📈 Introduction: The Man Who Made Wall Street a Gladiator Arena

Let’s be crystal clear about one thing: the world of finance was a grey, boring, country club affair before Jim Cramer kicked the door down. This isn’t just about a TV host; it’s about a renegade who took the cryptic language of Wall Street and turned it into a full-contact sport for the masses. He’s loud, he’s unapologetic, and he’s got more energy than a trading floor on triple-witching hour.

Before Cramer grabbed the microphone, your average retail investor was getting their information from dusty newspapers and analysts who spoke in monotone. Cramer changed the game. He brought sirens, soundboards, and a “BOOYAH!” that echoed from trading desks to living rooms. He transformed stock picking from a quiet, solitary activity into a raucous, public spectacle. He made it personal, visceral, and, for better or worse, wildly entertaining.

So why should you care? Because whether you think he’s a genius or a jester, Jim Cramer moves markets. When he talks, people listen. When he screams “Buy, Buy, Buy!”, order books fill up. His influence on the retail investor is immense, a tidal wave of sentiment that can lift a stock to the heavens or drag it down to the depths. Ignoring him isn’t an option; it’s a liability. To win in this game, you have to understand every player on the board, especially the king.

💰 The Cramer Playbook: Decoding the “Mad Money” Method

You think Cramer is just throwing darts at a board? Think again. Behind the shouting and the sound effects, there’s a method to the madness. It’s a playbook built on years of running a hedge fund where if you didn’t perform, you were out on the street. It’s not just about numbers; it’s a killer combination of storytelling, fundamental analysis, and a gut feeling for the macro-picture.

First, Cramer sells a story. He knows that people don’t buy stocks; they buy into a vision. He’ll paint a picture of a company’s future so vivid you can almost taste the profits. He talks about disruptive CEOs, game-changing technology, and unstoppable secular trends. He makes you believe you’re not just buying a ticker symbol; you’re buying a piece of the future. It’s a powerful, persuasive technique that gets people off the sidelines and into the game.

But it’s not all smoke and mirrors. Cramer insists on “doing the homework.” He dives into balance sheets, income statements, and conference call transcripts. He’s looking for strong fundamentals: revenue growth, expanding margins, and low debt. He wants to see companies with a wide moat, a fortress that protects them from the competition. He preaches diversification and patience, principles that the pros live by but are often lost in the noise of his on-screen persona.

Finally, he connects it all to the big picture. He’s constantly analysing macroeconomic news—interest rate decisions from the Fed, geopolitical tensions, consumer spending habits. He understands that a great company can still get crushed by a bad market. His goal is to find the intersection of a great story, solid fundamentals, and a favourable macro-environment. That’s the trifecta, the sweet spot where fortunes are made. To truly master the markets, you need to grasp the foundational principles that separate the winners from the losers; a great starting point is understanding the core concepts of What is Tokenomics? Why Study Tokenomics When Investing in Crypto?.

🏆 Cramer’s Grand Slams: The Calls That Made Fortunes

When Cramer gets it right, he really gets it right. We’re not talking about small wins here. We’re talking about grand slams, home runs that set his followers up for life. These are the calls that built his reputation and created a legion of loyal fans who hang on his every word. These weren’t lucky guesses; they were convictions based on his playbook.

Let’s talk about Apple. Long before every hedge fund on the planet owned it, Cramer was screaming from the rooftops about the iPhone revolution. He saw that it wasn’t just a phone; it was an ecosystem. He understood the power of the brand and its sticky customer base. He told his viewers to own it, not trade it. Anyone who listened and held on from those early days is sitting on a mountain of cash right now. It was a career-defining call.

Then there’s Nvidia. Cramer was all over the graphics card giant years before “AI” became the hottest buzzword in the world. He saw its dominance in gaming and correctly predicted its pivot into data centres and artificial intelligence. He understood that Nvidia wasn’t just making chips; they were building the engine of the future. While others were sleeping, he was telling his audience to get in on the ground floor of a technological super-cycle.

