💥 Introduction: The Investment World Just Got Shaken Up

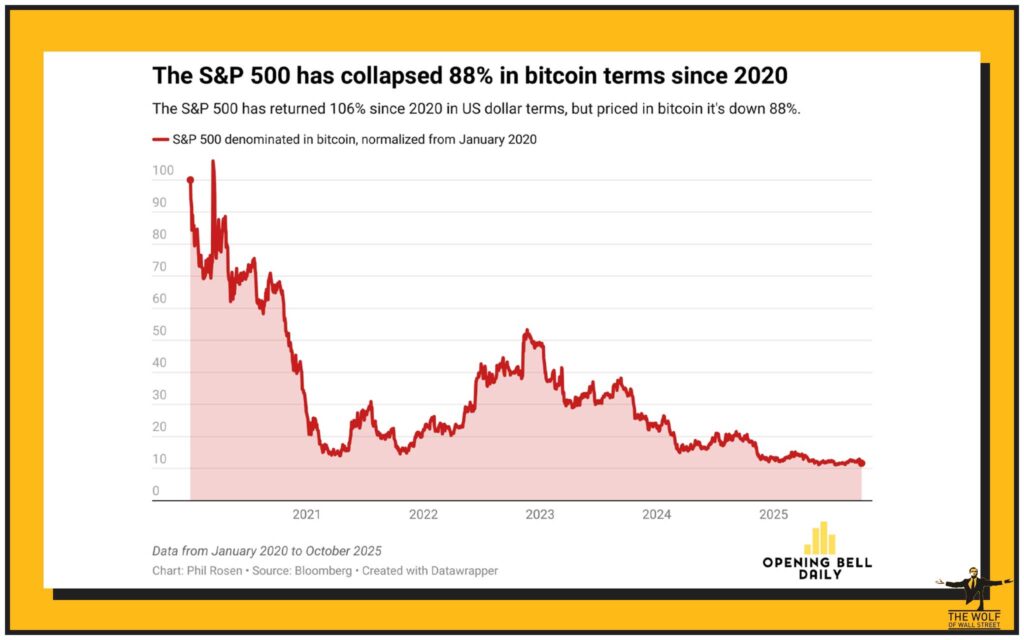

Let’s get one thing straight — Warren Buffett is a living legend. The man built empires off patience, fundamentals, and a love affair with the S&P 500. But right now? That golden index, the pride of traditional investors, is getting wrecked — down 88% compared to Bitcoin over the past five years.

That’s right. The S&P 500 hit record highs in 2025, but next to Bitcoin, it looks like a clunky dinosaur gasping in the digital age. And if you’re still clinging to your 90/10 Buffett portfolio without looking at what’s happening in crypto — you’re not investing. You’re sleepwalking.

📈 S&P 500 – The Classic Titan That Refuses to Quit

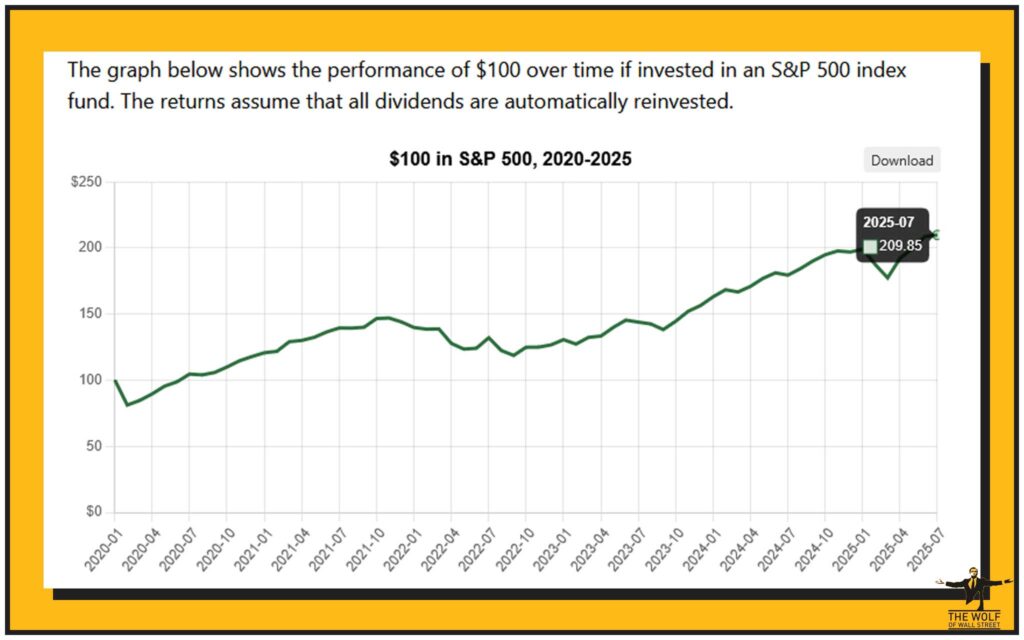

The S&P 500 has done what it’s always done: deliver stability. Since 2020, it’s surged 106% in USD terms, reaching a record level of around $6,715.79 with a 14.43% year-to-date gain. Solid returns, steady growth, predictable outcomes — the safe path Buffett swears by.

