🧭 Introduction: The New Money Game

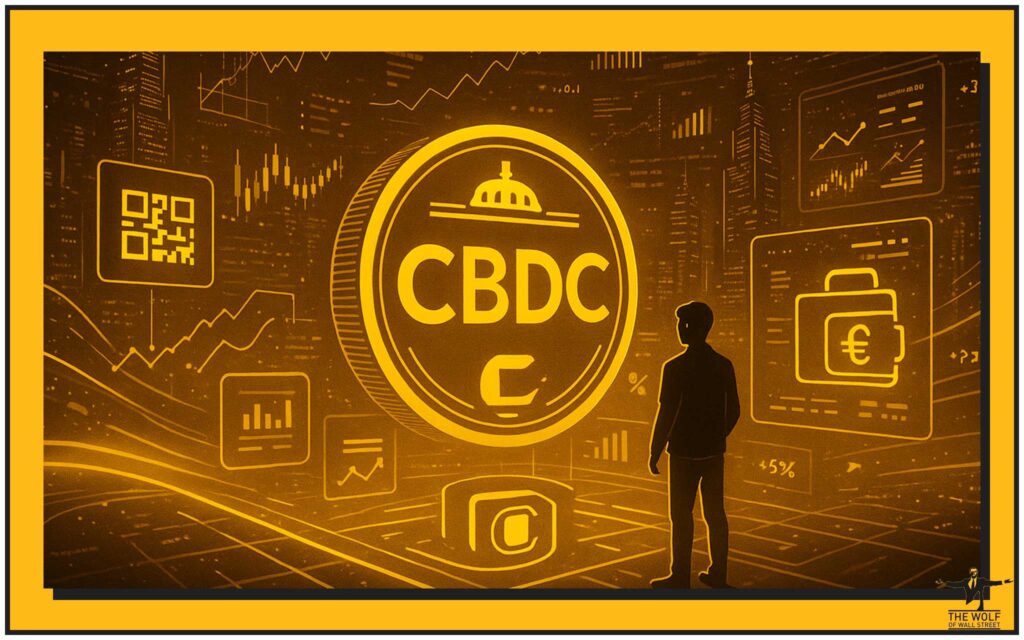

Listen up – money is evolving, fast. We’re not just talking about crypto anymore. We’re talking about something far bigger: Central Bank Digital Currencies (CBDCs) – the government’s high-powered play to digitise national currencies and take back control of the financial frontier.

Think of it as the biggest monetary shift since gold turned into paper. Now, that paper’s going digital. But this isn’t your typical decentralised crypto circus – it’s precision-engineered, regulated, and backed by central banks. The wolves of finance are watching closely, and so should you.

CBDCs are the next evolution of digital money, a bridge between the traditional system and the blockchain revolution.

💰 What Exactly Are CBDCs?

Let’s cut through the jargon. A CBDC is a digital version of your country’s fiat currency – pounds, dollars, euros – issued directly by the central bank.

Here’s the killer difference: it’s not crypto. No miners, no proof-of-work, no anonymity. It’s digital cash, minted by your government, and it holds the same value as physical currency.

If Bitcoin is a wild stallion running free across decentralised fields, a CBDC is that same horse – saddled, trained, and ridden by the state. It’s money on a leash, but with serious speed.

In short:

- CBDCs = government-backed digital money

- Crypto = decentralised private money

One runs on regulation. The other thrives on rebellion.

🔍 The Two Types: Retail vs Wholesale

CBDCs come in two breeds – both powerful, both strategic.

Retail CBDCs are for you, me, and every coffee-buying consumer out there. They let individuals make direct transactions with a digital pound or dollar issued by the central bank.

Wholesale CBDCs, on the other hand, are for the big dogs – commercial banks, financial institutions, and clearinghouses. They speed up settlement times, slash costs, and eliminate middlemen.

Examples:

- Bahamas’ Sand Dollar – a live retail CBDC

- Switzerland’s Project Helvetia – a wholesale pilot

CBDCs aren’t just a concept – they’re a strategic monetary weapon, reshaping how nations move money.

Explore the fundamentals of crypto and banking evolution in the newbie section or review digital finance policy insights.

⚖️ CBDCs vs Cryptocurrencies – The Digital Power Play

Let’s face it – this is a fight for control.

| Feature | CBDCs | Cryptocurrencies | Stablecoins |

|---|---|---|---|

| Issuer | Central Bank | Decentralised network | Private company |

| Control | Centralised | Decentralised | Semi-centralised |

| Backing | Fiat currency | Market-driven | Fiat or crypto reserves |

| Privacy | Limited | High | Moderate |

| Risk | Policy-driven | Volatility | Peg stability |

CBDCs offer stability, legal recognition, and trust – but at a price. Every transaction can be traced. That’s great for compliance, terrifying for privacy.

