Let’s not sugarcoat it. The LIBRA memecoin wasn’t just a rugpull. It was a high-stakes, hyper-marketed con that blew up like a firecracker in a petrol tank—and now a US court has slammed the brakes, freezing $57.65 million in USDC. This isn’t your average crypto scandal. It’s a masterclass in manipulation, and you need to know the playbook so you don’t get played next.

💥 The Big Bang – What Triggered the $57M Freeze

When the Court Slammed the Gavel

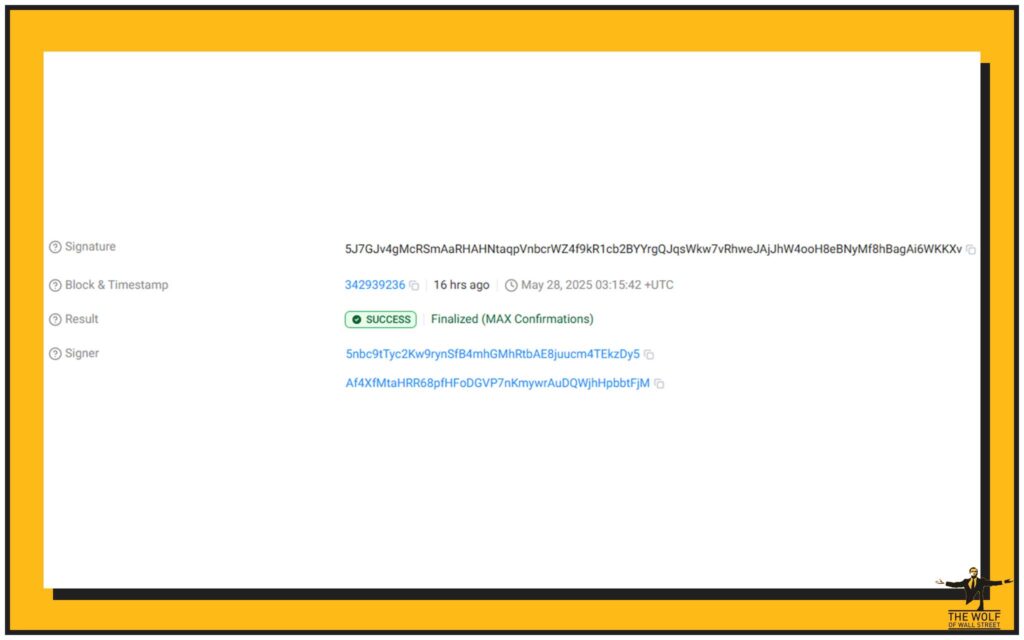

On May 28, 2025, the US District Court for the Southern District of New York dropped a legal bomb. It issued a Temporary Restraining Order—locking down $57.65 million in USDC sitting at Circle, the stablecoin’s issuer. The move came after a class-action lawsuit claimed this pile of digital cash was ripped straight from investors via LIBRA.

What Got Frozen & Why

Blockchain sleuths pinpointed two Solana wallets: one with $44.59M and another with $13M in USDC. These weren’t random wallets—they were tied to the LIBRA crew, and they got the full freeze treatment from the Multisig Freeze Authority. No movement, no cover-ups—just cold, hard locked funds.

🎯 Who’s on the Hook – The Players Behind LIBRA

Kelsier Ventures: Smoke & Mirrors Inc.

At the core of the scandal? Kelsier Ventures—a crypto “venture” firm that positioned itself as the next big thing. But behind the suits and pitch decks were co-founders Gideon, Thomas, and Hayden Davis—now accused of orchestrating this entire crypto circus.

KIP Protocol & Meteora: Partners or Pawns?

They weren’t alone. Entities like KIP Protocol and Meteora are also named in the lawsuit. Were they innocent infrastructure, or co-conspirators in a giant liquidity heist? The court will sort that out—but either way, they’re deep in the legal trenches now.

🚨 Memecoin Madness – How LIBRA Exploded and Imploded

From Zero to $4.6B

In February 2025, LIBRA launched with fireworks. It wasn’t subtle—it came with an endorsement tweet from Argentine President Javier Milei. The tweet’s gone now, but the fallout isn’t. Within days, LIBRA hit a $4.6 billion market cap. Insane numbers. Insane hype.

The 94% Crash

Then boom. Just as fast as it rose, LIBRA crashed by 94%. The value evaporated. Retail traders got nuked. Some lost life savings. Meanwhile, insiders were already cashing out—over $100 million siphoned, according to court docs.

One-Sided Liquidity = One-Sided Profits

They didn’t even try to hide it. The team withheld 85% of the supply and set up one-sided liquidity pools, so the price would moon while they dumped on retail. That’s not innovation—that’s daylight robbery.

