🔥 Introduction: The Money-Making Power of a White Paper

If you’re in crypto and you don’t have a white paper, you’re invisible. Period. A white paper is your project’s golden ticket—your shot to prove you’re legit, show off your vision, and persuade investors to throw money your way. Done right, it educates, inspires confidence, and sells without sounding like a sales pitch. Done wrong, it screams “scam” faster than a rug pull.

This guide is going to show you exactly how to write, structure, and format a killer white paper that makes people lean in, not scroll away.

📜 The Origin Story: Where White Papers Came From

White papers didn’t start in crypto. They were born in government. About 100 years ago, the British government created them to inform citizens about key policy decisions. From there, businesses hijacked the format and turned it into a marketing tool to persuade decision-makers.

Crypto projects made them mandatory. Why? Because crypto is new, volatile, and risky—investors need something solid to trust. The white paper became the rulebook, the blueprint, the gospel of a project.

🎯 The True Purpose of a White Paper

Let’s cut the crap. The purpose of a white paper is not just to look smart—it’s to:

- Educate potential investors about the problem your project solves.

- Prove credibility with research, stats, and facts.

- Persuade readers to believe your solution is the best.

It’s a trust-building machine. You don’t hype—you inform. You don’t oversell—you prove.

🧑🤝🧑 Know Your Audience Before You Write

Before you write a single word, you need to know exactly who you’re talking to:

- Retail investors want simplicity. Keep the language clean, avoid jargon.

- Institutional investors want data, risk analysis, compliance.

- Developers want technical depth. Show them you know your stuff.

Too many projects make the mistake of writing for themselves—big words, complex sentences, no clarity. Don’t do it. Write for the reader, not your ego.

👉 Beginner investors? Check out How to Buy Crypto.

🧩 The Core Anatomy of a White Paper

Every powerful white paper follows a formula. Miss one piece and you’re dead in the water:

- Problem statement – Make it painful. Investors must feel the urgency.

- Supporting data – Stats, studies, market reports. Prove it’s real.

- Your solution – Enter your project. Show why you’re the fix.

- The team – Faces, names, backgrounds. No anonymous ghosts.

- Tokenomics – Supply, distribution, mechanics. Numbers must make sense.

- Roadmap – Clear goals, timelines, milestones.

- Investor protections – Compliance, disclaimers, risk mitigation.

👉 Want a deep dive into project economics? Learn more in Tokenomics.

