🚀 Intro – The Billion-Dollar Bet on Ethereum

Ethereum isn’t just a cryptocurrency anymore — it’s becoming Wall Street’s next guilty pleasure. The suits are here, the institutions are sniffing around, and Vitalik Buterin — yes, the genius architect of Ethereum — is giving a big, fat thumbs-up to the rise of ETH treasury firms.

But here’s the twist: while he’s cheering the influx of institutional money, he’s also waving a giant caution flag. The danger? Overleverage. That seductive, fast-money monster that’s toppled empires before.

This is a high-stakes game, and if you play it right, you’re looking at life-changing opportunities. Play it wrong? You’re looking at a digital bloodbath.

🏦 Ethereum Treasury Firms: The New Power Players

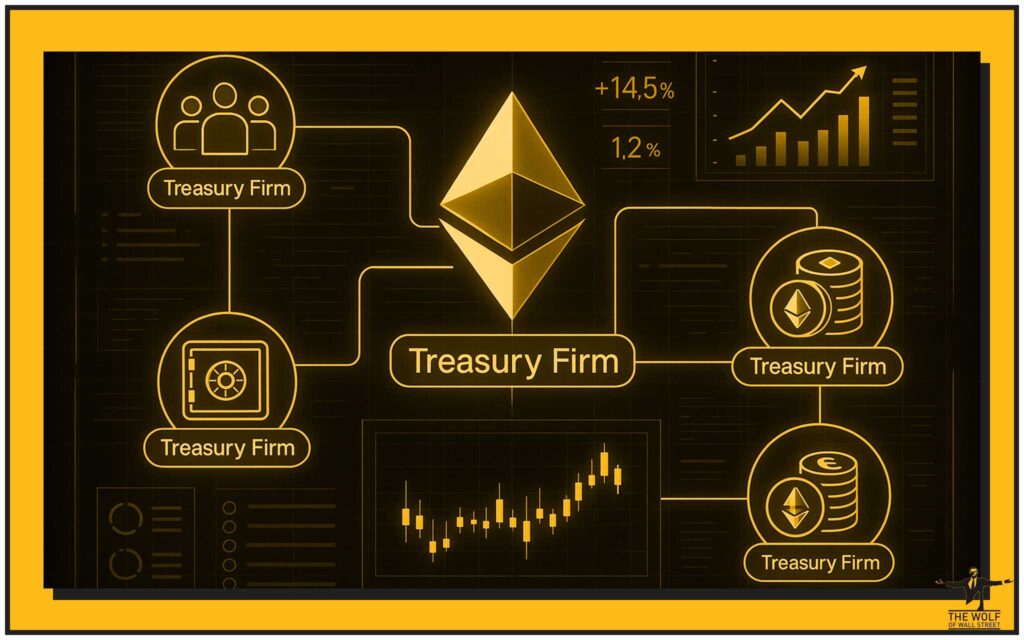

Let’s cut to the chase — treasury firms are not your everyday crypto bros. These are publicly traded companies and institutional players buying Ethereum in bulk and holding it as part of their balance sheets.

Think of it like corporate Bitcoin treasuries (hello, MicroStrategy), but with the second-largest crypto asset in the game. This isn’t a fad — it’s an institutional bridge to Ethereum exposure without the tech headaches of private wallets, cold storage, and seed phrases.

For Ethereum, this means legitimacy. For investors, it means a backdoor into ETH’s upside without touching the blockchain yourself.

⚙️ How They Work — And Why Investors Love Them

Here’s the playbook:

- Treasury firms raise capital from shareholders or the market.

- They deploy part of that capital into ETH.

- Investors buy the company’s stock — gaining indirect ETH exposure without ever owning a single token.

Why this works:

- Lower barriers — no need to worry about wallets or security.

- Regulatory cover — shares are traded on stock exchanges, not decentralised networks.

- Liquidity — investors can cash out via the stock market anytime.

This setup is perfect for conservative investors who want ETH’s upside without the crypto complexity.