If you’d dropped $100 into the index in 2020, it’d be about $210 today. That’s respectable — the kind of number that makes pension funds smile.

But respectable doesn’t make millionaires anymore. Respectable doesn’t beat inflation, and it sure as hell doesn’t keep up with assets designed to disrupt entire financial systems.

🚀 Bitcoin – The Rebel Asset That’s Outperformed Wall Street

Now enter Bitcoin, the digital apex predator. Since 2020, it’s exploded — turning that same $100 into roughly $1,474. That’s not just performance. That’s a paradigm shift.

In 2025 alone, Bitcoin’s already up 32%, hitting a new all-time high of $125,000. Forget safe — this is asymmetric growth that flips the risk-reward equation upside down. The volatility? That’s not a bug. It’s the price of freedom, volatility that comes with potential — the kind that changes lives.

And with a total market cap sitting near $2.47 trillion, Bitcoin’s no longer a speculative corner of finance. It’s a global powerhouse challenging Wall Street itself.

If you’re not paying attention, you’re leaving money — and history — on the table.

🧠 The Buffett Doctrine: Simplicity, Patience, and Compound Growth

Buffett’s 90/10 strategy is iconic:

- 90% into the S&P 500,

- 10% into short-term Treasury bonds.

Low-cost, diversified, and time-tested. The man’s logic is ironclad — for a world that existed before blockchain, before global digital liquidity, before decentralised finance turned finance upside down.

He’s famous for saying, “Never invest in a business you don’t understand.”

But here’s the twist — most people didn’t understand the internet in 1995 either.

⚡ When Old Wisdom Meets a New Era of Digital Assets

The world Buffett mastered runs on earnings reports and dividends. But the new world? It runs on scarcity, decentralisation, and digital velocity. Bitcoin isn’t competing with Coca-Cola or Apple. It’s competing with currencies themselves.

Buffett’s skepticism about crypto made sense in 2017. But in 2025, when nations are tokenising debt instruments and institutions are holding Bitcoin on balance sheets, the ground beneath traditional investing is shifting.

If you’re still anchored to yesterday’s rules, you’re already losing today’s game.

💰 Market Reality Check: Data Doesn’t Lie

Let’s run the numbers like wolves on Wall Street.

| Asset | Performance (2020–2025) | 2025 YTD | Value of $100 (2020) |

|---|---|---|---|

| S&P 500 | +106% | +14.43% | $210 |

| Bitcoin | +1,374% | +32% | $1,474 |

That’s an 88% collapse in S&P 500 value when denominated in Bitcoin. Same time frame. Different universe.

Volatility? Sure. But risk without reward is just fear. Bitcoin’s volatility is controlled chaos, while the S&P 500’s “stability” hides overextension — the Buffett Indicator and Shiller P/E both flashing red.

Numbers don’t lie. They scream.

📊 The Power Gap: Market Cap vs Monetary Impact

The S&P 500’s market cap sits around $56.7 trillion — 20x Bitcoin’s $2.47 trillion. On paper, that looks unshakable. But markets don’t move on size — they move on momentum.

Bitcoin is lean, fast, and borderless. It doesn’t close on weekends. It doesn’t rely on CEOs or central banks. That’s why it’s the fastest-growing asset class on Earth.

It’s not about how big your market cap is. It’s about how fast your money multiplies.

⚙️ The Risk Spectrum: Stability vs Volatility

Here’s the deal: the S&P 500 is safe — until it isn’t. Remember 2008? Remember 2020? Traditional assets crash too — they just do it with better PR.

Bitcoin’s volatility cuts both ways. The difference? It rewards conviction. If you know how to read momentum, tools like the Money Flow Index (MFI) can help identify reversals before they hit.

Volatility is opportunity, not danger — if you’ve got the guts and the data.

🧩 Beyond Buffett: The New Breed of Hybrid Investors

Meet the hybrid investor — part Buffett, part Bitcoin maximalist. These players hold both the S&P 500 and BTC, leveraging traditional growth with exponential potential.

Institutions are catching on, rolling out Bitcoin and Ethereum ETFs to bridge both worlds. Even conservative pension funds are adding digital exposure — not for speculation, but for diversification.

The new rule of money: adapt or get left behind.

🔥 The 88% Collapse in BTC-Denominated S&P Value

When the S&P 500 “loses 88%” in BTC terms, it’s not that it’s crashing — it’s that Bitcoin’s value is skyrocketing faster. It’s a new measuring stick for wealth.

Investors now calculate returns not just in dollars, but in Bitcoin units. That’s power. When your portfolio’s benchmark changes from fiat to crypto, you’ve officially entered the future.

