Listen up. Buying crypto is easy. Knowing when to sell crypto? That’s where fortunes are made or lost. This isn’t about gut feelings or chasing pumps. It’s about strategy, discipline, and understanding the signals the market and the projects themselves are screaming at you. Get this wrong, and you’re just gambling. Get it right, and you lock in profits and protect your capital. This guide shows you how to make the smart calls.

🎯 The Profit Play: Setting Your Target Price

The simplest, most straightforward reason to sell your crypto is because you’ve hit your predetermined profit target. This approach requires discipline but removes a huge amount of emotional stress from the selling decision.

Defining Your Goals Before You Buy.

Before you even click that ‘buy’ button, you should have a clear idea of what you want to achieve with that investment. Are you looking for a 2x return? A 5x? Or a specific price level based on your analysis? Having a concrete target in mind from the outset gives your investment a purpose and your selling decision a clear trigger. This is a core part of any trading plan.

Sticking to the Plan: Taking Profits Without Greed.

The market can be intoxicating. When prices are soaring, the temptation to hold on for “just a little more” is immense. This is where greed creeps in and often leads to disaster. If you’ve set a rational profit target, and the price hits it, execute your plan. Sell. Taking profits off the table is never a bad decision. You can always re-evaluate and re-enter later if conditions change, but locking in gains protects you from sudden reversals.

Example: Selling Ether at $4,000 after buying at $3,100.

Imagine you bought Ethereum (ETH) at $3,100, and based on your research of its potential and resistance levels, you set a target price of $4,000. When ETH reaches $4,000, you sell, securing a profit of approximately 29%. You don’t wait to see if it will hit $4,100 or $4,500. You stick to your plan.

🛡️ Stop-Loss Orders: Your Safety Net

Just as important as taking profits is protecting yourself from significant losses. That’s where stop-loss orders come in. They are your non-negotiable safety net.

What is a Stop-Loss? Automatic Selling.

A stop-loss order is an instruction you place with an exchange to automatically sell your cryptocurrency if its price drops to a specific, predetermined level. It’s designed to limit your potential loss on a position. Once the price hits your stop-loss level, the order triggers, and your crypto is sold at the best available market price.

How to Set Effective Stop-Loss Levels.

Setting stop-loss levels isn’t random. It should be based on your risk tolerance and your technical analysis:

- Percentage-Based: Deciding you’ll sell if the price drops, say, 10% or 15% below your entry price.

- Support Levels: Placing your stop-loss just below a significant support level identified on price charts. If price breaks that support, it’s likely to fall further.

- Volatility-Based: Using indicators like Average True Range (ATR) to set stops based on the typical daily price movement of the asset, placing the stop outside normal fluctuations.

Avoiding Emotional Exits During Dips.

Markets are volatile. Prices dip. Without a stop-loss, fear can take over, leading you to panic-sell at the worst possible moment. A pre-set stop-loss order removes this emotional component. It executes your risk management plan automatically, based on logic, not fear.

🌍 Market Conditions: Reading the Bigger Picture

Sometimes, the decision to sell isn’t driven by your individual asset’s performance but by broader market signals or external events.

Spotting Market Overvaluation and Bubbles.

When prices detach from fundamental value and are driven purely by speculation, hype, and irrational exuberance, you’re likely in a market bubble. Signs include parabolic price rises, extreme positive sentiment, and widespread media attention. Selling during these periods, even if prices are still rising, can protect you from the inevitable crash. This requires a contrarian mindset.

Reacting to External Shocks and Regulatory Scrutiny.

Major global events – geopolitical crises, economic recessions, significant regulatory crackdowns on Cryptocurrencies – can drastically impact market sentiment and prices. If a major negative event occurs that threatens the stability of the market or your specific investment, selling to preserve capital might be a prudent move. Stay updated on market News and Policies for this.

Selling in Major Downtrends or Bear Markets.

If the overall market enters a confirmed primary downtrend (a bear market), holding onto assets (especially speculative ones) can lead to severe losses. Selling early in a downturn, or during corrective rallies within a bear market, can preserve capital. This strategy is more suited to active traders than long-term “hodlers,” but it’s a valid approach for risk management.

📉 Project Fundamentals: When the Game Changes

Your decision to sell can also be driven by negative changes specific to the cryptocurrency project you’re invested in.

Negative Developments: Security Breaches, Team Issues.

If a project suffers a major security breach, a hack, internal team conflicts leading to key departures, or consistent failure to meet roadmap milestones, these are serious red flags. Such events erode trust and can severely impact the project’s long-term viability and token price.

Regulatory Crackdowns Affecting a Specific Project.

Sometimes, regulatory actions target specific projects or types of tokens. If a project you hold faces a direct legal challenge or a regulatory ban in a key market, its future becomes uncertain, and selling might be a wise decision.