And we can’t forget Amazon and Salesforce. With Amazon, he looked past the thin margins and saw a behemoth of e-commerce and cloud computing in AWS that would crush everything in its path. With Salesforce, he identified the shift to cloud-based software as an unstoppable force. In both cases, he ignored the short-term noise and focused on the long-term, world-dominating narrative. These are the kind of visionary calls that separate the legends from the pack.

📉 The Disasters: When the “BOOYAH!” Became a Bust

Let’s get one thing straight: in this business, you’re going to have losses. But some losses are bigger than others. Some are so catastrophic, so epically wrong, that they follow you forever. Cramer has a few of these stains on his record, and they are brutal. These are the moments when the high-energy hype collided with the cold, hard reality of the market.

The most infamous, without a doubt, was his call on Bear Stearns in March 2008. As the investment bank was teetering on the brink of collapse, a viewer asked if they should pull their money out. Cramer’s response is now legendary: “No! No! No! Bear Stearns is not in trouble… Bear Stearns is fine! Do not move your money.” Just six days later, the firm was sold to JPMorgan for pennies on the dollar in a bailout deal, its stock having utterly collapsed. It was a devastatingly wrong call that cost his viewers their savings.

Then came Lehman Brothers. While he didn’t give it the same “all-clear” signal as Bear Stearns, he failed to see the systemic risk that was about to bring the entire global financial system to its knees. He, like many on Wall Street, underestimated the toxicity of subprime mortgages. His failure to sound the alarm on the biggest bankruptcy in U.S. history was a massive black eye, undermining his image as a market guru with his finger on the pulse.

More recently, he’s had some spectacular misses in the tech space. He championed Meta (Facebook) just before it cratered on concerns about slowing growth and metaverse spending. He was bullish on Netflix before the streaming giant reported a shocking loss of subscribers, sending the stock into a nosedive. These calls served as a painful reminder that even the most dominant companies can fall from grace, and following anyone’s advice blindly—even Cramer’s—is a recipe for disaster.

🤡 The “Inverse Cramer” Phenomenon: Betting Against the King

What happens when a financial guru makes enough high-profile bad calls? The market, in its infinite and brutal wisdom, creates a meme. And so, the “Inverse Cramer” strategy was born. The concept is beautifully simple: whatever Jim Cramer tells you to buy, you sell. Whatever he tells you to sell, you buy. It started as a joke on social media and Reddit forums but has since evolved into a full-blown phenomenon.

The meme gained so much traction that it jumped from the internet into the real world of high finance. Tuttle Capital Management launched two ETFs: the Inverse Cramer ETF (ticker: SJIM), which shorts Cramer’s recommendations, and the Long Cramer ETF (ticker: LJIM), which buys them. The fact that an investment firm saw a viable product in systematically betting against a single media personality is a testament to the level of public scepticism surrounding his advice. The LJIM was eventually closed due to a lack of interest, which tells its own story.

But does it actually work? The results are mixed. There have been periods where the Inverse Cramer ETF has performed spectacularly, particularly when Cramer has made ill-timed calls on volatile tech stocks or cryptocurrencies. However, it’s not a foolproof money-making machine. Cramer’s long-term successful calls on giants like Apple and Nvidia would have been terrible stocks to short.

Ultimately, the Inverse Cramer phenomenon is less of a viable long-term strategy and more of a cultural symbol. It represents the retail investor’s frustration with so-called “experts” and a deep-seated desire to hold them accountable. It’s a powerful reminder that no one has a crystal ball, and in the world of investing, a healthy dose of scepticism is your most valuable asset.

₿ Cramer on Crypto: The Ultimate Flip-Flopper?

If there’s one area that perfectly encapsulates the chaotic, contradictory, and often confusing nature of Jim Cramer, it’s cryptocurrency. His journey with digital assets has been a rollercoaster of emotions, shifting from outright scepticism to euphoric bullishness and back again, sometimes within the same quarter. It’s a masterclass in trying to ride a tidal wave you don’t fully understand.

Initially, Cramer was a classic crypto sceptic, dismissing Bitcoin as “monopoly money” and warning his viewers to stay away from the unregulated “Wild West.” He was the voice of the old guard, the Wall Street traditionalist who saw crypto not as an innovation but as a speculative bubble waiting to pop. He preached the gospel of tangible assets and corporate earnings, things you could see and measure.

