Forget the noise. President Donald Trump just pulled a political masterstroke that sent shockwaves through the crypto world – pardoning Changpeng “CZ” Zhao, founder of Binance, the world’s largest exchange.

This wasn’t a mercy move – it was a market signal. And if you’re not paying attention, you’re already late.

⚡ The Power Move Heard Around the Blockchain

On 23 October 2025, Trump granted CZ a full presidential pardon, saying he was told “what he did is not even a crime” (Reuters).

Zhao, once branded the “Wolf of Crypto,” had pleaded guilty back in 2023 to one count of violating the Bank Secrecy Act, admitting Binance failed to maintain an adequate anti-money-laundering (AML) programme. His sentence? Four months behind bars and a record-breaking $4.3 billion fine for Binance (AP News).

Trump’s move doesn’t erase the crime – it reframes the narrative. To traders, this wasn’t just a pardon; it was a signal of regulatory recalibration.

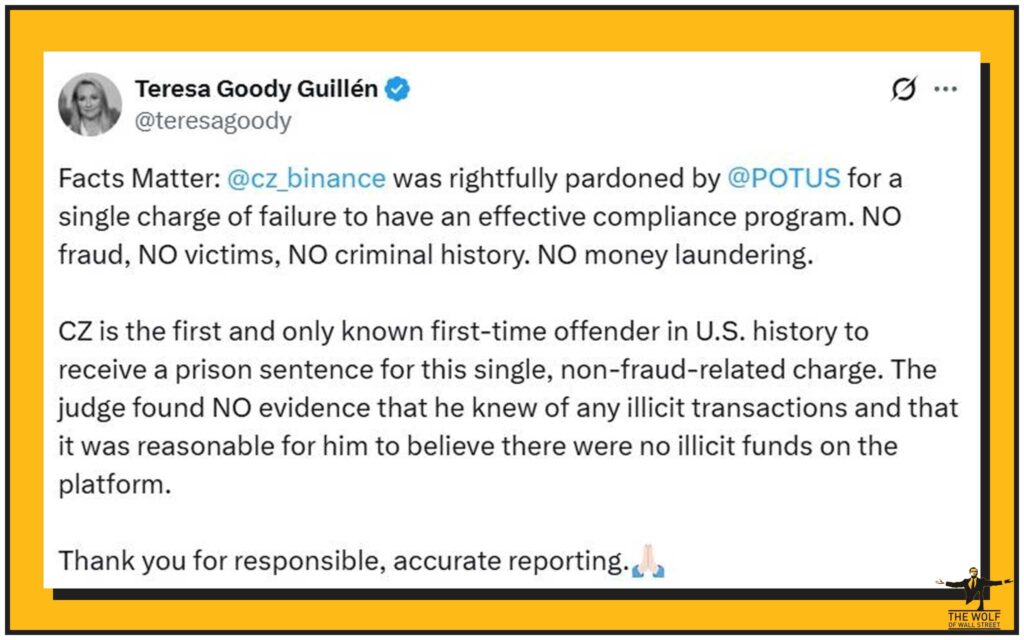

📊 The Facts Beneath the Flash

Let’s be clear – CZ wasn’t convicted of fraud. There were no victims, no rug-pulls, no scams. What got him was compliance negligence: a lack of a robust AML system that allowed illicit funds to flow through Binance’s books (CoinDesk).

That’s what prosecutors called out – process, not intent. Yet the narrative spun into political capital. The irony? The crypto world doesn’t just move on law; it moves on perception.

For deeper context on how AML regulation shapes the market, check out our guide on crypto AML compliance and security.

🚀 The Market’s Reaction: Sentiment Is the Spark

When the pardon dropped, Bitcoin spiked 3% within hours. Exchange tokens like BNB and CRO lit up the charts. Traders smelled opportunity – and chaos.

But here’s the truth: policy shocks create asymmetric setups. You get wild rallies, flash pullbacks, and emotional exits. The smart money knows how to surf that chaos.

This is the time to size positions using volatility metrics, not gut feeling. Use a volume calculator, monitor Average True Range (ATR), and track sentiment indicators. You can refine your skills using our tactical insights on crypto trading strategies.

Because the wolves don’t chase candles – they ride structure.

🛡️ The Compliance Comeback – Not a Free Pass

Some think the pardon means freedom. Wrong. It means the rules of the game are changing.

