Which comes first – wholesale rails or retail wallets?

Get this wrong, and you’re burning millions building a digital ghost town. Get it right, and you redefine money itself – rewiring payments, markets, and policy in one coordinated strike.

That’s what this guide delivers: a clear, current, and no-BS breakdown of wholesale vs retail CBDC, written in the energy of Jordan Belfort – persuasive, data-driven, and built to perform.

⚡ What Exactly Is a CBDC – No Jargon, No Hype

Let’s strip it down:

A Central Bank Digital Currency (CBDC) is just central bank money in digital form – not a crypto token, not stablecoin, but the digital evolution of fiat itself.

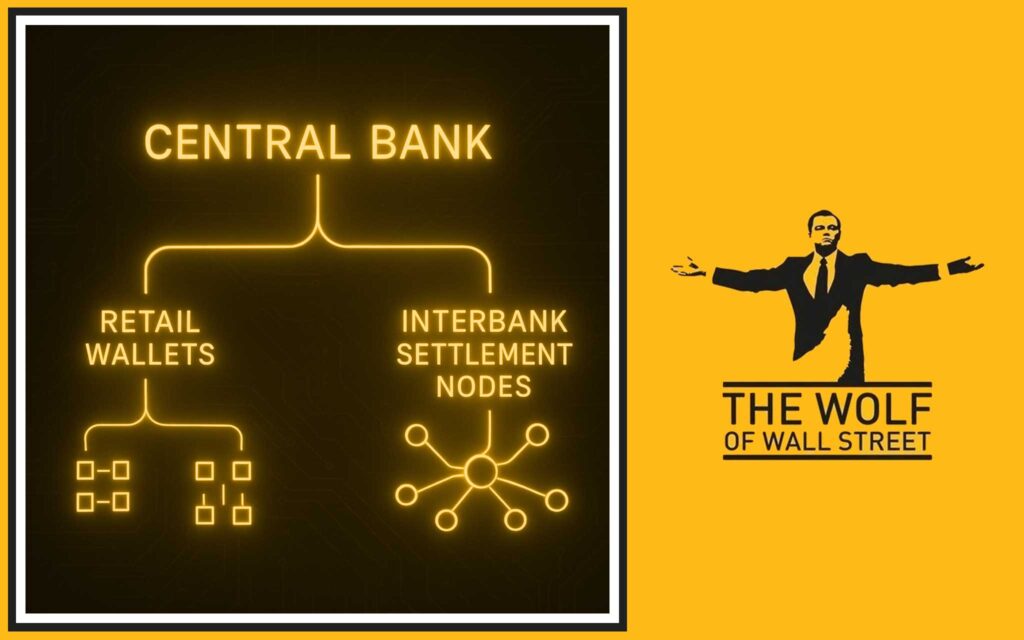

CBDCs come in two breeds:

- Retail CBDC – used by the public for payments.

- Wholesale CBDC – used by banks and financial institutions for settlement.

As of October 2025, only three countries have fully launched a CBDC: The Bahamas (Sand Dollar), Jamaica (JAM-DEX), and Nigeria (eNaira), with dozens more in pilots or development (Atlantic Council CBDC Tracker).

💳 Retail CBDC – Built for the People (If They Actually Use It)

Retail CBDCs are what everyone thinks of when they hear “digital currency from the government.”

They’re designed for everyday use – payments, savings, transfers – but the challenge is clear: if it’s not 10x better than what exists, people won’t bother.

🪙 Real-World Retail Examples

🇧🇸 The Bahamas – Sand Dollar

The pioneer. The Sand Dollar launched in October 2020, making The Bahamas the first nation to officially roll out a nationwide CBDC (Central Bank of The Bahamas).

It works through authorised financial institutions and mobile wallets, targeting financial inclusion for outer islands.

But adoption? Still modest. The lesson: tech alone doesn’t create trust – utility does.

🇯🇲 Jamaica – JAM-DEX

Launched in July 2022, JAM-DEX made CBDC legal tender and easily accessible through mobile wallets. Yet uptake remains slow, partly due to weak merchant integration and a lack of incentives (CBDC Tracker – HRF).

🇳🇬 Nigeria – eNaira

The eNaira went live in October 2021. Ambitious in vision, but banks were hesitant, and users preferred crypto or cash.

By 2025, the Central Bank of Nigeria is still fine-tuning adoption strategies, emphasising government transfers and business payments.