💡 Related read: Latest crypto trading insights

👍 Vitalik’s Thumbs-Up — With a Caveat

Vitalik Buterin sees treasury firms as a net win. They expand Ethereum’s reach, bring in deep-pocketed players, and make ETH a respectable addition to corporate balance sheets.

But — and this is where he sharpens the knife — he’s not blind to the risks. His message is clear: don’t let these companies drown themselves in leverage.

When the price of ETH drops, overleveraged firms can trigger a domino effect of forced selling, tanking prices and wrecking market confidence. That’s not just bad for them — it’s bad for everyone holding ETH.

⚠️ The Leverage Danger Zone

Here’s how it happens:

- Treasury firm takes a loan against ETH holdings to buy more ETH.

- ETH price drops.

- Margin calls hit.

- Forced liquidation slams the market.

Sound familiar? It should. It’s the same kind of cascading liquidation event that’s blown up hedge funds, banks, and more than one crypto project.

In crypto, leverage is like nitroglycerin — handle it wrong, and it will detonate your portfolio.

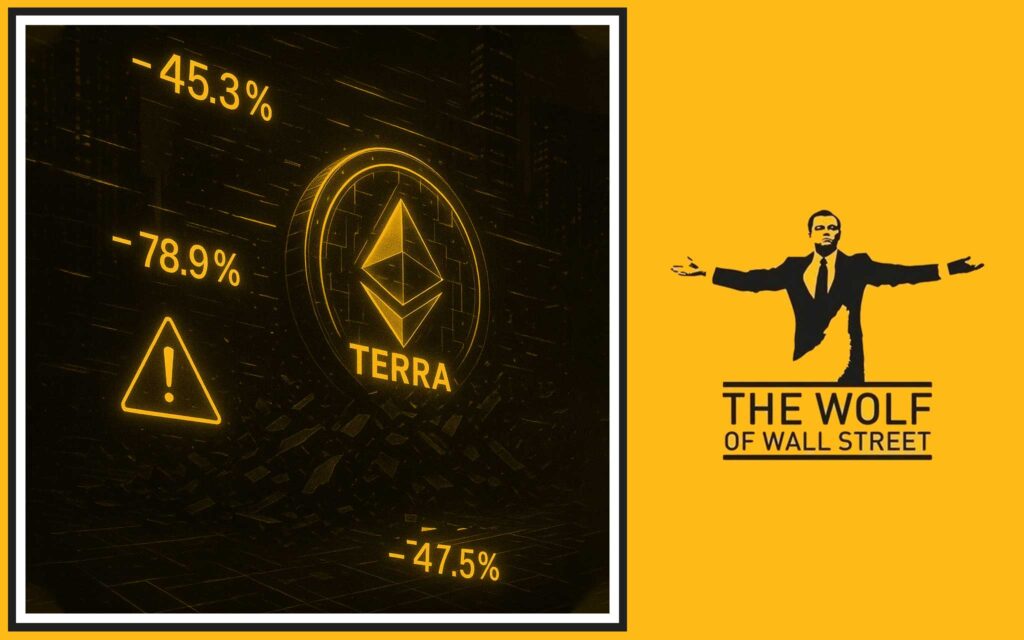

💥 Terra’s Collapse — The Wake-Up Call

Remember Terra? The blockchain empire that promised the moon and delivered rubble? Overleverage and unsustainable structures took it down, wiping out billions.

Vitalik’s point is simple: don’t let Ethereum treasury firms repeat that disaster. The good news? ETH investors are generally more disciplined. But discipline only lasts as long as greed is kept in check.

