When Arthur Hayes – the man traders call the Wolf of Crypto – drops a “vibe check” on X and says Zcash (ZEC) → $10 k, you either act fast or watch opportunity sprint past you. Within hours, ZEC ripped roughly 30 % in 24 hours, blowing past its peers and reigniting the entire privacy-coin narrative (CoinTelegraph).

The market didn’t just move – it exploded. FOMO hit feeds like wildfire, and everyone from retail traders to seasoned veterans piled in. Let’s break down the catalyst, the numbers, the risks, and the trade plan – no fluff, just hard data and sharper execution.

🚀 The Catalyst – Hayes lights the fuse

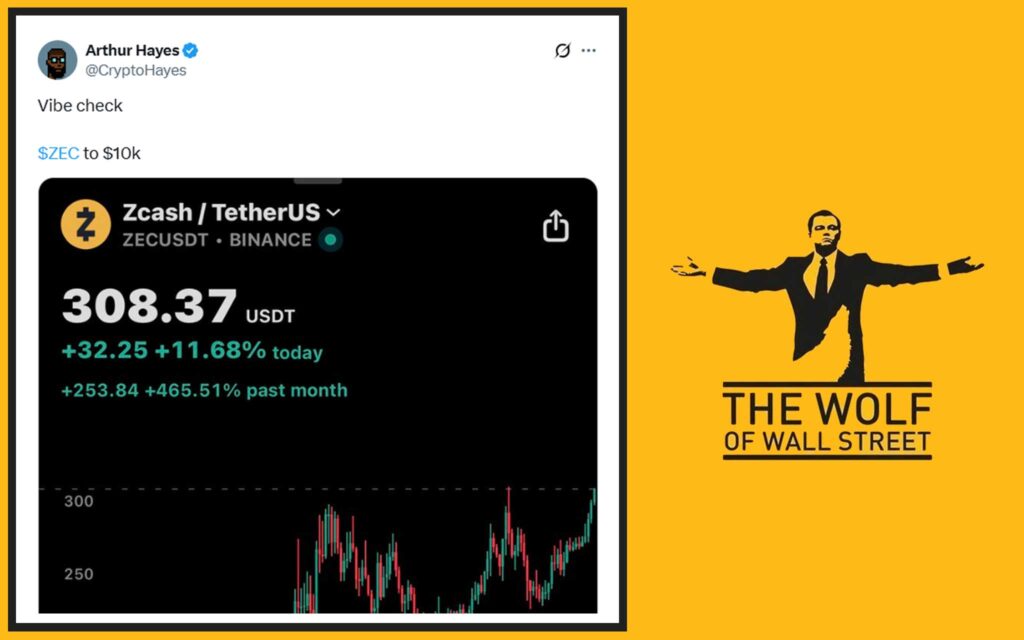

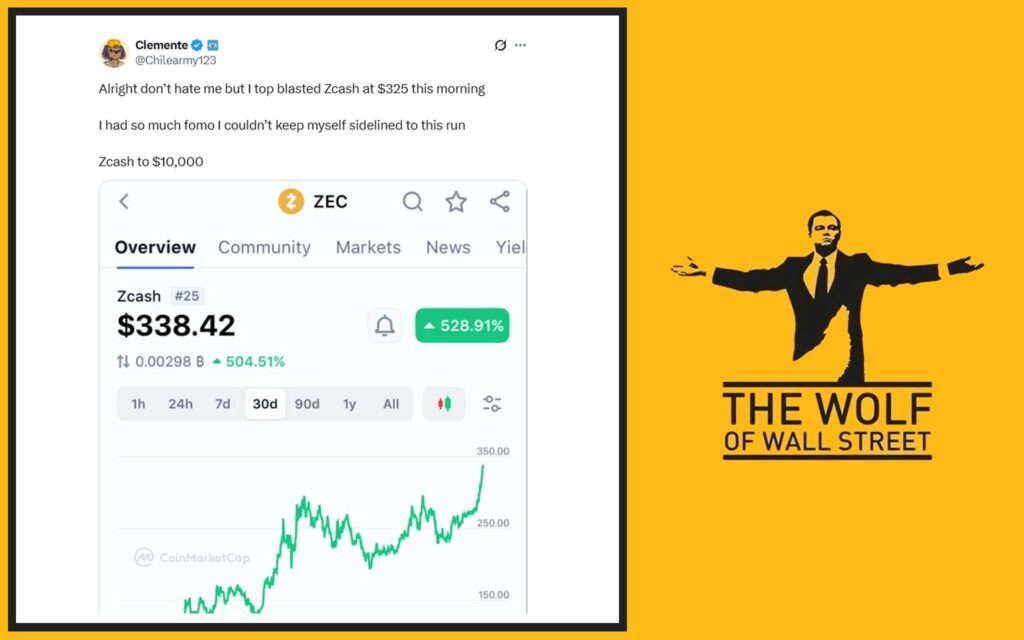

Hayes has done this dance before. Every time he talks, liquidity follows. His latest post – a two-line “vibe check” forecasting ZEC at $10 k – sent the token from around $272 → $355, outpacing every top-50 asset on the board (Yahoo Finance).

Traders admitted it openly: this was pure FOMO. A Binance Square contributor called Hayes a “legendary Silicon Valley investor” whose words alone triggered “a full month’s FOMO market frenzy.” Others confessed they simply couldn’t stay sidelined. That’s social proof on steroids.

📊 By the Numbers

| Metric | Value (approx.) | Source |

|---|---|---|

| 24-hour change | +30 % | CoinGecko |

| 7-day change | +110 % | CoinGecko |

| 30-day change | +490 % | CoinTelegraph |

| Market cap | >$5 billion | CoinGecko |

| Daily high / low | $355 / $272 | CoinGecko |

Always verify before you publish – this market moves faster than London FX desks at 8 a.m.

🧠 Why Zcash – The privacy prime mover

Zcash isn’t a hype coin with a meme mascot; it’s a pioneer. Since launching in October 2016, it’s built on zero-knowledge proofs (zk-SNARKs) that let users send transactions either transparent or shielded. That means you decide who sees what – the ultimate privacy flex (Wikipedia).

As global regulators tighten control over encryption and on-chain visibility, privacy tech is roaring back. The market’s rotation toward privacy-driven assets like ZEC, Dash, and Railgun signals a shift from hype to hedge – a bet on sovereignty in the digital age.

Need the full breakdown of how zk-proofs actually hide data? Check out zero-knowledge proofs (ZKPs) – your crash course in the tech behind this surge.

⚠️ Reality Check – The risk behind the roar

Now, let’s talk truth. The same verticals that print fortunes also destroy accounts.

- Overbought signals: Analysts are warning that ZEC’s RSI is deep in “overheating” territory. Price momentum this steep rarely lasts without a cooldown (TMA Street)).

- Exchange headwinds: Binance delisted Monero (XMR) in Feb 2024; OKX and several EU venues followed suit. If regulators push hard again, privacy coins as a class could bleed liquidity.

- Narrative risk: When sentiment shifts, hype dries up. What was “the next Bitcoin” yesterday becomes “exit liquidity” tomorrow.

Translation: if you’re trading this move, respect your stop like your life depends on it – because your capital does.

🐺 The Wolf’s Trade Plan – How to play this smart

You want the Belfort edge? Here’s the playbook:

- Mark your levels. The $355 top and the $281 support are your map. Watch how price reacts at each. Strength on declining volume = healthy consolidation. Weak bounces on rising volume = trap.

- Trail your wins. Use dynamic stops – ATR, structure-based, whatever fits your system – but never let a winner turn red.

- Split entries. Don’t FOMO into full size. Scale in with confirmation signals (see RSI trading strategies and MACD momentum signals).

- Bank partials. When you’re right fast, take profits faster. The market rewards discipline, not dreamers.

- Track catalysts. A new exchange listing, protocol upgrade, or on-chain privacy milestone could extend the run. Stay plugged in.

For a full technical toolkit, dive into Money Flow Index strategies and Parabolic SAR guides.

📈 What could prove Hayes right (or wrong)

🟢 Bullish path – The road to $10 k

- Broader privacy adoption and mainstream demand for encrypted finance.

- Increased liquidity and institutional on-ramps once regulation clarifies.

- Next Zcash halving reducing supply, tightening floats.

🔴 Bearish path – The hangover

- Renewed exchange bans or AML scrutiny (see Crypto AML guide).

- Market-wide risk-off events that flush altcoin liquidity.

- Overextension leading to profit-taking cascade.

Bottom line: Hayes’ $10 k target is a moon shot – not impossible, but statistically insane without multi-year tailwinds and mass adoption. Treat it as inspiration, not prophecy.

🧭 Privacy coins in context

Zcash is part of a bigger story: the privacy coin renaissance. Projects like Monero (XMR) and Dash have seen double-digit gains this month as investors search for crypto assets that defend financial anonymity. Some call it a throwback to the cypherpunk era; others call it a necessary hedge in a surveillance-heavy world – one we analyse deeply in Privacy in Web3: Digital Sovereignty Guide.

💡 Where to learn & level up

If this rally has you itching to trade smarter, explore these resources:

- Trading insights hub: expert guides on indicators and market timing.

- Crypto profit-taking guide: because profits mean nothing until you bank them.

- Understanding market makers & takers: master liquidity flows before they master you.

