🔥 Introduction: The New Age of Treasury Power

Picture this: boardrooms filled with executives, governments running late-night emergency meetings, and everyone’s eyes fixed on one thing—crypto. The treasury model is flipping on its head. The old guard—cash, bonds, and gold—are looking shaky, and digital assets like Bitcoin and Ethereum are storming the stage.

This isn’t a fad. It’s a shift in financial history. Inflation is eating away at fiat currencies, bond markets are wobbling, and gold… well, gold just doesn’t cut it anymore. The sharpest players—corporations and nations—are hedging with Bitcoin (BTC) and Ether (ETH). And they’re not dabbling; they’re stacking billions.

💰 The Death of Old-School Treasury Assets

For decades, corporate treasuries leaned on cash, bonds, and gold. But here’s the problem:

- Cash gets slaughtered by inflation.

- Bonds bleed from interest-rate risk.

- Gold, while stable, is heavy, illiquid, and underperforming in yield.

The so-called “safe” treasury model is crumbling. Fiat currencies lose purchasing power every year, central banks pull unpredictable stunts, and global corporations can’t afford to just sit still. Enter crypto—the hedge that bites back.

🪙 Bitcoin as Digital Gold – The Ultimate Treasury Hedge

Bitcoin is no longer the plaything of early adopters—it’s a serious treasury asset. Why?

- Scarcity: 21 million coins, hard cap, no inflation tricks.

- Liquidity: Tradeable 24/7, globally recognised.

- Stability of narrative: Everyone understands “digital gold.”

Nations like El Salvador made it legal tender. Corporations like MicroStrategy went all in. And now, BTC is a frontline defence against inflation, FX volatility, and broken financial systems.

For a deeper look at BTC strategy, check out our Bitcoin insights.

🇺🇸 Uncle Sam Joins the Game: The US Strategic Bitcoin Reserve

Here’s the bombshell: in 2025, the US Federal Government unveiled the Strategic Bitcoin Reserve.

- Holdings: 198,000 BTC.

- Value: $17–$20 billion.

This isn’t a speculative gamble—it’s a signal to the world. When the United States adds Bitcoin to its reserves, it tells every CFO and finance minister: “This is real. This is the future.”

That move alone turbocharged institutional adoption and legitimised BTC as a core treasury asset.

🌍 Sovereign Adoption – From El Salvador to Bhutan

El Salvador doubled down on Bitcoin as legal tender. Bhutan quietly ran Bitcoin mining operations, stacking BTC like a dragon hoarding treasure. Other nations—some quietly, some publicly—are using Bitcoin to hedge against sanctions, inflation, and dependency on foreign currency systems.

This isn’t just about tech. It’s about sovereignty. Nations are arming themselves with Bitcoin to stay financially bulletproof.

For more global crypto moves, dive into our policies coverage and crypto news.

⚡ Ethereum’s Play: From Asset to Income Stream

If Bitcoin is digital gold, Ethereum is programmable money. The 2022 upgrade to Proof-of-Stake flipped the script:

- ETH holders can stake and earn 3%–5% annually.

- ETH isn’t just sitting in vaults—it’s working, generating yield.

- Ethereum powers DeFi, tokenised assets, and next-gen finance.

For treasury managers, that’s a dream. Imagine reserves that don’t just preserve value but actively grow it.

🏦 ETH Treasuries – Beyond HODL

Ethereum isn’t just about staking. Treasuries holding ETH can plug into:

- DeFi protocols for lending, liquidity, and yield.

- Tokenised real-world assets, like bonds and real estate.

- Programmable financial tools that traditional treasuries can’t touch.

It transforms a treasury from a passive box of reserves into an active, profit-generating machine.

Check out our DeFi section for strategies on leveraging Ethereum’s ecosystem.

📊 Institutional Holdings in 2025 – The Numbers Don’t Lie

By mid-2025, the numbers were undeniable:

- Over 1 million BTC in institutional hands.

- Nearly 5 million ETH in treasuries.

That’s not retail hype—that’s corporations, governments, and DAOs. The adoption curve is steepening, the liquidity is deepening, and crypto is embedding itself in the financial bloodstream.

🧩 Dual Treasury Strategies – BTC Stability + ETH Yield

The smartest treasuries aren’t choosing between Bitcoin or Ether. They’re holding both.

- BTC = Stability. Rock-solid base reserve.

- ETH = Yield + Utility. Active income, programmable finance.

This dual approach balances the safe-haven value of Bitcoin with the growth potential of Ethereum. It’s the ultimate hedge-and-growth combo.

🏢 Case Study: BitMine Immersion Tech

BitMine Immersion Tech didn’t just buy Bitcoin and call it a day. They built a diversified treasury, mixing BTC for stability and ETH for growth.

It’s a blueprint for how corporations can build resilience and profit simultaneously. Expect more companies to follow this path.

📈 Market Dynamics – The Push & Pull of BTC vs ETH

Here’s how the split usually plays out:

- Governments love Bitcoin. It’s stable, recognisable, and apolitical.

- Corporates lean towards Ethereum. They want growth, yield, and programmable flexibility.

