Listen to me. If you’re a business owner, an entrepreneur, a creator with a vision, you need to understand how to tokenize your business equity, because right now, you are sitting on a goldmine that’s locked in a rusty cage. You have ambition, you have a product, but you’re shackled by an ancient, slow-moving financial system designed to keep you small. I’m here to give you the key.

Tokenization isn’t some tech-bro fantasy; it’s the financial revolution that separates the hungry wolves from the complacent sheep. It’s the act of converting the ownership rights of your company—your equity—into digital tokens on a blockchain. Think of it as taking your traditional, paper-based shares and forging them into digital, programmable, and instantly tradable assets. This is about taking control and playing the game on a global stage, on your terms.

This guide isn’t a university lecture. It’s a straight-line shot to the money. I’m going to walk you through the exact blueprint for transforming your company’s value into a liquid, global powerhouse. Forget begging venture capitalists for scraps; we’re building our own Wall Street. Pay attention, because the information here is the difference between building a legacy and becoming a footnote.

🐺 Why Tokenize? The Non-Negotiable Benefits

Let me be crystal clear. The question isn’t if you should tokenize; it’s how fast you can do it before your competition wakes up and smells the money. The old way of raising capital is dead. It’s slow, it’s restrictive, and it’s controlled by gatekeepers who don’t care about your dream. This is the new way.

Injecting Jet Fuel: Unlocking Unprecedented Liquidity

Right now, your company’s equity is probably as liquid as a block of concrete. Selling private shares is a nightmare of lawyers, paperwork, and finding a buyer in a tiny, exclusive pond. Tokenization shatters that. By placing your equity on a blockchain, you create a 24/7 global market for it. Your investors can buy or sell their stake as easily as they trade Bitcoin, giving them an exit strategy and making your equity infinitely more attractive from day one. More liquidity means a higher valuation. It’s that simple.

Fractional Ownership: Selling Slices of the Pie to Everyone

Do you think the average person on the street can afford a £100,000 block of private shares? Of course not. Tokenization allows you to slice your equity into millions of tiny, affordable pieces. Suddenly, you’re not just pitching to a handful of accredited investors; you’re opening the floodgates to a global army of retail investors who believe in your vision. This democratisation of investment isn’t just good ethics; it’s a brutal-force fundraising strategy.

Breaking Borders: Accessing a Global Ocean of Investors

Why limit yourself to your local postcode? Your business has global potential, and your investor base should reflect that. Blockchain is borderless. A programmer in Tokyo, a teacher in London, and a doctor in Dubai can all invest in your company with a few clicks. This isn’t just about more capital; it’s about building a global community of evangelists who are financially invested in your success. You’re not just selling shares; you’re starting a movement.

Transparency on Steroids: Building Unbreakable Trust

Every single transaction, every transfer of ownership, is recorded on an immutable, public ledger. There are no backroom deals, no hidden cap tables, no “creative” accounting. This level of transparency builds rock-solid trust with your investors. They can see exactly what they own and know that the rules of the game, encoded in a smart contract, cannot be changed behind their back. Trust is the ultimate currency, and blockchain gives you an infinite supply.

🧱 Step 1: Laying the Foundation – Blockchain 101

Don’t let the technology intimidate you. You don’t need to be a coder to understand the power you’re about to wield. Think of blockchain as a digital book of records, a ledger, that’s copied across thousands of computers worldwide. Once something is written in this book, it can never be erased or altered. It’s the ultimate source of truth, secured by mathematics, not middlemen.

This unshakeable security is what makes tokenized equity possible. It guarantees who owns what, without needing a broker, a lawyer, or a bank to verify it. But before you dive in, you need to know the difference between the two main types of ammunition in your arsenal.

- Security Tokens: This is what we’re focused on. A security token is a digital representation of an investment product. It represents actual ownership in your company, a right to dividends, or a share of the profits. It’s a traditional stock, just supercharged with blockchain technology.

- Utility Tokens: These are different. They provide users with access to a product or service. Think of them as digital coupons or access keys to an ecosystem. While valuable, they don’t typically represent ownership. Knowing the difference is crucial for staying on the right side of the law.

