If you think “digital money” begins and ends with Bitcoin, you’re missing the most ambitious monetary project on Earth. The digital yuan – officially called the e-CNY – isn’t just another payment app; it’s China’s power play to reshape how cash, banking, and sovereignty operate in the digital era.

This is the Wolf of Wall Street breakdown: no fluff, no academic jargon – just the facts, the strategy, and how this move could shake crypto markets and global finance alike.

🚀 The Elevator Pitch: Why the Digital Yuan Matters Now

Here’s the deal – when Beijing rolls out a new financial instrument, it’s not a “beta test.” It’s a declaration. The digital yuan (e-CNY) is China’s central bank digital currency (CBDC), issued by the People’s Bank of China (PBOC). It’s fully backed by the state, fully programmable, and fully capable of changing the game.

What it’s not:

- It’s not a cryptocurrency.

- It’s not decentralised.

- It’s not optional – it’s the next phase of state money.

So why does it matter? Because while the world debates crypto regulation, China’s already deploying its next-generation cash – programmable, traceable, and offline-capable. That’s how you stay ahead of the pack.

If you’re still wrapping your head around CBDCs, check out our primer on what a CBDC is and how it differs from retail and wholesale CBDCs.

🧭 Quick Definitions: Making Sense of the Buzzwords

Let’s clear the fog.

- CBDC (Central Bank Digital Currency): A digital form of fiat money, issued and backed by a central bank. It’s the digital equivalent of cash – not a crypto token.

- e-CNY (Digital Yuan): China’s CBDC – a digital version of the renminbi.

- Stablecoins (like USDT): Private tokens pegged to fiat. Useful, but not legal tender.

- Crypto: Decentralised, permissionless, and volatile – a different world entirely.

The e-CNY isn’t just another app like WeChat Pay or Alipay. Those are private payment systems sitting on top of the existing banking layer. The digital yuan is the money itself – issued straight from the PBOC’s vaults.

If you’re looking for a comparison, read our guide on stablecoins and their role in digital finance.

⏱️ Timeline: From Lab to Live (2014 → 2025)

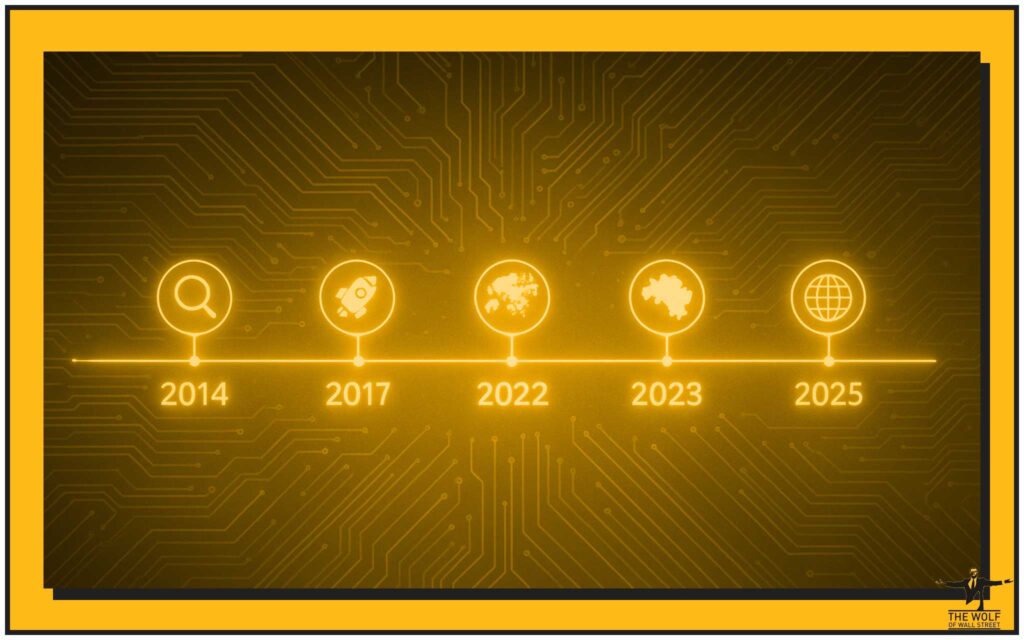

The digital yuan’s story starts in 2014, when the PBOC began researching digital currency. Fast forward to 2020, and China started rolling out pilot programmes in major cities like Shenzhen, Suzhou, and Chengdu. By 2021, the first foreign users could test the app during the Winter Olympics in Beijing.

