💰 Introduction: Why Asset Classes Are Your Golden Ticket to Riches

Alright, listen up, because this isn’t some penny stock spiel – this is about your financial future! You wanna get rich, right? You wanna live that life, the one where money isn’t a problem, it’s a tool. Well, let me tell you, the secret isn’t some magic formula; it’s understanding the fundamental building blocks of wealth: asset classes. These aren’t just fancy financial terms; they are the distinct categories of investments that act in their own way, react to the market differently, and ultimately, determine how much damn money you’re gonna make. Ignore them at your peril, embrace them, and you’ll be swimming in profits. This guide is your no-bullshit roadmap to understanding, leveraging, and ultimately, conquering the world of asset classes. We’re talking about diversification, risk management, and unlocking your full potential to profit in any market condition.

In the cutthroat world of finance, knowledge isn’t just power—it’s profit. Every single move you make, every dollar you invest, needs to be calculated, strategic, and aimed squarely at maximizing your returns. Asset classes are the bedrock of this strategy. They are groups of investments that share similar financial characteristics and respond to market events in comparable ways. Think of them as different types of ammunition in your investment arsenal. Each type has its purpose, its strengths, and its weaknesses. The true financial wizard knows when to deploy each, and in what combination, to achieve market dominance.

This isn’t about getting lucky; it’s about making your own luck. It’s about building a portfolio that can weather any storm, capitalize on every opportunity, and continuously generate wealth. We’re going to break down the traditional heavy hitters, expose the emerging power players, and give you the actionable insights you need to turn your aspirations into a reality. No more mediocrity, no more playing it safe – it’s time to unleash the wolf within and hunt down your fortune.

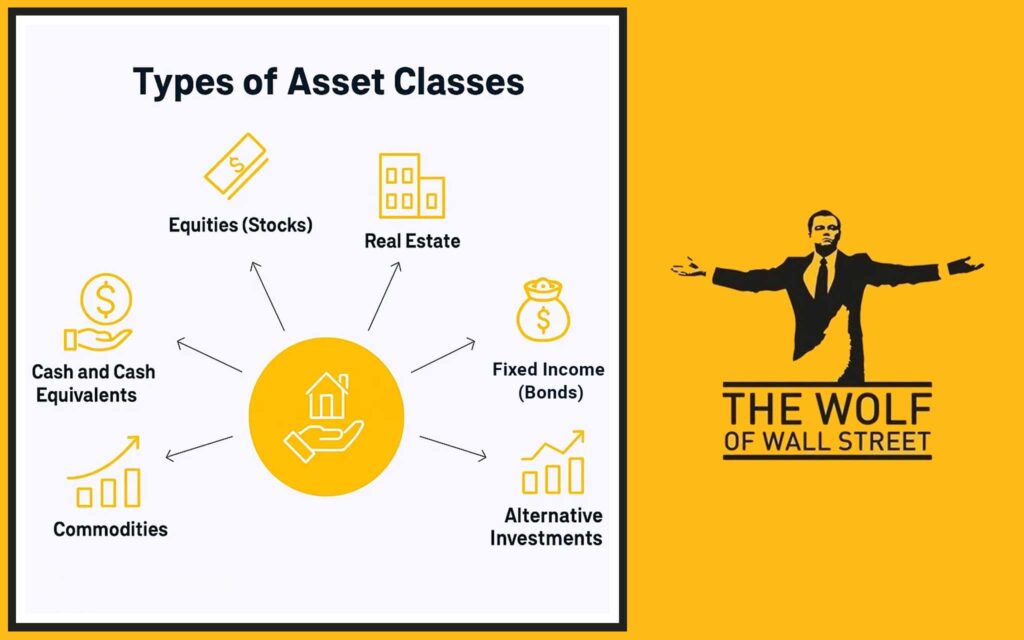

🚀 The Big Guns: Unpacking the Main Asset Classes

Forget what the talking heads tell you; there are core asset classes that form the backbone of every serious investor’s portfolio. You need to know ’em, you need to understand ’em, and you need to deploy ’em strategically. Let’s break down the heavy hitters:

Equities (Stocks): Your Ownership Slice of the Pie

This is where the real action is, folks! When you buy equities, or stocks, you’re buying a piece of a company. You become an owner, a partner in their success. That means growth potential, that means dividends, and that means you can ride the wave of innovation and industry. When a company hits it big, you hit it big. This isn’t just about passive income; it’s about being on the front lines of economic expansion. Imagine getting in on Apple or Microsoft in their infancy – that’s the kind of parabolic growth we’re talking about.