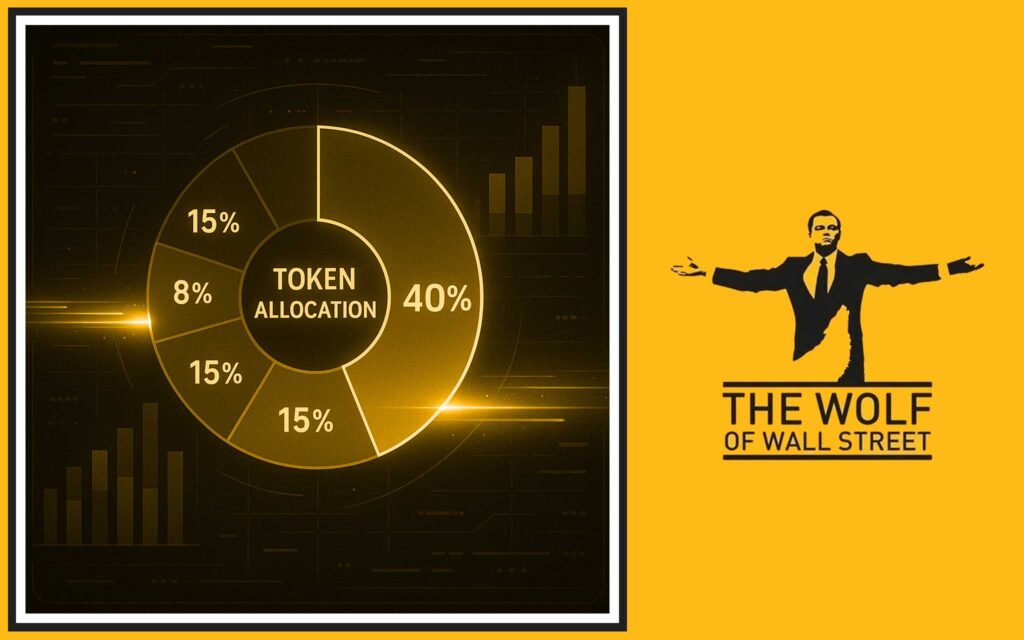

💰 Tokenomics: The Investor’s First Stop

Let’s be real. The first thing serious investors check is tokenomics. If your numbers don’t add up, your white paper goes straight in the trash.

Key elements:

- Total supply, circulation, and burn mechanics.

- Utility: what the token is actually used for.

- Distribution: fair allocation, no whale traps.

Bad tokenomics has killed more projects than bear markets. Nail this section, or pack it up.

🛡️ Investor Protections & Trust Signals

Crypto investors have been burned too many times. They need reassurance. Show them:

- Fundraising transparency: where funds go, how they’re managed.

- Legal compliance: disclaimers, licensing, regulatory notes.

- Security practices: audits, KYC, smart contract transparency.

👉 Want to avoid compliance nightmares? Check out this Crypto AML Guide.

📅 Roadmaps That Actually Inspire Confidence

Vague promises don’t cut it. Your roadmap must:

- Break into short, mid, and long-term goals.

- Use measurable KPIs, not “we will change the world.”

- Be visual: charts, timelines, graphics.

Remember, a roadmap isn’t just for investors—it keeps your own team accountable.

🎨 Design & Formatting: Make It Easy to Digest

You could have the best idea in the world, but if your white paper looks like a wall of text, no one will read it. Formatting matters:

- White space is your friend.

- Simple language makes it accessible to beginners.

- Professional design signals you’re serious.

- Brand alignment: colours, fonts, visuals should match your identity.

Pro tip: hire a graphic designer. This is not a DIY Canva job.

⚔️ The Bitcoin & Ethereum Case Studies

Two iconic examples:

- Bitcoin white paper: Short, academic, laser-focused. It was less a marketing tool and more a manifesto.

- Ethereum white paper: A living, evolving document. More technical, more adaptable.

What you can learn: Be clear, but also be flexible as your project grows.

🤯 Common Mistakes That Kill White Papers

Here’s where most projects blow it:

- Overly technical jargon that confuses beginners.

- Hype with zero proof.

- Copy-pasting someone else’s format.

- Massive walls of text with no visuals.

These mistakes don’t just look bad—they destroy credibility.

👨💼 DIY vs. Hiring Pros: Who Should Write It?

Founders are visionaries, but most can’t write for shit. That’s the truth. Writing is a skill—and when millions are at stake, you don’t cut corners.

Options:

- DIY: only if you’ve got serious writing chops.

- Hire specialists: white paper writers exist, and they’re worth every penny.

👉 Need insights before you hire? Explore Researching Crypto Opportunities.

📢 Distribution: How to Get Eyeballs on Your White Paper

A brilliant white paper hidden in a dark corner of your website is worthless. You’ve got to promote it:

- Publish it prominently on your homepage.

- Share across Telegram, Twitter, Discord.

- PR blasts and guest posts in crypto news outlets.

- SEO optimisation to keep traffic flowing long-term.

📊 Measuring White Paper Success

If you can’t measure it, you can’t improve it. Key metrics:

- Downloads and read-through rates.

- Investor inquiries after publication.

- Engagement on socials.

- Mentions and shares in the community.

Use these to refine, tweak, and keep your white paper sharp.

🚀 White Papers & Fundraising Models

Whether it’s an ICO, STO, venture capital round, or IPO—white papers stay relevant. Why?

