⚡ Introduction

Listen up—because this move from Tether isn’t just another crypto headline. It’s a strategic pivot with teeth. Tether was about to freeze USDT on five blockchains—Omni Layer, Bitcoin Cash SLP, Kusama, EOS, and Algorand. But guess what? They reversed course. Transfers stay alive, while issuance and redemptions are officially dead.

This isn’t just policy—it’s survival. If you’re a trader, an investor, or hell, even a regulator watching the stablecoin chessboard, you need to understand why this matters. The message is crystal clear: liquidity flows to winners, dead chains get left behind, and only ecosystems with real adoption survive.

🚀 Background: Tether’s Original Plan

Back in 2023, Tether dropped a bomb: they’d start sunsetting support for chains that weren’t pulling their weight. The original plan? Full freeze. No issuance, no redemption, no transfers. Done.

That freaked out holders who still had USDT sitting on older chains like Omni. Fast-forward to mid-2025, and we’ve got the update: transfers remain possible, but you can’t mint or redeem anymore. Translation? Your tokens won’t vanish, but they’re second-class citizens.

📢 Community Pushback & Why Tether Listened

Tether didn’t pull this U-turn out of kindness—it was pressure. Community feedback came in hot: developers, traders, and ecosystem players all said the same thing—don’t kill transfers.

In crypto, optics are everything. Tether’s dominance rides on trust, and freezing tokens outright could’ve created chaos. By allowing transfers, they avoided PR suicide while still trimming dead weight. Smart? Yes. Ruthless? Absolutely.

🔗 Impacted Blockchains – Winners & Losers

Omni Layer – The Legacy Giant Losing Steam

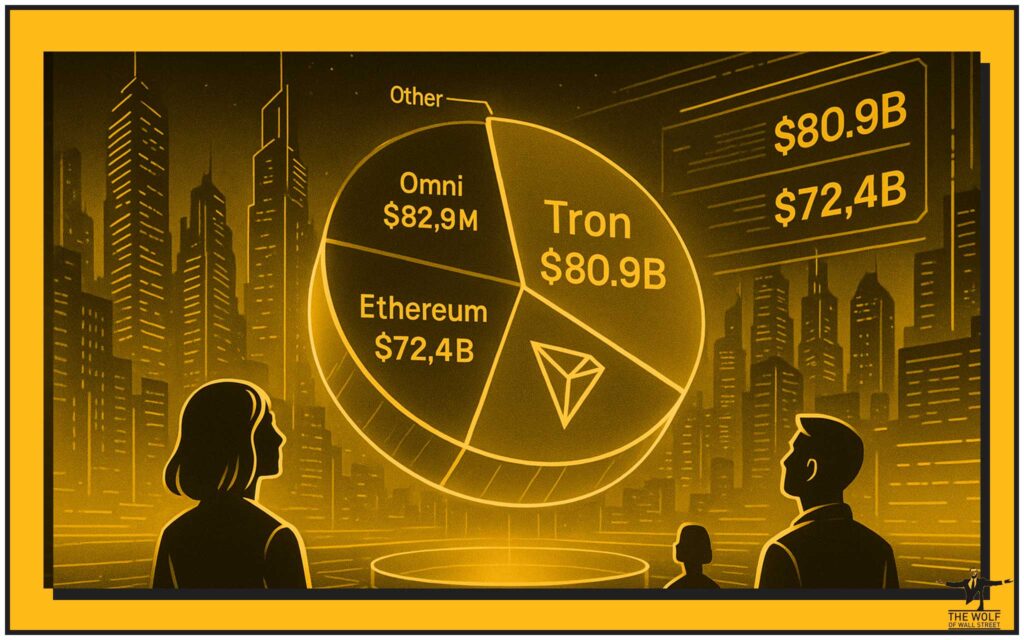

Omni Layer used to be the launchpad for USDT. Today? A relic. There’s still $82.9M USDT hanging around, but compared to Ethereum and Tron’s billions, that’s pocket change.

Bitcoin Cash SLP & Kusama – Ghost Town Supply

BCH SLP and Kusama combined hold less than $5M in supply. That’s not a market; that’s a rounding error. Traders already moved on years ago.

EOS & Algorand – From Hype to Sunset

Both chains came in with fanfare. EOS was hyped as “Ethereum killer.” Algorand marketed itself as scalable perfection. Reality check? Neither cracked adoption at scale. Tether cutting them loose is just business.