But here’s the deal: with high reward comes higher volatility. These aren’t safe little savings accounts; they’re high-octane machines that can make you a fortune, or if you’re a rookie, cost you. The stock market can be a brutal arena, and only the prepared survive and thrive. You need to know your game, understand market sentiment, and be ready to pull the trigger when opportunity strikes. You need to be able to identify value, spot trends, and have the guts to hold when others are selling. It’s not for the faint of heart, but for the bold, the returns can be life-changing.

Fixed Income (Bonds): The Steady Hand in the Storm

Alright, so not everything can be a rocket ship. Sometimes you need a solid foundation, something that pays you regularly without the wild swings. That’s where fixed income – bonds – come in. Think of it like lending money to a government or a corporation. They pay you interest, a regular stream of income, and eventually, they pay back the principal. It’s the predictable part of your portfolio, the ballast that keeps your ship steady when the market waves get choppy.

Generally, bonds are considered lower risk than equities. They provide a predictable income stream, making them a favourite for those nearing retirement or investors looking to preserve capital. However, don’t get complacent; they’re sensitive to interest rate changes. When interest rates go up, bond values can dip because new bonds offer higher yields, making older, lower-yielding bonds less attractive. It’s a balancing act, requiring a keen eye on macroeconomic trends, especially central bank policies. Despite their lower risk profile, smart bond investing requires vigilance and an understanding of the intricate dance between interest rates and bond prices. It’s a crucial element for any smart portfolio, offering diversification and stability when other asset classes are on a rollercoaster.

Cash and Cash Equivalents: The Safe, but Slow, Lane

Look, you gotta have some liquid assets, some cold, hard cash ready to deploy or to cover your back. Cash and cash equivalents are your highly liquid, super safe options. They’re bank accounts, money market funds – easily convertible. They offer stability, protection against market downturns, and immediate access to funds. This is your dry powder, your ready-to-deploy capital for when the market throws you a curveball, or more importantly, when it presents a screaming opportunity you can’t afford to miss.

The downside? Low returns. And here’s the kicker: inflation will eat away at your purchasing power if you keep too much stashed away. In a high-inflation environment, holding too much cash is like watching your money shrink. This is for quick moves, for short-term needs, or for positioning yourself to pounce on a distressed asset. It’s your war chest for seizing opportunities, not your primary investment vehicle for long-term wealth building. Think of it as a strategic reserve, not a retirement plan.

Real Estate: Tangible Assets, Real Returns

This isn’t just about owning a house, it’s about owning property that generates income, that appreciates in value. Real estate, whether it’s direct property ownership, investment in commercial properties, or through Real Estate Investment Trusts (REITs), offers income potential and long-term growth. It’s a tangible asset, something you can see and touch, a physical piece of the economy. Real estate can provide stable rental income, potential capital appreciation, and can act as a hedge against inflation. It’s a classic path to wealth, a cornerstone of many millionaires’ portfolios.

But here’s the reality: it’s less liquid than stocks or bonds. You can’t just sell a building overnight. Transactions are slower, and there are significant upfront costs and ongoing management responsibilities if you’re directly owning property. However, REITs offer a more liquid way to invest in real estate, allowing you to buy shares in companies that own and operate income-producing properties. You gotta be patient, you gotta play the long game, but for the shrewd investor who understands local markets and economic cycles, the rewards can be massive. It’s a bedrock asset that offers stability and a robust income stream for those who know how to play the game.

Commodities: The Raw Power of the Earth

Gold, oil, wheat, copper – these are the commodities, the raw materials that fuel the world economy. They’re often used for diversification and as a hedge against inflation. When the dollar falters, or when geopolitical tensions rise, commodities can shine, acting as a safe haven or an inflationary hedge. They are critical inputs for industries worldwide, making their prices sensitive to global supply and demand dynamics, economic growth, and even weather patterns.