Then, he did a complete 180. He announced he had bought Bitcoin and Ethereum, calling it a prudent hedge against inflation and a store of value. He praised the technology and even started giving price targets. He went from a bear to a bull almost overnight, trying to position himself as a savvy investor who was evolving with the times. But just as quickly, when the crypto market turned south, he liquidated his holdings and went back to issuing dire warnings, declaring the crypto dream was dead. This constant flip-flopping has led many in the crypto community to view him as a “contrarian indicator”—when Cramer turns bullish, it’s time to sell, and when he’s bearish, it’s time to buy.

His current stance is a call for heavy-handed regulation. He argues that the industry needs strict rules to protect investors from fraud and the collapse of platforms like FTX. While investor protection is a valid concern, many critics see this as an attempt by the old financial guard to tame and control a disruptive force they can’t beat. For those who want to navigate this volatile market with real expertise, you need more than a TV personality’s shifting opinions. You need a dedicated community and professional tools. You need to understand how professional traders approach the market, which is why learning about advanced concepts like Crypto Token Listing Process: The Real Game Behind the Glitz is essential for serious players.

🏛️ Politics & Portfolios: Cramer’s Take on Power and Money

Jim Cramer doesn’t live in a vacuum. He understands that the decisions made in Washington D.C. have a massive impact on Wall Street. His political commentary is always viewed through the lens of a trader: “How does this affect my portfolio?” He’s less concerned with ideology and more concerned with policy and its real-world impact on corporate profits and market sentiment.

One of his more surprising stances was his support for President Trump’s tariff policies. While most of Wall Street screamed about the dangers of a trade war, Cramer took a more nuanced view. He argued that years of free trade agreements had hollowed out American manufacturing and hurt small businesses. He saw tariffs not as an economic evil, but as a necessary tool to level the playing field and bring jobs back to the United States. It was a populist stance that aligned him more with Main Street than with Wall Street’s globalist consensus.

His core advice during times of political turmoil is simple: don’t panic. When Washington is in chaos—whether it’s a government shutdown, a debt ceiling debate, or a contested election—Cramer tells his audience to stay calm and look for buying opportunities. He believes that the American economy is resilient and that great companies will find a way to thrive regardless of who is in the White House. He advises investors to focus on the long-term fundamentals of their stocks, not the short-term noise from the political circus. It’s pragmatic, level-headed advice designed to prevent emotion-driven mistakes that can wreck a portfolio. Learning to distinguish between market noise and genuine signals is a skill every trader must develop, much like learning to use tools like MACD: Your Edge in Seeing Market Momentum effectively.

⚔️ The Critics’ Corner: Hero or Hype Machine?

You don’t become as big as Jim Cramer without making a few enemies. His critics are numerous and vocal, and their arguments aren’t without merit. The central criticism lobbed against him is that he blurs the line between financial education and pure entertainment, creating a dangerous cocktail for inexperienced investors.

Critics argue that the Mad Money format itself—with its fast pace, sound effects, and rapid-fire stock picks—encourages a short-term, gambling mentality. They claim he fosters a “get rich quick” attitude that can lead retail investors to take on excessive risk without fully understanding the companies they are buying. His over-the-top, emotional delivery can incite feelings of FOMO (Fear Of Missing Out) or panic, prompting viewers to make impulsive decisions rather than carefully considered ones.

Another major point of contention is the “Cramer effect.” Because of his massive audience, a positive mention of a stock on his show can cause its price to spike temporarily, while a negative comment can cause it to drop. Critics argue that this gives him an undue influence on the market, creating artificial volatility. There are ethical questions about whether it’s responsible for one person to have that much power, especially when his calls can be hit-or-miss. The debate rages on: is he empowering the little guy with information, or is he a hype man setting them up for a fall?

🐺 Conclusion: The Final Verdict on Jim Cramer

So, after all is said and done, who is Jim Cramer? He’s not a simple hero or villain. He is a force of nature, a revolutionary who single-handedly democratised financial media. He took the keys to Wall Street from the pinstriped elites and handed them to anyone with a television. For that, he deserves his place in history. He has educated millions and ignited a passion for investing in a generation that might otherwise have stayed on the sidelines.