By 2024, according to the Atlantic Council, e-CNY transaction volume had crossed ¥7 trillion – a staggering leap from ¥1.8 trillion in mid-2023.

And now, in 2025, the e-CNY is in full-scale deployment across 30+ pilot zones, with over 120 million wallets in use and growing interoperability with Hong Kong, ASEAN, and even Belt and Road partners.

For a deeper policy comparison, check our analysis on how nations use digital assets as treasury tools.

🔧 How e-CNY Works: The Two-Tier Engine

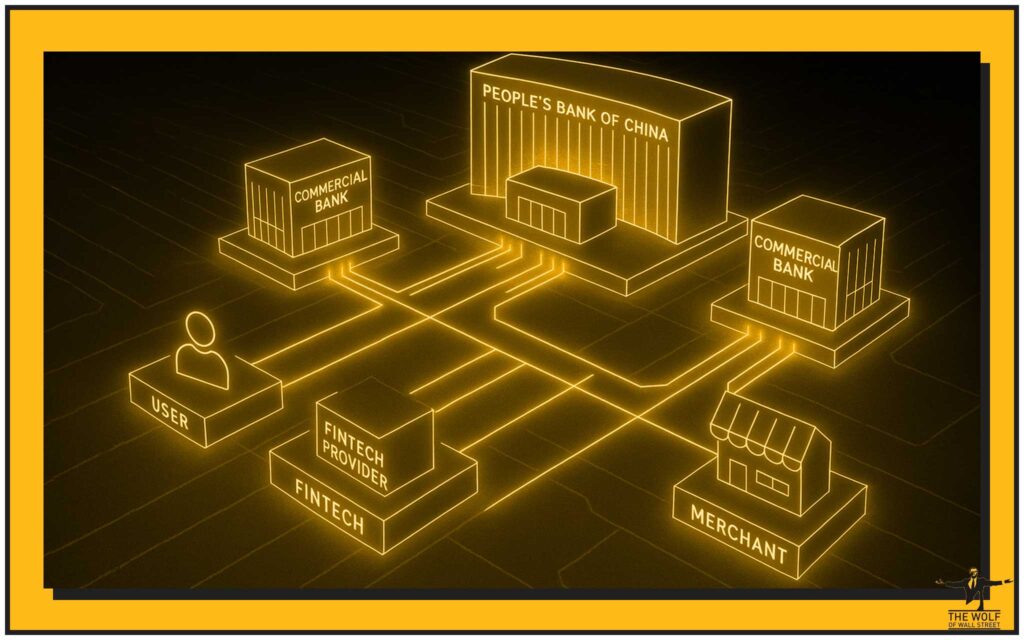

Think of the digital yuan as a two-tier financial engine.

- Tier 1: The PBOC issues e-CNY directly to commercial banks and authorised operators.

- Tier 2: Those banks distribute it to users and merchants – handling KYC, wallets, and customer service.

- Tier 2.5: Emerging fintechs and service providers that enhance functionality, UX, and merchant APIs.

Unlike Bitcoin, transactions aren’t mined; they’re verified and settled instantly through centralised infrastructure.

It’s fast. It’s final. And it’s built to operate even offline, using NFC and SIM-based modules.

Want to see how this compares to offline CBDCs? Check our guide on online vs offline CBDCs and the digital cash revolution.

