🚀 Introduction: The Digital Payments Power Play

Let’s cut through the noise—right now, we’re witnessing a digital payments showdown that’ll define the next decade of global finance. The US investigation into Brazil’s digital payment system isn’t just another trade spat; it’s an all-in, high-stakes poker game where the chips are control over trillions in global money flows. And if you’re not paying attention, you’re missing how Wall Street, Main Street, and the blockchain crowd are all about to get caught in the crossfire.

🧐 What Triggered the US Investigation?

You want the truth? The US doesn’t move unless there’s real money or power at risk. After Brazil’s Pix system bulldozed its way to the top—leaving American fintechs, Visa, and Mastercard standing in the dust—the White House fired back. In July 2025, under the direct order of President Trump, the Office of the US Trade Representative (USTR) launched a full-on probe. They’re not poking around for fun; they’re looking for ammunition.

It all started with whispers about unfair trade barriers, but quickly escalated thanks to social media bans, court showdowns, and hard evidence that Brazil might be playing favourites with local firms. Now, the US is bringing out the big legal guns.

⚖️ Section 301: The Trade Act Weapon

You want leverage? Section 301 of the Trade Act of 1974 is the sledgehammer the US swings when it’s time to get serious. This tool lets Washington slap tariffs, restrict imports, or play hardball in negotiations if it finds another country’s trade practices “unreasonable” or “discriminatory.”

That’s not just legalese. It’s a loaded gun pointed at Brazil’s booming digital finance sector—and the clock’s ticking, with August 1st flagged for the first potential round of 50% tariffs on Brazilian imports.

💥 The Brazilian Pix System: Disrupting Everything

Here’s the play: Pix is Brazil’s government-backed, instant payment system. Forget the legacy banks, forget waiting three days for wire transfers. With Pix, money moves 24/7, 365 days a year—no fees, no nonsense. The result? Over 150 million users, 60 million+ businesses onboard, and a nation hooked on frictionless payments.

For context, Pix has bulldozed its way into the daily lives of nearly every Brazilian consumer and merchant. It’s dominating the field so thoroughly, even the big US payment giants can’t keep up. And that, my friend, is why the world’s largest economy is losing its cool.

🏦 American Firms: Shut Out or Left Behind?

The real tension? US tech and payment titans feel like they’re sitting on the sidelines. With Brazil’s regulations giving home-field advantage to Pix and its local partners, American players are screaming foul.

There’s talk of higher tariffs on US goods, tighter rules for American social media giants, and outright preference for Mexican or Indian firms. Want more details on how global trading dynamics affect you? Check out our trading insights for the latest market plays.

🗣️ The Trump Factor: Tariffs and Political Power Moves

This isn’t just about money. Trump has cranked up the pressure with threats of 50% tariffs—unless Brazil backs off its prosecution of former President Bolsonaro. He’s playing political chess, tying US trade policy directly to foreign legal drama. It’s a move straight from the Wolf’s playbook: never negotiate from a place of weakness.

🃏 Brazil’s Trade Playbook: Are the Rules Rigged?

Let’s get real. Brazil’s trade strategy? Layered tariffs, import restrictions, and sweetheart deals for certain partners. US officials claim Brazil is bending the rules—giving preferential access to Mexico and India, squeezing out the American brands, and turning Pix into a fortress.

Brazilian authorities argue it’s all about protecting homegrown innovation. But for Washington, it looks like market manipulation with a national flag.

🔒 Digital Policy, Free Speech & Tech Control

It’s not just payments on the table. In 2024, Brazil’s Supreme Federal Court shut down platform X (formerly Twitter) after a legal standoff. The move sent shockwaves across Silicon Valley and set off alarms in Washington.

US firms see a pattern—political content moderation turning into outright censorship. The result? A regulatory environment that punishes American tech under the guise of local law. That’s not how you build a level playing field.

🕵️♂️ Intellectual Property & Anti-Corruption: US Demands vs Reality

Let’s talk compliance. Washington wants robust IP protection and serious anti-corruption efforts. The reality? US officials claim Brazil isn’t enforcing the rules. It’s a point of contention that goes far beyond digital payments—touching everything from pharma patents to software piracy.

Brazil says it’s making progress. The US says: show us the receipts.

🛢️ Ethanol, Ecosystems, and the Next Trade Skirmishes

Here’s where things get wild. This investigation isn’t just about fintech—ethanol and commodities are in the crosshairs too. Brazil is a global powerhouse in biofuels, but the US claims it’s blocking imports and tilting the table. Every sector in Brazil’s ecosystem is up for negotiation.

🌏 The BRICS Pay Offensive: Bypassing the Dollar

Now for the power move. Brazil is joining the rest of the BRICS—Russia, India, China, South Africa—by building their own payment rails, sidestepping the dollar and traditional Western infrastructure. BRICS Pay is the headline act, but Pix is the engine.

What’s at stake? The future of cross-border payments, crypto rails, and who controls the global flow of funds. Want to dive deeper into how this affects digital assets? Explore our cryptocurrencies coverage.

🏆🔥 Winners and Losers: Who Benefits, Who Gets Burned?

Let’s call it like it is. Brazilian fintechs? Winning—at least for now. US banks and payment platforms? Feeling the squeeze. International traders? Watching from the sidelines, waiting for the next headline.

If you’re holding crypto, trading BRICS assets, or operating cross-border, this investigation isn’t background noise—it’s a signal to get your risk radar up.

💣 What Happens If the US Drops the Hammer?

