🐺 Introduction: Enter the Wolf’s Den of Tokenomics

You want to make real money in crypto? Then forget the hype and influencer noise—because tokenomics is the first, last, and only line between fortune and failure. Every coin you see pumping or dumping? It’s not random. It’s engineered by the rules of tokenomics. This isn’t theory—it’s the playbook the pros use. If you’re serious about turning volatility into opportunity, strap in. The Wolf’s going to show you how the money’s really made.

🎯 What is Tokenomics? Cutting Through the Hype

Tokenomics is the economic framework behind any crypto project. It’s the DNA that dictates supply, demand, incentives, and ultimately—price action. Ignore it, and you’re gambling. Master it, and you’re trading with the house’s edge.

Here’s the brutal truth: 95% of investors lose because they never even read the tokenomics. Don’t be one of them.

💸 Why Tokenomics Can Make or Break Your Crypto Bet

Ask yourself—why do some coins explode, and others flatline? It’s not luck. It’s tokenomics at work.

- Binance Coin (BNB): A masterclass in burning, utility, and incentive alignment. Holders get richer, not diluted.

- SushiSwap (SUSHI): Handed out tokens like candy. The price? Collapsed 74% in days. The Wolf doesn’t chase junk.

Bottom line: If you don’t know the rules, you’re playing a game you can’t win.

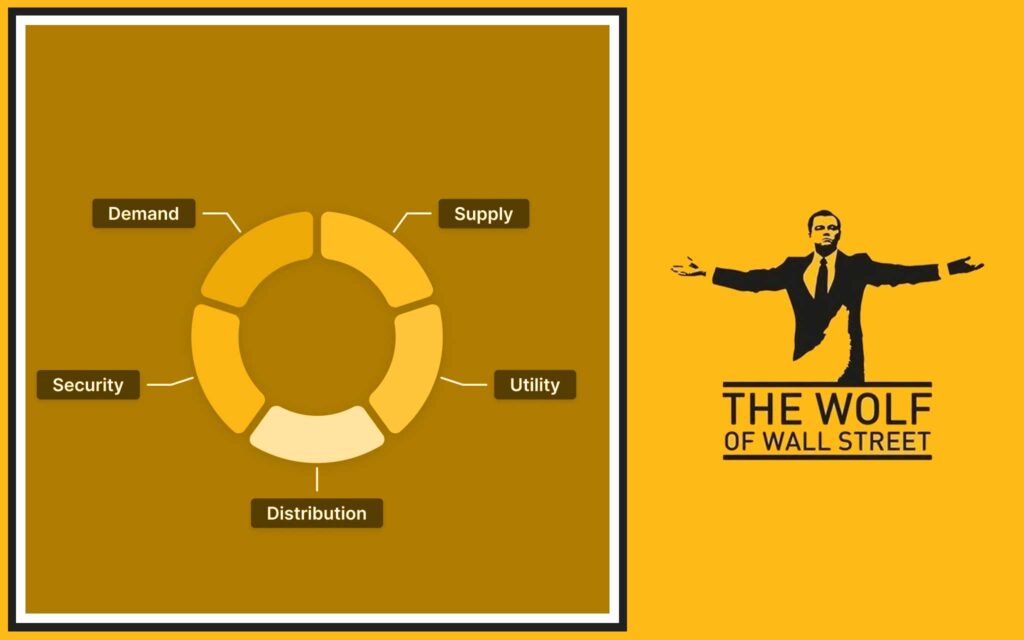

🔥 Core Pillars of Tokenomics: Know These or Get Burned

Every real project stands on four pillars:

- Supply: How many tokens exist now? How many will exist ever?

- Demand: Why would anyone actually need or want this token?

- Utility: Does it actually do something, or is it a bag of hot air?

- Incentives: Who profits, who pays, and what keeps everyone honest?

Get these wrong, and the whole thing crumbles.

Looking to sharpen your skills? Dive deeper into the Crypto Token Listing Process Guide, discover top tactics in the Research Crypto Opportunities Guide, or start with the basics in our Newbie Section.

🚦 Token Supply: Circulating, Max, and Why It Matters

Let’s get real: supply is everything. If the project can print more tokens at will, your bags are toast.

- Circulating Supply: What’s out in the wild right now.

- Max Supply: The absolute cap—no more, ever.

- Total Supply: Tokens minted, but maybe locked or unissued.

Scarcity sells. Think Bitcoin—capped at 21 million, always a buyer. Compare that to coins with no max? Welcome to infinite dilution.

Learn more about supply dynamics in our Cryptocurrencies Category and keep tabs on up-and-comers in the Altcoins Category.

📊 Market Cap & Fully Diluted Valuation (FDV): Don’t Be Fooled

Biggest rookie mistake? Chasing low-cap coins with massive FDVs.

- Market Cap: Circulating supply x current price. Looks cheap? Maybe not.

- FDV (Fully Diluted Valuation): Max supply x current price. This is the real ceiling.

Wolf Wisdom: If the FDV is 10x higher than the market cap, there’s a dump coming the moment locked tokens unlock. Get out before the insiders do.

🧑💼 Token Allocation: Who Gets What – and Why You Should Care

Here’s where most get played. The pie isn’t divided equally:

- Founders & Team: How much do they control? If it’s 50%+, you’re at their mercy.

- VCs & Early Investors: Insiders always want an exit—watch the vesting.

- Community: The best projects empower the crowd, not just the suits.

Wallet watcher pro-tip: Use blockchain explorers to track unlocks and whales moving tokens. If insiders are selling, the party’s over.