🧭 China’s e-CNY – The Giant Still in Pilot Mode

China’s digital yuan – now branded e-CNY – is often mistaken as “launched.” It’s not.

It’s been in large-scale pilot mode since 2020, expanding across cities and to Hong Kong in 2024, where locals can open wallets and top up via the FPS system (People’s Bank of China – e-CNY Pilot Update).

This cross-border phase matters. It’s the bridge test – integrating mainland and international transactions without losing regulatory control.

⚙️ How Retail CBDC Works (6-Step Flow)

- Issuance by the central bank.

- Distribution through intermediaries (banks or authorised payment providers).

- Wallet creation and tiered KYC (basic, verified, corporate).

- Spending online/offline, using QR, NFC, or app.

- Settlement & reconciliation via the central ledger.

- Support & dispute handling through intermediaries.

This model ensures scalability while keeping central bank control over issuance and flow – but not the direct user interface.

📊 Benefits vs. Reality Check

The Promise:

- Financial inclusion (for the unbanked).

- Faster payments.

- Resilient offline capabilities.

- Transparent government-to-person payments.

The Reality:

- Most users already have efficient mobile payments.

- Banks fear disintermediation.

- Privacy remains a hot-button issue.

- Adoption is slow unless paired with incentives.

Bottom line: Retail CBDCs need a “why,” not just a “what.”

🏦 Wholesale CBDC – The Market’s Hidden Engine

If retail CBDCs are the flashy sports cars of digital money, wholesale CBDCs are the engines powering the financial motorway.

They’re for banks, clearing houses, and financial market infrastructures (FMIs).

They settle high-value, low-volume transactions in real central bank money, improving efficiency, transparency, and risk management.

🇪🇺 Europe’s Wholesale Momentum – The ECB’s Dual-Track Masterplan

In July 2025, the European Central Bank (ECB) approved a dual-track wholesale settlement plan:

- Project Pontes: A short-term pilot bridging DLT platforms with TARGET Services.

- Project Appia: A long-term plan to integrate DLT-based settlement into the Eurosystem (ECB Press Release, 2025).

The takeaway? Europe’s not theorising. It’s building infrastructure that connects legacy RTGS systems to DLT rails.

🇨🇭 Switzerland – Helvetia III

The Swiss National Bank (SNB) tested Helvetia III, a real wholesale CBDC in Swiss francs, integrated with SIX Digital Exchange (SDX) for settlement of tokenised assets (BIS Helvetia III Report, 2024).

Key twist: SNB publicly stated it has no plans for a retail CBDC, preferring to focus on the wholesale layer – where risk, liquidity, and speed make or break markets.

🌏 Cross-Border Interoperability – mBridge

Enter Project mBridge, the cross-border multi-CBDC network from the BIS Innovation Hub, now in MVP phase (2024) (BIS mBridge MVP Report, 2024).

It connects multiple central banks for real-time FX settlement – think instant, programmable international payments without SWIFT.

For global trade and remittances, that’s massive.

⚙️ How Wholesale CBDC Works (6-Step Flow)

- Issuance to authorised institutions.

- Onboarding with regulatory and operational approvals.

- Integration with RTGS or DLT settlement layers.

- DvP/PvP operations (delivery vs payment / payment vs payment).

- Intraday liquidity and collateral management.

- Finality & oversight through the central bank ledger.

This isn’t about replacing money – it’s about upgrading financial plumbing.

🔍 Retail vs Wholesale CBDC: Side-by-Side Comparison

| Dimension | Retail CBDC | Wholesale CBDC |

|---|---|---|

| Primary Users | Public, merchants | Banks, FMIs, CCPs |

| Typical Transactions | Low-value, high-volume | High-value, low-volume |

| Ledger Type | Centralised, hybrid (offline options) | DLT, RTGS-bridged, hybrid |

| Policy Tools | Tiered wallets, holding limits, remuneration rates | Access policy, collateral, liquidity |

| Privacy Model | Tiered/pseudonymous, AML/KYC governed | Fully auditable institutional records |

| Cross-Border Potential | Limited; corridors and pilots | Strong; PvP & interoperability (e.g. mBridge) |

| Main Challenge | Adoption & UX | Legal framework & interoperability |

| Examples | Sand Dollar, eNaira, JAM-DEX | Helvetia, Jasper, mBridge, Pontes/Appia |

Quick read: Retail CBDCs aim to democratise access. Wholesale CBDCs aim to professionalise settlement. Both are reshaping monetary policy reach and financial stability frameworks.