That balance keeps the market dynamic. BTC provides the anchor, ETH provides the engine.

🔮 Future Outlook – Treasuries 2030

Fast-forward five years:

- Governments stacking Bitcoin like oil reserves.

- Corporates running treasuries through Ethereum-powered DeFi.

- Crypto treasuries merging with central bank digital currencies (CBDCs).

By 2030, dual treasury models won’t be experimental—they’ll be standard.

⚖️ Risks & Challenges of Crypto Treasuries

Let’s not sugarcoat it—crypto treasuries aren’t risk-free.

- Volatility: Prices swing hard.

- Regulation: Governments can shift rules overnight.

- Custody: Lose your keys, lose your fortune.

- Tech risk: Bugs, hacks, and exploits still exist.

That’s why smart treasuries balance BTC, ETH, and sometimes even stablecoins. They’re building systems that manage volatility while still capturing upside.

For treasury strategies, check out our trading insights and Layer-1 solutions.

🧠 Strategic Implications – Why This Matters

Crypto in treasuries isn’t a trend—it’s a weapon. It provides:

- Inflation hedging when fiat collapses.

- Liquidity preservation in volatile markets.

- Sanctions resilience for nations under pressure.

- Integration with digital finance, from DeFi to CBDCs.

It’s about control. Those who embrace crypto treasuries aren’t just surviving—they’re winning.

🎯 Final Word – The Wolf’s Take

The game has changed. The old treasury model is dying. The new one—powered by Bitcoin and Ethereum—is alive, aggressive, and unstoppable.

- Bitcoin gives you the base, the foundation, the rock.

- Ethereum gives you growth, income, and utility.

- Together, they’re not just treasury assets—they’re tools of financial dominance.

Corporations and nations who don’t adapt will get left behind. Those who do? They’ll own the future.

❓ FAQs

1. Why are corporations adding Bitcoin to their treasuries?

Because it hedges inflation, preserves value, and provides global liquidity like nothing else.

2. How does Ethereum’s staking make it unique for treasury use?

ETH generates 3%–5% annual yield while also unlocking access to DeFi and tokenised assets.

3. Which nations are leading in crypto treasury adoption?

El Salvador, Bhutan, and the United States with its Strategic Bitcoin Reserve.

4. Is crypto riskier than traditional treasury assets?

It’s volatile, yes—but fiat currencies and bonds carry silent risks like inflation erosion.

5. Will stablecoins rival BTC and ETH as treasury reserves?

Stablecoins may play a role, but BTC and ETH dominate in value preservation and yield potential.

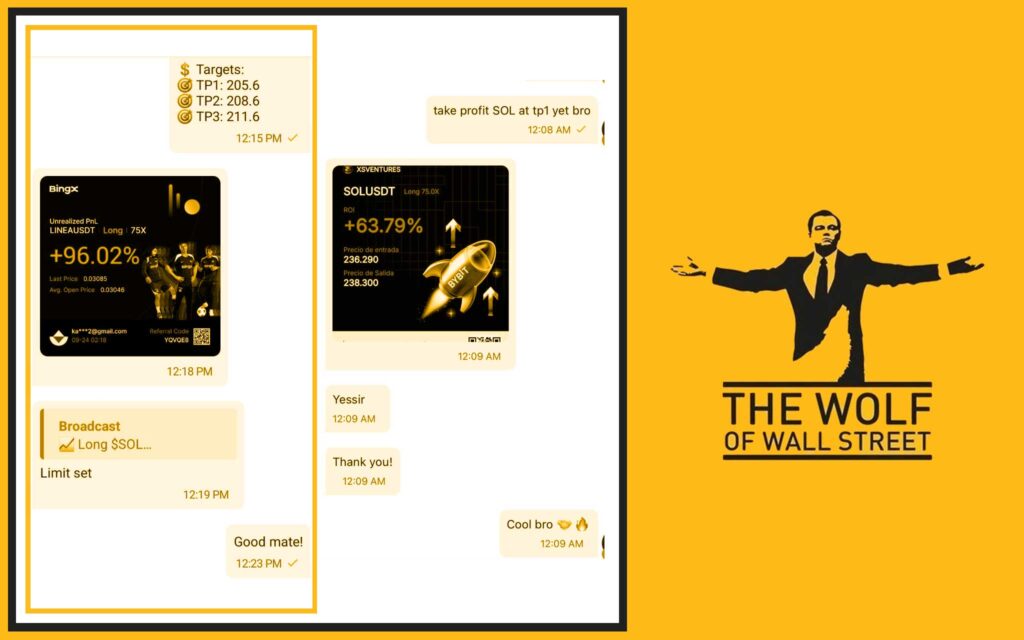

📌 The Wolf Of Wall Street Crypto Trading Community

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals – Maximise profits with proprietary signals.

- Expert Market Analysis – In-depth insights from seasoned traders.

- Private Community – 100,000+ like-minded traders sharing strategies.

- Essential Trading Tools – Volume calculators, decision-making resources.

- 24/7 Support – Round-the-clock help from experts.

👉 Empower your crypto trading journey: