🚀 Introduction: The XRP Cloud Mining Hype Train

Picture this: you wake up, check your phone, and see your crypto wallet fatter than when you went to bed. No servers humming in your living room, no mining rigs burning through your electricity bill—just sweet, effortless profit. That’s the dream sold by the new breed of “XRP cloud mining” platforms flooding the crypto market in 2025.

But here’s the hard truth—XRP cloud mining isn’t what most people think it is. There’s no “mining” XRP. Every XRP that will ever exist is already in circulation. So, what’s really happening? Let’s crack this open and see who’s getting rich…and who’s getting played.

💡 XRP 101: What Makes It Different?

If you’re not clear on XRP, you’re already two steps behind the real wolves. Unlike Bitcoin, XRP was pre-mined—meaning all 100 billion tokens were created at launch. The XRP Ledger? Blazing fast, dirt cheap to send, but you can’t mine XRP. End of story.

Why does this matter? Because every “XRP mining” pitch is marketing magic, not a technical breakthrough. These platforms don’t conjure up new XRP. They just let you invest XRP to fund mining contracts for other cryptos—usually Bitcoin (BTC) or Ethereum (ETH)—and pay you out, sometimes in XRP, sometimes not.

🖥️ The Cloud Mining Concept: Cash Flow Without the Hardware

The old way? You’d drop five figures on hardware, manage a sweaty server room, pray your electricity rates didn’t spike, and watch your mining rewards shrink every halving.

Cloud mining flips the script. You deposit crypto (like XRP), the platform “rents” hash power in a massive datacentre, and you get daily payouts—no hardware, no headaches. That’s the dream. But as any wolf knows, the devil’s in the details.

🔄 Breaking Down the Process: How XRP Cloud Mining Platforms Work

Let’s pull back the curtain:

- Step 1: You send XRP to a cloud mining app (think: slick interface, promises of “instant onboarding”).

- Step 2: The platform pools your XRP, buys or rents mining power for BTC or ETH.

- Step 3: You receive payouts (in XRP or BTC)—daily, weekly, whatever the contract says.

Features to watch for:

- Entry from as little as $10 or £8—frictionless for newbies.

- “Mobile-first” platforms—track earnings in real time, withdraw on the go.

- “Eco-friendly” datacentres, military-grade encryption, and 24/7 support (at least, that’s what the pitch deck says).

But don’t get distracted by the shiny objects—focus on the cash flow and the fine print.

📢 Internal Links & Resources

Want to see more on passive income and smart crypto moves? Check out these resources:

💰🔥 Big Promises, Bigger Risks: Analysing the ROI Claims

Now, here’s where you need to put on your sceptic’s hat.