🌐 Step 2: Choosing Your Battlefield – The Right Blockchain Platform

Not all blockchains are created equal. Choosing the right platform is like choosing the right engine for a race car. You need speed, reliability, and an ecosystem that can support your ambition. This decision will impact your transaction costs, speed, and scalability for years to come. Here are the heavyweights you need to be watching.

The Heavyweights: Ethereum, Solana, Polkadot, and Tezos

- Ethereum: This is the king, the original gangster of smart contracts. It’s the most battle-tested, has the largest developer community, and the highest level of security. However, its popularity comes at a cost. Transaction fees, known as “gas fees,” can be brutally expensive during peak times. It’s the Wall Street of blockchains—prestigious but pricey.

- Solana: If Ethereum is a Bentley, Solana is a Formula 1 car. It’s built for insane speed and incredibly low transaction costs, capable of handling tens of thousands of transactions per second. It’s newer and has faced some reliability issues, but for projects that require high throughput, it’s a top contender.

- Polkadot & Tezos: These are sophisticated platforms focused on interoperability and governance. Polkadot allows different blockchains to talk to each other, while Tezos has on-chain governance that allows it to upgrade itself smoothly. They are powerful choices for complex, future-proof projects.

The bottom line is you need to analyse your specific needs. Are you building a simple ownership structure, or a complex ecosystem? How important are transaction costs versus decentralisation and security? Pick your battlefield wisely.

⚖️ Step 3: Taming the Beast – Legal and Regulatory Compliance

Listen to me very carefully. This is the part where amateurs get wiped out. You can have the best tech and the most brilliant idea, but if you ignore the regulators, they will shut you down so fast your head will spin. Treating legal compliance as an afterthought is financial suicide.

Navigating the Minefield: Securities Laws Are Not a Suggestion

When you issue a token that represents equity, you are almost certainly issuing a security. That means you fall under the jurisdiction of financial regulators like the FCA in the UK or the SEC in the US. You must comply with securities laws for every single jurisdiction you plan to sell your tokens in. This involves preparing prospectuses, making disclosures, and adhering to strict rules about who you can sell to. Hire a lawyer who specialises in digital assets. Do not, under any circumstances, try to do this yourself.

KYC/AML: Weeding Out the Amateurs

Know Your Customer (KYC) and Anti-Money Laundering (AML) are non-negotiable. You must have a robust system to verify the identity of every single investor and ensure their funds are from legitimate sources. This protects you, your business, and the integrity of your offering. For a deep dive into this critical area, our crypto AML guide on compliance and security is required reading. Failure to comply can result in catastrophic fines and even prison time. Take it seriously.

Tax Man Cometh: Global Tax Implications to Watch

When you have investors from dozens of countries, you also have dozens of different tax laws to consider. How are token distributions taxed? What about capital gains for your investors? The rules are complex and vary wildly. You need a tax advisor with international and crypto-specific experience to structure your offering correctly and avoid devastating financial surprises down the line.