💰 $12 Billion and Counting — The Big Holders

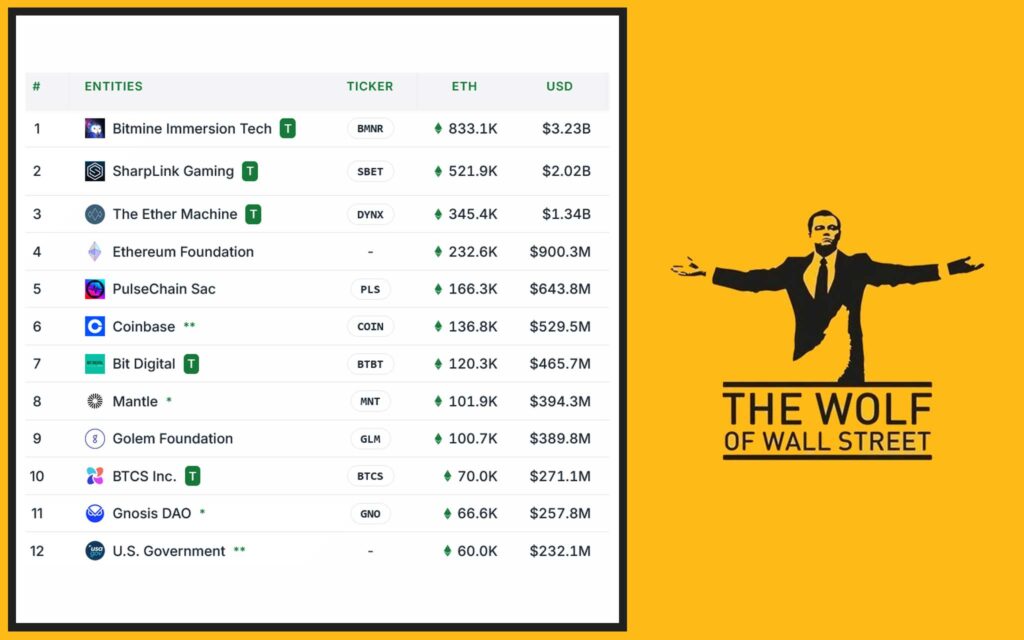

Let’s talk numbers. As of now, public ETH treasury firms hold nearly $12 billion worth of Ethereum.

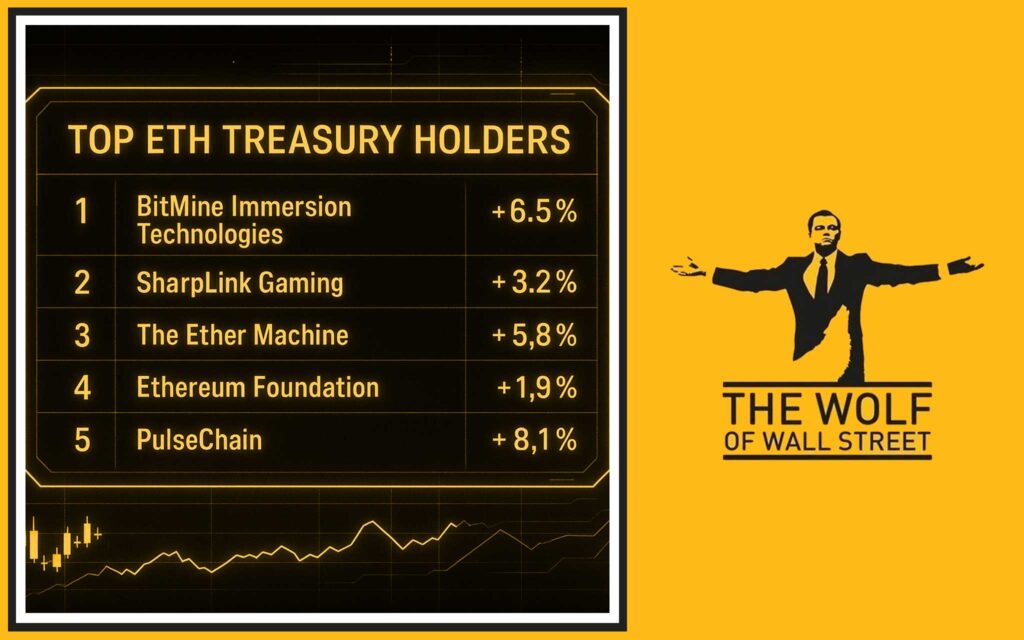

Top of the leaderboard:

- BitMine Immersion Technologies — 833,000+ ETH

- SharpLink Gaming

- The Ether Machine

Add the Ethereum Foundation and PulseChain into the mix, and you’ve got a formidable concentration of ETH in institutional hands.