They’re a different beast, driven by unique market forces unlike traditional financial assets. While they can be volatile, their performance is often uncorrelated with stocks and bonds, making them excellent for diversification. For the shrewd investor, commodities offer another avenue to protect and grow your wealth, especially during periods of economic uncertainty or rising prices. Knowing how to read the global economic tea leaves and anticipate shifts in demand and supply can make you a fortune in this sector.

Alternative Investments: The Wild Side of Wealth Creation

Now we’re talking about the cutting edge, the places where real money is made for those who dare to venture. Alternative investments are a broad category, but they’re all about thinking outside the traditional box. We’re talking hedge funds, private equity, venture capital – getting in on ground-floor opportunities before the masses even know what hit ’em. These often involve illiquid assets, sophisticated strategies, and higher minimum investments, making them more accessible to institutional investors and high-net-worth individuals.

And then, there’s the game-changer, the new frontier: cryptocurrencies. This is where fortunes are being minted in a blink, but also where the uninitiated get burned. They are higher risk, lower liquidity, but the potential for exponential returns? Unmatched. Other alternatives include collectibles like art, rare wines, or classic cars, and derivatives such as options and futures, which can be used for hedging or speculation. These alternative assets often provide diversification benefits due to their low correlation with traditional assets, but they come with higher risk, lower liquidity, and often higher costs. Think smart, think bold, and be prepared to move fast.

⏳ A Blast from the Past: How Asset Classes Evolved

You think this is all new? Think again. The game has been changing, but the core principles remain. From ancient times, when gold and land were king, to the dawn of sovereign debt and then the explosion of equities, the world of investing has always been evolving. Financial instruments have become more sophisticated, markets more interconnected, and the speed of information transfer has reached warp drive.

Now, we’re in the digital age, with cryptocurrencies and NFTs shaking things up, creating new avenues for massive wealth. This evolution reflects broader economic, technological, and regulatory changes. Historically, asset classes served basic economic functions like facilitating trade (gold, silver), funding governments (sovereign debt), and enabling corporate growth (equities). Today, digital assets are challenging traditional notions of value and ownership, forcing us to rethink how we build wealth. This isn’t just history, it’s a lesson in adaptability. The smart money always finds the new frontier, learns its rules, and then breaks them to their advantage.

🎯 The Core Principle: Diversification for Domination

Listen up, because this is crucial: diversification. It’s not just a buzzword, it’s your shield against market chaos. Every asset class reacts differently to economic events. When one zigs, another might zag. By spreading your investments across various classes, you’re not just managing risk, you’re optimising for returns. You’re building a portfolio that can weather any storm and still come out on top. It’s about aligning your investments with your financial goals, your risk tolerance, and your investment horizon. You gotta know yourself, know your limits, and then push them.

Proper allocation is the key to achieving your financial goals. A truly diversified portfolio means having a mix of equities, fixed income, real estate, commodities, and perhaps even some tactical alternative investments. The goal is to minimise the impact of poor performance in any single asset class, while still capturing upside potential from others. This strategic approach ensures that even if one sector takes a hit, your overall portfolio remains resilient. Want to learn more about how to make smart choices in a volatile market? Dive into understanding market makers and takers in crypto to get an edge on market dynamics.

📈 Risk and Return: The Two Sides of the Coin

Every investment has its own unique dance between risk and return. You want high returns? You usually gotta take on more risk. You want safety? Be prepared for slower growth. It’s a trade-off, and understanding this relationship is paramount. Risk assessment tools—such as volatility, beta, and standard deviation—help investors evaluate and manage these differences. Volatility measures how much an asset’s price fluctuates; beta measures its sensitivity to overall market movements; and standard deviation quantifies the dispersion of returns around the average. These aren’t just academic terms; they’re your weapons to evaluate opportunities and protect your capital.

Return metrics, such as annualized return and Compound Annual Growth Rate (CAGR), provide a snapshot of performance over time. However, true mastery involves not just looking at past performance, but anticipating future risks. This means understanding macro-economic indicators, geopolitical events, and technological advancements that can impact asset values. Know your metrics, understand your plays, and never invest blindly. For those looking to master their crypto trading strategies, delving into technical analysis with resources like the RSI crypto trading strategies or the Bollinger Bands trading strategy will sharpen your edge.