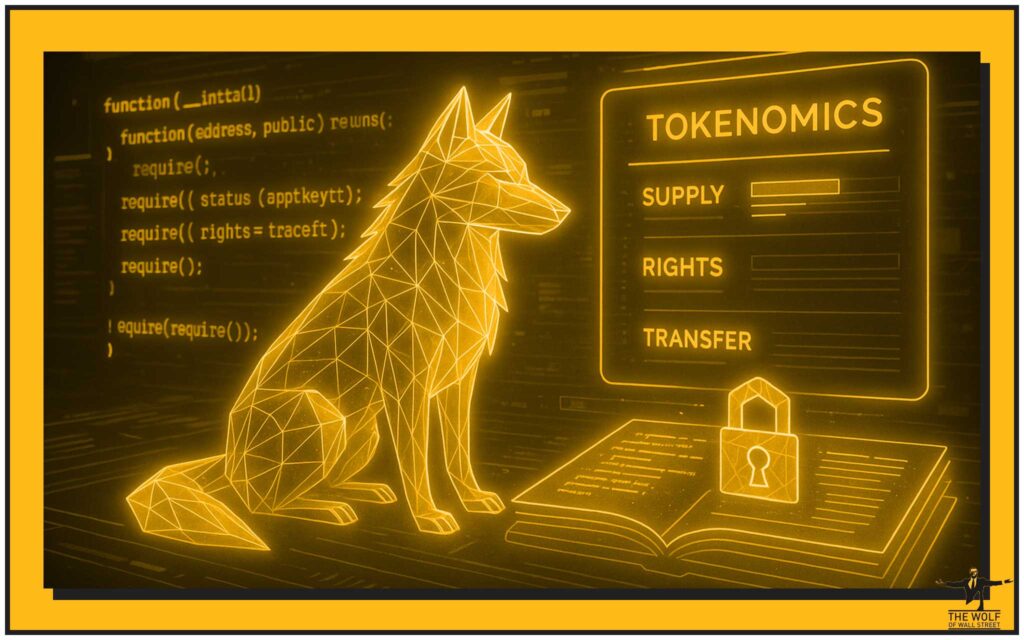

💻 Step 4: Forging Your Weapon – Token Development and Smart Contracts

This is where your vision gets encoded into unbreakable law. A smart contract is a self-executing contract with the terms of the agreement directly written into code. It’s your digital lawyer, your automated compliance officer, and your shareholder ledger, all rolled into one. It lives on the blockchain and automatically enforces the rules you set.

Your smart contract will define the absolute fundamentals of your token. To truly grasp the power you’re wielding, you must understand what is tokenomics, as this will form the economic soul of your project. The contract must meticulously detail:

- Total Supply: How many tokens will ever exist? Will it be a fixed supply, creating scarcity, or can more be minted later?

- Ownership Rights: What exactly does the token entitle the holder to? Voting rights? Dividends? A share of revenue? Be explicit.

- Transfer Rules: Are there any restrictions on who can hold or trade the token? This is where you can enforce compliance with securities laws, for example, by whitelisting approved investor wallets.

You’ll need a team of elite blockchain developers to build and audit this. A single bug in a smart contract can be exploited for millions. Do not cut corners here. Pay for the best, because the security of your entire company depends on it. For those with the ambition to understand the nuts and bolts, our guide on how to create a crypto token provides the foundational knowledge.

🛡️ Step 5: Securing the Vault – Digital Wallet Setup

If the smart contract is the rulebook, the digital wallet is the vault. This is where your investors will store their tokens. It’s where you will hold the company’s treasury. Security is not a feature; it’s everything. One mistake here and your assets are gone forever. Understanding the basics of public and private keys is the absolute minimum requirement for anyone in this space.

You need to educate your investors on the two main types of wallets:

- Custodial Wallets: Managed by a third party, like a crypto exchange. They are convenient but mean you don’t truly control your assets. As the saying goes: “not your keys, not your crypto.”

- Non-Custodial Wallets: The user holds the private keys themselves, giving them full and absolute control. This is the sovereign choice, but it comes with the responsibility of securing those keys.

For your company’s treasury, a standard wallet is child’s play. You need a Multisignature (Multisig) Wallet. This requires multiple keys to approve a transaction, meaning no single person can run off with the funds. It’s the Fort Knox of digital asset security and should be your default standard.

🌊 Step 6: Unleashing the Floodgates – Token Distribution Strategy

You’ve built the foundation, chosen the battlefield, and forged your weapon. Now it’s time to go to war. How you distribute your tokens will determine the success of your fundraise and the health of your secondary market.

- Initial Token Offerings (ITOs): Also known as a Security Token Offering (STO), this is your public launch. It’s where you sell your tokens directly to the masses. It requires significant marketing horsepower, regulatory clearance, and a rock-solid tech platform to handle the influx.

- Private Sales: Before the public sale, you court the big whales. These are strategic investors, venture funds, and high-net-worth individuals who buy large blocks of tokens, often at a discount. This secures early capital and lends credibility to your project.

- Rewarding Your Pack: ESOPs: Tokenize your Employee Stock Ownership Plan. Reward your loyal employees with actual, liquid ownership in the company they are bleeding for. This is a ridiculously powerful tool for attracting and retaining A-level talent.

📈 Step 7: Creating the Marketplace – Secondary Market Liquidity

Selling the tokens once is great. But the real power comes from creating a vibrant, liquid secondary market where they can be traded freely. This is what gives your investors confidence and what keeps your token’s value healthy.