🪙 Bitcoin as Digital Gold – Or the Ultimate Speculation?

Bitcoin is the 21st-century version of gold — only it moves faster and has no physical limitations. Its 21 million hard cap ensures permanent scarcity. Unlike gold, it’s borderless and programmable.

While Buffett loves tangible value, digital scarcity is the new alpha. Check out the Bitcoin Hard Cap Guide to understand why this fixed supply changes everything.

This isn’t speculation. It’s evolution.

📉 Market Valuations: Buffett Indicator Screaming Red

Even Buffett’s favourite metrics — like his namesake Buffett Indicator (total market cap vs GDP) — are shouting “overvalued.” Add the inflated Shiller P/E, and the S&P 500 looks stretched thin.

The dot-com bubble looked the same before it burst.

The difference now? Investors have a digital exit ramp.

The next correction won’t just be a crash — it’ll be a capital migration into crypto assets.

🎯 The Evolving Investment Climate – Signals of a New Cycle

When Berkshire Hathaway trims its exposure to banks like Nubank while the world’s largest funds accumulate Bitcoin, that’s not noise — it’s signal.

We’re witnessing the start of a generational rotation: capital moving from legacy assets to decentralised ones. Institutional adoption, crypto ETFs, and hedge funds shifting strategies confirm it.

Buffett’s framework built wealth in the industrial age. But the next wave? It’s born in the blockchain age.

🔑 The Wolf’s Playbook: Taking Control of Your Portfolio

If Buffett taught you discipline, I’m teaching you domination.

Here’s the Wolf’s way to play this new market:

- Diversify — but don’t dilute. Hold conviction in high-performance assets.

- Learn — use tools like The Wolf Of Wall Street Service to master real-time trading.

- Engage — join The Wolf Of Wall Street on Telegram for community-driven insights.

- Strategise — apply crypto profit-taking methods to secure wins.

This isn’t financial advice. It’s financial awakening.

💼 Lessons From Buffett – And What He Might Be Missing

Buffett’s principles — patience, research, and discipline — are eternal. But opportunity doesn’t wait for value investors to finish their annual reports.

He once said, “Our favourite holding period is forever.”

In crypto, forever can happen in six months.

Generational wealth doesn’t come from copying the past. It comes from evolving it.

🚨 Expert Voices: Is the Paradigm Shift Real or a Bubble Reloaded?

Analysts are divided. Some say Bitcoin’s rise is a classic bubble cycle. Others argue it’s the natural evolution of global finance.

AI-driven research, like How ChatGPT Analyses Bitcoin Trends in 2025, shows strong fundamentals behind the move — increased institutional adoption, declining exchange reserves, and tightening supply.

If this is a bubble, it’s the most fundamentally sound one in history.

🧭 Strategic Takeaways – The 2025 Investor Roadmap

Here’s the clear, no-BS takeaway:

- Conservative investors: Keep your S&P exposure, but allocate 5–10% to Bitcoin.

- Aggressive traders: Ride volatility with smart position sizing and stop-loss discipline.

- Institutions: Blend digital assets into long-term portfolios before regulation forces your hand.

The future isn’t about choosing between Buffett and Bitcoin. It’s about combining both for exponential growth.

🤝 Conclusion: Buffett’s Wisdom Still Stands – But the Game Has Changed

Warren Buffett’s principles will never die. But the market has evolved. The S&P 500 may still be the safe fortress — yet Bitcoin is the rocket that left the fortress behind.

The real investor in 2025 knows this truth: you don’t need to abandon the old guard. You just need to add a new weapon.

The Wolf’s advice? Learn the rules, master the tools, and dominate both worlds.

For hands-on mastery, join the elite:

👉 The Wolf Of Wall Street Crypto Service | Join the Telegram Community

💬 FAQs

1. Is Bitcoin still a safe investment in 2025?

Yes — as long as you manage risk intelligently and diversify properly. Use institutional-grade insights from The Wolf Of Wall Street Service to navigate volatility.

2. Should I follow Buffett’s 90/10 rule?

Adapt it. Try a 70/20/10 split — S&P 500, Bitcoin, and stable yield assets.

3. Can I hedge my portfolio with crypto?

Absolutely. Bitcoin and Ethereum are effective hedges against fiat devaluation.

4. Why is the S&P 500 still relevant despite Bitcoin’s gains?

It provides diversification, liquidity, and long-term consistency.

5. Where can I learn advanced crypto trading strategies?

Join The Wolf Of Wall Street Service and access the Trading Insights category for expert breakdowns.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

- Exclusive VIP Signals: Maximise profits with proprietary insights.

- Expert Market Analysis: Access professional crypto trader intelligence.

- Private Community: 100,000+ members sharing real-time strategies.

- Essential Tools: From volume calculators to data-driven dashboards.

- 24/7 Support: Because markets never sleep.

Empower your journey: The Wolf Of Wall Street Service | Join Telegram