Need to learn the red flags of these schemes? Check out our trading insights hub for deeper breakdowns.

🔥 Political Dynamite – Milei and the Argentine Fallout

Presidential Promo Gone Wrong

Milei’s tweet promoting LIBRA was the matchstick. Investors saw it and dove in. When the token collapsed, Argentine opposition parties lost it—accusing him of pumping a scam.

Impeachment Talk and Public Outrage

Impeachment threats, protests, and a nosedive in public trust followed. The scandal put Milei in the global spotlight—and not the kind presidents want.

Task Force… Dissolved?

Argentina formed a task force to investigate Milei’s LIBRA ties—but it was shut down after sharing findings with prosecutors. No transparency, no justice. Just more smoke.

Curious about more high-impact crypto/policy drama? Explore the policies category.

🧠 The Mechanics of the Scam – How They Pulled the Strings

85% Token Control: Rigged from the Start

The LIBRA crew hoarded most of the tokens. Retail thought they were early—they weren’t. They were liquidity exits for insiders.

Fake Liquidity, Real Damage

They pumped LIBRA by faking depth in liquidity pools. But it was all one-sided. When retail started buying, insiders dumped—stealing USDC and SOL in broad daylight.

Exit Strategy: $107M Gone in Hours

Within hours, over $107 million was extracted. It wasn’t just bad tokenomics. It was a deliberate setup.

⚖️ Legal Warfare – What’s Coming Next

The June 9 Court Showdown

Mark your calendars. On June 9, 2025, a court hearing will decide if the frozen funds stay locked. The plaintiffs want restitution. The defendants? They want out. Who wins? We’ll find out.

Circle’s Centralised Power: Friend or Foe?

Circle complied with the freeze order—but they haven’t made a statement. That silence speaks volumes. Can a centralised stablecoin really protect you when the heat’s on?

Milei: No Charges (Yet)

Despite the chaos, President Milei hasn’t been charged. But scrutiny is increasing. And so is public pressure.

Stay ahead of crypto legal shifts in DeFi and ecosystems.

📊 Investor Impact – Brutal Truths & Smart Moves

Retail Took the Hit

Most retail traders walked away burned. And here’s the truth: you’re not getting paid back first.

Centralised Risk = Centralised Pain

The LIBRA case is a warning shot. When you rely on centralised players—Circle, the LIBRA devs, government influencers—you give up control.

Spotting the Red Flags Next Time

- Overhyped launches

- Unclear tokenomics

- Celebrity endorsements with no real utility

- No clear liquidity strategy

🚀 What It Means for the Crypto Industry

Regulation Is Coming

LIBRA isn’t the first memecoin mess, but it might be the most politically toxic. Expect lawmakers to pounce—and hard.

Why Memecoins Still Matter

Memecoins reflect culture, emotion, momentum. But without transparency, they’re weapons, not assets.

Solana’s Crossroads

The fact that LIBRA was Solana-based doesn’t mean Solana’s finished. But this raises serious questions about project onboarding and ecosystem oversight.

Explore our memecoins and layer-1 and layer-2 solutions categories to stay informed.

💸 How to Win in This Market – Without Getting Burned

Use Tools, Not Hope

This is where The Wolf Of Wall Street comes in strong. This isn’t some Discord with wannabe traders—this is a professional, all-in-one crypto trading community.

You get:

- VIP Signals to ride winning trades

- Expert analysis so you don’t chase hype

- Private community of 100K+ who have your back

- Volume calculators & 24/7 support so you trade smart, not blind

Empower your crypto game:

- Visit The Wolf Of Wall Street.com

- Join our active Telegram

🧾 Recap – The High-Stakes LIBRA Meltdown

- $57.65M in USDC frozen by a federal court

- LIBRA launched and collapsed within weeks

- Over $100M allegedly extracted by insiders

- Political turmoil hits Argentina and President Milei

- Class-action lawsuit in motion, hearing on June 9

- Retail investors took massive losses

- Stablecoin issuers under scrutiny

- The need for smarter, safer trading strategies is more urgent than ever

📌 FAQs – Real Talk

1. Can Circle freeze my USDC too?

Yes. If a court tells them to, it’s game over for your funds.

2. What happens after June 9?

The court will decide if the frozen $57M stays locked or gets released to victims—or worse, the defendants.

3. Will LIBRA ever come back?

Highly unlikely. It’s toxic now. Any attempt at resurrection would trigger legal red flags.

4. How do I avoid getting scammed by memecoins?

Understand tokenomics. Look for real liquidity. Avoid hype cycles. And get verified signals.

5. What tools actually help me trade better?

Start with VIP crypto signals, calculators, and 24/7 access to experienced traders. That’s what The Wolf Of Wall Street offers.

🔗 Explore More

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/

- Join our active Telegram community: https://t.me/tthewolfofwallstreet