🌐 Emerging Trends: The New Wild West

This is where the real excitement is, the frontier where fortunes are being minted right now: digital asset classes. We’re talking cryptocurrencies, NFTs, tokenized assets. This is reshaping the investment landscape, opening up doors to opportunities that even a few years ago were unimaginable. Cryptocurrencies offer decentralization, transparency, and often, rapid price movements driven by adoption, technological innovation, and speculation. NFTs, representing unique digital assets, have created entirely new markets for art, collectibles, and gaming. Tokenized assets are democratizing access to traditionally illiquid investments like real estate or private equity by converting their value into digital tokens on a blockchain.

But make no mistake, with new opportunities come new risks, new regulatory challenges. This isn’t a playground for amateurs; it’s a battleground for those who are quick, decisive, and ready to adapt. The regulatory landscape is evolving rapidly, with governments worldwide grappling with how to classify and oversee these new forms of wealth. Market manipulation, cybersecurity threats, and sudden price swings are ever-present dangers. You need to be informed, you need to be smart, and you need to be connected to leverage these opportunities and avoid the pitfalls. This is the future of finance, and you need to be at the forefront.

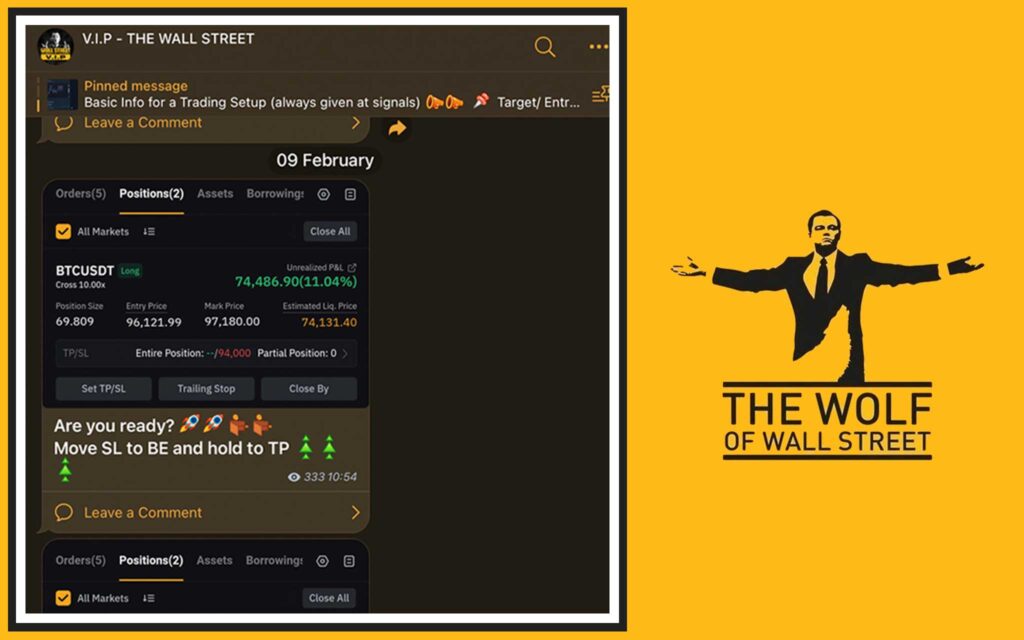

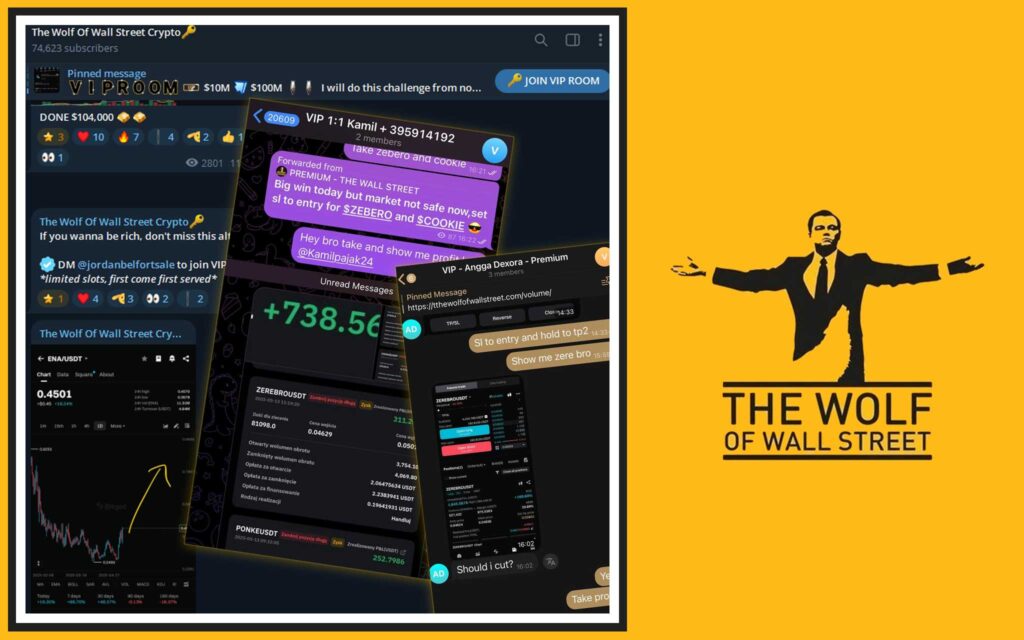

🤝 The Power of Community: Mastering the Crypto Market with The Wolf Of Wall Street

Now, when it comes to dominating the cryptocurrency market, you can’t go it alone. This isn’t a solo mission; it’s a collective assault on the market. That’s where the The Wolf Of Wall Street crypto trading community comes in. This isn’t just some casual chat group; it’s a comprehensive platform designed to give you the unfair advantage you need to navigate this volatile market and absolutely crush it.

Here’s what you get when you join the ranks of the elite at The Wolf Of Wall Street:

- Exclusive VIP Signals: Forget guesswork. We’re talking proprietary signals designed by seasoned pros, engineered to maximize your trading profits. These are the insights that separate the winners from the wannabes, giving you a crystal-clear edge in making lucrative trades.

- Expert Market Analysis: You’ll get in-depth market analysis from traders who live and breathe crypto. No fluff, just actionable intelligence that helps you make informed decisions, fast. Our analysts dissect market trends, identify key support and resistance levels, and provide predictions that can literally make or break your portfolio. Want to understand deeper market dynamics? Explore on-chain vs. trading volume crypto mastery to uncover the hidden signals in the market.

