Alright, pop a bottle, strap yourself in, and listen up, because what I’m about to tell you will change the way you think about money forever. This is the big one.

Introduction: Stop Playing in the Minor Leagues

Open Banking is the key that will unlock your financial future, and ninety-nine per cent of people are too slow, too lazy, or too damn dumb to see what’s right in front of them. Not you. You’re here because you’re a predator, a player, someone who sniffs out opportunity while the sheep are sleeping.

For decades, the big banks have had you by the throat. They held your money, they owned your data, and they made you play by their rules. They got fat and rich on your information, doling out breadcrumbs in the form of pathetic interest rates and one-size-fits-all services. Those days are over. The game has been blown wide open, the rulebook torched. This isn’t just another financial trend; it’s a revolution. It’s about taking back what’s yours and leveraging it to build your empire. So, pay attention, because class is in session.

🤑 What the Hell is Open Banking, and Why Should You Care?

Let’s get one thing straight. If you can’t explain it in 30 seconds, you don’t understand it. And if you don’t understand it, you can’t profit from it. So, listen closely.

It’s Not Your Grandad’s Banking System

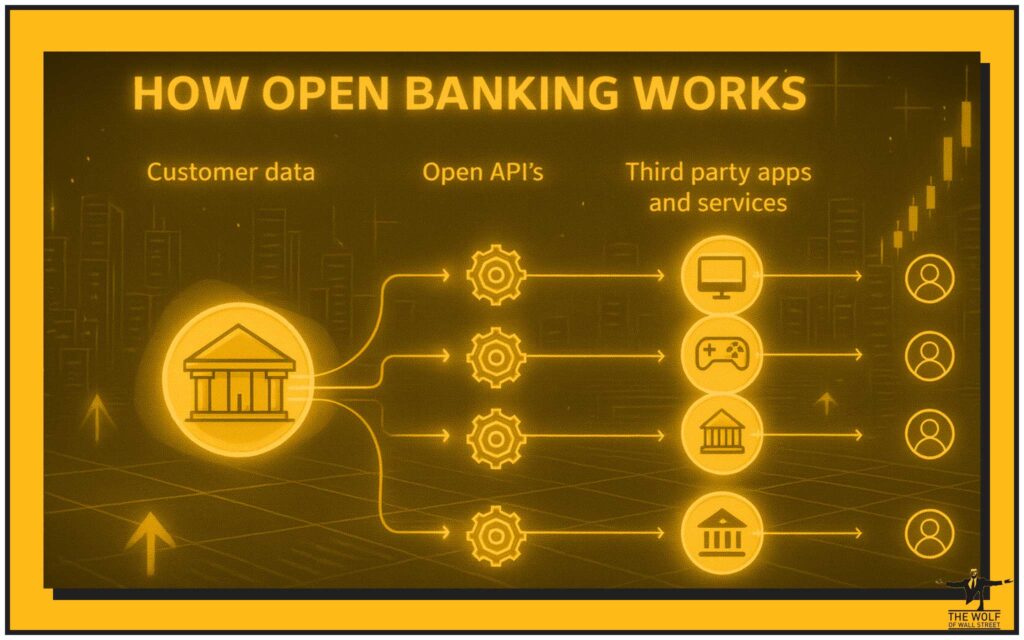

Forget the dusty old ledgers and the sour-faced tellers behind bulletproof glass. Open Banking is a wrecking ball to that entire system. In the simplest terms, it’s a set of rules and technologies that forces your bank to share your financial data with other authorised financial companies, but only with your explicit permission. Think of it as a universal remote for your money. You are now in the driver’s seat. You decide who gets to see your data, what they can see, and for how long. It’s power, pure and simple.

The API: Your Golden Key to the Kingdom

How does this magic happen? Through something called an API – an Application Programming Interface. Don’t let the tech jargon throw you; it’s simple. An API is just a secure pipeline, a secret tunnel, that lets different software applications talk to each other. In this case, it’s the pipeline that lets a new, hungry fintech app securely connect to your old, bloated bank account to pull data or even initiate payments on your behalf. This is the engine of the revolution, the golden key that unlocks the vaults.