The U.S. Treasury and FinCEN have made it clear: compliance is non-negotiable (U.S. Treasury Press Release). The pardon doesn’t make AML optional; it makes it urgent.

Projects with airtight AML frameworks, clean audits, and transparent governance will now command premium market trust. The next bull cycle won’t be fuelled by speculation – it’ll be powered by regulatory legitimacy.

For a detailed breakdown, read our analysis on crypto travel rule compliance.

🐺 The Wolf’s Playbook: Profit from the Policy Shock

This is your playbook – no fluff, just moves that make money:

- Segment your risk. Split your portfolio into policy-beta (exchange, compliance-linked) and tech-beta (L2s, infrastructure).

- Trade smart. Use volatility-based position sizing. Never bet emotion.

- Time your exits. Treat this like an earnings event – trade the aftermath, not the headline.

- Follow filings, not tweets. Political noise fades; court documents shape reality.

- Join a pro network. Real-time signal intelligence is how you stay ahead of the herd.

Dive deeper into advanced crypto dominance trading strategies to refine your edge.

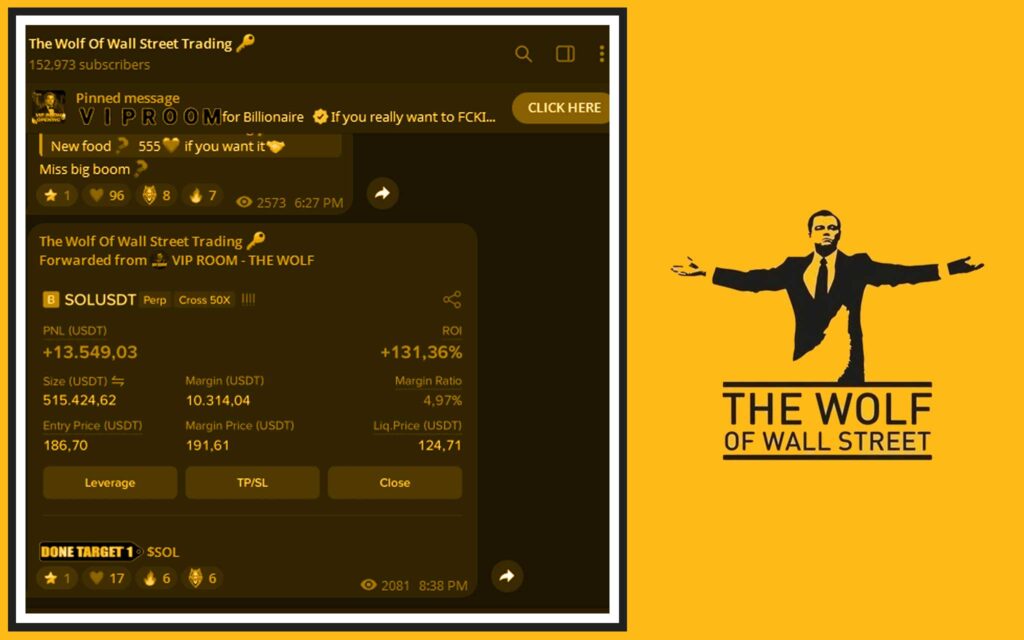

🔥 The The Wolf Of Wall Street Edge – Trade Like You Mean It

While everyone else argues about politics, real traders are already compounding profits.

At The Wolf Of Wall Street, you get what the noise-makers don’t:

- Exclusive VIP Signals – the same setups pros use to front-run volatility.

- Expert Market Analysis – insights from seasoned crypto traders who’ve survived every cycle.

- Private Community (150,000+ strong) – traders who move like a pack, not a crowd.

- Essential Trading Tools – calculators, indicators, and position-sizing models.

- 24/7 Support – because the market never sleeps, and neither do we.

Turn uncertainty into alpha. Visit The Wolf Of Wall Street and join the action on Telegram.

💥 Final Verdict – The Pardon Is Just the Beginning

Trump’s signature didn’t end regulation – it reignited it. CZ’s pardon is a turning point: crypto isn’t underground anymore; it’s in the spotlight.

The traders who’ll thrive in 2026 aren’t the loudest – they’re the most disciplined.

Those who adapt early will own the liquidity; those who don’t will chase it.

As I always say: the game doesn’t reward patience – it rewards precision.

So, the question is… are you trading headlines or mastering the market?