🦾 Introduction: The Gold Rush 2.0

There’s a reason people call crypto the modern Wall Street — it’s a jungle where only the bold survive. But here’s the kicker: in 2025, this jungle isn’t lawless anymore. It’s structured, regulated, and stacked with opportunity.

Venture capital — once the playground of Silicon Valley elites — has moved into the blockchain space. Institutional money is now prowling for the next 100x crypto startup. Spot Bitcoin ETFs, AI–blockchain integrations, and decentralised finance infrastructure are drawing big-money attention faster than you can say “series funding.”

According to Galaxy Research, over $4.8 billion was invested in crypto startups in Q1 2025, and another $1.97 billion flowed in during Q2 2025. That’s not “hype” — that’s conviction.

This is the Gold Rush 2.0 — and in this guide, you’ll learn exactly how venture capital works, how to secure it, and how to make it work for you.

💸 What Is Venture Capital, Really?

Let’s cut the noise. Venture capital isn’t a gift — it’s a deal with the devil and an angel. You’re trading equity for acceleration.

Here’s the truth: VCs don’t throw money at you because they like your logo. They do it because they see potential leverage — your startup becomes their vehicle for exponential return.

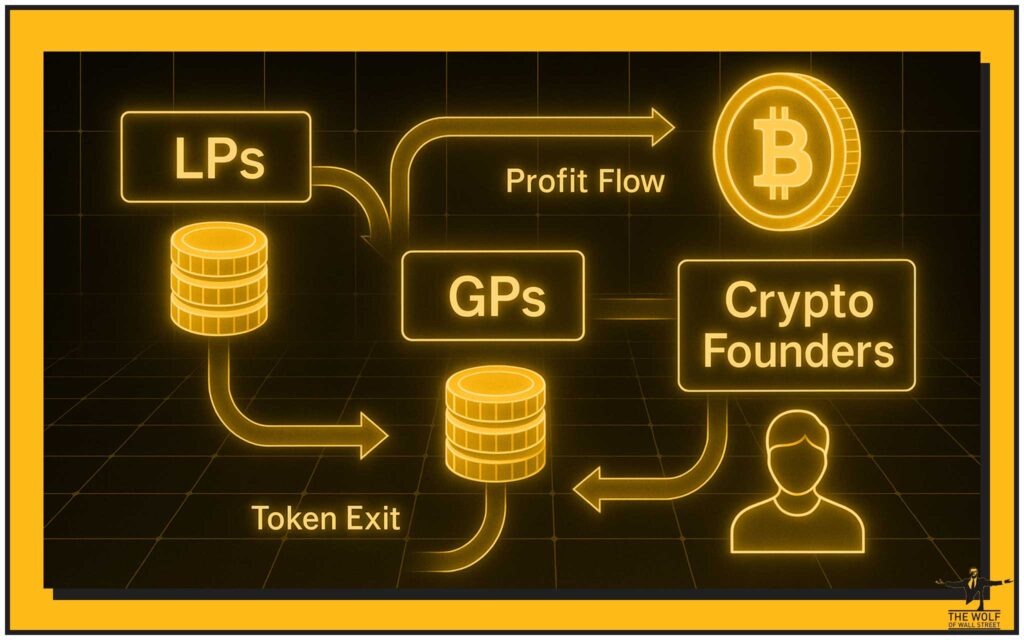

Every VC fund is built on a limited partnership (LP/GP) structure. The LPs (pension funds, hedge funds, high-net-worths) provide capital. The general partners (GPs) place bets — high risk, long horizon. They expect most startups to fail, but one to hit a home run big enough to justify the rest.

Now, in crypto, that game just got more complex — and faster. Token-based models, dual equity, and liquidity events happen long before IPOs. It’s not your dad’s venture world anymore.

If you want to understand where crypto meets institutional strategy, check out the crypto hedge funds market shift or learn the crypto token listing process.

🔥 Why Crypto and VC Finally Make Sense Together

Once upon a time, VCs avoided crypto like a plague. Unclear regulation, speculative mania, rug pulls — you name it. But by 2025, the landscape has flipped.

The approval of spot Bitcoin ETFs by the SEC in 2024 cracked open the floodgates. Institutional investors — the same ones who once mocked crypto — are now integrating it into balanced portfolios. According to CB Insights, AI may have stolen the spotlight in venture, but blockchain remains the dark horse with long-term asymmetry.