However, his legacy is a double-edged sword. His sensational style, his epic bad calls, and his dizzying flip-flops are a stark reminder that no one should ever be your guru. The biggest lesson Jim Cramer can teach you is this: you must be the CEO of your own money. You do the homework. You make the final call. Use his show for ideas, for entertainment, for a pulse on market sentiment—but never, ever follow him blindly.

The world is moving faster than ever, especially in markets like crypto where the real action is happening far from the bright lights of a TV studio. If you’re serious about creating real wealth, you need to graduate from the mainstream. You need an edge. You need a community of winners who share real-time insights, expert analysis, and the tools to execute. That’s how you get ahead and stay there. The final decision always rests with you, and the ultimate responsibility for your success or failure lies with the person you see in the mirror, not some personality on a screen like Jim Cramer.

❓ Frequently Asked Questions (FAQs)

- What is Jim Cramer’s most famous bad call?His most infamous bad call was on the investment bank Bear Stearns in March 2008. He emphatically told a viewer that the company was “fine” and not to pull their money out just days before it collapsed and was sold for a fraction of its value.

- Is the Inverse Cramer ETF a good investment?The performance of the Inverse Cramer ETF (SJIM) is mixed. While it has had periods of success by shorting Cramer’s recommendations, it’s not a guaranteed strategy for long-term profit. It’s more of a tool for short-term speculation and a reflection of market sentiment against his advice.

- What are Jim Cramer’s biggest successful stock picks?Cramer has made several legendary long-term calls. His most notable successes include being an early and vocal bull on companies like Apple (AAPL), Nvidia (NVDA), Amazon (AMZN), and Salesforce (CRM), all of which have generated massive returns for investors who followed his advice.

- Why is Jim Cramer so controversial?Jim Cramer is controversial for several reasons. His high-energy, entertainment-focused style is seen by critics as encouraging reckless, short-term trading. His significant market influence (the “Cramer effect”) raises ethical questions, and his record of major failed predictions, like Bear Stearns, has damaged his credibility among many investors.

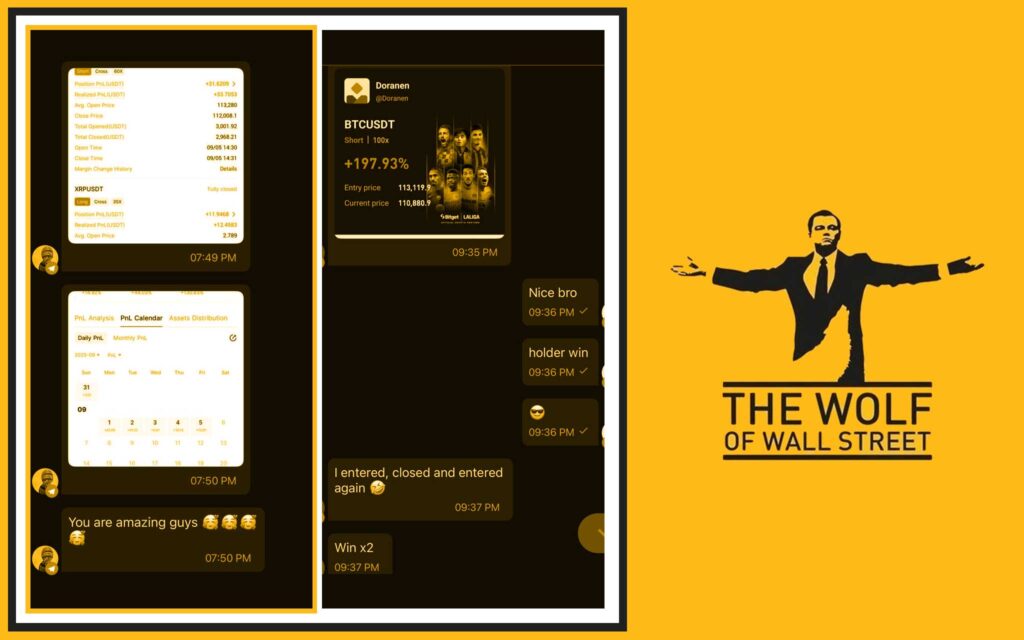

The The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey: