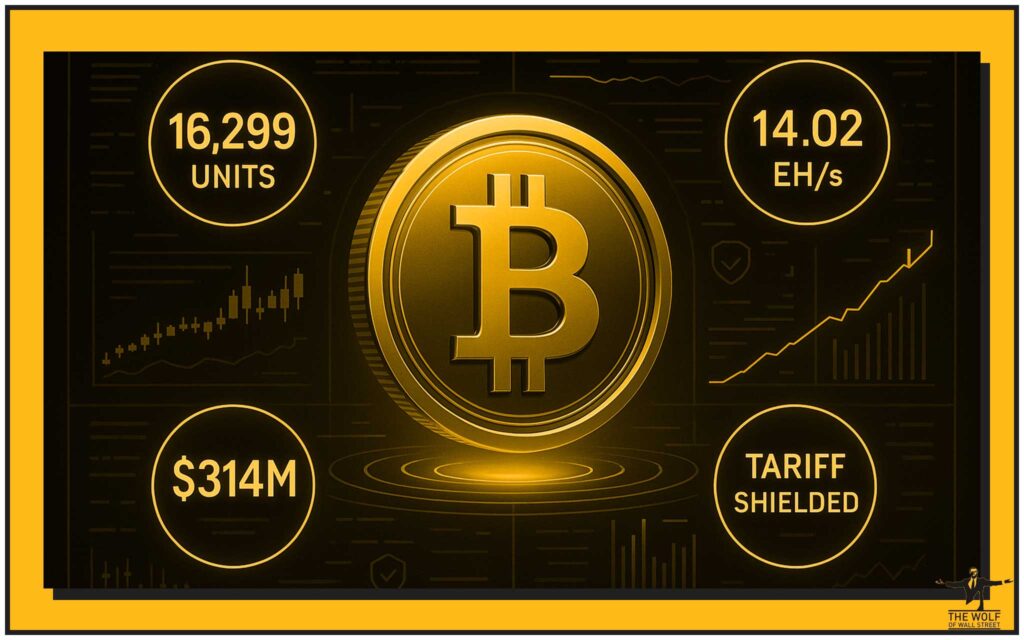

When you drop $314 million on mining rigs, you’re not just playing the game — you’re rewriting the rules.

That’s exactly what American Bitcoin, a mining firm backed by members of Donald Trump’s family, just did.

They didn’t tiptoe into the market. They stormed in, buying 16,299 Bitmain Antminer U3S21EXPH units with enough computing power to light up the

Bitcoin network like Times Square on New Year’s Eve.

This isn’t just a purchase. It’s a power play.

A calculated move that dodges U.S. tariffs, secures massive hashpower, and positions American Bitcoin as a front-runner in the mining arms race.

💼 The Deal in Black and White

Let’s break it down:

- 16,299 Bitmain Antminer U3S21EXPHs

- 14.02 exahashes per second (EH/s) in total capacity

- $314 million total cost

- Secured under an exercised option from earlier in the month to buy up to 17,280 rigs

Here’s the kicker — the deal excludes potential tariff-driven price hikes. That’s right, they locked in their price before U.S. import duties on Chinese mining hardware could jack it up.

This isn’t luck. This is strategy — Wall Street-style.

🏆 Why This Isn’t Just Another Purchase

Fourteen point zero two EH/s might sound like a number from a tech manual, but in mining terms, it’s a monster.

For context, many mid-sized U.S. mining farms run at under 1 EH/s. American Bitcoin just multiplied that by 14 — overnight.

Why does this matter?

- Network dominance: The higher your EH/s, the bigger your slice of the Bitcoin block rewards.

- Halving readiness: With the next Bitcoin halving around the corner, every extra hash counts.

- Market influence: This scale can influence difficulty adjustments and secondary hardware pricing.

This is the crypto equivalent of buying every Ferrari in the showroom so your competition has to race in go-karts.

🔥 The Trade War Twist

The U.S.–China trade war isn’t just a headline — it’s a profit-killer if you’re not careful. Tariffs on China-made mining rigs can add serious costs.

American Bitcoin sidestepped that landmine. But Bitmain — the hardware giant supplying them — isn’t just sitting back. They’re moving fast to open their first U.S.-based ASIC production facility by the end of the year.

Location shortlist: Florida or Texas. Both have cheap power, crypto-friendly policies, and logistics advantages.

Related: Learn more about how policy changes affect crypto in our policies section.

🏗️ Bitmain’s Global Grip

When you talk Bitcoin mining hardware, you’re really talking about three companies:

- Bitmain – ~82% market share

- MicroBT

- Canaan

Combined, they own over 99% of global supply. This is oligopoly territory.

That dominance means two things:

- They can absorb shocks (like tariffs) better than smaller rivals.

- They can dictate global pricing and delivery timelines.

When one of them makes a move — like opening U.S. production — the entire industry feels the ripple.

⚖️ The Tariff Debate – Winner Takes All or Lose It All?

Critics like Hashlabs CEO Jaran Mellerud argue tariffs will crush U.S. miner demand. Why? If rigs cost more here, miners will either downsize or buy cheaper rigs abroad — hurting U.S. competitiveness.

Supporters see it differently. Tariffs could force a reshoring boom, bringing manufacturing back to the States and creating jobs.

Here’s my “Wolf” read: in a war, the players who adapt survive. Tariffs are just another market condition. The winners are already adjusting their playbooks.

🦅 Behind the Scenes: The Trump Connection

American Bitcoin isn’t just another mining startup. It’s backed by Trump family connections, which could mean political muscle when it comes to shaping mining policy.

While no one’s flashing executive orders yet, having allies in high places never hurt when you’re playing in a heavily regulated, politically charged industry.

🚀 The Power of a Preemptive Strike

Locking in 16,299 rigs before tariffs? That’s classic preemptive strike strategy.

Wall Street calls it “buying before the spike.” You anticipate a market shift, lock in your assets, and let everyone else scramble at inflated prices.

For American Bitcoin, this wasn’t just about capacity — it was about timing the market to perfection.

🌍 Tariffs and the Global Mining Map

When U.S. tariffs make imports more expensive, production doesn’t just vanish — it relocates.

- Southeast Asia: Lower costs, tech-savvy labour

- Eastern Europe: Cheap energy, crypto-friendly jurisdictions

Smaller U.S. miners may get squeezed out, but global competitors will happily fill the gap.

🛠️ The Technical Lowdown – Antminer U3S21EXPH

The Antminer U3S21EXPH is Bitmain’s latest powerhouse:

- Efficiency: Top-tier J/TH rating for its class

- Cooling: Advanced heat dissipation for optimal uptime

- Lifespan: Built for multi-year ROI cycles

Against MicroBT’s flagship, it offers slightly better energy efficiency; against Canaan’s, it boasts more stable overclocking performance.

Bottom line? You get maximum output without bleeding electricity costs.

🧠 What This Means for the Average Miner

Here’s where the trickle-down effect kicks in:

- Hardware availability: Big orders can cause shortages for smaller buyers.

- Secondary market prices: Expect used rig prices to spike.

- Network difficulty: As hashpower rises, rewards per rig drop.

Want to learn how to navigate these shifts? Check out our newbie mining guides.

📊 U.S. Mining Competitiveness – The Next 5 Years

Two possible futures:

- Tariffs stay → Domestic manufacturing ramps up, prices stabilise long-term.

- Tariffs go → Cheaper imports flood the market, squeezing margins for U.S. producers.

The companies that will win are those who can either produce domestically or lock in foreign supply chains early.

📈 Investor Impact – From BTC Price to Mining Stocks

For investors, this move sends a clear signal: big players are confident in mining’s future.

- BTC price could see upward pressure as major capacity comes online.

- Public mining stocks may rally on news of large-scale expansions.

Want actionable plays from this kind of news? Dive into our trading insights hub.

🐺 Lessons from the Wolf’s Playbook

If there’s one takeaway here, it’s that timing and scale win markets.

- Aggressive scaling: Don’t nibble when you can feast.

- Hedge policy risk: Lock in deals before the market shifts.

- Think macro: See the big picture while competitors obsess over pennies.

🛡️ The Wolf Of Wall Street Crypto Trading Community – Your Secret Weapon

In a game this volatile, you need more than gut instinct. You need inside intelligence.

That’s exactly what you get with the The Wolf Of Wall Street crypto trading community:

- Exclusive VIP Signals to maximise your trades.

- Expert Market Analysis from seasoned traders.

- Private Community of over 100,000 like-minded pros.

- Essential Tools like volume calculators to keep you sharp.

- 24/7 Support so you’re never left guessing.

Join the winning side:

- Visit our service for full details.

- Join our Telegram community for real-time market moves.

🏁 Final Verdict – The Mining Arms Race Has a New Leader

American Bitcoin’s $314 million strike isn’t just a shopping spree. It’s a calculated assault on market share, a bet on the future of Bitcoin mining, and a hedge against the political and economic tides of the trade war.

The message is loud and clear: adapt or get left behind.

❓ FAQs

- Why is 14.02 EH/s such a big deal for a single purchase?

It represents massive capacity — enough to outpace entire mining operations, securing a bigger slice of BTC rewards. - Will Bitmain’s U.S. facility lower hardware prices?

If tariffs remain, domestic production could stabilise or even reduce costs. - How do tariffs impact mining profitability?

Higher import costs raise capex for miners, delaying ROI unless BTC prices rise. - Can small miners still compete?

Yes — by joining mining pools, leveraging efficient rigs, and using smart trading strategies. - Is The Wolf Of Wall Street only for pros?

No. The Wolf Of Wall Street caters to beginners and seasoned traders alike.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet