🔥 Introduction – The Big Shift

Tron just pulled a power move that’s sending shockwaves across the blockchain world. By slashing gas fees, the network has made transactions cheaper for users but hammered block producers with a brutal 64% revenue drop in just 10 days.

The question is: Was this a risky sacrifice or a masterstroke that cements Tron’s dominance as the king of low-cost, high-volume blockchain activity? Let’s break it down—fast, sharp, and with the kind of energy that separates the amateurs from the professionals.

💡 Background: Why Gas Fees Matter

Every blockchain runs on incentives. Users pay transaction fees—gas fees—that fund the validators or block producers who keep the network secure and functional. High fees can choke user adoption, while low fees risk starving validators of profit. It’s a delicate balancing act, and Tron just tipped the scales big time.

On Tron, gas fees are denominated in “sun,” the smallest unit of TRX (1 TRX = 1,000,000 sun). This setup makes fees granular, transparent, and easy to calculate. Until recently, fees were set at 210 sun per energy unit. But that number just got slashed nearly in half.

📜 Proposal #789: The Game-Changer

On August 29, Tron’s Super Representatives passed Proposal #789, cutting the energy unit price from 210 sun to 100 sun. That’s like halving the cost of gas at the pump overnight.

This wasn’t a quiet change—it was a bold governance move designed to spark massive user growth. Community advocates argued that lower fees would unlock up to 12 million additional transactions, expanding network utility and pushing Tron’s accessibility to new heights.

💸 The Shockwave: 64% Revenue Crash

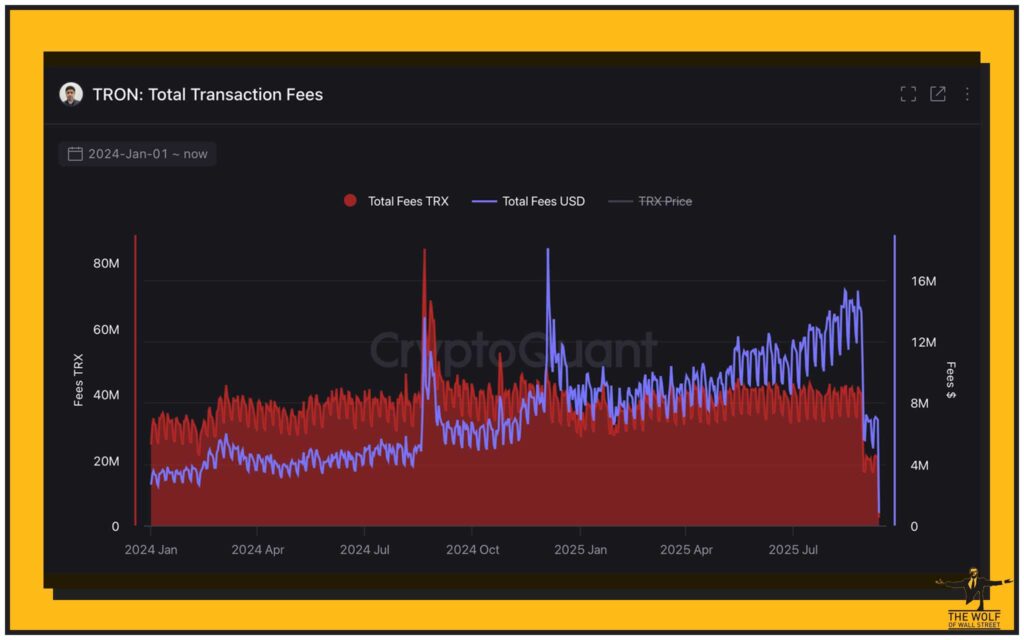

Here’s where it gets brutal. Within ten days of Proposal #789, block producers’ daily revenue tanked from $13.9 million to $5 million—a staggering 64% haircut.

For validators, this wasn’t just a dip—it was a gut punch. The very people who secure the network took the biggest financial hit. But remember, Tron’s strategy is long-term: sacrifice short-term validator profit for long-term transaction dominance.

🤑 The User Advantage: 60% Lower Costs

If you’re a trader or a casual user, this was Christmas morning. Average transaction fees plummeted by 60%, instantly making Tron one of the most affordable chains to transact on.

For users, lower fees mean:

- More frequent transfers

- Affordable micro-transactions

- Increased accessibility for retail investors

This is how you drive mass adoption—cut costs, boost volume, and make the blockchain irresistible.

⚔️ Tron vs Ethereum vs Solana vs BNB: The Layer-1 Showdown

Let’s talk competition. Despite slashing validator profits, Tron still dominates. In recent stats, Tron captured a jaw-dropping 92.8% of all industry revenue among layer-1 blockchains.