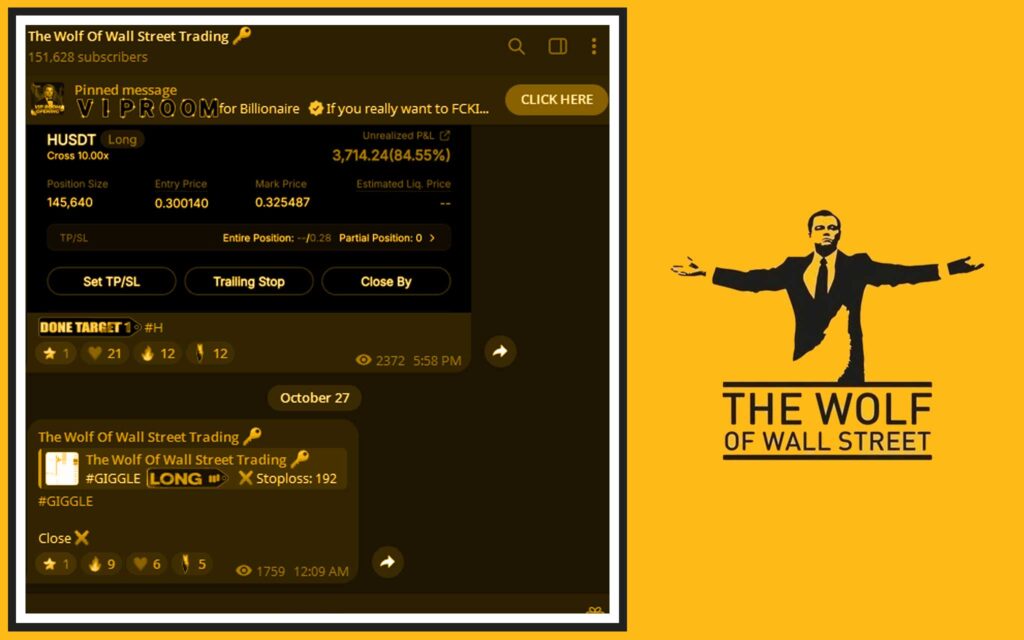

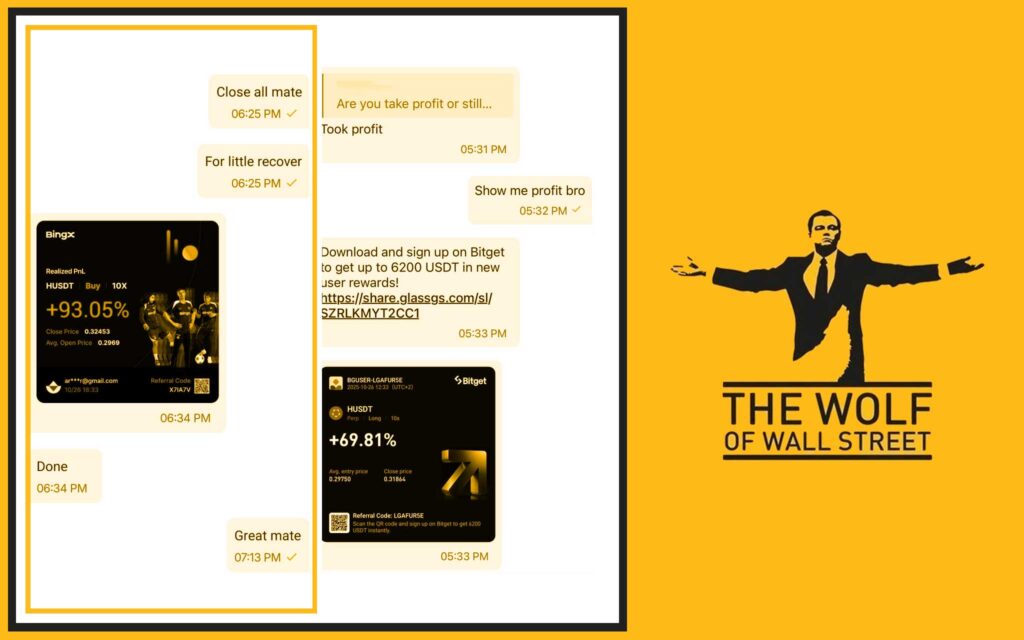

🔥 The Unfair Advantage – Join The Wolf Of Wall Street

Here’s the truth: trading solo in crypto is like boxing blindfolded. You need intel, tools, and a tribe that hunts with you.

The Wolf Of Wall Street Crypto Trading Community gives you exactly that:

- 🧭 Exclusive VIP Signals – catch volatile moves before they trend.

- 📊 Expert Market Analysis – real-time breakdowns from seasoned traders.

- 🤝 Private Community – 150 k members sharing live plays.

- 🛠️ Trading Tools – volume calculators, position sizers, risk matrices.

- 🕐 24 / 7 Support – because crypto never sleeps.

👉 Visit The Wolf Of Wall Street Service Page or join the Telegram community and level up your execution.

Not financial advice – just professional tools for a volatile game.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Features include VIP signals, expert analysis, a private network of 150 000 traders, essential tools and 24 / 7 support. Empower your journey: tthewolfofwallstreet.com/service | Telegram community.