🔐 Wallet Types & Limits: From Anonymous to Verified

The PBOC designed four wallet tiers, each with different KYC and spending limits:

| Wallet Level | KYC Requirement | Daily Limit | Balance Cap | Use Case |

|---|---|---|---|---|

| Level 4 | Mobile number only | ¥2,000 | ¥10,000 | Low-risk microtransactions |

| Level 3 | ID verification | ¥5,000 | ¥50,000 | Everyday retail use |

| Level 2 | Bank-linked | ¥50,000 | ¥500,000 | Regular consumer/merchant |

| Level 1 | Full KYC | ¥500,000 | ¥1 million+ | Institutional/commercial |

This tiered anonymity system allows small anonymous transactions while maintaining auditability for large transfers.

Need to understand how crypto wallets differ? Explore our primer on public and private keys and how they relate to self-custody wallets.

🛠️ Getting Started: Step-by-Step Wallet Setup

Setting up an e-CNY wallet is straightforward:

- Download the e-CNY app (available in pilot cities).

- Register with your phone number.

- Select a partner bank (ICBC, CCB, Agricultural Bank, etc.).

- Choose your KYC level.

- Load funds from your bank account.

- Start transacting via QR code, NFC tap, or offline mode.

Transactions settle instantly. Refunds? They’re rare – the digital yuan is legal tender, meaning once sent, it’s final.

For broader onboarding insights, check our guide on how to buy crypto step by step.

🛒 Using e-CNY Day-to-Day: Real-World Use Cases

You can already use e-CNY to:

- Pay subway fares in Shenzhen

- Buy lunch at Meituan restaurants

- Pay electricity bills

- Receive payroll

- Send red envelopes during festivals

Merchants get settled fast and pay lower fees than Alipay or WeChat Pay. It’s a power move to make state-backed payments the cheapest option in the market.

The move fits a broader trend toward financial inclusion – something we explore in our piece on open banking advantages.

⚔️ e-CNY vs WeChat Pay & Alipay: The Face-Off

Here’s where the gloves come off.

| Feature | e-CNY | Alipay / WeChat Pay |

|---|---|---|

| Issuer | PBOC (State) | Private companies |

| Backing | Sovereign credit | User deposits |

| Settlement | Instant / final | Clearing via banks |

| Privacy | Tiered anonymity | Full data visibility |

| Offline use | Yes | No |

The result? The e-CNY cuts out private middlemen.

But convenience still rules – so China made the smart move: integration. Users can now link e-CNY wallets inside WeChat and Alipay apps for seamless spending.

If privacy matters to you, read our deep-dive on digital sovereignty in Web3.

🕵️ Privacy, Programmability & Control: The Hard Questions

Privacy – that’s the elephant in the room.

The PBOC promises “controllable anonymity” – meaning small payments are private, but the state can trace transactions when necessary. Critics, including the Geopolitical Monitor, say this introduces a potential surveillance layer.

Programmability is the double-edged sword here.

The e-CNY can support smart contract-like features:

- Purpose-limited spending (e.g., stimulus vouchers).

- Time-bound tokens (expire if unused).

- Automated tax settlement.

Sound futuristic? It’s already being tested.

If you’re curious about privacy-enhancing tech, see our guide on zero-knowledge proofs in crypto or learn about CBDC privacy risks.

📊 Adoption & Scale: Where the Numbers Land

By mid-2024, the e-CNY had processed over ¥7 trillion in transactions, per Atlantic Council.

More than 120 million personal wallets and 30 million merchant wallets were active.

Adoption hotspots:

- Public transit (Shenzhen, Chengdu)

- E-commerce (JD.com, Meituan)

- Cross-border (Hong Kong pilots)

The average transaction size? Roughly ¥260, showing strong retail uptake.

To put it in macro perspective, explore our latest crypto market indicator breakdown.

🌏 Cross-Border Experiments: Hong Kong & Beyond

In 2024, the Hong Kong Monetary Authority and PBOC expanded their cross-boundary pilot, letting residents in both regions use e-CNY for retail payments.

This pilot connects directly to the mBridge platform, a multi-CBDC network that could allow instant FX settlements between China, Thailand, and the UAE.

For traders, this is the future of settlement speed and arbitrage reduction – check our P2P vs centralised exchanges guide to understand why that matters.

🐺 What It Means for Crypto Markets: The Wolf’s Take

Now let’s talk money.

