🔥 Intro – The Billion-Dollar Question

Listen up — Bitcoin isn’t just some shiny digital trinket anymore. It’s not a meme, not a fad, not a gamble. It’s the most powerful asset class on the planet, and the United States government just admitted it. Lawmakers are moving forward with the BITCOIN Act, a plan to scoop up one million Bitcoin in the next five years.

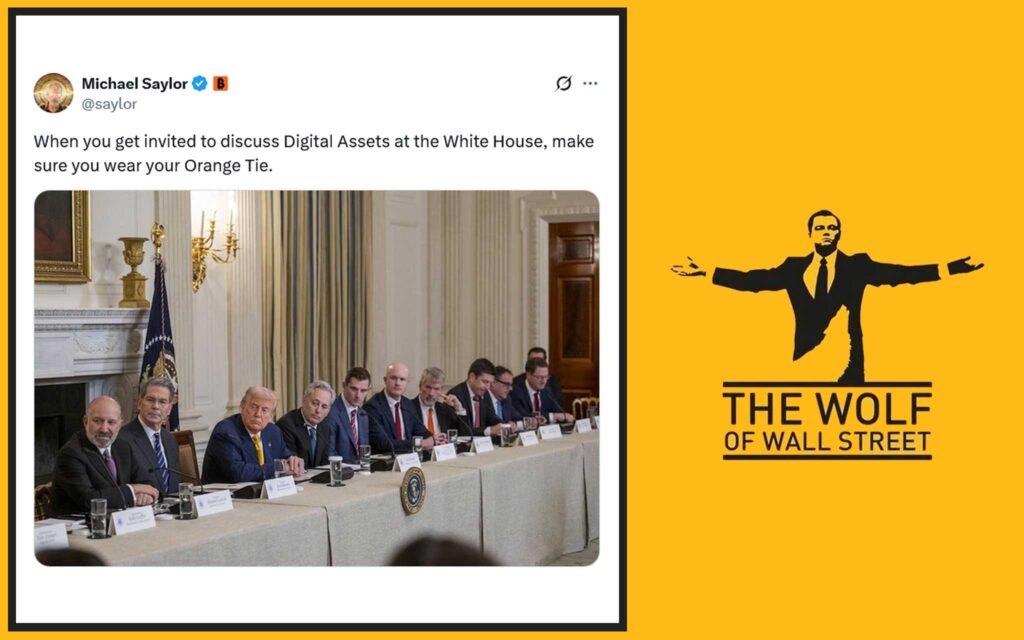

And they’re not flying solo. Heavyweights like Michael Saylor and Tom Lee are at the table, alongside 18 of the sharpest players in crypto, banking, mining, and venture capital.

This isn’t a drill. This is the moonshot that could reshape America’s economic strategy for decades to come.

🚀 What the BITCOIN Act Really Means

Here’s the deal: the BITCOIN Act is a legislative bombshell. It requires the U.S. government to acquire 1,000,000 BTC over five years. That’s roughly 5% of all Bitcoin that will ever exist.

Why? Because Bitcoin isn’t just money. It’s:

- Digital property more scarce than gold.

- A strategic hedge against inflation and global instability.

- A geopolitical weapon in the currency wars of the 21st century.

If the Act passes, the U.S. will become the first nation to lock down a sovereign Bitcoin reserve — setting the stage for a global scramble.

🏛 The Power Players in the Room

This isn’t some half-baked committee with no teeth. The lineup includes:

- Michael Saylor – Bitcoin evangelist, MicroStrategy chairman, the guy who turned corporate treasuries into Bitcoin vaults.

- Tom Lee – Fundstrat co-founder, Wall Street strategist who has been calling Bitcoin’s moves with frightening accuracy.

- Fred Thiel – CEO of Marathon Digital, one of the largest Bitcoin mining firms in the world.

Add to that mix bankers, venture capitalists, mining moguls, and traditional finance leaders, and what you’ve got is a who’s who of money, influence, and crypto firepower.

When people like this sit down with Congress, you can bet something big is coming.

📜 From the GENIUS Act to the BITCOIN Act

Not long ago, Washington passed the GENIUS Act, the first major U.S. law setting standards for stablecoins. That was the warm-up. The BITCOIN Act is the main event.

It’s a leap from regulating the playground to owning the entire ballpark. If stablecoins were about rules, Bitcoin reserves are about power.

👉 For deeper updates on U.S. crypto policies, check out News and Policies.

💰 The Money Question – Who’s Paying?

Here’s where the Act gets slick. The U.S. isn’t going to raise taxes or print new dollars to buy Bitcoin. Instead, they’re playing it budget-neutral with:

- Reevaluating gold certificates — pulling value out of dusty corners of America’s vaults.

- Redirecting tariff revenue — turning foreign trade friction into Bitcoin accumulation.

Translation? No new taxes. No burden on the average American. Just a financial jiu-jitsu move to stack sats without spooking voters.