Sectors leading the charge:

- Infrastructure and security tools

- DeFi analytics and compliance platforms

- AI–blockchain convergence projects

Crypto isn’t the casino anymore — it’s the backbone of tomorrow’s internet.

If you’re curious about these foundational ecosystems, dive into Layer-1 foundation coins in the crypto market or understand how Bitcoin ETFs are transforming 2025 investment strategies.

💡 The Five Stages of Venture Capital Funding

Let’s strip it down to brass tacks. Here’s the funding ladder every serious crypto startup climbs — from napkin sketch to billion-pound valuation.

1️⃣ Pre-Seed: From Idea to Proof

This is where it all begins — chaos, caffeine, and conviction. You’ve got an idea, maybe a prototype, and a dream to disrupt.

At this stage, investors are usually:

- Friends and family

- Angel investors

- Crypto-native DAOs

Your job? Validate the concept. Build an MVP, prove there’s demand, and get the first community traction. Think of projects building wallet APIs or analytics dashboards for DeFi as your peers.

Typical raise: £100K–£500K. Risk level? Astronomical.

2️⃣ Seed: Building the First Product

Now you’ve got proof — but you need power. Seed funding lets you refine your MVP into a usable product, recruit a core team, and gain early traction.

In 2025, average crypto seed rounds fall between $1–3 million, often blending token warrants with equity. The narrative shifts from “we might make it” to “we are making it.”

Early investors want to see:

- A clear business model

- Evidence of user growth

- A convincing roadmap

This is where founders start thinking about tokenomics. Learn more in our tokenomics investing guide.

3️⃣ Series A: Scaling Early Traction

Forget that outdated nonsense about “steady cash flow.” Series A isn’t about profit — it’s about potential.

This is your first major institutional round. You’ve shown early product–market fit, and investors now fund your ability to scale.

Key players: a16z, Paradigm, Sequoia, Pantera Capital.

They’re betting on traction, not turnover.

Typical raise: $5–15 million

Goal: Scale early traction, refine monetisation, expand tech stack

Crypto examples include DeFi infrastructure startups or Web3 wallets entering new markets.

4️⃣ Series B: Expansion and Brand Power

Now we’re talking serious capital — think $15–50 million. You’re no longer selling dreams; you’re scaling execution.

Funds go into:

- Product expansion

- Geographic market entry

- Talent acquisition

- Brand partnerships

But tread carefully: dilution is real. Overfunding can be as dangerous as undercapitalisation. If your investors own more of your company than you do, you’re an employee — not a founder.

5️⃣ Series C (and Beyond): Market Domination

At this stage, you’re a proven beast. Institutional funds, hedge funds, and even corporate venture arms start sniffing around. You’re preparing for IPO, token listing, or strategic acquisition.

The stakes are enormous, but so are the paydays.

⚡ Pre-IPO or Pre-Token Listing

The modern twist? Many crypto startups exit via token rather than IPO. This hybrid model — equity + token distribution — allows early investors liquidity without waiting a decade.

These rounds often attract hedge funds or “strategic investors” seeking exposure before public launch.

Learn how it works in our crypto token listing process guide.

📊 Funding Stages Simplified

| Stage | Purpose | Typical Investors | Risk Level | Avg. Deal (Crypto 2025) |

|---|---|---|---|---|

| Pre-seed | Concept validation | Founders, angels | 🔥 Very High | $100K–$500K |

| Seed | Build MVP | Angels, micro VCs | 🔥 High | $1–3M |

| Series A | Scale traction | Institutional VCs | ⚡ Medium | $5–15M |

| Series B | Expansion | Growth VCs | ⚡ Medium-Low | $15–50M |

| Series C | Market capture | Funds, banks | 💎 Low | $50M+ |

🧭 Why Crypto Startups Seek VC Funding

Money alone doesn’t build empires — strategy does.

When you bring on venture capital, you’re not just getting cash; you’re getting leverage.

Advantages of VC funding:

- Access to global networks and partnerships

- Mentorship from operators who’ve scaled before

- Legitimacy that attracts top-tier hires and media

But remember — every pound you raise costs equity. Control dilution is real, and so is pressure.

Crypto founders often face an additional challenge: regulatory uncertainty. Staying compliant with KYC, AML, and securities laws is critical. Our crypto AML guide for 2025 covers exactly how to keep your startup on the right side of the law.

⚖️ The Flip Side: VC’s Darker Edge

Let’s get brutally honest — not every VC cheque is your golden ticket.