Loss of Competitive Advantage or Stagnating Growth (S-Curve).

The crypto space is fiercely competitive. If a project loses its technological edge, is outcompeted by newer projects, or if its user adoption and transaction volume stagnate (often referred to as hitting the top of its ‘S-curve’ of growth), its potential for future gains diminishes. This can be a signal to exit.

Capital Reallocation: Finding Better Opportunities.

Sometimes you sell not because a project is bad, but because you’ve identified another project with even better risk-adjusted return potential or superior technology. Smart investors are always looking to optimise their portfolio by reallocating capital to the most promising ventures. Learning how to research crypto opportunities is key here.

Adverse Selection: When Hidden Risks Emerge.

Adverse selection occurs when one party in a transaction has information that the other doesn’t. In crypto, this can mean project insiders knowing about critical flaws or impending bad news before the public. If such hidden risks become apparent, as seen in high-profile collapses like Terra’s LUNA/UST, it signals an urgent need to sell, if possible, before the situation deteriorates further.

💼 Personal Finances & Portfolio Management

Not all selling decisions are driven by market dynamics. Sometimes, your personal life dictates when it’s time to sell.

Selling to Meet Personal Financial Needs.

Life happens. You might need to sell crypto to fund a major purchase (a house, a car, education), cover unexpected expenses (medical bills, job loss), or simply achieve a long-term financial goal. In these cases, the market conditions might be secondary to your personal needs.

Portfolio Rebalancing: Maintaining Your Asset Allocation.

Portfolio rebalancing is a disciplined strategy to manage risk. If one asset class (like crypto) performs exceptionally well, it can become an oversized portion of your overall investment portfolio, increasing your risk exposure. Rebalancing involves selling some of the outperforming asset (crypto) and reinvesting the proceeds into underperforming asset classes to bring your portfolio back to its target allocation. This forces you to take some profits systematically.

🛠️ Tools and Indicators for Timing Your Sale

While no tool is a crystal ball, several can help you make more informed selling decisions rather than relying on pure guesswork. Combining these often provides the best insights.

On-Chain Metrics: Active Addresses, Transaction Volumes, Whale Activity.

On-chain data provides a transparent look at what’s happening directly on a cryptocurrency’s blockchain.

- Active Addresses: A declining number of active addresses can signal waning interest.

- Transaction Volumes: A drop in on-chain transaction volume can indicate reduced utility or adoption.

- Whale Activity: Monitoring large holders (whales) moving significant amounts of crypto to exchanges can sometimes precede a sell-off.

Technical Analysis: Chart Patterns, Support/Resistance, RSI, MACD.

Technical analysis involves studying price charts and indicators to identify patterns and predict potential future movements.

- Chart Patterns: Bearish reversal patterns like Head and Shoulders, Double Tops, or Rising Wedges can signal a potential top and a good time to consider selling. Using Trendlines can help spot these.

- Support/Resistance Levels: Selling when price approaches a major resistance level where it has previously struggled to break through.

- Indicators:

- RSI (Relative Strength Index): Selling when RSI shows overbought conditions (typically above 70) or bearish divergence.

- MACD (Moving Average Convergence/Divergence): Selling on a bearish MACD crossover or bearish divergence.

- Bollinger Bands: Price consistently hitting the upper band and showing signs of reversal.

- Fibonacci Levels: Fibonacci extension levels can act as profit targets.

Macro Events: Interest Rates, Geopolitical Events.

Broader economic shifts like changes in interest rates, inflation data, or significant geopolitical events can heavily impact crypto prices. A shift towards a risk-off environment globally might be a signal to reduce crypto exposure.

Market Sentiment: Gauging the Crowd (Social media, news, sentiment indexes).

Collective investor mood can be a powerful indicator. Extreme optimism or euphoria (often indicated by sentiment indexes like the Crypto Fear & Greed Index showing “Extreme Greed”) can signal a market top, suggesting it might be a good time to sell before sentiment shifts.

Tokenomics and Upcoming Events: Supply Changes, Token Unlocks, Protocol Upgrades.

Understanding a project’s tokenomics is crucial. Large token unlocks (when previously locked tokens are released to insiders or early investors) can create significant selling pressure. Conversely, successful major protocol upgrades can sometimes be a “sell the news” event if the hype was already priced in.

🧠 The Psychology of Selling: Taming Your Emotions

This is often the hardest part of selling for any investor, whether a Newbie or experienced. Emotions, if unchecked, lead to poor decisions.

Fear of Missing Out (FOMO) on Further Gains.

Selling a winning position is psychologically difficult because of FOMO. You see the price continuing to rise after you sell, and regret kicks in. This fear can lead to holding on too long.

Greed: Holding on for Too Long.