🏦 Federal Reserve & Treasury’s Role

This isn’t a free-for-all. The Federal Reserve and the Treasury will manage purchases, custody, and long-term storage.

- 20-year minimum holding requirement — no flip-flopping.

- Quarterly Proof of Reserve disclosures — transparency baked in.

- Cold storage, multi-site custody — Bitcoin locked down like Fort Knox 2.0.

That’s not speculation. That’s written into the Act.

🌍 The Global Race for Bitcoin Reserves

Here’s the killer: the U.S. isn’t the only one eyeing Bitcoin. Other nations are

already stacking quietly. El Salvador made headlines, but do you really think China and Russia are sitting this out?

already stacking quietly. El Salvador made headlines, but do you really think China and Russia are sitting this out?

If America drags its feet, it risks falling behind in the greatest asset accumulation race of our lifetime. The BITCOIN Act is about more than economics — it’s about global dominance.

⚖️ Objections, Critics & Roadblocks

Of course, not everyone’s cheering. Some lawmakers and economists are screaming:

- “Too volatile!”

- “Too risky for taxpayers!”

- “The government shouldn’t mess with Bitcoin!”

Here’s the truth: those arguments are fear talking. The counter? Bitcoin has outperformed every asset class for a decade straight. Ignoring it is the real risk.

🔗 Coalition Building – The Political Chess Game

This isn’t a partisan stunt. Both sides of the aisle see the writing on the wall. Republicans see Bitcoin as a sovereignty play. Democrats see it as financial inclusion.

The coalition forming around the Act isn’t about ideology — it’s about future-proofing America’s balance sheet.

📈 What This Means for Bitcoin Price Action

Let’s cut the fluff: if the U.S. government starts buying 1 million Bitcoin, the supply shock will be seismic.

Scarcity + credibility = rocket fuel for price.

Institutional money, retail FOMO, and global headlines will all pile in. Anyone holding Bitcoin before the government makes its move is sitting on a golden ticket.

👉 Stay ahead with real insights from Trading Insights and the latest on Bitcoin.

⚡ The Ripple Effect Across Crypto

Don’t think this is just a Bitcoin story. When the U.S. validates BTC as a strategic asset, the entire crypto market benefits:

- Ethereum — becomes the next logical candidate for institutional accumulation.

- Altcoins — liquidity and adoption surge.

- DeFi — credibility boost as crypto moves mainstream.

👉 Explore more at DeFi and Altcoins.

🛡 Security & Custody – Protecting the Crown Jewels

We’re talking multi-sig wallets, geographically distributed vaults, and military-grade cybersecurity.

The U.S. isn’t just holding Bitcoin — it’s fortifying it like the nuclear arsenal. Because in many ways, that’s exactly what it is: digital nuclear money.

📊 Public Accountability & Transparency

The Act demands:

- Quarterly Proof of Reserve attestations.

- Clear custody standards.

- Separation of public Bitcoin from private property.

This isn’t reckless gambling. It’s structured, transparent, and accountable.

💡 Lessons from Gold & Oil Reserves

History repeats. In the 20th century, nations that controlled gold and oil controlled global power. In the 21st, it’s going to be Bitcoin.

This Act is the modern equivalent of filling Fort Knox. Except this time, it’s digital.

🕹 Opportunities for Retail Traders

Here’s the golden nugget: when governments move, markets move faster. Retail traders who position early ride the wave.

The smart money is already preparing. The question is: are you?

👉 If you’re new, dive into Newbie and track Trending markets.

🚀 The Wolf Of Wall Street – Giving You the Edge

Navigating this chaos alone? Rookie mistake. That’s where the The Wolf Of Wall Street crypto trading community comes in:

- Exclusive VIP Signals — ride the wave with precision.

- Expert Market Analysis — insights from seasoned traders.

- Private Community — join 100,000+ driven traders.

- Essential Tools — calculators, indicators, and more.

- 24/7 Support — you’re never trading blind.

👉 Supercharge your trading journey with The Wolf Of Wall Street Service and join our Telegram community for real-time updates.

📌 FAQs

1. What is the BITCOIN Act in simple terms?

A law proposing the U.S. buys 1 million BTC over five years and stores it as a national reserve.

2. Will taxpayers fund the purchases?

No. The plan uses budget-neutral strategies like tariffs and gold certificates.

3. How will this affect Bitcoin’s price?

Massive bullish pressure from scarcity and legitimacy.

4. Could the Act fail?

Yes, political opposition exists. But momentum is building fast.

5. Why should everyday traders care?

Because government-level Bitcoin accumulation could trigger the next great bull run.

🔥 Conclusion – America’s Moonshot Move

The BITCOIN Act is the boldest financial play of the century. If passed, the U.S. will establish itself as a crypto superpower, sending shockwaves across markets, governments, and economies worldwide.

Bitcoin isn’t the future anymore. It’s the present. And America is finally getting serious about it.

The only question left is: are you positioned to ride the wave?