Introduction: A Sudden Economic Jolt

On April 2, 2025, President Donald Trump made waves across the global economic landscape with an unexpected and sweeping announcement. The U.S. President outlined a retaliatory tariff plan aimed at restoring trade balance, triggering a massive sell-off in both the stock market and cryptocurrency sectors. With tariff rates on hundreds of countries, ranging from Vietnam to China, the financial world braced itself for what could be the start of another trade war. Investors, already weary of market fluctuations, found themselves facing a sharp downturn, and the cryptocurrency community wasn’t spared either. Bitcoin, Ethereum, and the broader altcoin market saw massive dips, leaving traders scrambling.

But what does this mean for the U.S. economy, global trade, and the future of cryptocurrency? Let’s dive in.

The Trump Tariff Announcement: What’s on the Table?

The New Retaliatory Tariffs: A Closer Look

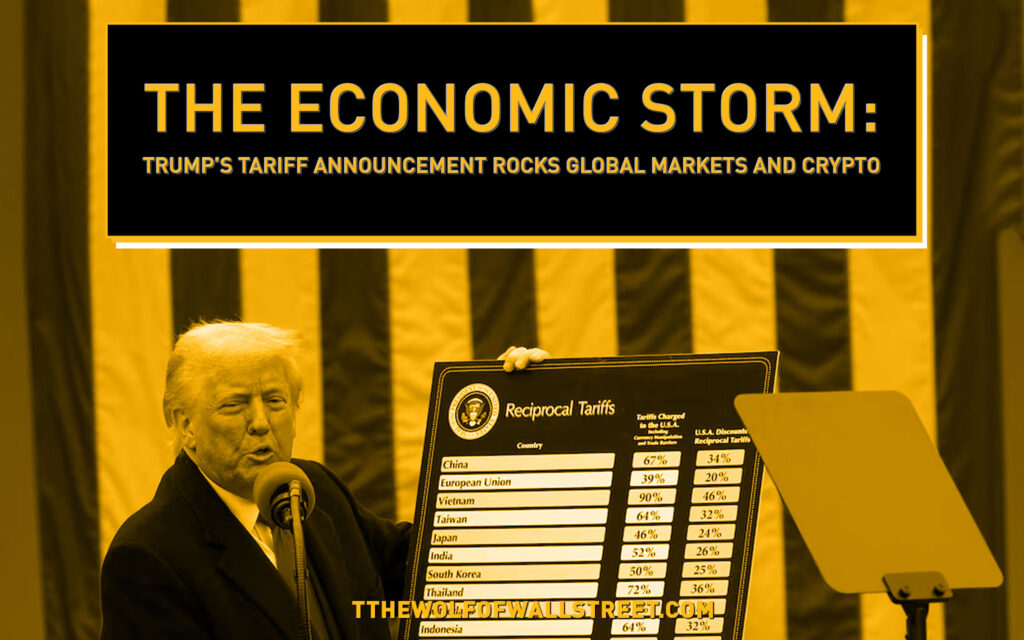

In a dramatic announcement, Trump revealed that the U.S. would impose a blanket 10% import tax on goods coming into the country. However, this was just the beginning. Additional retaliatory tariffs would be specifically targeted at countries with whom the U.S. has long-standing trade deficits. The tariffs are set to impact over 180 nations and territories, with varying rates based on trade relations.

For example:

- Vietnam: 46%

- Cambodia: 49%

- China: 34%

- EU: 20%

- Japan: 24%

- South Korea: 25%

- India: 26%

These tariffs are set to go into effect on April 9, 2025, making it one of the most ambitious trade measures the U.S. has seen in recent history.

The Methodology Behind These Tariffs

What truly set this announcement apart was Trump’s new methodology for calculating tariffs. Instead of considering actual trade barriers, tariffs would now be based on a nation’s trade deficit ratio with the United States. The logic here is clear: if a country has a higher trade deficit with the U.S., they’ll face higher tariffs. The question remains, though—does this new approach hold up to scrutiny? Many critics have raised concerns about its fairness and the accuracy of the trade deficit metrics, which could be skewed or miscalculated.

A Swift Reaction: How the Markets Reacted

Stock Markets in Freefall

The initial reactions to Trump’s tariff news were swift and brutal. U.S. stock futures took a massive hit, falling between 2% and 4% almost immediately. Big tech stocks, such as Apple, Amazon, and Tesla, suffered sharp declines in after-hours trading, with some losing between 3% and 7% of their value. Investors in both Wall Street and global markets braced themselves for further fallout, with fears of a possible recession rising.