Cryptocurrencies? They’re the untamed frontier – decentralised, permissionless, and uncontrollable. And that’s exactly why governments are stepping in.

To understand the crypto landscape that birthed this digital revolution, check out Bitcoin insights and the altcoin market.

🧩 Why Central Banks Are Rushing In

Let me give it to you straight: central banks hate losing control.

The explosion of crypto, DeFi, and stablecoins lit a fire under them. They saw billions moving outside traditional systems – and they’re not letting that slide.

CBDCs give central banks:

- Faster, cheaper cross-border transactions

- Better financial inclusion for the unbanked

- Total visibility of money flows

- A tighter grip on monetary policy

According to the Bank for International Settlements (BIS, 2025), over 91% of central banks are exploring or piloting CBDCs (source).

This isn’t theory anymore – it’s strategy.

💳 How CBDCs Actually Work

Imagine this:

- The central bank issues digital pounds.

- Commercial banks distribute them to users.

- You store them in a digital wallet, just like crypto – except this one’s government-approved.

Unlike Bitcoin, which operates on decentralised ledgers, CBDCs use permissioned ledgers – secure, private systems controlled by the state.

Some use blockchain. Others use modified digital ledgers. The result? Instant settlements, low transaction fees, and total oversight.

To secure your funds in this evolving landscape, learn more about public and private key security and digital identity management.

🧱 Will CBDCs Replace Cash?

The million-pound question.

Here’s the truth – not yet. Central banks are cautious. While cash usage declines, the European Central Bank’s 2024 study showed that over 50% of Europeans still prefer cash for privacy reasons (source).

CBDCs will likely coexist with cash – at least for a decade. But make no mistake – the direction is digital, and it’s irreversible.

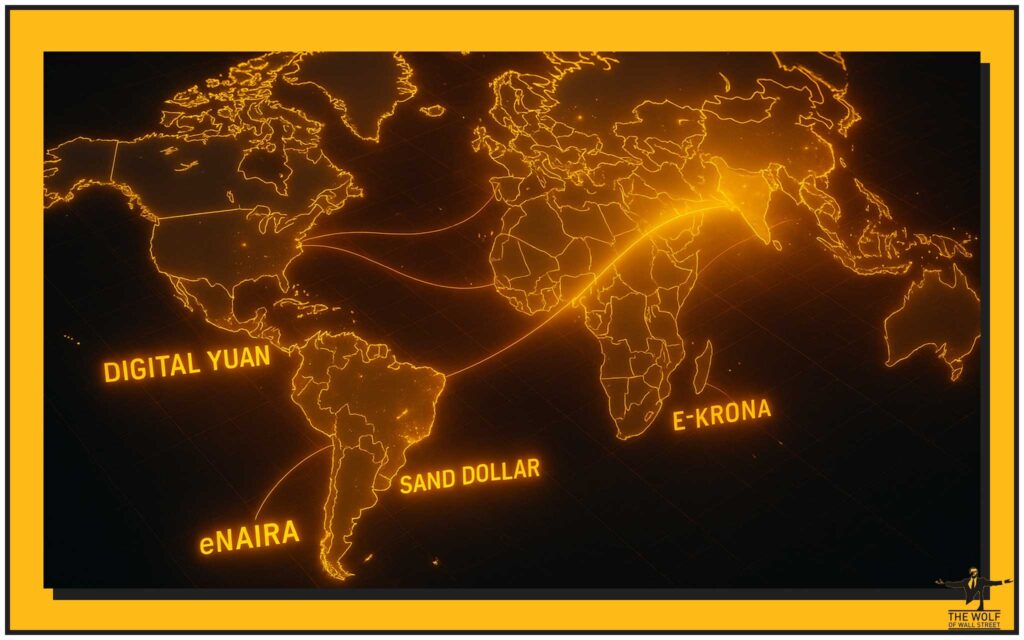

🌍 Global Adoption – Who’s Leading the Charge?

Here’s the global leaderboard – the early adopters setting the pace:

- 🇧🇸 Bahamas – Sand Dollar: Fully launched retail CBDC.

- 🇨🇳 China – Digital Yuan: Over 260 million users in pilot phase.

- 🇳🇬 Nigeria – eNaira: Active nationwide rollout.

- 🇯🇲 Jamaica – JAM-DEX: Live and operational.

- 🇸🇪 Sweden – e-Krona: Testing in progress.