The desire for even bigger profits can cloud judgment, causing investors to ignore sell signals or their own profit targets, hoping for that one last surge. Greed often turns winning positions into losing ones when the market inevitably corrects.

Panic Selling During Dips.

Fear is an equally powerful, destructive emotion. Watching prices plummet during a sharp correction can trigger panic selling, often near the bottom, locking in losses.

The Importance of a Pre-Defined Exit Strategy.

The best way to combat these emotions is to have a clear, written exit strategy before you enter a trade or investment. This plan should outline your profit targets, stop-loss levels, and the conditions under which you will sell based on fundamentals or market conditions.

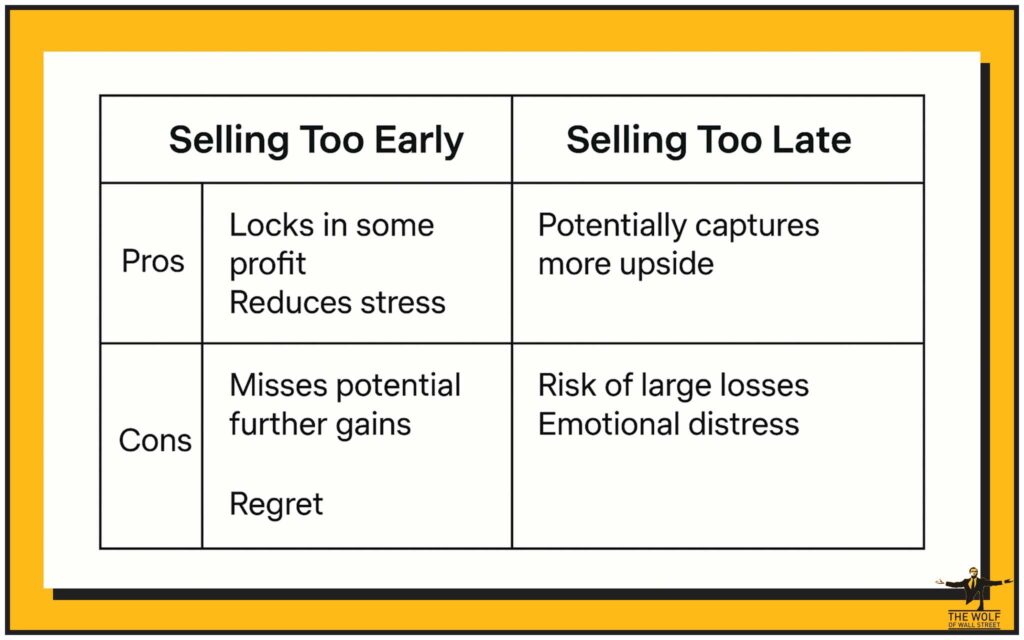

⏳ Risks of Timing: Selling Too Early vs. Too Late

Perfect market timing is a myth. You will almost never sell at the absolute top or buy at the absolute bottom. Understanding the risks of imperfect timing is part of the game.

The Pain of Selling Too Soon: Missing out on significant further upside.

The classic example is Laszlo Hanyecz, who famously paid 10,000 BTC (worth hundreds of millions of dollars at its peak) for two pizzas in 2010. While an extreme case, selling an asset that then goes on to multiply in value many times over is a common regret.

The Cost of Selling Too Late: Holding through a major downturn and incurring substantial losses.

Conversely, holding on too long, ignoring sell signals, and riding a bull market into a bear market can result in watching significant paper profits evaporate, or worse, turn into substantial losses. Bitcoin’s drop from around $69,000 in late 2021 to below $17,000 in 2022 caught many unprepared investors.

💸 Tax Implications: Don’t Forget Uncle Sam

Selling crypto isn’t just about market timing; it has real-world financial consequences, particularly taxes. This is an area many investors overlook until it’s too late.

Selling as a Taxable Event: Realising profits (or losses) usually triggers capital gains tax.

In most jurisdictions, selling cryptocurrency for a profit is a taxable event, typically subject to capital gains tax. The rate can vary depending on how long you held the asset (short-term vs. long-term capital gains) and your overall income.

Varying Rules by Jurisdiction and Holding Period.

Tax laws for cryptocurrencies differ significantly from country to country and are constantly evolving. What’s considered a taxable event, how gains are calculated, and the applicable tax rates can all vary. It’s absolutely essential to understand the specific tax regulations in your country of residence.

Strategies like Tax-Loss Harvesting.

Tax-loss harvesting involves selling some assets at a loss to offset capital gains realised from other investments, potentially reducing your overall tax liability for the year. This is a strategy that requires careful planning and understanding of local tax rules. Given the complexity, consulting with a tax professional who is knowledgeable about cryptocurrency regulations is highly advisable.