🧨 Risks, Safeguards, and Policy Trade-Offs

1. Bank Run Risk

If users can park unlimited funds in CBDC wallets, deposits drain from banks.

→ Solution: Tiered wallets, capped balances, and non-interest-bearing holdings.

2. Privacy vs Transparency

Too private, and AML suffers. Too transparent, and public trust collapses.

→ Solution: Tiered privacy; pseudonymity for small transactions, traceability for large.

3. Operational Resilience

Offline and cross-border settlement need failover solutions.

→ Solution: Local offline storage (Riksbank model) and RTGS integration.

4. Adoption Friction

Users don’t change behaviour without incentive.

→ Solution: Integrate rewards, tax credits, or loyalty mechanics in wallet UX.

📅 Timeline: From Research to Reality (2016–2025)

| Year | Milestone |

|---|---|

| 2016 | Bank of Canada launches Project Jasper, testing DLT for wholesale settlement. |

| 2020 | Sand Dollar launches – first national CBDC (Bahamas). |

| 2021 | Nigeria launches eNaira. |

| 2022 | Jamaica launches JAM-DEX. |

| 2023 | Helvetia III runs wholesale CBDC pilots in Switzerland. |

| 2024 | mBridge MVP achieved; e-CNY expands to Hong Kong. |

| 2025 | ECB’s Pontes/Appia wholesale roadmap approved for implementation. |

The trend is undeniable: wholesale is moving faster than retail.

Central banks know – fix the rails, and the rest follows.

📈 What’s Next for CBDCs (2025–2026)

- Europe leads wholesale pilots – live DLT settlements expected in 2026 (ECB/Banca d’Italia Report, 2025).

- mBridge goes operational, connecting Asia–Gulf corridors.

- Retail adoption remains cautious – central banks learning from the slow uptake of eNaira and JAM-DEX.

- US and UK continue exploratory projects, focusing on privacy-preserving design rather than full rollout.

By 2026, expect hybrid models: tokenised deposits, synthetic CBDCs, and RTGS-DLT bridges operating in parallel.

💡 Trader’s Edge: What This Means for Crypto Markets

CBDC developments ripple through the entire digital asset ecosystem.

When central banks tokenise sovereign money, liquidity flows, regulatory standards, and cross-chain interoperability change overnight.

That’s why serious traders watch CBDC updates like hawks.

Want the edge before it hits headlines?

Join The Wolf Of Wall Street – the crypto trading community built for high performers.

- Exclusive VIP Signals: proprietary trade setups.

- Expert Market Analysis: daily reports from seasoned traders.

- Private Network: 150,000+ members.

- Essential Tools: volume calculators, real-time alerts.

- 24/7 Support: never trade alone again.

🔗 Join our Telegram for live updates and strategies.

🤔 FAQs – Quickfire Answers

1) Is China’s e-CNY fully launched?

No. It’s still a pilot, expanded to Hong Kong in 2024 for cross-border wallet access (People’s Bank of China).

2) What’s the difference between wholesale CBDC and tokenised deposits?

Wholesale CBDC = central bank liability.

Tokenised deposit = commercial bank liability.

Different risk, same tech potential.

3) Can retail CBDCs pay interest?

Most designs don’t. Central banks prefer non-interest-bearing models with holding caps to avoid draining private bank deposits.

4) Why did DCash shut down?

Operational issues and limited uptake led the Eastern Caribbean Central Bank to discontinue DCash in January 2024 (Human Rights Foundation – DCash Shutdown).

5) Which CBDC model is winning right now?

Wholesale – hands down. It’s cheaper to scale, lower risk, and improves the global plumbing without touching consumers (yet).

📚 Sources

- Atlantic Council CBDC Tracker (Updated July 2025)

- ECB Pontes/Appia Press Release

- BIS Project Helvetia III

- BIS mBridge MVP Report

- IMF CBDC Handbook (2024)

- People’s Bank of China e-CNY Pilot Update (2025)

- Human Rights Foundation DCash Shutdown Report

🚀 The Bottom Line

The CBDC game isn’t about replacing cash. It’s about re-engineering trust and efficiency at the foundation of finance.

Retail CBDCs test public adoption.

Wholesale CBDCs move markets.

By 2026, central banks won’t just issue money – they’ll run programmable monetary networks.

And when that happens, traders, investors, and institutions that understand the rails will have the unfair advantage.

Stay sharp. Stay informed. Stay in the loop with The Wolf Of Wall Street – the wolf’s edge in the world of crypto trading.