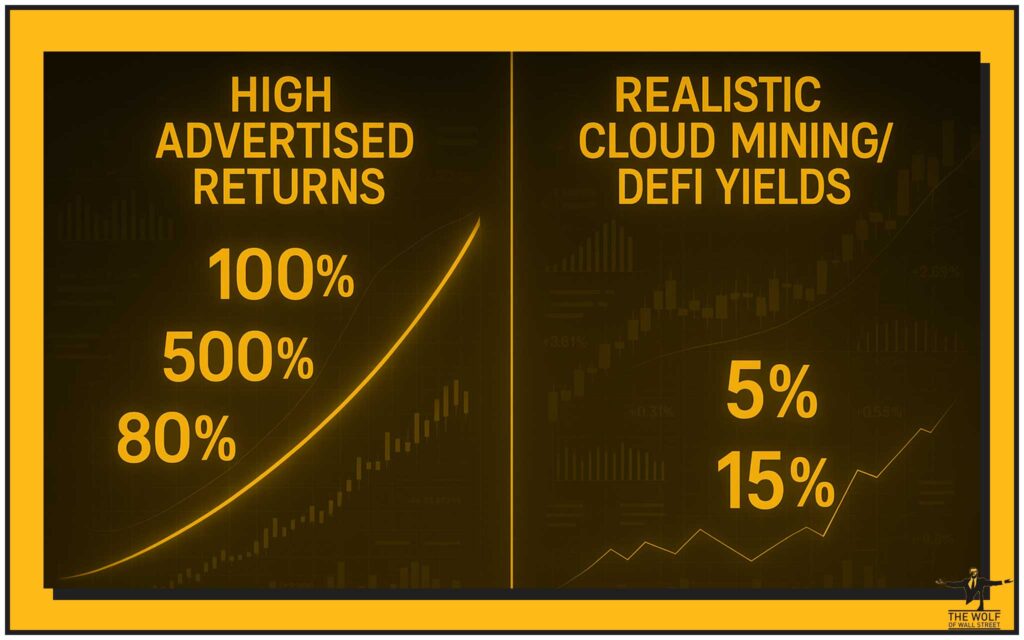

Cloud mining platforms dangle headline returns that’ll make your head spin: 100%…300%…sometimes up to 800% APR. “Turn $100 into $3 a day, for five days—15% in a week!” If it smells like easy money, it usually is…for someone else.

Here’s the data the wolves look at:

- 2024 saw nearly $500 million lost to cloud mining scams worldwide. Yes, you read that right—half a billion dollars. Mostly from deals that promised the moon and delivered zip.

- Most “high-yield” contracts are unsustainable. Returns rely on a constant stream of new deposits. When that dries up? The house of cards collapses.

If you think you’re the exception, think again. Remember—nobody ever got rich buying the hype.

🚩 The Red Flags: Spotting Scams Like a Pro

Scammers love two things: unregulated money, and uninformed victims.

Look for these warning signs:

- No audit, no dice: If the platform can’t show real audits or regulatory approvals, walk away.

- Hidden fees and long lockups: “You can withdraw anytime!”—until you actually try.

- Guaranteed profits: In crypto, “guaranteed” is code for “Ponzi”.

- Referral pyramids: When the main way to make money is signing up others, the end is near.

Do your research—read Crypto Scams to Avoid in 2025. Protect your stack.

📉 Volatility: The Real Enemy of “Passive” Income

Even if you dodge scams, volatility can wipe you out. Your daily payout might look juicy in XRP—but what if the price tanks 20% overnight? You’re losing in real terms, even as the platform brags about “fixed” crypto returns.

Crypto is a shark tank. You need to understand the rules before you jump in.

🌱📱 “Eco-Friendly” and Mobile: Marketing Hype or Real Value?

Let’s cut through the greenwashing.

- “Eco-friendly” often means nothing more than a stock photo of solar panels on the homepage.

- “Mobile-first” is great, but it doesn’t replace real due diligence.

Don’t let slick branding replace hard questions about security, transparency, and track record.

💸 Why People Still Jump In: The Allure of Easy Money

Here’s what the platforms get right:

- Ultra-low entry: Even broke students can start.

- Bonuses and daily rewards: $10 free just to sign up? Irresistible.

- No technical skills needed: Grandma could do it.

- FOMO: “If I don’t jump now, I’ll miss the crypto bull run.”

But don’t confuse easy onboarding with easy profit.

🧠 Smart Alternatives: Where to Actually Earn With XRP

Don’t gamble—strategise. Real wolves know how to sniff out real yield:

- Regulated lending platforms: Lend your XRP or stablecoins, earn 5–15% APY. Lower returns, but much safer.

- Wrapped XRP in DeFi: Use audited protocols for yield farming or liquidity pools.

- Passive income via staking, not mining: Learn about staking options in Layer-1 and Layer-2 Solutions Explained.

Compare this with casino-style cloud mining. Sometimes slow and steady really does win the race.

✅ How to Vet a Platform: The Wolf’s 5-Step Due Diligence Checklist

- Check real reviews: Search communities (like the The Wolf Of Wall Street crypto trading community) for unfiltered feedback.