- 🇬🇧 United Kingdom – Digital Pound: Under research.

According to the Atlantic Council’s CBDC Tracker (2025), 134 countries are exploring CBDCs (source).

🔐 The Benefits: Speed, Security, and Stability

CBDCs promise to supercharge financial systems:

- Instant payments with zero middlemen.

- Lower transaction costs across borders.

- Enhanced security and anti-fraud systems.

- Programmable money for targeted government spending.

As the BIS (2025) puts it, CBDCs could “future-proof national finance systems” (source).

⚠️ The Risks: Privacy, Power, and Policy Nightmares

Now here’s where it gets spicy. CBDCs are a double-edged sword.

They could empower – or enslave.

Risks include:

- Government overreach: every transaction is traceable.

- Cyberattacks: one hack could cripple a nation’s money supply.

- Bank disintermediation: people might ditch banks for direct wallets.

- Loss of privacy: anonymity could vanish.

Would you trust your government with a window into your every purchase?

Understand how privacy battles shape Web3 with digital sovereignty insights and AML compliance strategies.

🧠 The Technology Behind the Curtain

CBDCs rely on digital ledger technology (DLT) – sometimes blockchain, sometimes centralised servers.

Unlike crypto, these networks are permissioned, meaning only approved entities can validate transactions.

Some designs include offline functionality – so even if your internet goes down, your money still works. Others integrate smart contracts, opening the door to programmable payments.

For a deeper look at crypto tech security, explore multi-party computation and the new ERC-7265 safety circuit breaker.

🏦 Case Studies: From the Bahamas to Beijing

Real-world examples speak louder than theory.

- Bahamas: The Sand Dollar – first live CBDC. Seamless integration with banking systems.

- China: The Digital Yuan – piloted across major cities; 260M+ users.

- India: Digital Rupee – under RBI pilot, expanding fast.

Each project has shown that CBDCs can boost efficiency – but also trigger debates over surveillance and policy control.

The takeaway? CBDCs are inevitable, and they’re coming fast.

🧮 CBDCs and the Future of Banking

Here’s the shockwave no one wants to admit – CBDCs could cut commercial banks out of the picture.

If you can hold money directly with your central bank, why bother with an intermediary?

That’s called disintermediation, and it could transform the entire financial sector. Some analysts even call it “the death of traditional banking” (IMF, 2024).

The old system won’t go quietly. But the tide is turning.

🌐 CBDCs and the Crypto Market Connection

CBDCs might look like the enemy of crypto, but savvy traders see opportunity.

They won’t kill crypto – they’ll legitimise it. When governments go digital, the entire crypto market gains validation. Liquidity rises, infrastructure strengthens, and adoption accelerates.

That’s why elite traders in the The Wolf Of Wall Street Crypto Trading Community are already front-running CBDC trends with expert signals, volume calculators, and 24/7 support.

Join over 150,000 traders in the The Wolf Of Wall Street Telegram group for real-time crypto-CBDC insights.

🚀 The Future of CBDCs – Revolution or Regulation?

The future isn’t about choosing sides – it’s about positioning yourself.

CBDCs will redefine monetary policy, cross-border trade, and financial inclusion. The real power move is hybridisation: CBDCs for regulation, crypto for innovation.

The IMF (2024) predicts that CBDCs will “define the next decade of monetary evolution” (source).

🧭 Conclusion: The New Digital Empire

CBDCs aren’t coming – they’re already here.

From Bahamas to Beijing, the financial elite are already building the rails for a new digital economy. The question isn’t if – it’s when.

So, are you ready to profit from it?

Get ahead of the curve with The Wolf Of Wall Street, where traders master volatility before the world catches up.

For deeper market insight, read the Crypto Profit-Taking Wolf’s Guide or our Research Opportunities Hub.

❓ FAQs

1. Are CBDCs the same as stablecoins?

No. Stablecoins are private tokens backed by fiat reserves, while CBDCs are state-issued and fully sovereign.

2. Will CBDCs kill crypto?

Not likely. Crypto will coexist as the innovation layer, while CBDCs become the regulatory base.

3. Can CBDCs be anonymous?

Partially. Central banks promise limited privacy, but traceability is fundamental.

4. Which countries lead CBDC development?

China, Bahamas, Nigeria, India, and Sweden are at the forefront.

5. When will the UK launch its CBDC?

The Digital Pound remains in research and testing through 2025, with pilot programmes expected soon.

The Wolf Of Wall Street Crypto Trading Community provides VIP signals, expert analysis, and essential tools for navigating volatile markets. Join over 150,000 traders for real-time market updates, insights, and 24/7 support.