- Private Community: Join a network of over 100,000 like-minded individuals. This isn’t just about signals; it’s about shared insights, mutual support, and a collective drive to succeed. You’ll be surrounded by wolves, not sheep, sharing strategies, discussing opportunities, and pushing each other to higher levels of profitability. This is your inner circle, your strategic alliance in the crypto jungle.

- Essential Trading Tools: We’re not just giving you information; we’re arming you with the best. Utilise volume calculators and other cutting-edge resources to make decisions that are backed by data, not emotion. These tools empower you to manage your risk, calculate your positions, and execute trades with precision. Learn more about effective trading tools and strategies like the Parabolic SAR 2025 strategy guide to optimize your entry and exit points.

- 24/7 Support: The market never sleeps, and neither do we. You’ll receive continuous assistance from our dedicated support team, ensuring you’re never left in the dark, no matter what time zone you’re operating from. We’re here to answer your questions, resolve your issues, and make sure you’re always operating at peak performance.

This isn’t just about making a few quid; it’s about empowering your entire crypto trading journey. It’s about unlocking your potential to profit in the crypto market like never before. With The Wolf Of Wall Street, you’re not just trading; you’re becoming a part of an elite force, armed with superior intelligence and unwavering support.

To get the full rundown, to see what it truly means to operate at the top tier:

- Visit our website: https://tthewolfofwallstreet.com/ for all the detailed information and to see the full scope of what The Wolf Of Wall Street offers.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions that will keep you ahead of the curve, providing instant access to signals and expert insights.

Don’t just trade; dominate. Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.

🛡️ Protecting Your Kingdom: Guarding Against Scams

Alright, now listen up. In this wild, wild world of finance, especially in the emerging digital spaces, there are always sharks circling. Scams are everywhere, lurking in the shadows, waiting to pounce on the unsuspecting. You build your fortune, and some low-life wants to take it from you. You gotta be smart, you gotta be vigilant. Always, always, conduct thorough due diligence. Research opportunities with an eagle eye, scrutinize every detail. Verify the credibility of the issuer—who are they? What’s their track record? Are they legitimate or just a flashy façade?