- Audit trails: Does the platform publish third-party audits? If not, run.

- Withdrawal test: Start small, try withdrawing early. If there’s friction, you have your answer.

- Customer support: Ping support at 3am. If they ghost you, so will your money.

- Fee transparency: If fees are buried in fine print, the platform’s playing you.

🔒⚖️ Security, Tax, and Legal: Don’t Get Burned

Security:

- Use unique passwords, enable 2FA, never store all funds in one place.

- Read our Private Key vs Seed Phrase Guide for basics.

Tax:

- In most jurisdictions, mining or yield payouts are taxable—sometimes even if you never withdraw.

- Track every payout, and consult a crypto-savvy accountant. For more, see Tax Year vs Tax Season: Crypto Tax Compliance 2025.

Legal:

- Most cloud mining outfits operate in legal grey zones. If you lose money, recovery is tough.

- Regulators worldwide are cracking down—don’t get caught in the crossfire.

📊 Case Studies & Real Stories: Success, Scams, and “Wolf” Wisdom

- The Lucky Newbie: Alice put in $100, cashed out $110 in five days, then lost her next $200 to a “maintenance upgrade.” Luck isn’t a strategy.

- The Cautious Pro: Bob joined The Wolf Of Wall Street, relied on expert market analysis, and steered clear of platforms with no audit. Bob’s portfolio? Still green.

- The Scammed Student: Liam was hooked by a referral bonus. He got his friends in; the site vanished a month later. Lesson: Chasing “guaranteed” profits usually ends in tears.

Join a real community (The Wolf Of Wall Street Telegram) where people share real lessons—not hype.

🏁 Conclusion: Final Verdict – Is XRP Cloud Mining a Hustle or Hidden Gem?

Here’s the Wolf’s no-BS verdict:

- XRP cloud mining in 2025 is marketed as a frictionless way to grow your stack, but 90% of platforms are either unsustainable or outright scams.

- The ones that aren’t? They pay low single-digit returns, often with more risk than reward.

- If you’re going to play, start tiny—test everything, and expect the worst.

- Smart traders chase transparency, not hype.

Trade smart, or get eaten alive.

🙋 FAQs: Everything You’re Too Afraid to Ask

Q: Is XRP cloud mining legit in 2025?

A: Most platforms are either unregulated or operate with zero transparency. Approach with maximum caution—if at all.

Q: What are the safest ways to earn with XRP?

A: Look for regulated lending, audited DeFi protocols, and avoid any platform promising double-digit daily returns.

Q: How can I spot a cloud mining scam?

A: Watch for guaranteed profits, lack of audits, hidden fees, and withdrawal headaches. Real platforms welcome scrutiny.

Q: Can you really make passive income with XRP?

A: Only through transparent, regulated services. Anything else is speculation, not investing.

Q: What’s the The Wolf Of Wall Street advantage for smart traders?

A: The The Wolf Of Wall Street crypto trading community offers VIP signals, expert analysis, a massive private network, essential tools, and 24/7 support—giving you the real edge.

📚 Further Reading & Internal Links

- Crypto Scams to Avoid in 2025

- Layer-1 and Layer-2 Solutions Explained

- Wolf’s Guide to Asset Classes

- How to Buy Crypto

- The Wolf Of Wall Street Crypto Trading Service

- Newbie’s Guide to Crypto Passive Income

- Trading Insights for Risk-Takers

- DeFi Opportunities 2025

- Passive Income Without Selling Crypto

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our active Telegram community: The Wolf Of Wall Street Telegram

Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.

Key Takeaway:

XRP cloud mining platforms in 2025 offer sky-high promises but are fundamentally risky, often lacking transparency and depending on marketing hype rather than genuine mining operations. Cautious investors should prioritise due diligence, healthy scepticism, and explore safer, regulated alternatives for passive crypto yields.

Ready to hunt with the real wolves? Stay sharp, stay sceptical, and always back your moves with knowledge.