💣 Token Release Schedules: Vesting, Cliff, and the Dump

You ever wonder why coins nuke on a random Tuesday? Token unlocks.

- Cliff: Period before any tokens unlock.

- Vesting: Gradual release to team/investors.

- Public Sale: Often liquid from day one.

Check the whitepaper. If there’s a cliff and then a tsunami of new tokens—run. The dump is coming.

💱 Inflationary vs. Deflationary Models: The Real Money Mechanics

This is where the real edge lies:

- Inflationary: More tokens minted over time (think rewards, staking). Great until rewards dump price.

- Deflationary: Tokens are burned, supply shrinks, value rises (see BNB or buyback coins).

The Wolf’s pick: Hybrid models—reward early, burn later, keep utility growing.

🔗 Token Utility: Beyond ‘Just a Coin’ – Why Real Use Matters

Let’s be clear—if your token has zero use, it’s dead on arrival.

- Payments: Used for fees, services, or goods.

- Governance: Vote on project changes.

- Staking: Earn yield, secure the network.

- Access: Unlock features, tiers, or exclusive content.

2025 trend alert: Watch for tokens driving decentralised physical infrastructure (DePIN), restaking, and real-world asset integration. The more ways a token is needed, the stronger the demand floor.

🚀💀 Case Studies: Tokenomics That Print Money vs. Tokenomics That Tank

Binance Coin (BNB): The Playbook for Success

- Buyback & Burn: Quarterly burns, reducing supply—holders benefit directly.

- Utility: Fee discounts, launchpad access, DeFi staking.

- Result: Outperformed 99% of the market.

SushiSwap (SUSHI): A Cautionary Tale

- High Emissions: Paid out huge rewards—caused hyperinflation.

- Weak Utility: Copied competitors, never innovated.

- Result: Price dumped 74% in three days after farm launch. Ouch.

Lesson: Tokenomics isn’t window dressing. It’s life or death for your portfolio.

✅ Ten Steps to Analyse Tokenomics Like a Pro (Checklist)

- Read the Whitepaper: No exceptions.

- Check Token Supply: Circulating, total, and max.

- Study Allocation: Who owns what, and why?

- Inspect Vesting Schedules: Look for cliffs and mass unlocks.

- Assess Utility: Does the token have real use?

- Understand Incentives: What motivates holders to stay?

- Check for Deflationary Mechanisms: Buybacks, burns, fees.

- Calculate Market Cap & FDV: Avoid lopsided ratios.

- Track Community Engagement: Real users, not just bots.

- Monitor Insider Activity: Are founders holding, or dumping?

Print it. Memorise it. Live by it.

🚨 Warning Signs: Tokenomics Red Flags That Scream ‘Run!’

- Over 50% allocated to team/VCs

- Unlock schedules with big cliffs

- No utility or only vague promises

- Obscure whitepaper, no transparency

- Anonymous founders—zero accountability

If you see these? Get out. Fast.

🔮 2025 Trends: What’s Hot and What’s Dead in Tokenomics

In:

- Buyback & burn mechanics – more projects are following BNB’s model.

- Revenue sharing – token holders getting real, on-chain profit splits.

- Decentralised community incentives – power to the people.

- Dynamic, flexible reward structures – fewer ponzis, more sustainability.

Out:

- Endless inflation – nobody wants to hold what’s endlessly printed.

- Fake utility – if you can’t explain it in two sentences, it’s a gimmick.

- Opaque vesting – investors want full transparency.

Stay ahead—focus on projects innovating, not just copying yesterday’s trends.

❓ Frequently Asked Questions (FAQ)

Q1: How do I know if a token is inflationary or deflationary?

Check the whitepaper or token dashboard—look for burn schedules or ongoing rewards.

Q2: Is token allocation to VCs always bad?

Not if it’s reasonable (<20%) and vesting is long-term. But high VC allocation with short vesting? Danger.

Q3: Can tokenomics change after launch?

Yes, sometimes via governance. But major changes without community input? Red flag.

Q4: Where can I see token unlock schedules?

Websites like TokenUnlocks or project docs. Always check before you buy.

Q5: Do all great projects have perfect tokenomics?

No project is perfect—but the best keep improving. The rest fade away.

🏁 Conclusion: No Fluff, Just Profit – The Wolf’s Final Word

Let’s put it straight: Tokenomics is the X-ray vision of crypto investing. Ignore it and you’re the mark at the table. Master it, and you’re holding the cards. The winners in this market aren’t the loudest—they’re the sharpest. They know how to read, research, and ruthlessly cut losers from their portfolios.

Don’t gamble with your money. Learn the rules, spot the red flags, and move with conviction.

🏆 Ready to Win? Next Steps for Serious Crypto Investors

Want to stack the odds in your favour? Don’t just sit there—join a community that lives and breathes this stuff. The The Wolf Of Wall Street crypto trading community offers:

- Exclusive VIP signals—proprietary insights for max profit

- Expert analysis from real market veterans

- Private network of 100,000+ sharp traders

- 24/7 support and top trading tools to keep you ahead

Ready to elevate your crypto game?

Check out our full service, or get live tips in our Telegram community.

And for more hands-on trading strategies, visit:

- Trading Insights

- Bollinger Bands Trading Strategy

- Master Crypto Order Types

- How to Buy Crypto Guide

- Newbie Section

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.

For ongoing market insights, visit the News, Trending, and Hot categories. New to crypto? The Newbie Section is your launchpad.

Ready to stop gambling and start winning? This is the Wolf’s way—analyse, act, and always move with intent. Welcome to the smart money.