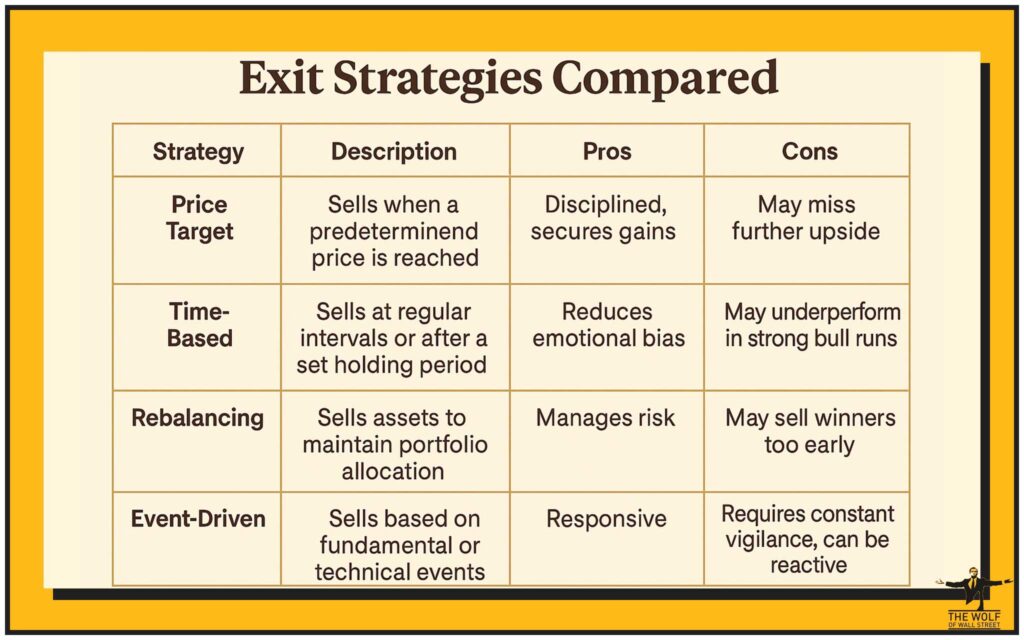

📊 Popular Crypto Exit Strategies Compared

There are several common strategies traders and investors use for deciding when to sell.

- Price Target Selling: Selling when the asset reaches a predefined price level.

- Time-Based Selling (Reverse DCA): Selling fixed amounts of crypto at regular intervals (e.g., weekly, monthly), regardless of price, to average out exit prices.

- Portfolio Rebalancing: Selling portions of an outperforming asset to reinvest in underperforming ones, maintaining a target asset allocation.

- Event-Driven Selling: Selling in response to specific news, project developments (positive or negative “sell the news” events), or macroeconomic shifts.

Glossary of Key Selling Terms:

To better understand this guide, here are some key terms:

- S-curve growth: A pattern of growth that starts slowly, accelerates rapidly, then slows and plateaus.

- Adverse Selection: A situation where one party in a transaction has more or better information than the other, leading to potentially poor decisions for the less-informed party.

- On-chain Metrics: Data derived directly from a blockchain, such as transaction counts, active addresses, and wallet balances.

- Tax-Loss Harvesting: A strategy of selling assets at a loss to offset capital gains taxes on other investments.

- FOMO (Fear Of Missing Out): An emotional state that can drive impulsive investment decisions.

- Market Sentiment Index: A tool that gauges the overall mood or emotion of market participants (e.g., Crypto Fear & Greed Index).

- Stop-Loss Order: An automated order to sell an asset when it reaches a specific price, used to limit losses.

Frequently Asked Questions (FAQs)

- Is it better to sell crypto based on price targets or market conditions?

A combination is often best. Price targets offer discipline, while being aware of market conditions (like bubbles or major negative news) allows for adaptive responses. - How can I avoid emotional selling in a volatile crypto market?

Having a pre-defined written exit strategy (including profit targets and stop-loss levels) and sticking to it helps remove emotion from decision-making. - What is the “S-curve” in relation to selling a crypto project?

The S-curve describes a typical growth pattern. Selling might be considered if a project’s user adoption or utility appears to be hitting the plateau phase of the S-curve, indicating slowing growth. - Are profits from selling crypto always taxed?

In most jurisdictions, yes, profits from selling crypto are considered capital gains and are taxable. Tax laws vary significantly, so consult local regulations or a tax professional. - What’s more important: avoiding selling too early or avoiding selling too late?

Both have significant downsides (missing gains vs. incurring large losses). A balanced strategy with profit targets and stop-losses aims to mitigate both risks, though perfect timing is impossible.

The bottom line on when to sell crypto? It comes down to a solid plan, sharp analysis, and steel nerves. Use this guide, build your strategy, and you’ll be miles ahead of the emotional herd.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team./n/nEmpower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street””