🔥 Introduction

Welcome to the world where politics, hype, and blockchain collide — the kind of high-stakes arena where fortunes are made or lost overnight. World Liberty Financial (WLFI), a crypto project tied to the Trump family, just pulled the trigger on a 47 million token burn.

That’s a bold move designed to fight off a nosedive in token value. But here’s the question: will it save the project or is this just smoke and mirrors? Strap in, because we’re breaking it all down with no fluff, just the raw truth.

🚀 The Trump Factor: Branding Meets Blockchain

WLFI isn’t just another token launch — it carries the heavyweight name of the Trump family. Political branding brings instant eyeballs and early hype, sure. But here’s the kicker: celebrity tokens rarely survive on hype alone. Investors may pile in fast, but without real fundamentals, the party ends as soon as the music stops. WLFI’s wild ride after launch proves it — this isn’t just branding, this is a survival game.

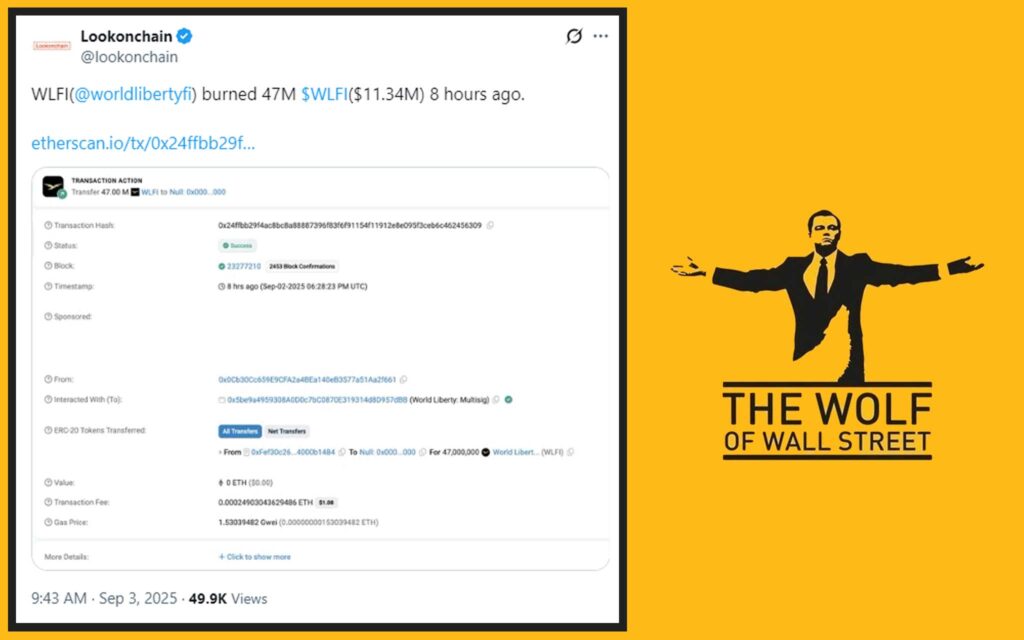

💣 The 47 Million Token Burn Explained

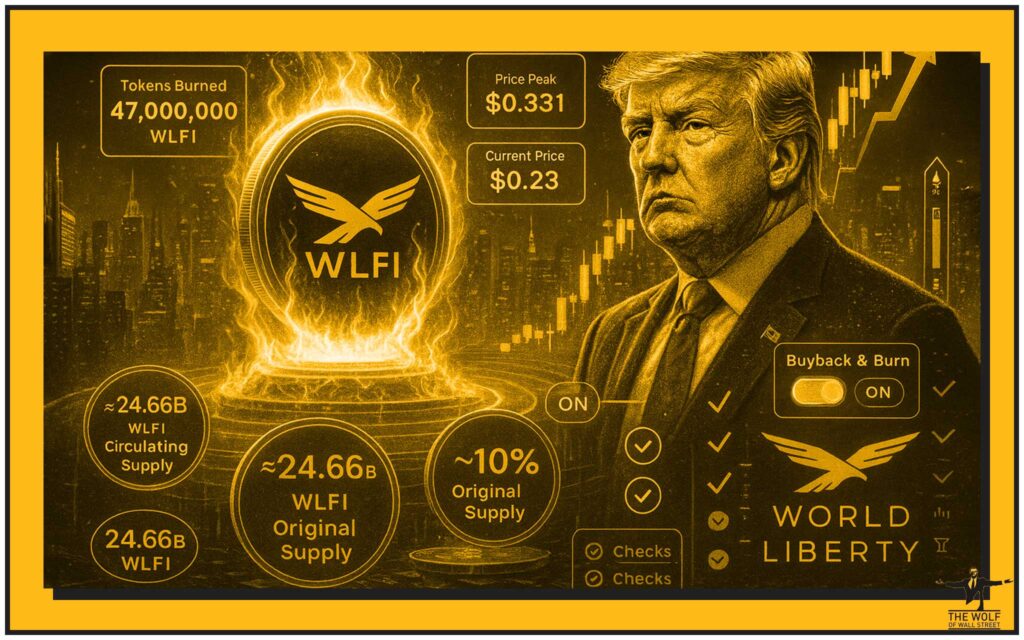

Let’s cut through the noise. A token burn means permanently removing tokens from circulation, usually by sending them to an inaccessible wallet. WLFI burned 47 million tokens — sounds like a mountain of money, right? But when the total supply is a jaw-dropping 100 billion tokens, this burn only shaved off 0.19%. It’s a drop in the ocean. Symbolic? Yes. Game-changing? Not yet.