And always, always, review historical performance—not just what they promise, but what they’ve actually delivered. Don’t be swayed by hype or empty promises of guaranteed returns. If it sounds too good to be true, it probably is. Be a predator, not prey. Arm yourself with knowledge and scepticism to protect your capital. Your hard-earned money is your kingdom, and you are its fiercest guardian. Knowing how to research crypto opportunities is your first line of defense, empowering you to distinguish legitimate ventures from deceptive schemes.

📈 Mastering the Market: Your Next-Level Plays

To truly excel, you need to understand not just what asset classes are, but how they interact, how they move, and how to exploit those movements for maximum gain. This isn’t about playing checkers; it’s about playing three-dimensional chess.

The Art of Allocation: Strategic Deployment of Capital

It’s not enough to know the assets; you need to know how to deploy your capital. Asset allocation is the strategic distribution of your investments across different asset classes to achieve your specific investment objectives. Are you a young gun ready to take on significant risk for high returns, diving deep into emerging markets and high-growth equities? Or are you looking for stability and income as you get older, prioritizing bonds and dividend-paying stocks? Your allocation strategy will change throughout your life.

This isn’t a set-it-and-forget-it deal; it’s dynamic. You need to adjust based on market conditions, your personal circumstances, and your evolving financial goals. Rebalancing your portfolio periodically, selling assets that have overperformed and buying those that have underperformed, ensures you maintain your desired risk profile and capture potential returns. Learning about when to sell crypto strategies can significantly impact your allocation decisions, ensuring you lock in profits and manage your exposure effectively.

Global Markets, Global Opportunities: Beyond Your Borders

The world is your oyster, and the markets are global. Don’t limit yourself to your backyard. Look at international equities, emerging market bonds, and global real estate. Diversifying geographically adds another layer of protection and opens up new avenues for growth that might be missed if you only focus domestically. Different economies are in different stages of their cycles, offering unique opportunities. What might be slowing down in one region could be booming in another.

The global economy is interconnected, but also diverse, offering opportunities for diversification that can smooth out your portfolio’s returns. Investing globally means you’re not solely reliant on the economic performance of one country or region. It means tapping into growth stories from Asia, stable dividends from Europe, or innovative technologies from emerging markets. Be a global wolf, hunting for opportunities wherever they may arise.

Understanding Market Cycles: Ride the Waves, Avoid the Crashes

Markets move in cycles – expansion, peak, contraction, trough. This is the rhythm of finance, and you need to learn to dance to it. Different asset classes perform differently during these cycles. Knowing where we are in the cycle can help you position your portfolio for maximum impact. When the economy is booming and confidence is high, equities often soar. During a contraction or recession, bonds might offer a safe haven, and commodities could react strongly to supply shocks.

This isn’t prophecy; it’s understanding patterns and reacting strategically. It’s about being proactive, not reactive. Recognizing the signs of an impending shift, whether it’s a slowdown in growth or a sudden surge in inflation, allows you to adjust your asset allocation to mitigate risks and capitalize on new trends. For those deep in crypto, mastering day trading vs. hodling crypto is crucial for navigating these cycles, allowing you to switch tactics based on market momentum.

The Power of Information: Stay Ahead of the Curve

In this game, information is power, and rapid access to it is the ultimate weapon. You need to be plugged in, constantly absorbing market news, economic indicators, and regulatory changes. This isn’t just about reading headlines; it’s about deep diving into how events like Fed rate cuts can impact your crypto holdings, or how Bitcoin and Ethereum ETFs are reshaping institutional investment by opening new avenues for mainstream capital.

The flow of information is relentless, but your ability to filter, analyze, and act upon it is what will separate you from the herd. Understand that every piece of news, every policy announcement, every technological breakthrough, creates ripples across the market. The more you know, the more informed your decisions, and the higher your chances of hitting it big. Stay hungry for knowledge, stay sharp, and always be one step ahead.

🚀 The Future is Now: Crypto and Beyond

We’ve talked about cryptocurrencies, but let’s be crystal clear: this isn’t a passing fad. This is a legitimate asset class that is here to stay and is redefining wealth. The underlying technology, blockchain, is revolutionary, changing how transactions are recorded, how ownership is verified, and how digital value is exchanged. From Bitcoin to Altcoins, to the entire ecosystem of DeFi (Decentralized Finance) and NFTs & Gaming, this space is exploding with innovation and opportunities for unprecedented growth.