CBDCs like the e-CNY reshape liquidity. When fiat becomes programmable, it pressures stablecoins – but it also legitimises digital assets as a whole.

Three implications for traders:

- Liquidity concentration: If e-CNY integrates with exchanges, on/off ramps become instant.

- Volatility compression: State-backed settlement dampens short-term market noise.

- Regulatory spillover: Expect other nations to fast-track CBDCs to stay competitive.

Smart traders use these inflection points. See our playbook on mastering crypto dominance trading strategies and crypto profit-taking methods.

☕ Risks & Critiques: Don’t Drink the Kool-Aid

Let’s cut through the hype.

Privacy is the top concern – as seen in Reuters’ 2025 coverage, users worry about transaction tracking.

Bank disintermediation is another: if consumers hold funds directly with the central bank, commercial banks could lose deposits.

Cybersecurity remains a live risk – from SIM swaps to potential offline double-spend attacks.

Want to understand how this compares to fiat’s own risks? Read our fiat freezing vs crypto blacklisting guide.

🌐 e-CNY vs Other CBDCs: EU, US, Emerging Markets

Compared to Europe’s cautious digital euro and America’s still-theoretical Fed digital dollar, China is miles ahead.

The IMF’s 2024 paper (IMF, 2024) confirmed: no other nation has deployed retail CBDC at China’s scale.

Meanwhile, BRICS nations are quietly experimenting with cross-border CBDCs, inspired by China’s mBridge leadership.

For an outlook on U.S. digital currency plans, read our analysis of what the U.S. CBDC might look like.

❓ FAQs: Straight Answers, No Spin

Is the digital yuan a cryptocurrency?

No. It’s a state-issued digital currency – centralised, not decentralised.

Can foreigners use e-CNY?

Yes, in pilot regions like Hong Kong, Shenzhen, and during international events.

Is it private?

Only at small transaction levels. Large payments are fully traceable.

Will it replace cash?

Not yet – it’s a complement. But the writing’s on the wall.

How is it different from USDT?

USDT is privately issued and dollar-backed; e-CNY is sovereign currency.

Explore the USDT profitability guide for deeper comparison.

🧭 Playbook for Investors & Businesses: Practical Next Steps

If you’re a merchant, developer, or investor, here’s your roadmap:

- Compliance: Follow crypto AML best practices.

- Infrastructure: Integrate e-CNY rails into POS or API stacks.

- Hedging: Use it to manage FX exposure in RMB trades.

- Research: Track pilot outcomes before scaling – it’s early days.

Global payment flows are about to be rewritten. Keep an eye on the crypto travel rule and compliance updates.

💼 The Belfort Close: What Smart Money Does Next

Here’s the truth:

The digital yuan isn’t an experiment – it’s the template for how digital money will function globally.

Three possible futures:

- Status Quo: e-CNY grows domestically, but remains localised.

- Acceleration: Cross-border adoption expands via Belt & Road.

- Domination: The e-CNY becomes a settlement layer for Asia’s trade ecosystem.

If you’re watching for wealth pivots, study our crypto opportunity research guide and Bitcoin ETF insights. The future of money is already programmable – question is, are you?

🧩 The The Wolf Of Wall Street Advantage: Trade Like a Wolf

You can know the theory – or you can profit from it.

The The Wolf Of Wall Street crypto trading community gives you the edge you need to navigate volatility and seize opportunity:

- Exclusive VIP Signals: Insider-grade precision.

- Expert Market Analysis: From traders who live this every day.

- Private Community: 150,000+ sharp minds and market hawks.

- 24/7 Support: Because profit never sleeps.

👉 Visit The Wolf Of Wall Street Services or join the Telegram community to plug into the flow.

Because in trading – just like on Wall Street – if you don’t have an edge, you are the edge.

🗒️ Glossary

- CBDC: Central Bank Digital Currency – state-backed digital money.

- PBOC: People’s Bank of China – China’s central bank.

- e-CNY: Electronic Chinese yuan.

- Programmability: Ability to embed rules or conditions into money.

- Offline Payments: NFC-based CBDC transactions without internet.

- Tiered Wallets: KYC-based e-CNY account structure.