Because they are your bridge between idea and funding. Investors don’t drop cash without a detailed map of where it’s going.

👉 Thinking of listing a token? Learn the Crypto Token Listing Process.

💡 Advanced Tips to Take Your White Paper Next Level

Want to separate yourself from the amateurs? Do this:

- Storytelling: frame your problem and solution like a narrative.

- Visuals: infographics, flowcharts, and illustrations.

- Evolve: keep updating the paper as your project grows.

🤝 Final Word: Why Your White Paper Is Your Golden Ticket

Without a white paper, your project doesn’t exist. With one, you have a fighting chance at raising capital, winning trust, and building adoption. Do it right, and it’s the difference between being forgotten and being funded.

📌 FAQs

1. What’s the difference between a white paper and a lite paper?

Lite papers are short, simplified versions for beginners or quick reads. White papers are the full, detailed breakdown.

2. How long should a crypto white paper be?

Usually 10–25 pages, but length matters less than clarity and completeness.

3. Can you launch without a white paper?

Technically, yes. But good luck getting serious investors without one.

4. Should white papers include legal disclaimers?

Absolutely. Disclaimers protect you and set boundaries for investors.

5. How often should you update a white paper?

Every time your project roadmap shifts, funding model changes, or new regulations apply.

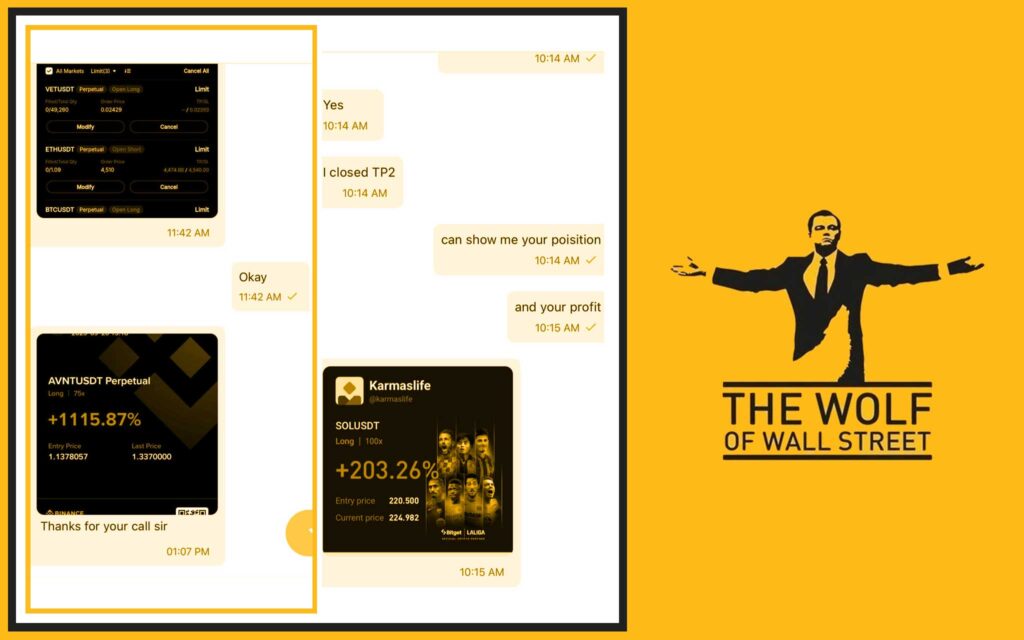

The The Wolf Of Wall Street crypto trading community is your ultimate resource for navigating the wild world of crypto. Here’s what you get:

- Exclusive VIP Signals – Proprietary signals designed to maximise profits.

- Expert Market Analysis – In-depth breakdowns from seasoned traders.

- Private Community – Network with 100,000+ like-minded traders.

- Essential Tools – Volume calculators, decision-making resources.

- 24/7 Support – Get help anytime from dedicated pros.

Empower your crypto trading journey:

- Visit our service page for details.

- Join our Telegram community for real-time updates.