Blockchain Technology: The Backbone of the New Economy

Understanding blockchain is key. It’s a distributed, immutable ledger that underpins most cryptocurrencies, ensuring transparency and security without the need for intermediaries. This technology isn’t just for money; it’s for everything from supply chains to digital identity, from voting systems to intellectual property rights. It’s the infrastructure of the future, enabling entirely new forms of value exchange and economic interaction. Investing in the right projects built on this technology, or understanding how it impacts traditional finance, is crucial for staying ahead of the curve. Delve deeper into the technology with insights on Layer 1 and Layer 2 solutions, which are vital for scaling and efficiency within the blockchain ecosystem.

Security and Wallets: Protecting Your Digital Gold

Just like you wouldn’t leave stacks of cash lying around, you need to protect your digital assets. Crypto wallets, both hot (online) and cold (offline hardware devices), are essential for securely storing your cryptocurrencies. Understanding wallet addresses and how to perform on-chain analysis is vital not only for security but also for identifying profitable opportunities by tracking smart money movements. The digital realm is rife with opportunists and hackers, so mastering the nuances of digital security is paramount. Your vigilance here is directly proportional to your financial security. Knowing how to buy crypto safely is the first step, but securing it is the lifelong commitment.

Regulations and Policies: Navigating the Legal Landscape

The crypto space is still evolving, and regulations and policies are constantly being developed worldwide. Staying informed about new laws, particularly concerning crypto token listings or rulings like those affecting ETPs vs. ETFs, is critical for understanding the legal landscape and potential market impacts. Regulatory clarity can bring institutional adoption and stability, while uncertainty can lead to volatility.

Governments and financial bodies are grappling with how to integrate digital assets into existing frameworks, impacting everything from taxation to investor protection. The legal landscape impacts everything from market sentiment to access to certain assets and can significantly influence the growth trajectory of specific cryptocurrencies. The smart money stays ahead of the curve, anticipating regulatory shifts and positioning their portfolios accordingly.

Unleashing Trading Mastery: Beyond the Basics

Beyond understanding asset classes, true mastery comes from the execution of strategic trades. This means diving deep into advanced trading concepts and tools. Whether it’s learning about spot and derivatives trading for Bitcoin, understanding the intricacies of crypto order types, or deciphering crypto funding rates for perpetual futures, every piece of knowledge adds to your arsenal. The market is a battleground, and those with the sharpest tools and tactics will emerge victorious.

Consider the role of trading bots vs. AI agents in automating and optimizing your strategies. Explore indicators like the Stochastic Indicator, the Money Flow Index (MFI), or the Commodity Channel Index (CCI) to fine-tune your market entries and exits. Understanding Elliott Wave Theory, Fibonacci Retracements, and the use of Trendlines in charting market direction provides critical technical insights. Even classic theories like Dow Theory and the application of Moving Averages and MACD indicators can be invaluable for identifying market trends and momentum.

For those looking to truly diversify and create sustainable income, investigating how to earn crypto without selling for passive income or understanding the dynamics of crypto hedge funds and market shifts can open up entirely new revenue streams. Don’t just trade; innovate. Don’t just follow; lead. This is your opportunity to not just participate in the market, but to master it.

💡 Key Takeaway: Your Path to Unstoppable Wealth

Listen up, because this is the bottom line: asset classes are the fundamental building blocks of any serious investment portfolio. You gotta know them, you gotta understand their risks and rewards, and you gotta diversify like your financial life depends on it – because it does! By strategically mixing equities, fixed income, real estate, commodities, and especially the game-changing alternative investments like cryptocurrencies, you’re building a fortress around your wealth.

This isn’t just about making money; it’s about dominating the market, about creating a legacy. You’ve got the knowledge, now go out there and execute! Don’t just sit on the sidelines; jump into the arena. Whether you’re looking at traditional markets or the explosive potential of crypto, the principles remain the same: understand the assets, manage the risk, and seize every damn opportunity. The market is a beast, and you are the wolf. Go hunt your fortune.

You want to make profit? You want to live the life? Then you need to act. Start by mastering your understanding of asset classes, and then, with resources like the The Wolf Of Wall Street community, you’ll be well on your way to unlocking your full potential to profit in the market.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”