Crypto’s a beast — it eats dreams for breakfast and leaves devastation in its wake. But if you know how to play it, that beast becomes your golden goose. And on 15 June 2025, Polyhedra Network’s ZKJ token got absolutely slammed — an 83 % crash in hours, nearly half a billion dollars wiped off the board. You better strap in, because this wasn’t a minor hiccup. It was a seismic rumble in the DeFi jungle, and your portfolio needs to learn from it.

⚡️ Boom, Bust — And a Billion-Dollar Bloodbath

Let’s cut to the chase: ZKJ got nuked. One minute it was riding high, the next it cratered. That’s the nature of cryptocurrencies — explosive upside, brutal downside. This crash isn’t just a sensational headline; it’s a blueprint of how crypto markets really work. And you’re going to see the mechanism of a liquidity collapse, a Binance intervention, Polyhedra’s crisis control, and the speculator frenzy that followed.

🔍 The Anatomy of the Collapse

The root of the problem? “Abnormal on-chain transactions” involving ZKJ/KOGE. That’s code for “weird stuff happening on the blockchain.” Large holders started removing liquidity, which collapsed the price structure. Then came the margin calls, then bots piled on, and then the average trader got steamrolled.

🚨 Liquidity Yanked, Chaos Triggered

It all snowballed. Big fish moved first, yanking liquidity. Market confidence evaporated. With volume gone, panic took over. Welcome to a classic liquidation cascade — and if you weren’t hedged or out early, you became the liquidity.

🧠 Binance’s Playbook: Risk Mitigation Mode

Binance saw what happened and wasted no time. They confirmed the flash crash, then dropped a policy shift: Alpha Points rewards are being reworked to stop circular trading abuse. Beginning June 17, trades between Alpha tokens won’t earn rewards.

This matters. It tightens up incentives, chokes manipulation, and adds much-needed structure to a fast-moving layer-1 and layer-2 token environment.

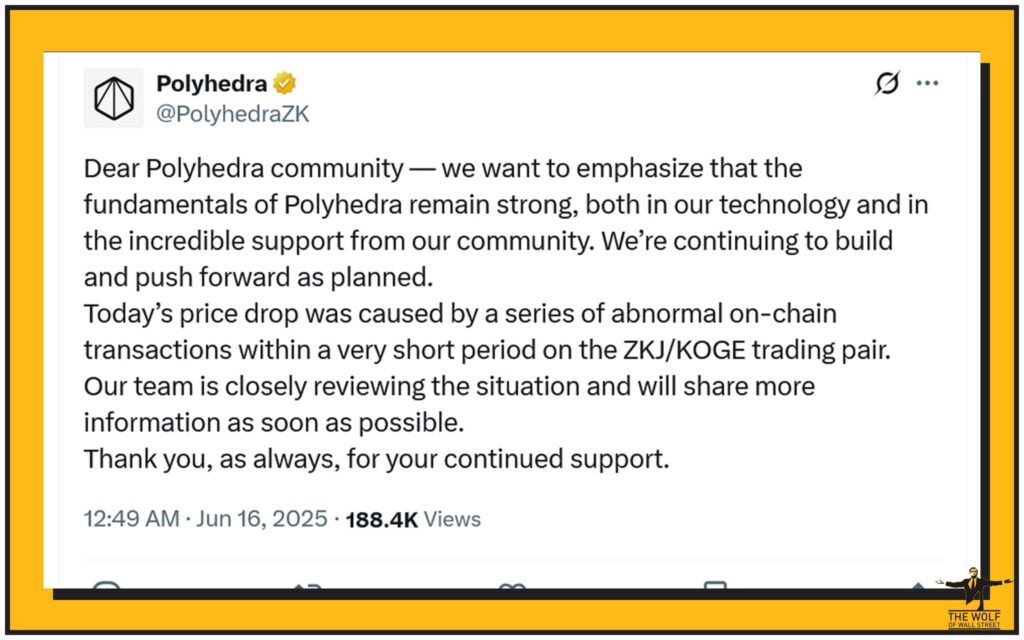

💬 Polyhedra’s Response: Reassurance or Spin?

The company claimed “core fundamentals remain solid,” which is crypto PR 101. A promised post-mortem is pending, but traders aren’t holding their breath. Until then, this remains a reputational mess on Polyhedra’s ledger. The network may be technically sound, but the trust has definitely taken a hit.

🕵️ Rumours, Speculations, Theories

Twitter lit up. Some blamed token unlocks, others screamed insider manipulation. But no proof. Blockchain data is public, but interpreting it requires nuance. For now, treat this as an aggressive liquidity event — not a confirmed exploit. Speculators, step aside.

📉 Retail Traders Get Rekt (Again)

The real losers? Retail. Especially newbie investors. When crashes like this hit, whales bounce back. Small traders don’t. Wallets were liquidated, positions annihilated, and confidence shattered.

🛡️ Shield Your Portfolio: Learn from the Bloodbath

Here’s what you must do:

- Never chase hype without due diligence.

- Use stop-losses religiously.

- Monitor liquidity, not just price.

- Be part of a real trading community.

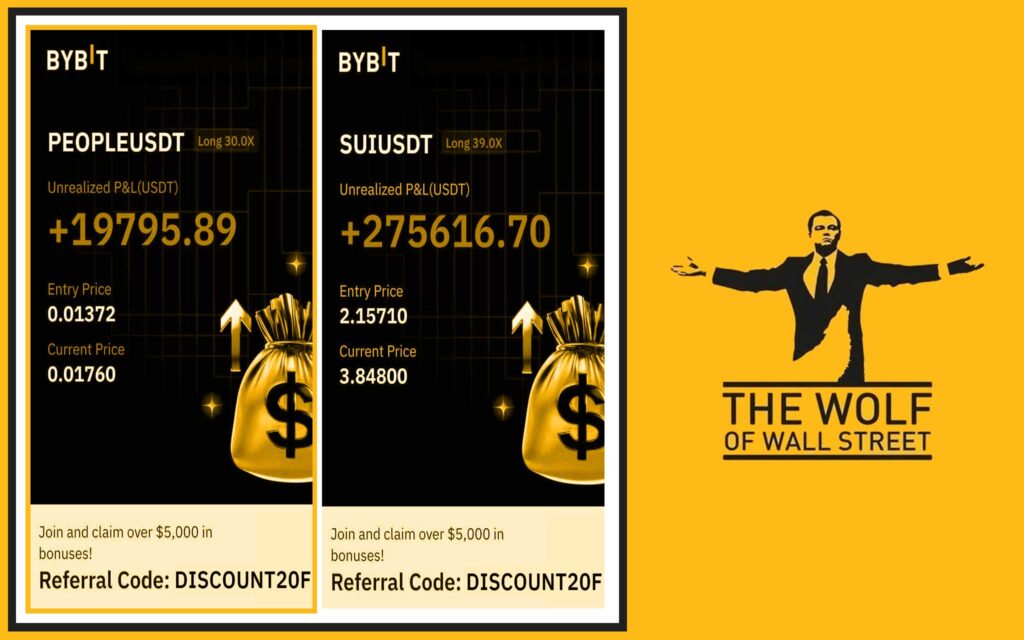

🧐 Enter The Wolf Of Wall Street: The Smart Trader’s Secret Weapon

In this game, intelligence and speed win. The Wolf Of Wall Street gives you:

- VIP trading signals — proven, tested, timely.

- Expert analysis from real pros.

- Community access to over 100,000 active traders.

- Essential tools like volume calculators.

- 24/7 support for non-stop markets.

Join the The Wolf Of Wall Street Telegram group and get plugged in now. Whether you trade altcoins, memecoins, or NFT-related tokens, this is how you level up.

📈 The Bounce That Wasn’t

ZKJ saw a minor bounce after the crash — a textbook dead cat bounce. No sustained recovery. Flatlined price, zero momentum. Without trust and liquidity, there’s no real comeback.

🔗 Broader Ecosystem Impact

ZKJ’s collapse affected more than just one token. Ecosystems linked to ZKJ or Alpha tokens faced ripple effects. If one cog in the wheel fails, it grinds the machine. This was a systemic stress test.

📖 History Repeats: Other Token Crashes

Remember YAM, SUSHI, or OHM? They also promised innovation, then collapsed under poor risk controls. Policies matter. Risk frameworks matter. Community trust really matters.

❗ Call to Action: Your Next Move

If you do nothing, this lesson is wasted. Here’s your action plan:

- Protect your downside.

- Plug into The Wolf Of Wall Street.

- Trade smarter, not louder.

- Rebuild with stronger risk rules.

❓ FAQs

What caused the crash?

Large liquidity withdrawals and abnormal trading patterns on ZKJ/KOGE triggered a market-wide collapse.

Can ZKJ recover?

Technically, yes. But sentiment and trust must be rebuilt.

How do I avoid similar events?

Use analytics, rely on verified signals, and join vetted communities like The Wolf Of Wall Street.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”