Some investors are wolves in sheep’s clothing. They’ll promise the moon, but the fine print hands them control of your company.

Watch for:

- Liquidation preferences that favour investors on exit

- Board control clauses that limit your decision-making

- Down rounds that crush early equity

Jordan Belfort said it best: “You don’t let the money own you — you own the money.”

💼 VC Alternatives in the Crypto World

Not every founder wants or needs VC money. The crypto world invented new ways to raise capital — decentralised, democratic, and fast.

ICO (Initial Coin Offering)

Launched the 2017 bull run. Simple, global, but now heavily regulated.

IEO (Initial Exchange Offering)

Conducted through exchanges. Offers more trust but less control.

IDO (Initial DEX Offering)

On decentralised exchanges. Permissionless, transparent, volatile.

STO (Security Token Offering)

Regulated, legally compliant, ideal for tokenised equity or real assets.

| Method | Gatekeeper | Regulation Level | Investor Type | Pros | Cons |

|---|---|---|---|---|---|

| ICO | None | Low | Retail | Fast, global | Risky, unregulated |

| IEO | Centralised Exchange | Medium | KYC Investors | Trusted, vetted | Exchange fees |

| IDO | DEX Launchpad | Low–Medium | DeFi community | Fair launch | Volatile |

| STO | Regulator | High | Accredited | Legal, transparent | Complex |

For deeper dives, explore Initial DEX Offering (IDO) explained, IEO fundraising in 2025, or STO beginners’ guide.

🏛️ Regulation & Reality Check

Let’s be clear: compliance isn’t optional anymore.

Between MiCA in the EU and SEC oversight in the U.S., the regulatory landscape in 2025 is tightening fast. Token offerings must adhere to securities law, and advertising policies by Google and Meta now allow crypto ads only with certification and jurisdictional compliance.

The takeaway? Legitimacy sells. Founders who bake compliance into their DNA attract smarter, longer-term capital.

🧠 The Wolf’s Playbook: How to Pitch to a Crypto VC

Now comes the part most founders screw up — the pitch.

You’ve got one shot to convince someone that your project isn’t just another coin — it’s a movement.

Here’s the Wolf’s formula:

- Open with pain and solution — show you solve a real market inefficiency.

- Prove traction — numbers, users, partnerships.

- Sell the dream — make them feel FOMO.

- Handle objections like a pro — clarity kills doubt.

- Close with urgency — scarcity creates momentum.

Remember, storytelling closes deals, not spreadsheets.

And before you hit the pitch circuit, sharpen your trading edge and network in the The Wolf Of Wall Street crypto trading community. Access VIP signals, expert analysis, and a private network of over 100,000 traders — the perfect environment to test strategies and connect with serious investors.

If you’re building your pitch deck, check out The Wolf’s Guide to Asset Classes & Crypto Wealth or learn how to create your own crypto token.

💬 FAQs

Q1: What makes crypto startups attractive to VCs in 2025?

The combination of token liquidity, early traction, and institutional validation. Post-ETF approval, crypto is seen as a legitimate innovation frontier.

Q2: Can I raise VC money with just a white paper?

Rarely. Investors need to see product progress, traction, and real demand — not just ideas.

Q3: How do tokenomics affect valuation?

Poorly structured tokenomics can tank investor confidence. Smart models balance utility, governance, and supply caps.

Q4: Are STOs safer than ICOs?

Yes. STOs comply with securities law, providing legal protection and investor confidence.

Q5: What’s the average VC exit timeline in crypto?

Three to six years — faster than traditional tech, thanks to token liquidity events.

🏁 Conclusion: Smart Money Meets the Smart Chain

Venture capital isn’t just about raising funds — it’s about raising standards. The crypto market of 2025 rewards founders who understand both the financial game and the regulatory maze.

The wolves aren’t just on Wall Street anymore — they’re on-chain, and they’re watching for your next move.

Join the The Wolf Of Wall Street community today to supercharge your trading and networking. Access exclusive signals, market insights, and 24/7 mentorship to level up your crypto game.

Because in this market, fortune doesn’t favour the cautious — it favours the calculated.

The Wolf Of Wall Street crypto trading community offers:

- Exclusive VIP Signals to maximise profit

- Expert Market Analysis from seasoned traders

- Private Community of 100,000+ members

- Essential Tools like volume calculators

- 24/7 Support for consistent success

👉 Visit The Wolf Of Wall Street Service or join The Wolf Of Wall Street Telegram.