momentum.

And timing is everything. Stripe is handing you the keys before this market explodes. The question is, do you drive or stay in the passenger seat while others cash in?

⚖️ Regulation & the GENIUS Act: Trump’s Stablecoin Legacy

For years, stablecoins were caught in regulatory limbo. Then came the GENIUS Act, signed during the Trump administration.

It gave stablecoins a clear regulatory framework, meaning companies like Stripe can build without fear of a rug pull from Washington. Compliance isn’t optional — it’s the ticket to legitimacy. And Stripe has it.

For more on how regulation shapes crypto’s future, check out Stable Act vs GENIUS Act.

🏦 Stripe’s Regulatory Chess Moves

Stripe isn’t just playing offense — they’re playing chess. They’re pursuing both a federal banking charter and a New York State trust license.

Why does this matter? Because the difference between “startup experiment” and “global money infrastructure” is whether regulators shake your hand or shut you down. Stripe is positioning itself as the legal safe bet.

🎯 Business Use Cases: Rewards, Loyalty, and Beyond

Here’s where it gets real. Businesses can issue stablecoins in days and use them in creative, profit-driving ways:

- Customer rewards → Replace points with tradeable, cash-backed tokens.

- E-commerce incentives → Stablecoin discounts and bonuses.

- Cross-border payments → Fast, cheap, global settlement.

- Brand engagement → Your token becomes part of your identity.

This isn’t theory. It’s executable today.

🛠️ Infrastructure: The $1.1B Bridge Acquisition

Behind the scenes, Stripe bought Bridge for $1.1 billion. That’s not pocket change — that’s conviction.

Bridge powers all the minting, burning, and reserve management for Open Issuance. It’s the plumbing that ensures your token doesn’t collapse under pressure.

🔥 Competitors: Coinbase, Binance & the Crypto-as-a-Service War

Let’s be clear: Stripe isn’t the first player. Coinbase and Binance have been offering white-label crypto solutions.

But here’s the edge:

- Coinbase is for the crypto-native.

- Binance is for the high-risk global crowd.

- Stripe? Stripe is for the world of business. Compliance-first, easy-to-use, and backed by institutions.

If crypto-as-a-service is the war, Stripe just walked in with the bigger army.

🤖 AI Meets Crypto: The Agentic Commerce Protocol

This is where the future gets wild. Stripe, in collaboration with OpenAI, built the Agentic Commerce Protocol — an AI-driven e-commerce system that integrates directly with stablecoins.

Imagine AI-powered agents that buy, sell, and trade on behalf of your customers — all powered by your own branded stablecoin. That’s not science fiction. That’s Stripe’s roadmap.

⚡ Why Stripe Just Lowered the Barriers for Everyone

Before Stripe, launching a stablecoin required a dev team, lawyers, and months of work. Now? A few lines of code and you’re in.

They’ve knocked down two walls:

- Technical barriers → Easy API.

- Compliance barriers → Regulatory licenses in progress.

That’s why this isn’t just another crypto tool. This is Stripe creating the Apple of stablecoins: simple, powerful, universal.

💡 Use Case Deep Dive: Who Should Be First Movers?

If you’re in these industries, you should already be testing:

- E-commerce platforms → Tokenised rewards and cashback.

- SaaS firms → Subscription incentives with stablecoins.

- Financial services → Customer loyalty programs backed by reserves.

- Gaming & NFTs → Stablecoin-powered microtransactions.

Want to understand how tokens integrate into business models? Read our guide to creating a crypto token.

🦾 The Competitive Edge: Speed, Trust, and Scale

Why Stripe’s play is lethal:

- Speed – Launch in days, not quarters.

- Trust – Backed by Wall Street asset managers.

- Scale – Stripe already runs payments for millions of businesses worldwide.

When you combine those three, you get not just a product — you get dominance.

📊 Stablecoins, DeFi, and the New Financial Era

Stablecoins aren’t just a tool; they’re the bridge to DeFi. Stripe’s Open Issuance means businesses can easily interact with decentralised ecosystems.

This isn’t just about rewards — it’s about future-proofing against a financial system that’s going fully digital. Dive deeper into the DeFi ecosystem to see how this interconnects.

🧩 The Missing Piece: Risks and Challenges

No play is without risk. Here’s the reality check:

- Regulatory shifts could slow adoption.

- Market volatility remains a factor.

- Customer education is a hurdle — will they trust “your” stablecoin?