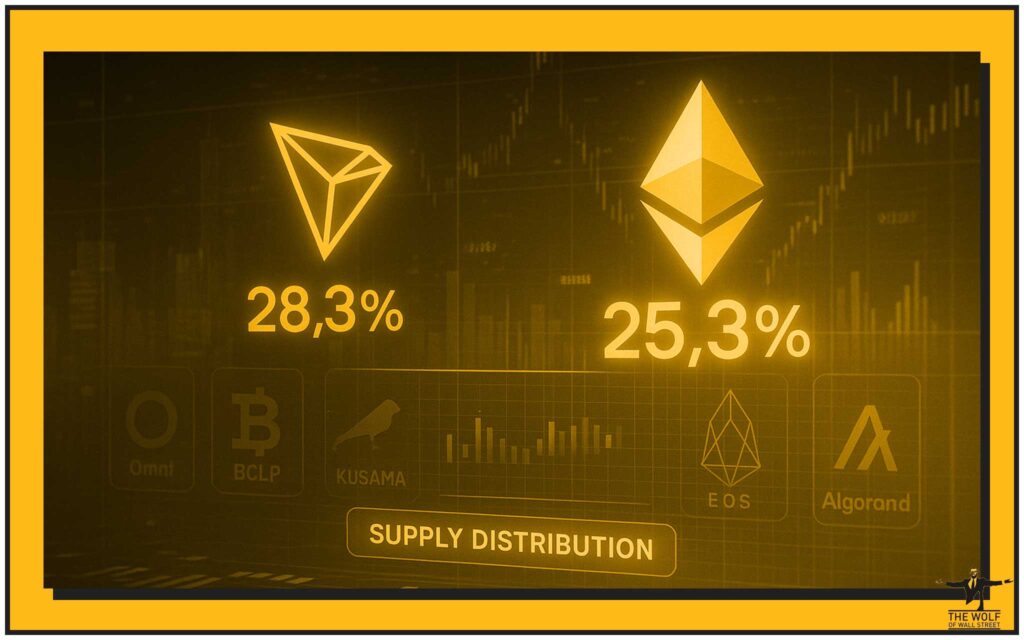

💰 Market Reality Check – Supply Distribution

Here’s where the numbers slap you in the face:

- Tron: $80.9B in USDT supply

- Ethereum: $72.4B in USDT supply

- Omni + Others: Barely scratching relevance

That’s the real scoreboard. The liquidity game isn’t spread thin anymore—it’s concentrated where developers build, where traders trade, and where DeFi thrives.

🏗️ Strategic Realignment: Why Tether Cut These Chains

Tether’s playbook is simple:

- Developer activity matters. No devs = no growth.

- User adoption rules. No demand = no liquidity.

- Scalability is king. If your chain can’t handle volume, you’re out.

This is Tether trimming fat to stay lean and dominate. Think of it like pruning: cut the dead branches so the tree thrives.

🥊 Competitor Spotlight: Circle’s USDC

While Tether’s consolidating, Circle’s USDC is making its own moves—pushing hard on Solana and Ethereum L2s. With a market cap of $71.5B, Circle isn’t backing down.

The strategies diverge: Tether doubles down on dominance chains; Circle experiments with high-speed networks. Who wins? Depends on whether users prefer deep liquidity or bleeding-edge rails.

📈 The Bigger Stablecoin War

Zoom out: the stablecoin market sits at $285.9B, and two players own the lion’s share—Tether and Circle.

Together, USDT + USDC control the table. But this isn’t just about supply. It’s about trust, adoption, and regulation. The war isn’t for today’s billions; it’s for tomorrow’s trillions.

🏛️ Regulatory Winds: The GENIUS Act

Enter the U.S. GENIUS Act—new legislation aimed at stabilising and boosting dollar-backed stablecoins.

- Reinforces dollar dominance.

- Encourages adoption globally.

- Projects the market to $2 trillion by 2028.

Regulation isn’t the enemy here—it’s the rocket fuel. The GENIUS Act could make USDT and USDC the de facto rails for digital dollars worldwide.

🛠️ The Missing Piece – Migration Guidance

Here’s where Tether screwed up: no clear migration guide. Holders on Omni, EOS, Algorand? You’re left guessing. That’s sloppy execution.

Smart traders know what to do:

- Move assets to Ethereum or Tron.

- Use centralised exchanges as bridges.

- Track official announcements.

But newbies? They’re at risk. And that’s where community resources (like trading groups) become gold.