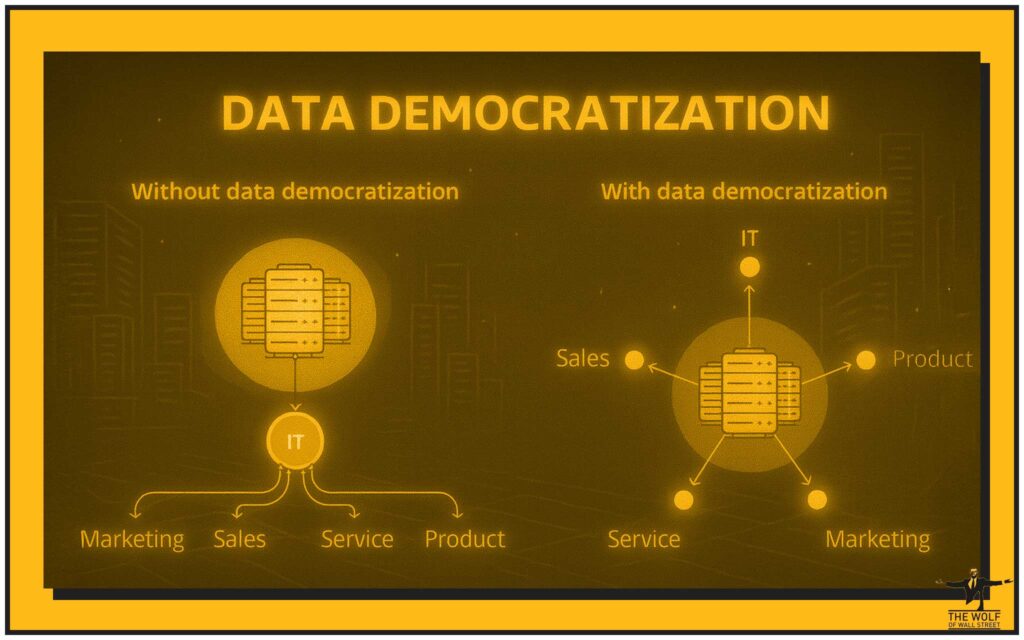

You Own Your Data, You Call the Shots

This is the most important part, so listen up. For years, you thought the money in your account was yours. Wrong. The data about that money, your spending habits, your income, your investments – that was the real goldmine, and the banks kept it locked down tighter than Fort Knox. Open Banking changes the ownership. It legally establishes that your financial data belongs to you. It’s your asset. And like any asset, you can now put it to work to make you more money.

🚀 The Game-Changing Benefits for a Shark Like You

So, who cares? You should. Because this shift puts a whole arsenal of new weapons in your hands. This is how you get an edge on everyone else.

A 360-Degree View of Your Empire

Are you still logging into five different apps and websites to see where your money is? That’s for amateurs. With Open Banking, you can plug all your accounts – your current accounts, credit cards, investment portfolios, even your crypto holdings – into a single, elegant dashboard. You get a real-time, bird’s-eye view of your entire financial empire. You can’t conquer the world if you don’t know where your armies are. This gives you the map.

Sniffing Out a Better Deal Like a Bloodhound

The old way of getting a loan or a mortgage was a joke. You’d go, cap in hand, to your bank, and they’d offer you whatever garbage rate they felt like. Now, the tables have turned. With your permission, comparison apps can use your actual financial data to have lenders fight over you. They can see your real income, your real spending, and prove you’re a good bet. This creates a hyper-competitive market where companies are forced to offer you their absolute best deals on loans, credit cards, and insurance just to win your business. It’s a buyer’s market, and you’re the prize.

From Zero to Hero: Financial Empowerment

The old system was designed to keep people out. No credit history? Bad credit score? The door was slammed in your face. Open Banking kicks that door off its hinges. By looking at real-time income and spending data, new lenders can make smarter decisions. They can offer fair credit to students, freelancers, or immigrants who were previously invisible to the system. This isn’t just about fairness; it’s about unlocking a massive, untapped market of hungry, ambitious people.

💼 How Smart Businesses Are Making a Killing with Open Banking

If you think the consumer benefits are good, you haven’t seen anything yet. For entrepreneurs and business owners, this is like discovering oil.

Building Killer Apps People Can’t Live Without

Open Banking has unleashed a tidal wave of innovation. Smart fintech startups are building apps that solve real problems. Budgeting apps that actually work. Investment platforms that are accessible to everyone. Services that help you save money automatically. If you’ve got an idea that can help people manage their money better, the tools are now there for you to build it and make a fortune.

Knowing Your Customer Better Than Their Own Mother

Data is the new oil, and Open Banking gives you a direct pipeline to the refinery. By analysing anonymised spending patterns, businesses can understand what their customers really want. They can create hyper-personalised offers, products, and services that are so perfectly tailored, customers feel like you’re reading their minds. This is how you build loyalty. This is how you crush your competition. To win, you must understand the battlefield, and in business, the customer is the battlefield. If you’re serious about this, you need to know how the pros operate—start by learning to Master Crypto Order Types to see how precision can multiply your returns.

Getting Paid Faster: The Ultimate Power Move

What’s the number one killer of small businesses? Cash flow. Waiting 30, 60, or 90 days for an invoice to be paid is a death sentence. Open Banking is changing this with streamlined payment initiation services. You can put a “Pay Now” button directly on your invoice that allows your client to pay you instantly and securely from their bank account. No more chasing payments. No more waiting. Just pure, unadulterated cash flow.

🌐 Open Banking Meets Crypto: The Next Trillion-Dollar Frontier

Now for the main event. If Open Banking is gasoline, crypto is the lit match. This is where the real fireworks happen.