But those who can navigate the risk will own the upside.

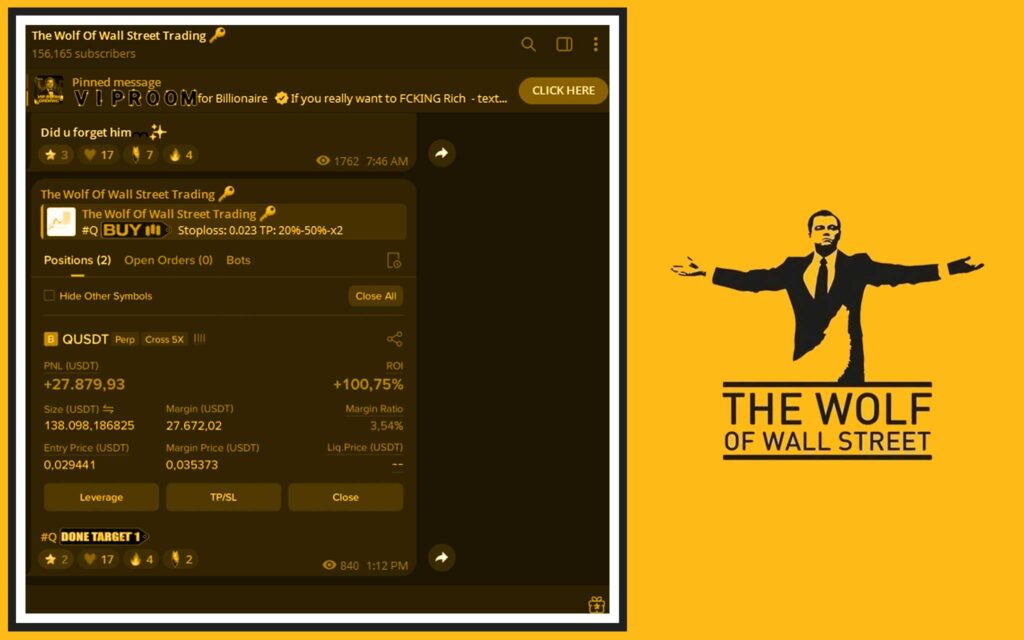

🔥 The The Wolf Of Wall Street Edge: Navigating Stablecoins Like a Pro

Let’s cut the BS — most businesses and traders aren’t ready to navigate this alone. That’s where The Wolf Of Wall Street crypto trading community comes in:

- Exclusive VIP Signals → Maximise profit opportunities.

- Expert Market Analysis → In-depth breakdowns from seasoned pros.

- Private Community → 100,000+ traders sharing insights daily.

- Essential Tools → From calculators to decision-making resources.

- 24/7 Support → Never trade blind.

Want to trade like a wolf, not a sheep? Visit The Wolf Of Wall Street Service or jump into the Telegram community.

💡 FAQs: Stripe Open Issuance Explained

1. How does Stripe’s Open Issuance work?

Stripe provides APIs to mint, burn, and manage stablecoins with minimal coding.

2. Is it safe for small businesses to issue stablecoins?

Yes, especially with institutional backing and Stripe’s regulatory compliance.

3. What makes Stripe different from Coinbase or Binance?

Stripe is compliance-first, business-focused, and backed by Wall Street institutions.

4. Can stablecoins replace traditional loyalty points?

Absolutely — stablecoins offer liquidity, flexibility, and brand loyalty.

5. How do I stay compliant while issuing stablecoins?

Stripe is pursuing federal and state licenses to ensure compliance. You still need legal oversight, but Stripe lowers the complexity.

🏁 Conclusion: Stripe’s Billion-Dollar Bet on the Future of Money

Let’s get real. The world is moving fast, and Stripe just gave you a chance to mint money — literally. Stablecoins aren’t the future. They’re the present.

The only question is: Are you going to sit on the sidelines while your competitors print their own money, or are you stepping up to the table?

Because in the new world of finance, you either issue the coin — or you get paid in someone else’s.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Insights from seasoned traders.

- Private Community: Over 100,000 members sharing knowledge.

- Essential Trading Tools: Volume calculators and more.

- 24/7 Support: Continuous assistance from dedicated experts.

Empower your crypto journey:

- Visit The Wolf Of Wall Street Service for details.

- Join the Telegram community for real-time updates.

- Unlock your potential with The Wolf Of Wall Street.