- Decentralised Exchanges (DEXs): These are peer-to-peer marketplaces that operate without a central authority. Listing on a DEX like Uniswap or exploring the possibilities of a platform like the dYdX decentralised crypto trading revolution allows anyone, anywhere, to trade your token. It’s permissionless and powerful.

- Partnering with Centralised Exchanges (CEXs): Listing on a major exchange like Binance or Kraken is like getting listed on the NASDAQ. It brings massive exposure, volume, and credibility. However, it’s expensive and comes with stringent listing requirements.

- Liquidity Pools: On DEXs, you can incentivise people to become liquidity providers. They deposit their tokens into a pool, which facilitates trading, and in return, they earn a share of the trading fees. This is how you grease the wheels of commerce and ensure a smooth trading experience from day one.

Once your token is out in the wild, the game really begins. To navigate this high-stakes environment, you need an edge. You need expert analysis and real-time signals. This is where a community like The Wolf Of Wall Street becomes your unfair advantage. With a network of over 100,000 traders, expert market analysis, and exclusive VIP signals, they provide the intelligence you need to dominate the market you just created. Don’t just enter the game; stack the deck in your favour.

🚨 The Wolf’s Wisdom: Acknowledging the Risks

I sell solutions, not pipe dreams. This world is not without its dangers, and only fools rush in blind. A true wolf studies the terrain and anticipates the traps.

- The Ever-Shifting Sands of Regulation: The rules of the game are still being written. A regulator can change their stance overnight, impacting the legality and market for your token. Constant vigilance is required.

- Technology Isn’t Bulletproof: A vulnerability in your smart contract code can be exploited. A bug on the underlying blockchain platform can halt trading. Rigorous, independent audits are not optional; they are mandatory.

- The Liquidity Mirage and Market Volatility: Just because your token is listed doesn’t guarantee a deep, liquid market. Early liquidity can be thin, and the price of your token will be volatile. Prepare your investors and your treasury for wild swings.

🏆 Real-World Titans: Who’s Already Winning This Game?

Think this is just theory? Think again. The biggest players on the planet are already making their moves.

- UBS Asset Management, one of the world’s largest financial institutions, launched a tokenized money market fund on the Ethereum blockchain. They see the writing on the wall: tokenization means efficiency and accessibility.

- A company called Backed is issuing tokens that represent ownership in stocks like the S\&P 500, making them accessible to global investors who are normally locked out of US markets.

- Commodities giant Enegra tokenized its equity on the Polygon network to enhance liquidity and streamline its capital structure, proving this model works for massive, complex enterprises.

The titans are moving their chess pieces. The question is, will you get in the game or be swept off the board?

💥 Conclusion: Stop Thinking and Start Doing: The Future is Tokenized

We’ve covered the entire blueprint. From understanding the earth-shattering power of liquidity to navigating the legal minefields and launching on global markets. You now have the 7-step path to take your company from a private, illiquid entity to a transparent, global, and liquid powerhouse.

The financial world is undergoing a seismic shift. Wealth is being created and transferred at a speed never before seen in human history. You can either stand on the sidelines and watch it happen, or you can grab the tools I’ve given you and build your own damn empire. The technology is here. The capital is waiting. The only variable is you. So, stop dreaming about the future and start building it. The first step to tokenize your business equity is the first step towards your legacy.

❓ FAQs: Quickfire Answers for Aspiring Wolves

How much does it cost to tokenize business equity?

The cost varies wildly depending on complexity. Expect to invest anywhere from £50,000 for a simple project to well over £500,000 for a complex offering requiring extensive legal work, top-tier development, and exchange listing fees. Don’t be cheap; your company’s future is on the line.

How long does the tokenization process take?

This isn’t an overnight job. A well-executed tokenization process takes a minimum of 6 to 12 months. This includes legal structuring, technology development, smart contract audits, marketing, and regulatory approvals. Rushing is a recipe for disaster.

Is tokenized equity legally recognised everywhere?

No. This is the critical point. The legal status of security tokens differs significantly by country. Some nations like Switzerland and Liechtenstein have progressive frameworks, while others are hostile or simply unclear. Comprehensive legal advice across all target jurisdictions is absolutely essential.

📌 The Wolf Of Wall Street Crypto Trading Community

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.