Bridging the Old World of Finance with the New

For too long, crypto has been like a private island – hard to get to and hard to leave. Getting your hard-earned cash onto an exchange was slow and clunky. Open Banking builds a super-highway between your bank account and the crypto universe. It allows for instant, secure account funding and withdrawals. This seamless integration is the catalyst that will bring cryptocurrencies to the masses. And if you want to play in that arena, you’d better understand the fundamental differences in how and where you trade. My personal guide on P2P vs. Centralised Crypto Exchanges is mandatory reading for anyone who doesn’t want to get fleeced.

Transparency is the Name of the Game

Crypto has a reputation problem—let’s be honest. It’s seen as the Wild West. Open Banking principles, when applied to crypto, can build a new era of trust and legitimacy. Imagine exchanges being able to securely verify a user’s source of funds, streamlining compliance and stamping out illicit activity. This transparency will attract the big money—the institutional investors who are still standing on the sidelines. To play in their league, you need to understand their rules, which is why a deep dive into Crypto AML Guide for Compliance & Security is non-negotiable.

Are You Ready for DeFi 2.0?

Decentralised Finance (DeFi) is all about rebuilding the financial system without the middlemen. Combine that with Open Banking’s secure data access, and you have a financial system on steroids. Think under-collateralised loans based on your real-world income data, or personalised insurance protocols built on the blockchain. The synergy is explosive, and the people who get in on the ground floor are the ones who will be telling their success stories from a yacht.

The Wolf Pack Awaits: Your Invitation to the Inner Circle

Listen to me. Knowledge is useless without action. Reading this article is a start, but it’s not enough. To truly win in this game, you need more than just information—you need intelligence, you need a team, and you need the best goddamn tools on the planet.

This is where you stop being a spectator and become a player. The The Wolf Of Wall Street crypto trading community is your ticket to the show. We’re not a book club; we’re a private network of over 100,000 stone-cold killers dedicated to one thing: profiting from the crypto market.

Here’s what you get when you’re on the inside:

- Exclusive VIP Signals: My proprietary signals, designed to maximise your profits. We tell you when to buy and when to sell. It’s that simple.

- Expert Market Analysis: In-depth, no-bullshit analysis from traders who live and breathe this market.

- Essential Trading Tools: Volume calculators and resources the pros use to make informed, decisive moves.

- 24/7 Support: The market never sleeps, and neither do we. Our team is always there to back you up.

Stop gambling and start trading with an edge.

- Get the full breakdown at our service page: https://tthewolfofwallstreet.com/service

- Join the real-time conversation on our Telegram: https://t.me/tthewolfofwallstreet

This is your chance to unlock your real potential. Don’t let it slip away.

⚠️ The Obstacles on the Road to Riches (And How to Smash Them)

Now, I’m not going to lie to you. This path isn’t all sunshine and rainbows. There are dragons to be slain. But obstacles are just opportunities in disguise for those smart enough to see them.

Security: Protecting Your Digital Fort Knox

When there’s honey, there are flies. And when there’s money, there are thieves. The biggest concern with Open Banking is, and always should be, security. The entire system is built on bank-grade security, but you still need to be smart. Only use regulated apps, never share your banking passwords, and treat your financial data like the crown jewels.

Regulation: The Slow-Moving Dinosaur

Governments and regulators are ten steps behind innovation, always have been. The rules of the road for Open Banking are still being written, and they differ from country to country. This creates uncertainty, which can slow things down. But for the nimble, regulatory confusion is a fog of war where fortunes can be made.

Adoption: Old Habits Die Hard

The biggest barrier is human psychology. People are comfortable with what they know, even if what they know is garbage. Convincing the average person to trust a new app with their financial data is a sales job. It requires education and building bulletproof trust. But the tide is turning. Once people get a taste of the convenience and power, there’s no going back.

🧠 Conclusion: The Future is Open – Don’t Get Left in the Dust

So there it is. The blueprint. The financial world is being rebuilt from the ground up, and you’re standing at the construction site holding the plans. You can either stand there and watch, or you can grab a hard hat, get to work, and claim your stake. The choice is yours. Are you a wolf or are you a sheep? The money is on the table, and the clock is ticking. The future belongs to those who act, and that future is Open Banking.

📜 Frequently Asked Questions (FAQs)

Is open banking safe?

Yes. It’s highly regulated and uses bank-grade security. You never share your login details with the third-party app. You authorise everything through your own bank’s secure portal, and you are in full control of who has access and for how long.

Will I be charged for using open banking?

For you, the consumer, it’s almost always free. The companies providing the new apps and services pay for the access. Their business model is to make money by providing you with a service so valuable you can’t live without it, not by charging you for access.

How does open banking affect my credit score?

Positively, in most cases. By providing a fuller, more accurate picture of your financial health (like your regular income and responsible spending), it can help you get access to better credit offers, even if your traditional credit file is thin.

What’s the difference between open banking and traditional banking?

Traditional banking is a closed box. Your data is locked inside one bank. Open Banking smashes the box open. It puts you in control, allowing you to securely share your data with other companies to get better services, a full view of your finances, and access to cutting-edge innovation. It’s the difference between a landline and a smartphone.