📉 WLFI’s Price Action: From Hype to Slump

Here’s the rollercoaster: WLFI launched on Monday, spiking to $0.331 before reality kicked in. Within hours, it plummeted over 31% down to $0.23. Why? Early investors cashed out, dumping their bags on the market. It’s the classic crypto pump-and-dump cycle — newcomers always pay the price when the hype train derails.

💡 Scarcity Play: The Theory Behind Burns

Scarcity sells. That’s the psychology. By reducing supply, projects hope to create an artificial sense of value. It’s the same reason rare art sells for millions. But here’s the truth — a token burn only works if demand is rising. Without buyers lining up, scarcity is meaningless. WLFI needs more than a burn; it needs real investor confidence.

🗳️ The Buyback & Burn Proposal

WLFI isn’t stopping at a one-time burn. There’s a proposal on the table: continuous buybacks and burns funded by liquidity fees. That means a percentage of every trade goes into reducing supply. Smart move — it shows commitment. The community feedback so far? Overwhelmingly positive. But until the vote is locked in, it’s still just a promise.

🕵️ Short Sellers & the War for Market Control

Every market has sharks, and crypto is no exception. Short sellers smell blood and they’re betting against WLFI. The burn was a counterstrike — designed to squeeze shorts and pump price stability. It’s a battle of wills: short sellers versus believers. History shows projects like Shiba Inu and Binance Coin have used burns to fight back, but the battlefield is brutal.

💬 Expert Opinions: Beyond the Hype

Industry veterans aren’t buying the celebrity hype. Analysts warn: celebrity tokens rarely deliver long-term value. Institutional adoption is what brings maturity, not headlines. Without strong fundamentals, WLFI risks being another footnote in the graveyard of hype-driven projects. Investors want transparency, utility, and a roadmap — not just fireworks.

⛽ Ethereum Gas Fee Spike: Hidden Costs

Here’s the kicker nobody talks about: WLFI’s launch spiked Ethereum gas fees. Transaction costs shot through the roof, leaving everyday investors footing the bill. This exposes one of crypto’s biggest flaws — scalability. If gas fees cripple adoption, mainstream investors won’t touch it. WLFI’s hype storm revealed just how fragile the ecosystem still is.

📊 Supply Metrics in Perspective

Let’s talk numbers:

- Total WLFI Supply: 100 billion tokens.

- Circulating Supply: ~24.66 billion tokens.

- Tokens Burned: 47 million = 0.19%.

Translation? The burn barely scratched the surface. The optics were good, but the fundamentals remain unchanged. Investors need to see massive burns or genuine adoption to believe in long-term growth.

🤝 Community Engagement: Power of the Crowd

Say what you will, WLFI has one thing going for it: an active community. The proposal to fund buybacks and burns lit up comment sections with support. This matters. In crypto, communities are lifelines. Projects with engaged holders — think Dogecoin, Shiba Inu — have survived storms. WLFI is learning this fast.

🏛️ The Bigger Picture: Institutional Adoption

If WLFI wants to win, it can’t rely on celebrity stardust. The real goldmine is institutional money — hedge funds, banks, and long-term investors. These players want security, regulations, and fundamentals. Until WLFI evolves past hype and embraces trust-building, it’s vulnerable. Institutions don’t gamble; they invest.

📉 Risk vs. Reward: Should Investors Care?

Here’s the raw truth: WLFI is a speculative gamble. Early movers either cash out quick or risk holding a sinking bag. Long-term believers? They’re betting burns and branding will fuel adoption. If you’re in, treat it as high-risk, high-reward. This isn’t Bitcoin. This isn’t Ethereum. It’s a bet on scarcity meeting spectacle.

🛠️ Tools of the Trade for Smart Investors

Want to play the WLFI game smart? Use the right tools. Volume calculators, trading signals, and real-time market analysis are your edge. Communities like the The Wolf Of Wall Street crypto trading platform give traders exactly that — exclusive signals, expert insights, and 24/7 support. In a market this volatile, flying blind is financial suicide.

🧩 Internal Links for Context

- Stay updated with News.

- Explore the latest in Cryptocurrencies.

- Gain edge with Trading Insights.

🏁 Conclusion: Building Trust Beyond Speculation

WLFI’s 47 million token burn is bold, flashy, and headline-worthy — but it’s not a silver bullet. Unless the project delivers fundamentals, transparency, and a roadmap, it risks being another celebrity-backed flash in the pan. The truth? Token burns are band-aids, not cures. The future belongs to projects that mix hype with substance, community with trust, and scarcity with real-world adoption.

For investors, the lesson is simple: don’t get seduced by hype — demand substance.

❓ FAQs

1. What does a token burn actually achieve?

It reduces circulating supply, aiming to boost scarcity and price. But its impact depends on demand.

2. Why did WLFI’s price drop despite the burn?

Because the burn was small relative to supply, and early investors dumped tokens, driving the price down.

3. Are celebrity-backed tokens worth investing in?

High risk, high reward. They can pump quickly but rarely sustain long-term without fundamentals.

4. How does community voting shape crypto projects?

It empowers holders to influence direction — like WLFI’s buyback-and-burn proposal.

5. What tools should traders use to protect themselves?

Signals, calculators, and market analysis platforms help cut through noise and manage risk.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our active Telegram community: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street