📈 ETH Price Rollercoaster — and Treasury Firms’ Impact

2024 wasn’t a smooth ride. ETH started at $3,685, crashed to $1,470, then exploded back over $3,870 — a 163% rebound.

What pushed it up? Treasury firms loading up. When big money buys in bulk, supply gets squeezed, and prices get pushed up.

Compared to Bitcoin and Solana, ETH’s comeback was one of the most aggressive in the market, narrowing the performance gap and putting Ethereum firmly back in the institutional spotlight.

💡 Explore more: DeFi market analysis

🔥 Why Institutional Interest in ETH is Heating Up

It’s not just about price speculation. ETH powers:

- DeFi protocols

- NFT marketplaces

- Layer-2 scaling solutions

- Smart contracts driving Web3 infrastructure

Institutions see Ethereum as the backbone of decentralised finance — with revenue streams from transaction fees, staking yields, and network usage.

Bitcoin is digital gold. Ethereum? Digital oil. And everyone wants in.

🏹 The Opportunity for Retail Investors

If you’re a retail trader, here’s the play:

- Track treasury firm accumulation. If they’re buying, it’s a signal.

- Ride the wave. Treasury buying pressure can create medium-term bullish trends.

- Diversify. Don’t go all-in on ETH — balance with BTC or promising Layer-1/Layer-2 plays.

Want more on positioning strategies? Check Layer-1 and Layer-2 solutions.

🛡️ Overleverage Prevention — Vitalik’s Implicit Game Plan

Vitalik isn’t calling for regulators to step in — yet. He’s calling for industry self-discipline:

- Conservative loan-to-value ratios.

- Transparent reporting on leverage levels.

- Avoiding “double-dipping” on ETH collateral for multiple loans.

If the industry polices itself, Ethereum can avoid the reputation damage of a treasury collapse.

🔮 What This Means for the Future of Ethereum

If ETH treasury firms succeed without blowing up, the floodgates open for:

- ETH-based ETFs.

- Broader corporate adoption.

- Recognition of ETH as a blue-chip crypto alongside Bitcoin.

But if greed wins and leverage spirals out of control? We could be looking at a Terra-style implosion with global headlines that set Ethereum adoption back years.

💎 Conclusion — The High-Stakes Future of Ethereum

The takeaway? Ethereum treasury firms are a game-changer — but they’re also a ticking time bomb if leverage goes unchecked.

Vitalik’s message to investors, institutions, and the crypto community is crystal clear:

Play smart, stay disciplined, and understand that in this market, risk management is profit protection.

If you want to ride this wave, you need the right information at the right time — and the discipline to use it.

📌 FAQs – Quickfire Answers

1. What is an Ethereum treasury firm?

A public company holding ETH on its balance sheet to give shareholders indirect exposure.

2. How much ETH is currently held by public treasuries?

Around $12 billion, led by BitMine Immersion Technologies.

3. Why does Vitalik warn against leverage?

Because excessive leverage can cause cascading liquidations and crash the market.

4. How do treasury firms impact ETH price?

Large purchases can create upward pressure; forced sales can crash prices.

5. Can retail investors benefit from this trend?

Yes — by tracking treasury firm activity and aligning their trades accordingly.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: In-depth insights from seasoned crypto traders.

- Private Community: Network with 100,000+ like-minded traders.

- Essential Trading Tools: Volume calculators and more for informed decisions.

- 24/7 Support: Dedicated help anytime you need it.

Empower your crypto journey:

- Visit The Wolf Of Wall Street Service for more.

- Join The Wolf Of Wall Street Telegram for real-time updates.