Crypto Markets in Chaos

If you thought that traditional markets were the only ones in turmoil, think again. The cryptocurrency sector—often seen as an alternative to traditional finance—wasn’t immune to the storm. Bitcoin, which had been enjoying a recent surge, saw a significant drop from $88,500 to $82,200. Ethereum and other altcoins followed suit, experiencing 3% to 10% declines. Within just 24 hours, over $500 million in crypto derivatives were liquidated as the markets reacted to the news.

The crash left many traders scrambling, as the very foundation of the crypto market seemed to shake under the pressure of geopolitical tensions. Could these tariffs represent the first crack in the crypto dream, or are they merely a temporary setback?

The Ripple Effect: More Tariffs to Come?

End of Tax Exemptions for Chinese Goods

If the imposition of tariffs wasn’t enough, Trump is also looking to end the tax exemption for goods under $800 coming from China and Hong Kong, effective May 2, 2025. This move could mean higher prices for millions of consumer goods, ranging from electronics to clothing, making life even more expensive for U.S. consumers.

Possible New Tariffs on Critical Sectors

But wait, there’s more! Trump’s trade strategy isn’t stopping at general tariffs on imports. The U.S. is also considering new tariffs targeting specific industries, such as:

- Pharmaceuticals

- Semiconductors

- Critical minerals

These industries are essential to modern economies and technological development. Imposing tariffs here could have far-reaching consequences, potentially stalling growth in these key sectors.

The Economic Fallout: Recession Risk and Global Instability

Global Impact: Could We See a Recession?

James Surowiecki, along with many other economists, has criticized the logic behind the U.S. tariff strategies, especially the calculation of trade deficits as the basis for tariffs. Experts argue that this could lead to economic imbalances, creating a ripple effect across global markets. Countries that rely heavily on trade with the U.S. could see economic slowdowns, with some even facing the threat of a global recession.

The question on everyone’s mind is: will these tariffs ultimately lead to a full-scale trade war? Only time will tell, but the early signs suggest that this could be the start of something much bigger.

Crypto Mining: The Unintended Consequence

The U.S. Crypto Mining Sector Faces Rising Costs

For the U.S. cryptocurrency mining industry, Trump’s tariffs pose a significant challenge. As the world’s largest crypto mining hub, the U.S. imports a vast amount of mining equipment from China. With the new tariffs set to apply, the cost of these machines will skyrocket. This increase could undermine Trump’s goal of making the U.S. a global leader in crypto mining.

As a result, mining companies may find it increasingly difficult to remain competitive on the global stage. Could these tariffs ultimately hinder U.S. innovation and growth in the crypto sector?

The Bigger Picture: Is This a Temporary Setback?

Rebalancing Global Trade: A Long-Term Strategy?

While the immediate reaction to Trump’s tariff plan has been overwhelmingly negative, some believe this could be part of a long-term strategy to rebalance global trade. By forcing countries with significant trade imbalances to pay higher tariffs, Trump hopes to encourage them to lower their own trade barriers. Whether this vision succeeds or fails remains to be seen, but what’s certain is that this could reshape global commerce for years to come.

Will It Lead to a New Trade War?

The elephant in the room remains the potential for a global trade war. As countries retaliate, the world could see a cycle of escalating tariffs, leading to economic instability and even more uncertainty in the markets.

Conclusion: A Global Economy in Flux

Trump’s tariff announcement marks a pivotal moment in U.S. trade policy. With retaliatory tariffs affecting over 180 countries and potentially reshaping entire industries, the world is on edge. From stock markets to cryptocurrency, no sector is left untouched by the fallout. As the economic consequences continue to unfold, one thing is clear: the global economy is at a crossroads, and only time will tell how this bold strategy will shape the future of trade.

FAQs

1. What are the main countries affected by Trump’s new tariffs?

Trump’s tariffs will primarily target countries with significant trade deficits with the U.S., including China, Vietnam, Cambodia, the EU, Japan, and South Korea, among others.

2. How will these tariffs affect global stock markets?

The tariffs have already caused a sharp decline in stock futures, with major companies like Apple and Amazon losing significant value in after-hours trading.

3. How does the new tariff calculation method work?

Trump’s tariffs will now be based on a country’s trade deficit ratio with the U.S., rather than the actual trade barriers in place.

4. What impact will these tariffs have on U.S. consumers?

Consumers will likely face higher prices on a wide range of goods, especially electronics, clothing, and other imports.

5. Could these tariffs lead to a global recession?

Many experts warn that the widespread imposition of tariffs could lead to a global recession, especially if countries retaliate with their own tariffs.