📊 Data Snapshot Table

| Blockchain | USDT Supply | Status |

|---|---|---|

| Tron | $80.9B | Fully supported |

| Ethereum | $72.4B | Fully supported |

| Omni Layer | $82.9M | Transfers only, no issuance |

| BCH SLP, Kusama, EOS, Algorand | < $5M combined | Transfers only, no issuance |

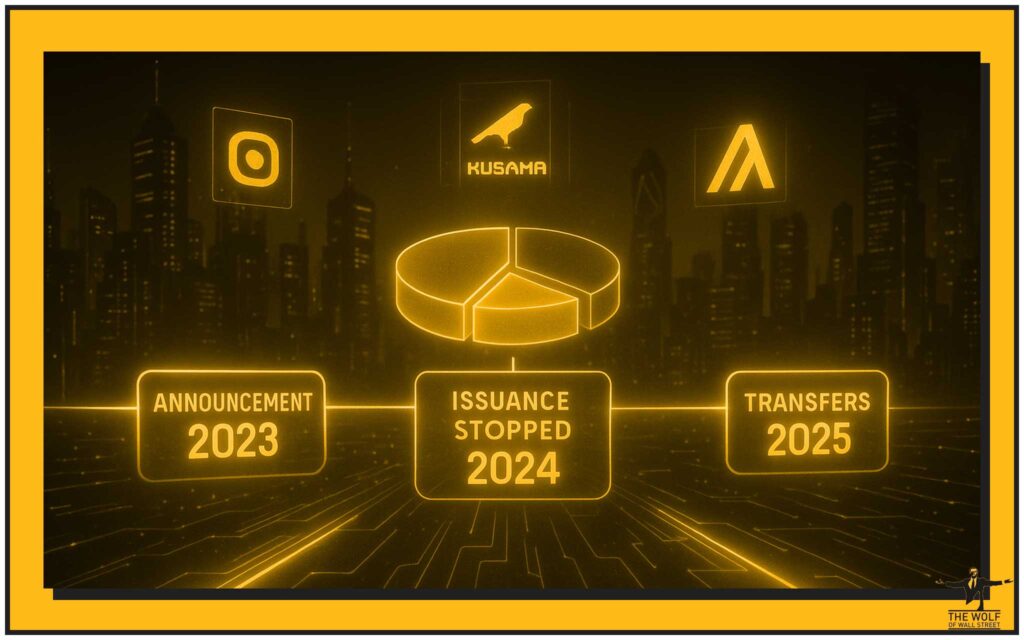

⏳ Timeline: Tether’s Two-Year Sunsetting

- 2023: Announcement of phase-out begins.

- 2024: Issuance stopped on weak chains.

- 2025: Transfers remain, issuance and redemption gone. Final stage complete.

This wasn’t sudden. It was a controlled wind-down.

⚡ Lessons for Traders & Investors

- Follow liquidity, not nostalgia. Don’t get stuck on dead chains.

- Adoption matters. USDT thrives where DeFi lives.

- Stay agile. Crypto punishes the slow.

🧠 Lessons for Blockchain Developers

- Ecosystem > Tech. You can build the fastest chain alive, but if no one uses it, it’s useless.

- Dev activity signals survival. Abandonment equals extinction.

- Stablecoins are lifeblood. If you can’t attract them, your chain’s irrelevant.

🔥 Action Plan for Affected Users

- Move fast. Transfer USDT off unsupported chains.

- Use exchanges. Binance, Coinbase, and others act as liquidity bridges.

- Switch to Tron or Ethereum. That’s where the action is.

- Join trading communities. Real-time updates = survival edge.

🌍 Global Perspective – Beyond the U.S.

Don’t think this is just an American game. Emerging markets—Turkey, Argentina, Nigeria—are using USDT like lifelines. Cutting dead chains won’t stop that. In fact, it strengthens adoption on major rails.

Global money flow is going digital, and USDT is still the kingpin.

📊 The Future of Stablecoins – Trends to Watch

- Layer 2 dominance. Watch Ethereum rollups become USDT strongholds.

- Institutional adoption. With regulation, banks won’t resist forever.

- DeFi integration. Protocols will crown winners based on liquidity depth.

🔥 Conclusion

Tether didn’t freeze USDT into oblivion. Instead, it streamlined, cleaned house, and bet on winners. The lesson? In crypto, survival belongs to chains with adoption, developers, and real users.

If you’re holding stablecoins, the takeaway is blunt: don’t fight the tide—move with the liquidity.

❓ FAQs

1. Why did Tether reverse its decision to freeze USDT?

Community backlash and reputation management. Freezing transfers was a PR nightmare waiting to happen.

2. What happens if I hold USDT on Omni Layer or EOS?

You can transfer, but you can’t mint or redeem. Migrate to Ethereum or Tron.

3. Is USDC safer than USDT long-term?

Depends on your strategy. USDT dominates liquidity; USDC is betting on regulation-first adoption.

4. Will Tether support new blockchains in the future?

Yes, but only those with serious dev activity and user adoption.

5. How does the GENIUS Act affect stablecoin adoption?

It legitimises dollar-backed stablecoins, projects massive market growth, and could accelerate mainstream adoption.

🔗 Internal Links

- Explore our The Wolf Of Wall Street crypto trading service.

- Stay updated in news and cryptocurrencies.

- Sharpen your edge with trading insights.

- Learn more about layer-1 and layer-2 solutions.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

👉 Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street