Time for some scenario planning. If the US finds Brazil guilty of unfair trade practices under Section 301, here’s what could hit the market:

- Tariffs: Up to 50% on Brazilian imports, impacting everything from coffee to cars

- Trade Restrictions: Limits on Brazilian goods and digital services in the US

- Retaliation: Brazil could hit back, with BRICS nations backing them up

The global chain reaction could spill over into trending assets and reshape entire industries.

📈 Strategies for Crypto Traders and Investors

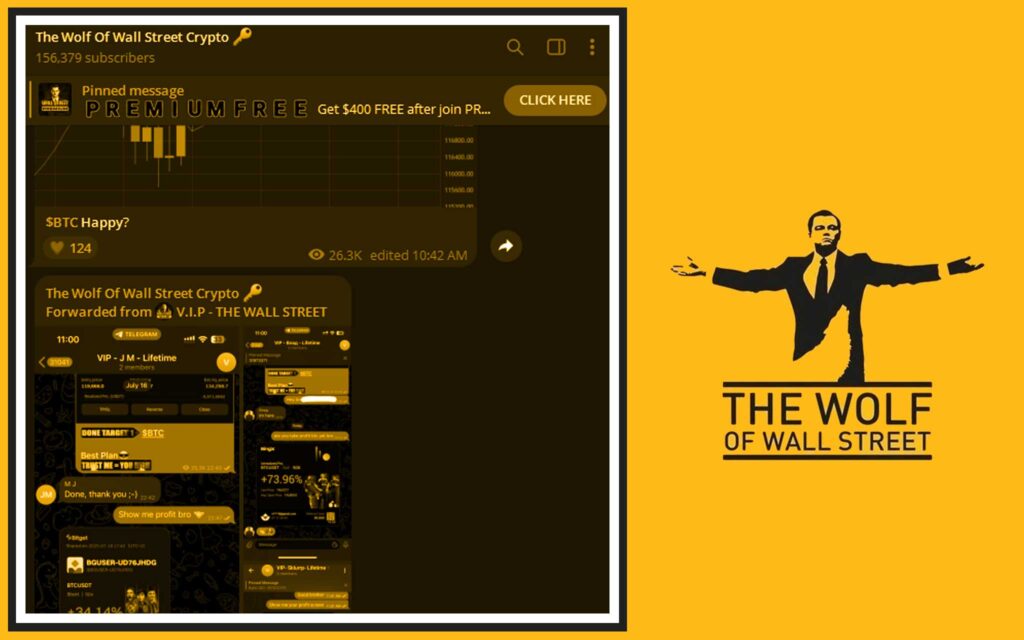

No time for analysis paralysis—if you want to profit, you need real intelligence and fast execution. This is where the The Wolf Of Wall Street crypto trading community becomes your secret weapon.

- Exclusive VIP Signals—cut through the market noise and get actionable buy/sell alerts before the herd.

- Expert Market Analysis—learn directly from crypto veterans who’ve seen it all.

- Private Community—network with 100,000+ active traders and get real-time market support.

- Essential Trading Tools—from volume calculators to risk management checklists.

- 24/7 Support—you’re never trading alone.

Ready to level up? Join The Wolf Of Wall Street or jump into the Telegram group to get the latest trading signals and actionable insights right now.

🧠 Expert Insights: What the Pros Are Watching

Leading analysts on both sides of the equator are glued to this story:

- US fintech execs warn that ceding ground in Brazil could set a precedent for other emerging markets.

- Brazilian officials claim the country is simply levelling the playing field for local innovation, but remain tight-lipped on policy tweaks.

- Global market strategists are watching BRICS Pay and Pix as test cases for a post-dollar world order.

- Crypto industry leaders see this as proof that decentralised finance is here to stay—central banks can disrupt, but crypto adapts faster.

For regular updates and analysis, our news feed and policies section have you covered.

🎯 Conclusion: The Future of Digital Trade Warfare

Let’s wrap it up, Wolf of Wall Street style: This isn’t just about Pix or tariffs. It’s about who writes the rules for tomorrow’s global economy. The US investigation into Brazil’s digital payment system is a warning shot for any nation looking to rewrite the playbook on finance.

For American companies, this is a make-or-break moment. For Brazil and its BRICS allies, it’s a declaration of independence from US financial dominance. For crypto traders, fintech founders, and global investors, it’s a call to stay nimble, stay informed, and never bet against change.

As this drama unfolds, smart money will follow the signals, adapt to new realities, and seize opportunities before the rest even know what hit them.

❓ Frequently Asked Questions (FAQs)

Q1: Why is the US investigating Brazil’s Pix system?

Because the US believes Brazil’s policies favour local firms and block American tech and finance from fair competition—especially as Pix takes over Brazil’s payments market.

Q2: What could happen if the US finds Brazil at fault?

The US could slap major tariffs on Brazilian imports, block digital services, or set off a global trade war—impacting commodities, tech, and even crypto markets.

Q3: How does this affect crypto traders and fintech investors?

It could lead to new market volatility and opportunities. As Brazil and BRICS build their own systems, cross-border crypto and alternative finance become even more relevant.

Q4: What is the role of BRICS Pay in all this?

BRICS Pay represents a coordinated effort to bypass Western payment rails, reducing dependency on the US dollar and opening new corridors for digital asset flows.

Q5: Where can I get real-time market updates and trading insights?

Join the The Wolf Of Wall Street crypto trading community and the Telegram group for exclusive VIP signals, market analysis, and round-the-clock support.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.

For more context on global policy and fintech disruption:

Ready to move? The future of digital trade—and your next winning trade—starts now.