- Tron: 92.8% short-term industry earnings

- Ethereum: Long-term titan, $13B in five-year fee revenue

- Solana & BNB Chain: Popular but nowhere near Tron’s short-term earning power

Tron’s short-term volume is unmatched. Ethereum may be the historical leader, but Tron is the current profit machine.

📈 90-Day Blitz: $1.1B in Fees Collected

In the last 90 days alone, Tron raked in $1.1 billion in transaction fees. Compare that to Ethereum’s $13 billion over five years, and the message is clear: Tron is built for speed, volume, and revenue velocity.

Tron’s lifetime total sits at $6.3 billion—already closing in fast on Ethereum’s dominance. That’s the power of a low-cost, high-throughput blockchain.

☀️ The Power of ‘Sun’: Tron’s Secret Weapon

The secret sauce behind Tron’s fee system is the sun. By breaking down TRX into micro-units, Tron enables:

- Ultra-low transaction fees

- Flexibility for micro-payments

- Transparent cost calculations

This makes Tron especially appealing for high-frequency traders and developers building decentralised applications (dApps) that demand low overhead.

🗣️ Community Reaction: Traders vs Validators

The community split was immediate:

- Traders and users cheered. Lower costs = more profit margin.

- Validators grimaced. Their revenue tanked almost overnight.

And here’s the kicker: despite the validator pain, transaction growth is expected to spike, ultimately securing the long-term sustainability of the network. Short-term losers, long-term winners.

🏛️ The Bigger Picture: Decentralised Governance in Action

Proposal #789 wasn’t dictated by a central authority. It was a Super Representative vote, a live example of decentralised governance shaping blockchain economics.

This is what separates true blockchains from corporate tech platforms. Decisions like this show the raw power of community-driven governance—high risk, high reward, and a living experiment in economic democracy.

👑 Why Tron Still Leads the Pack

Despite slicing validator revenue, Tron still commands the highest revenue share among all layer-1s. How? By leaning into volume over profit per transaction.

Ethereum’s play is high-value, high-cost transactions. Tron’s play is low-cost, mass adoption. And right now, Tron’s strategy is paying off in dominance.

💼 Opportunities for Retail and Institutional Investors

For retail investors, Tron’s low fees open doors:

- Frequent trades without high costs

- Access to micro-dApps and NFT markets

- Smooth DeFi participation

For institutional investors, Tron’s consistent transaction revenue and growing adoption present an opportunity to leverage a cost-efficient blockchain infrastructure.

🌍 What This Means for the Future of Blockchain

Tron’s move is forcing the industry to re-evaluate its models:

- Will other blockchains slash fees to keep pace?

- Will layer-2 solutions lose relevance if layer-1s like Tron undercut them?

- Is the future about validator profits or user affordability?

We’re witnessing a shift: accessibility is becoming the new kingmaker in blockchain.

📊 Trading Edge: Leveraging the Tron Advantage

Traders, listen up. Lower fees aren’t just about saving money—they’re about increasing your trading volume and profitability. More transactions = more opportunities.

Want to take it further? The The Wolf Of Wall Street crypto trading community gives you the firepower:

- VIP Signals to maximise profit

- Expert market analysis from seasoned pros

- Private community of over 100,000 traders

- 24/7 support so you never trade blind

Check it out: The Wolf Of Wall Street Service and join the The Wolf Of Wall Street Telegram for real-time updates.

🔗 Internal Links for Further Reading

- Explore service offerings for trading insights.

- Stay ahead with the latest crypto news.

- Dig deeper into layer-1 and layer-2 blockchain solutions.

- Learn practical altcoin strategies and DeFi trends.

❓ FAQs

1. What is “sun” in the Tron network?

Sun is the smallest unit of TRX (1 TRX = 1,000,000 sun), used for calculating gas fees.

2. How does Proposal #789 impact validators long term?

It cuts short-term revenue but aims to boost transaction volume and strengthen long-term sustainability.

3. Will lower fees boost TRX adoption?

Yes. Lower costs drive user adoption, increase network activity, and expand dApp utility.

4. Is Tron’s revenue model sustainable compared to Ethereum?

Ethereum dominates in historical earnings, but Tron’s low-fee, high-volume model is proving highly effective.

5. How can traders benefit from Tron’s cheaper transactions?

Cheaper fees mean more trades, more opportunities, and higher profitability margins.

🏁 Conclusion – The Takeaway

Tron’s bold fee cut delivered short-term validator pain but long-term ecosystem gain. Users win, traders win, and the network cements its position as the undisputed leader in transaction-based earnings. This is blockchain evolution in real time—adapt or get left behind.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”